Spinning Top Pattern

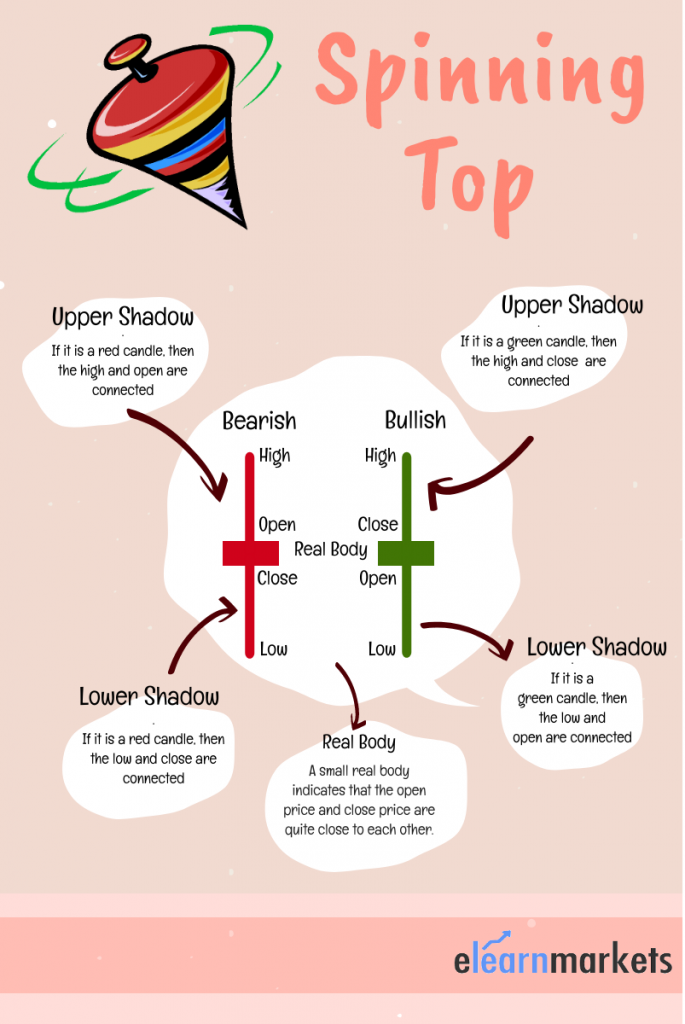

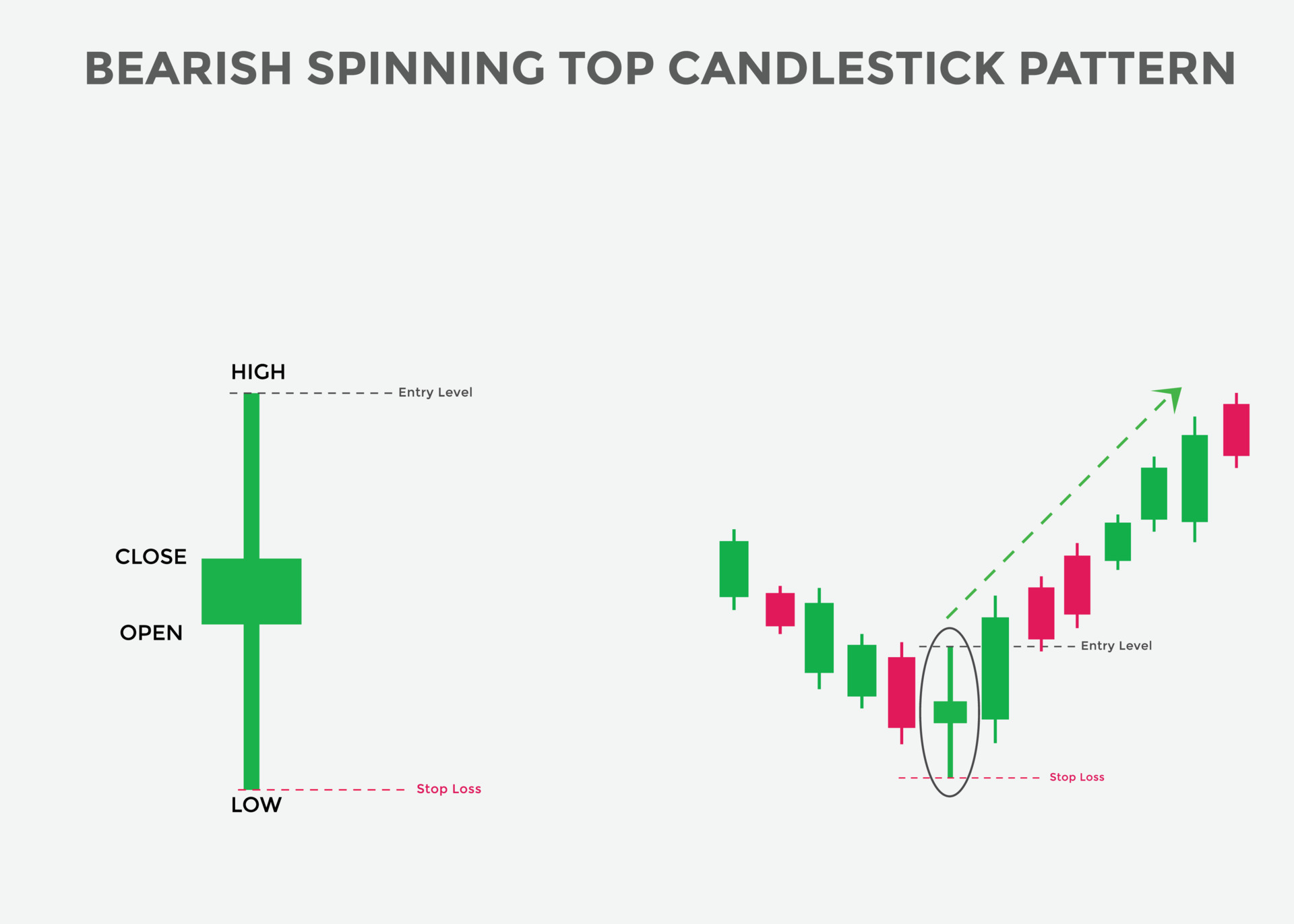

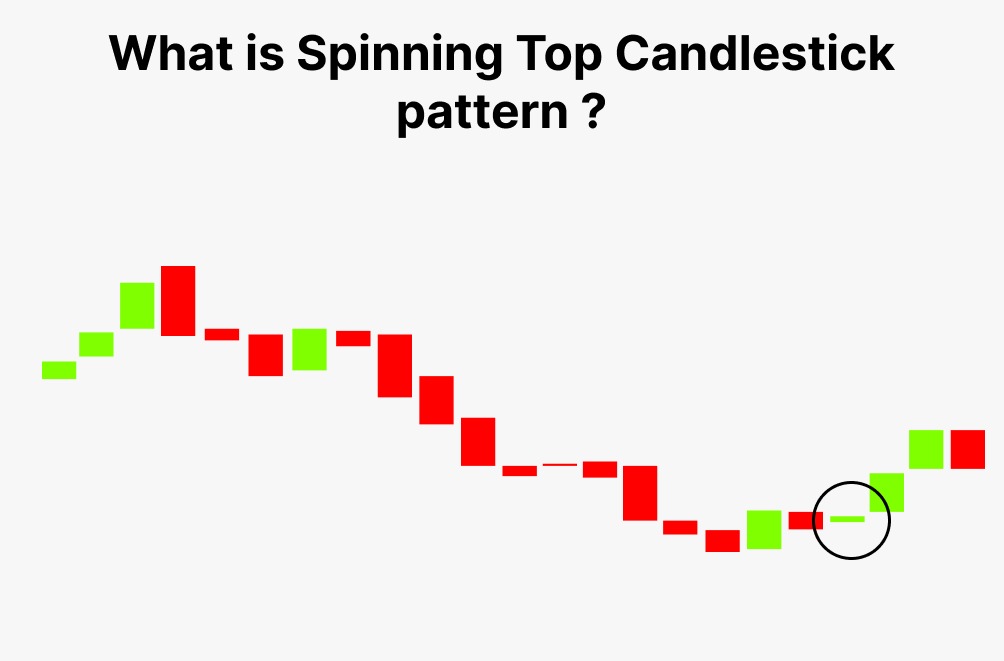

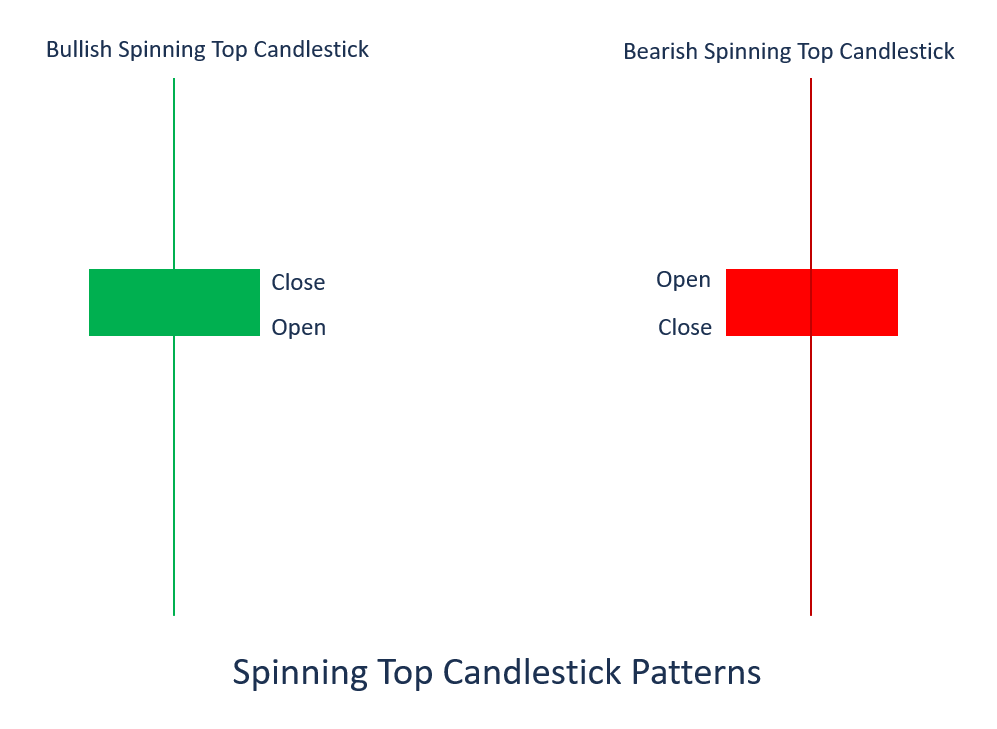

Spinning Top Pattern - Web a spinning top pattern involves a single candle indicating uncertainty in the market. When it’s spinning smoothly, you can’t say when it will fall and which way it will point. The spinning top pattern consists of a small body with long upper and lower wicks. The candlestick itself is defined by a short body surrounded by long wicks (approximately the same. Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. A spinning top is a single candlestick that has a small body. Candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable and unprofitable, they. During the time period represented, neither the buyers nor the sellers had control. The color of a spinning top does not matter. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. Web a spinning top candlestick is a type of japanese candlestick charting pattern that traders use to analyze price behavior in financial markets. Similarly, a spinning top candlestick pattern represents indecision. The bearish spinning top pattern signifies market indecision with a small real body and long shadows, indicating a struggle between bulls and bears but requiring confirmation from subsequent candles.. Similarly, a spinning top candlestick pattern represents indecision. Similar to a doji pattern, a spinning top is considered a neutral pattern, although many do end in reversals. It’s an indecision candle, meaning that when it appears, the price is not showing the intention to move in any particular direction. When you think of the spinning top candlestick pattern, think of. When it’s spinning smoothly, you can’t say when it will fall and which way it will point. Similarly, a spinning top candlestick pattern represents indecision. Web what is a spinning top in candlestick patterns? The opening and closing prices of the particular asset should be equal or at least closer, regardless of which one is higher. While closely resembling a. The candlestick pattern represents indecision about the. Web a spinning top pattern involves a single candle indicating uncertainty in the market. Web what is spinning top candlestick? It can form anywhere in the chart. It’s an indecision candle, meaning that when it appears, the price is not showing the intention to move in any particular direction. When you think of the spinning top candlestick pattern, think of a top toy. Web the spinning top candlestick chart pattern develops when buyers and sellers reach an equilibrium, leading to minimal changes between opening and closing prices. Its ability to identify market indecision and pauses in price movements makes it a truly invaluable tool in your trading arsenal. Web. Web the spinning top candlestick chart pattern is a formation that occurs when buyers and sellers balance each other out, resulting in similar opening and closing price levels. Web the spinning top is a japanese candlestick pattern. A spinning top chart pattern is a signal that neither buyers or sellers have control of price action in the time frame of. Web by steve burns. Similarly, a spinning top candlestick pattern represents indecision. It's characterized by a small body situated between long upper and lower wicks. The candlestick itself is defined by a short body surrounded by long wicks (approximately the same. Candlestick patterns deserve to be studied thoroughly and even though a strategy relying solely on them will be unstable. Web the spinning top is a japanese candlestick pattern. Web a spinning top candlestick can be defined as an asset price movement pattern where the candlestick has a short real body positioned between long upper and lower shadows. Web a spinning top pattern involves a single candle indicating uncertainty in the market. Web what is spinning top candlestick? A spinning. A spinning top chart pattern is a signal that neither buyers or sellers have control of price action in the time frame of the candle. Similar to a doji pattern, a spinning top is considered a neutral pattern, although many do end in reversals. It shows that neither buyers or sellers are in control and that the market is deciding. A spinning top is indicative of a situation where neither the buyers nor the sellers have won for that time period, as the market has closed relatively unchanged from where it opened; The market is indecisive regarding its trend. It shows that neither buyers or sellers are in control and that the market is deciding on its next move. Web. Similar to a doji pattern, a spinning top is considered a neutral pattern, although many do end in reversals. A small real body means that the open price and close price are close to each other. It can be red or green. A spinning top is indicative of a situation where neither the buyers nor the sellers have won for that time period, as the market has closed relatively unchanged from where it opened; This candlestick pattern has a short real body with long upper and lower shadows of almost equal lengths. Web a spinning top is a candlestick pattern with a short real body that's vertically centered between long upper and lower shadows. A spinning top is a single candlestick pattern that has a body in the middle of two longer wicks. Web a spinning top candlestick can be defined as an asset price movement pattern where the candlestick has a short real body positioned between long upper and lower shadows. It shows that neither buyers or sellers are in control and that the market is deciding on its next move. It has a small body closing in the middle of the candle’s range, with long wicks on both sides. The spinning top pattern consists of a small body with long upper and lower wicks. The spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! Spinning top candlestick is a pattern with a short body between an upper and a lower long wick. While closely resembling a doji, a spinning top has small differences. Web the spinning top is a japanese candlestick pattern. The candlestick itself is defined by a short body surrounded by long wicks (approximately the same.

Spinning Top Candlestick How to trade with Spinning?

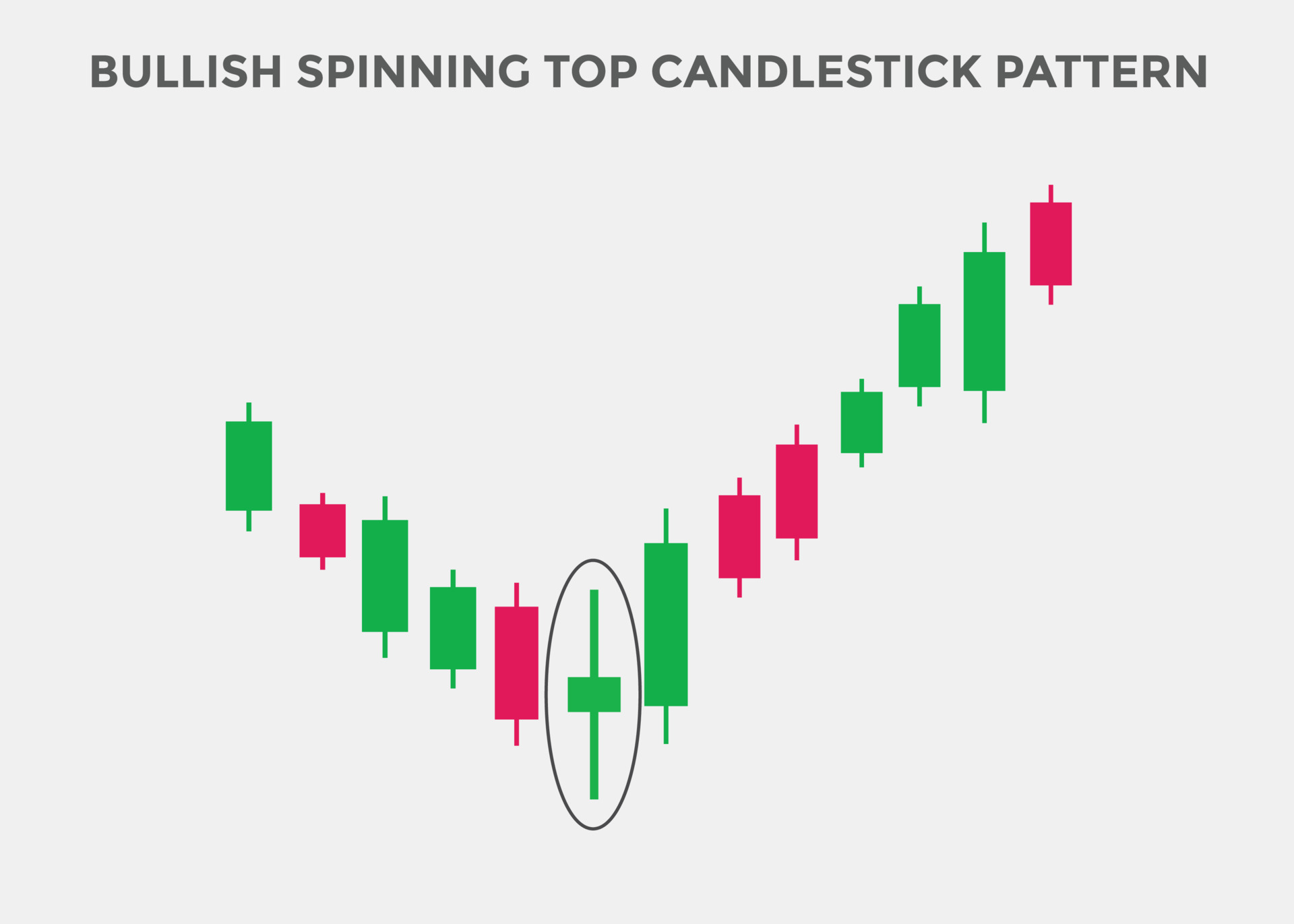

Bullish Spinning top candlestick pattern. Spinning top Bullish

Bullish Spinning Top Candlestick Pattern Candle Stick Trading Pattern

Spinning Top Candlestick Pattern Forex Trading

How to Trade with the Spinning Top Candlestick IG International

Spinning Top Candlestick Pattern How to trade & Examples Finschool

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

Trading with the Spinning Top Candlestick

:max_bytes(150000):strip_icc()/dotdash_Final_Spinning_Top_Candlestick_Definition_and_Example_Nov_2020-01-9ebe4d0e8ccb482c92214128a29874de.jpg)

Spinning Top Candlestick Definition

Bullish Spinning top candlestick pattern. Spinning top Bullish

A Spinning Top Is A Single Candlestick That Has A Small Body.

Web From A Supply And Demand Perspective, The Spinning Top Forex Pattern Represents A Period Of Indecision About The Future Direction Of A Market Where Neither Buyers Nor Sellers Could Gain The Upper Hand.

The Spinning Top Illustrates A Scenario Where Neither The Seller Nor The Buyer Has Gained.

It's Characterized By A Small Body Situated Between Long Upper And Lower Wicks.

Related Post: