Spinning Top Candle Pattern

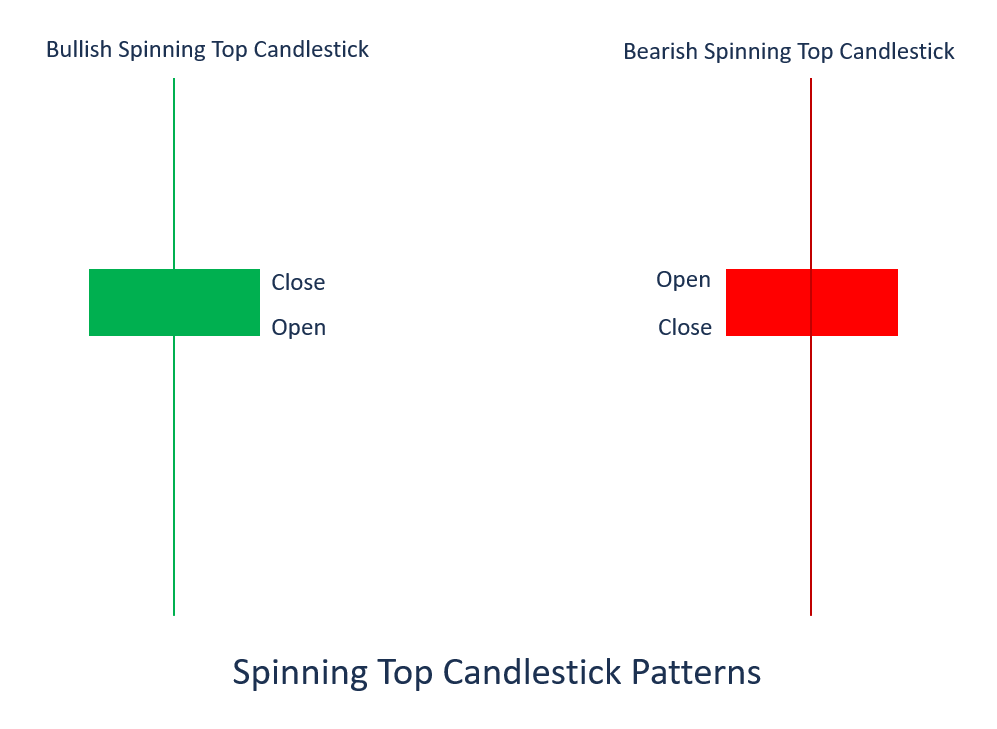

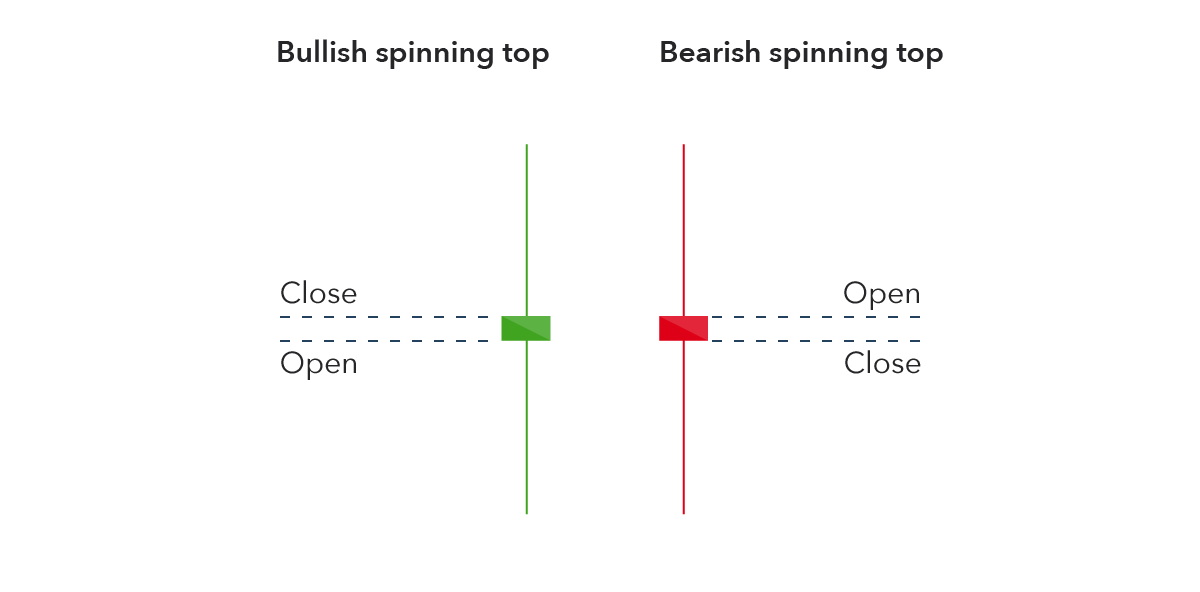

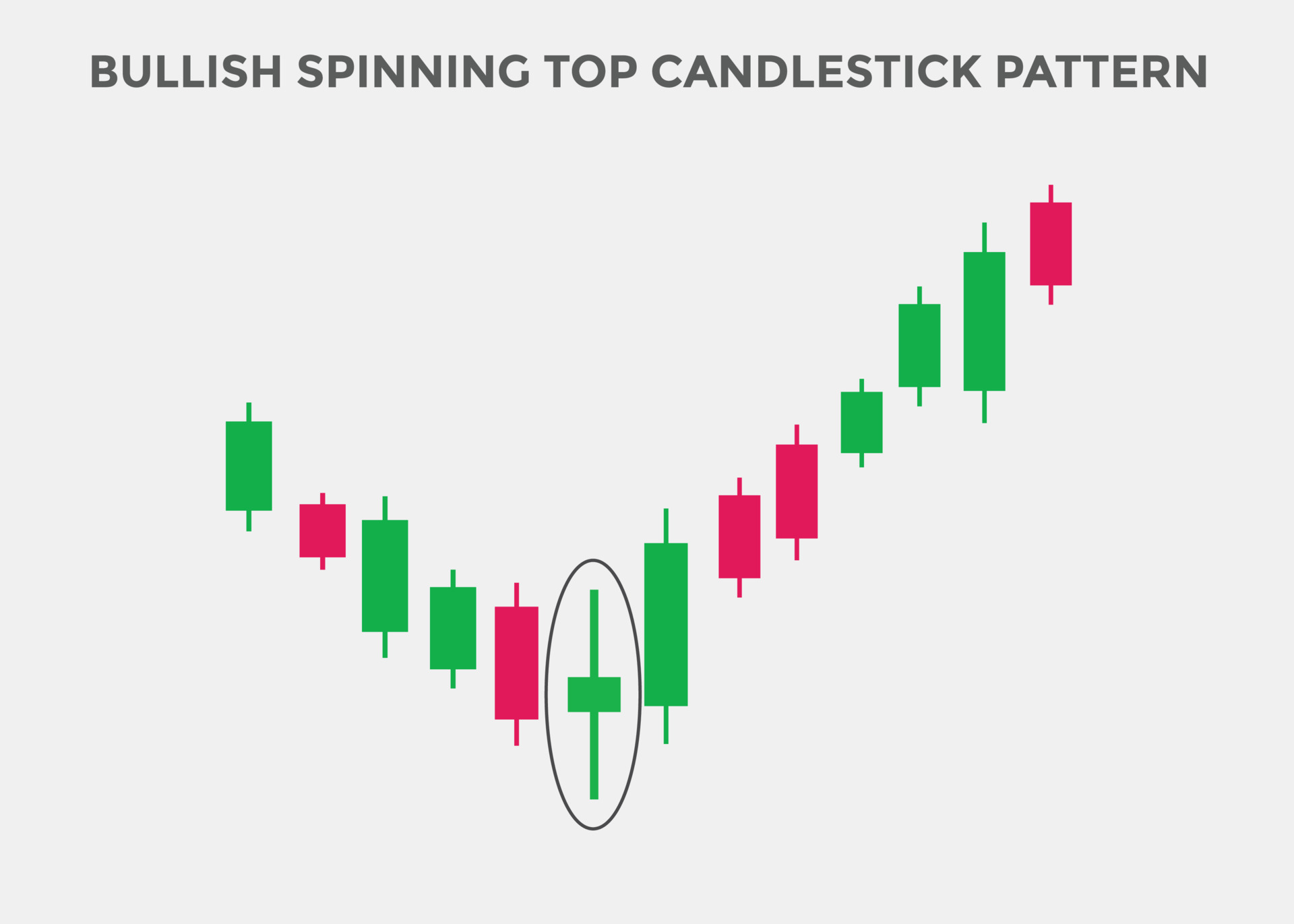

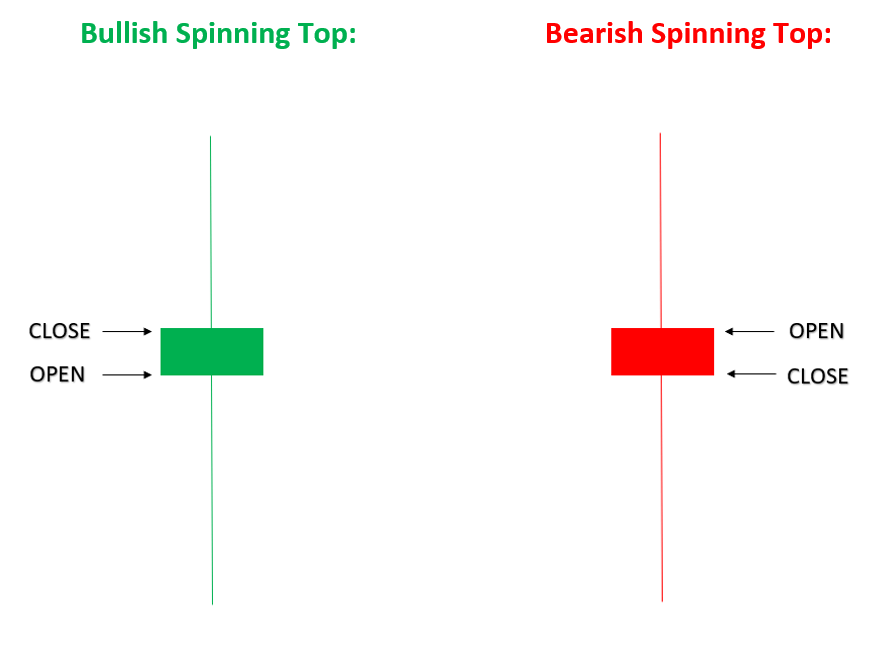

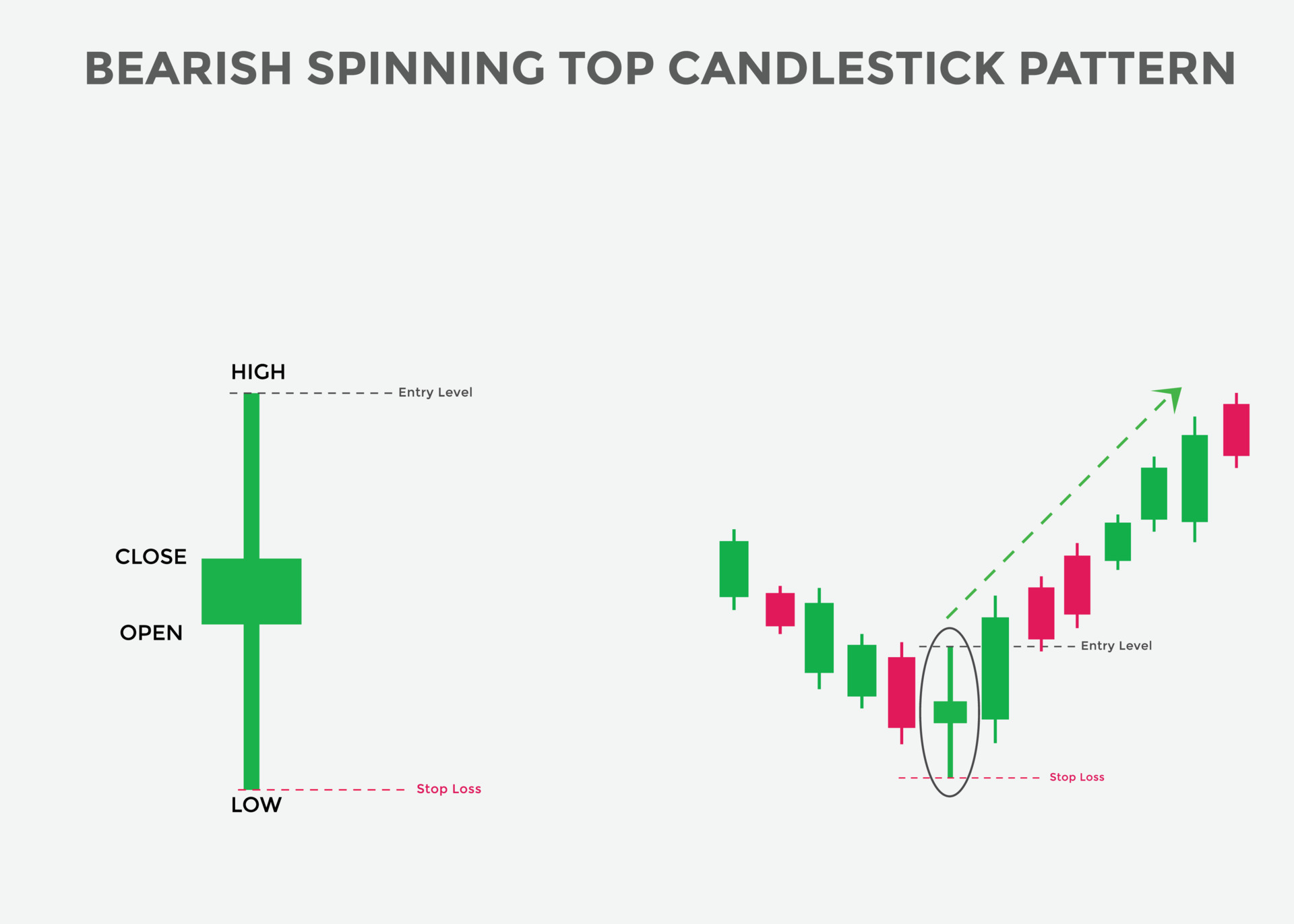

Spinning Top Candle Pattern - Draw fibonacci levels from the lowest to the highest level of the previous trend. Web how the spinning candlestick is formed. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. Web spinning top is a japanese candlesticks pattern with a short body found in the middle of two long wicks. The market is indecisive regarding its trend.the upper and lower long. Web a spinning top is a single candlestick pattern that has a body in the middle of two longer wicks. A spinning top is indicative of a situation where neither the buyers nor the sellers have won for that time period, as the market has closed relatively unchanged from where it opened; This candlestick formation signals indecisiveness amongst buyers and sellers, as neither of these sides has the upper hand, which is why it is. Web identify a spinning top pattern at the end of a bullish or bearish trend. A candlestick pattern known as a spinning top features a short true body that is vertically positioned in the middle of extended upper and lower shadows. A spinning top candlestick also signifies that a high volatility move is about to occur. After conducting 9,894 trades on 568 years of data, i confirm the spinning top profit per trade to be 0.49%. Web spinning tops form when the bulls and bears battle for control of price, but neither side can overwhelm the other. A candlestick pattern known. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. The market is indecisive regarding its trend.the upper and lower long. Web the spinning top candlestick chart pattern is a formation that occurs when buyers and sellers balance each other out, resulting in similar opening and closing price levels. A spinning top candlestick also. The market is indecisive regarding its trend.the upper and lower long. Web in the world of japanese candlesticks, spinning tops were the inspiration for the naming of the spinning top candlestick pattern. A small real body means that the open price and close price are close to each other. Web the patterns that form in the candlestick charts are signals. Spinning top a black or white candlestick with a small body. It has a small body closing in the middle of the candle’s range, with long wicks on both sides. A spinning top is indicative of a situation where neither the buyers nor the sellers have won for that time period, as the market has closed relatively unchanged from where. This candle is often regarded as. The candlestick pattern signifies uncertainty over the asset’s future course. This candlestick formation signals indecisiveness amongst buyers and sellers, as neither of these sides has the upper hand, which is why it is. This candlestick formation signals indecisiveness amongst buyers and sellers, as neither of these sides has the upper hand, which is. To. Generally, they are considered similar, with negligible distinctions. A spinning top candlestick also signifies that a high volatility move is about to occur. Web in the world of japanese candlesticks, spinning tops were the inspiration for the naming of the spinning top candlestick pattern. The opening and closing prices of the particular asset should be equal or at least closer,. “whoa, hold on a minute. Draw fibonacci levels from the lowest to the highest level of the previous trend. Web the spinning top pattern reflects an uncertainty within the market, with the candlestick patterns long upper and lower shadows indicating little change between the closing and opening price. Web a spinning top candlestick is a small to medium candle that. It has a small body closing in the middle of the candle’s range, with long wicks on both sides. Using the spinning top pattern in a trading strategy will help the trader work within the minimum suggested investment time. The candlestick itself is defined by a short body surrounded by long wicks (approximately the same length) on. Web in the. Despite bullish and bearish pressures, the price ultimately settles near its opening price, hinting at potential indecision or a pause in the prevailing trend. Web a white spinning top is a bullish candlestick chart pattern that indicates that the closing price of a security or other financial instrument was higher than the closing price. Similar to a doji pattern, a. Web the spinning top candlestick chart pattern is a formation that occurs when buyers and sellers balance each other out, resulting in similar opening and closing price levels. Doji and spinning top candles are quite commonly seen as part of larger patterns, such as. A small real body means that the open price and close price are close to each. Web a spinning top is a single candlestick pattern that has a body in the middle of two longer wicks. Generally, they are considered similar, with negligible distinctions. A spinning top candlestick also signifies that a high volatility move is about to occur. This candle is often regarded as. Draw fibonacci levels from the lowest to the highest level of the previous trend. Web the spinning top candlestick chart pattern is a formation that occurs when buyers and sellers balance each other out, resulting in similar opening and closing price levels. Web a white spinning top is a bullish candlestick chart pattern that indicates that the closing price of a security or other financial instrument was higher than the closing price. The spinning top candle shows that price ended up closer to the open or the close at the end of the time frame. Web the spinning top pattern reflects an uncertainty within the market, with the candlestick patterns long upper and lower shadows indicating little change between the closing and opening price. Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. This pattern is characterized by very long upper and lower wicks, and the open and close prices are the same or nearly the same, resulting in an extremely. The high and the low represent the opening and the closing prices. Web the patterns that form in the candlestick charts are signals of such actions and reactions in the market. A small real body means that the open price and close price are close to each other. A spinning top is a type of candlestick formation where the real body is small despite a wide range of price movement throughout the trading day. Similar in shape to its toy counterpart, with a short body and two long wicks, the spinning top is a common but important candlestick signal.

Trading with the Spinning Top Candlestick

Bullish Spinning Top Candlestick Pattern Candle Stick Trading Pattern

Spinning Top Candlestick Pattern The Complete Overview

Spinning Top Candlestick Pattern Forex Trading

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

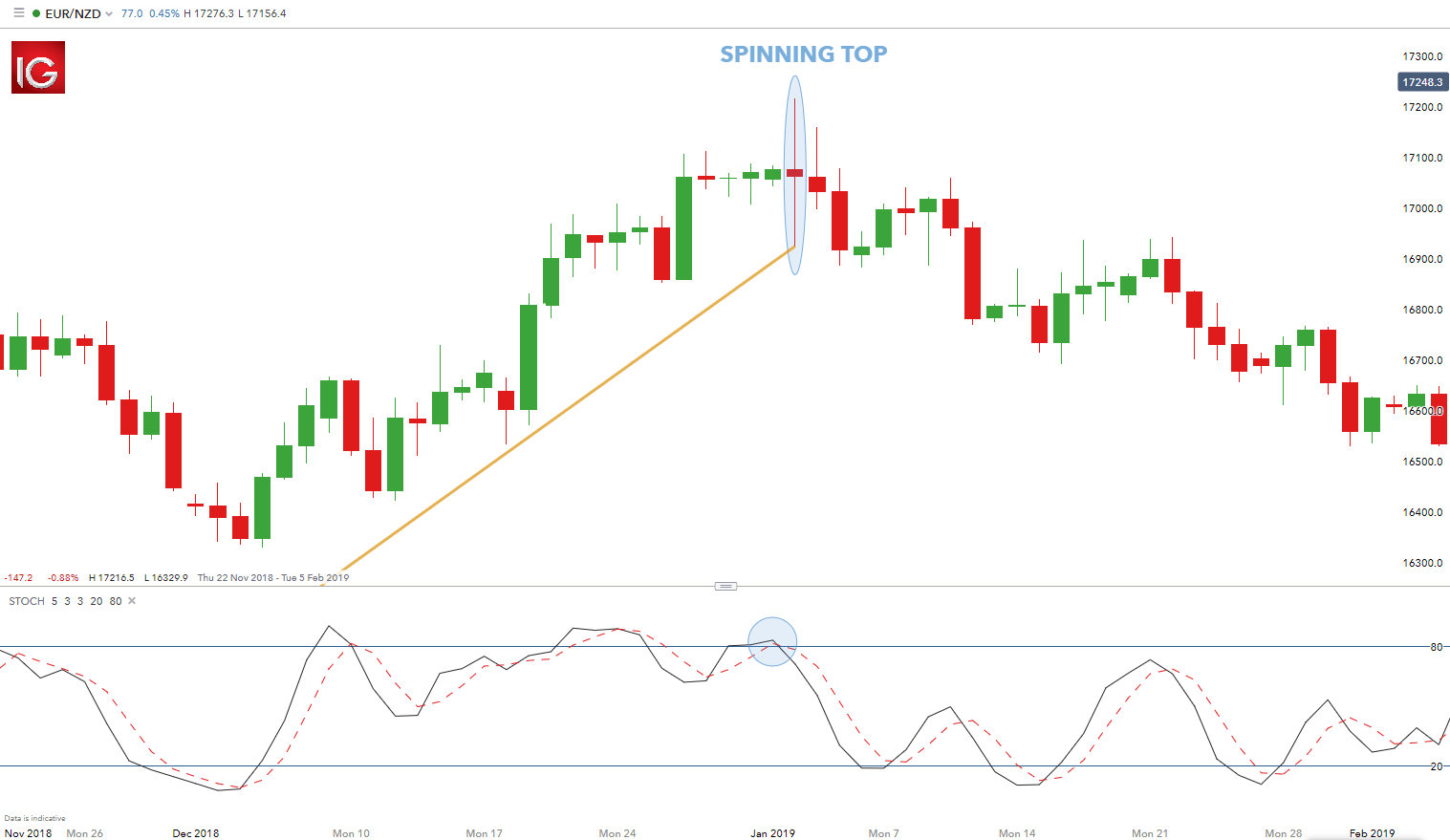

How to Trade with the Spinning Top Candlestick IG International

Bullish Spinning top candlestick pattern. Spinning top Bullish

Trading with the Spinning Top Candlestick

Bullish Spinning top candlestick pattern. Spinning top Bullish

:max_bytes(150000):strip_icc()/dotdash_Final_Spinning_Top_Candlestick_Definition_and_Example_Nov_2020-01-9ebe4d0e8ccb482c92214128a29874de.jpg)

Spinning Top Candlestick Definition

This Candlestick Pattern Has A Short Real Body With Long Upper And Lower Shadows Of Almost Equal Lengths.

“Whoa, Hold On A Minute.

Wait For The Next Candlestick To Close Above (Or Below) The Closing Price Of The Spinning Top Candle.

Price Movements Within The Spinning Top Candlestick Indicate That Buyers And Sellers Are Overriding Each Other, Resulting In Homogenous Open And Close Price Trends.

Related Post: