Spin Top Pattern

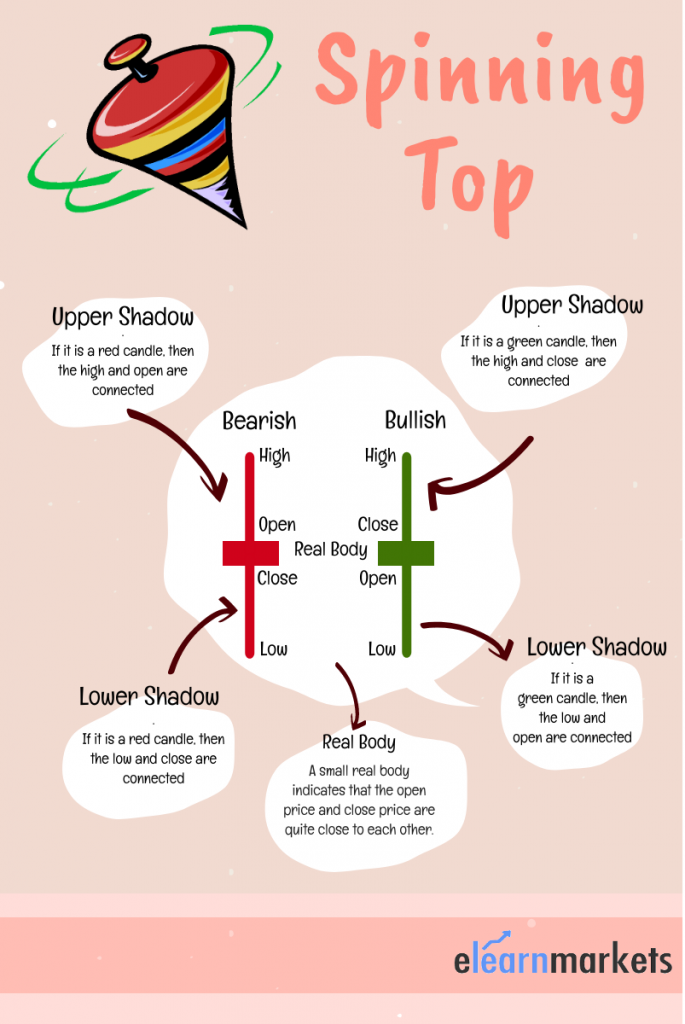

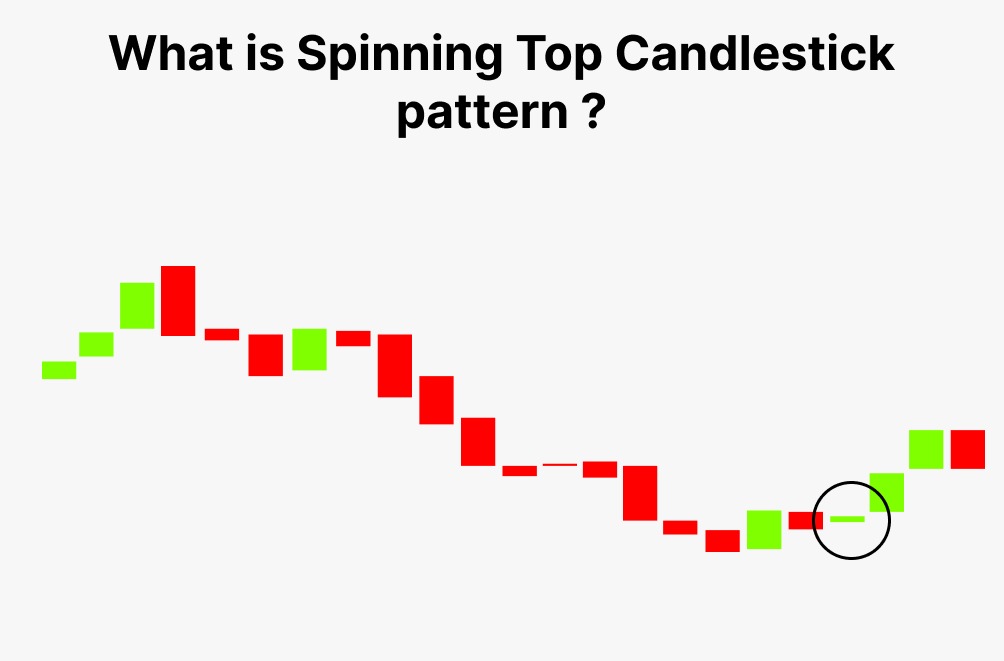

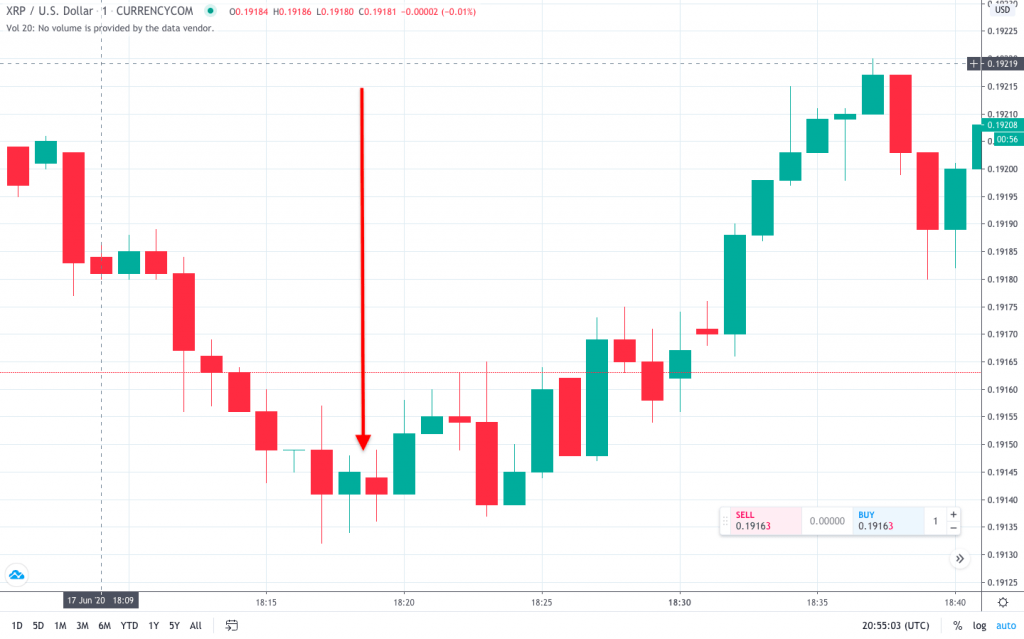

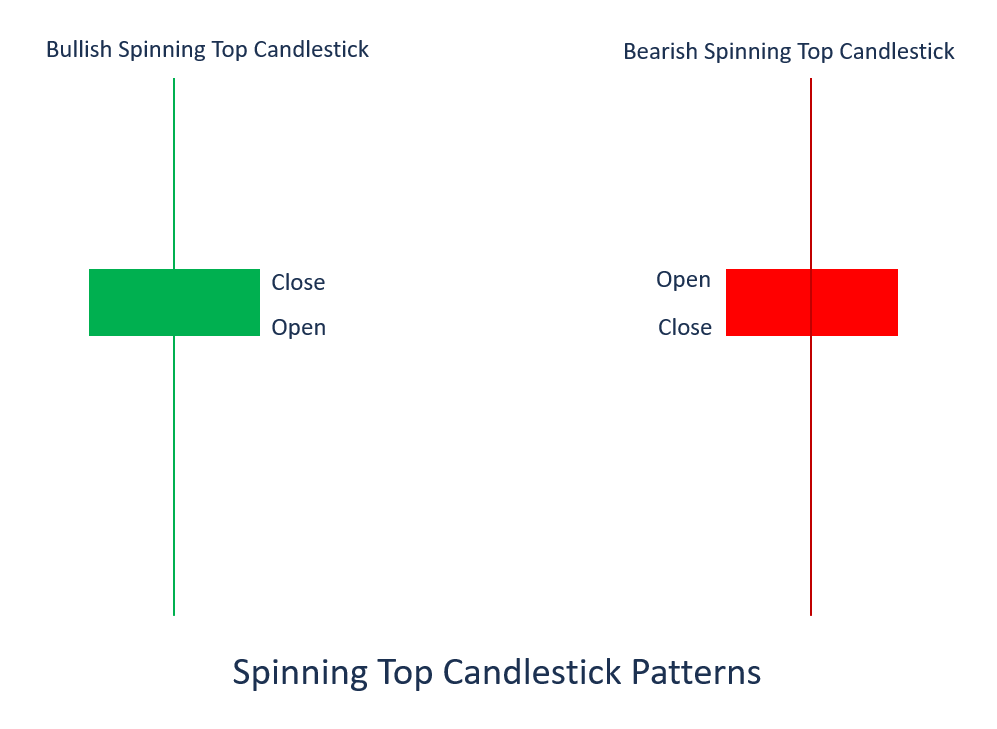

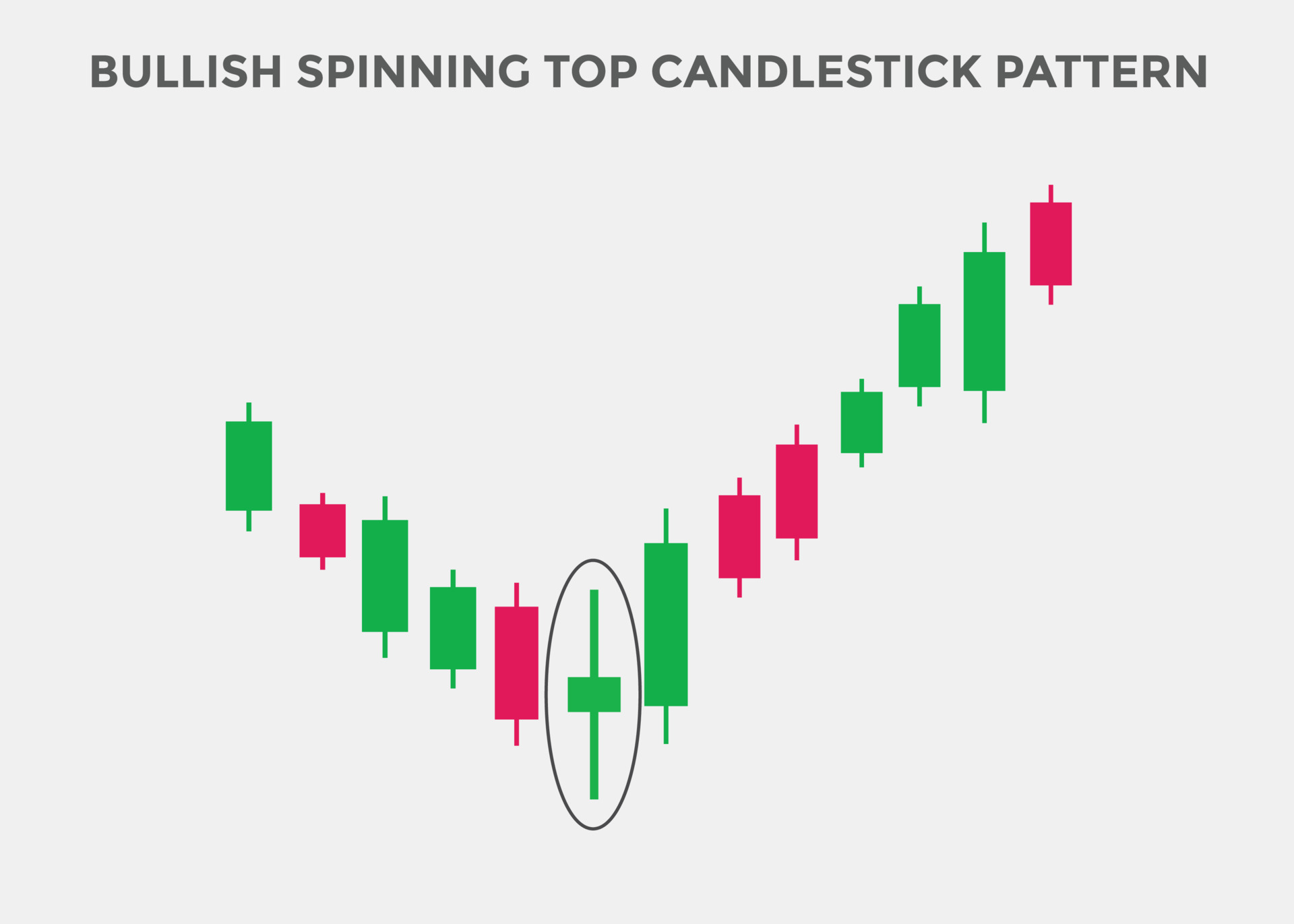

Spin Top Pattern - You can practise trading using the spinning top chart pattern with an ig demo account. The market is indecisive regarding its trend.the upper and lower long. It can warn of price reversal. Web thinkmarkets > learn to trade > indicators & patterns > general patterns > spinning top pattern. This candle represents a neutral position in which neither bulls or bears can gain control during the trading session. Web identify a spinning top pattern at the end of a bullish or bearish trend. Both patterns feature a single candlestick with a long wick extending from the top as well as the bottom. It results in equal opening and closing price units. Web the spinning top, however, provides insightful data regarding the state of the market at the moment. In other words, the open and the close of the spinning top are near to each other, which renders the color of the spinning top 's real. Web type in the name of the asset you want to trade in the search bar. Web a spinning top is a single candlestick pattern that has a body in the middle of two longer wicks. Web a spinning top is a japanese candlestick pattern that denotes indecision in the market, usually at the end of a trend. These compact. In other words, the open and the close of the spinning top are near to each other, which renders the color of the spinning top 's real. A spinning top chart pattern is a signal that neither buyers or sellers have control of price action in the time frame of the candle. This candlestick pattern has a short real body. Enter a long or selling position. Web spinning top is a japanese candlesticks pattern with a short body found in the middle of two long wicks. You can practise trading using the spinning top chart pattern with an ig demo account. On day 1, it opens at $70 and closes at $71, with highs at $73 and lows at $68,. So if you’re looking to identify a. If you don’t know, here’s what a flag pattern looks like…. The spinning top is identified by a narrow, but not completely flat, candlestick body and an upper and lower shadow of nearly equal size. This candlestick pattern has a short real body with long upper and lower shadows of almost equal lengths.. Web a white spinning top is a bullish candlestick chart pattern that indicates that the closing price of a security or other financial instrument was higher than the closing price. This candle is often regarded as. A spinning top is a type of candlestick formation where the real body is small despite a wide range of price movement throughout the. Web key takeaways for trading the spinning top candlestick pattern: The formation of a spinning top candlestick helps determine the probability of a price reversal especially. Web identify a spinning top pattern at the end of a bullish or bearish trend. First, the bulls push price beyond the open, causing the candle to turn bullish. Identify market trend by using. Web spinning top candlestick is a pattern with a short body between an upper and a lower long wick. It is a common pattern that can be found at any timeframe. A spinning top is indicative of a situation where neither the buyers nor the sellers have won for that time period, as the market has closed relatively unchanged from. Conversely, in a downtrend, another top emerges, indicating possible weakening bearish momentum. This gives it the appearance of a spinning top. However, it’s easy to distinguish between the two because one has a body (the spinning top) and the other doesn’t (the doji). A candlestick pattern known as a spinning top features a short true body that is vertically positioned. A spinning top or (koma) is a candlestick which the body of the candlestick is smaller than the lower and upper wicks. Web type in the name of the asset you want to trade in the search bar. Web one candlestick pattern is the spinning top. The spinning top candle shows that price ended up closer to the open or. In other words, the open and the close of the spinning top are near to each other, which renders the color of the spinning top 's real. The spinning top is identified by a narrow, but not completely flat, candlestick body and an upper and lower shadow of nearly equal size. As they rotate the designs will blend together. These. Web spinning top candlestick is a pattern with a short body between an upper and a lower long wick. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. A spinning top chart pattern is a signal that neither buyers or sellers have control of price action in the time frame of the candle. Web the spinning top, however, provides insightful data regarding the state of the market at the moment. Metal washers, wood beads and colorful tape! The color of the real body is irrelevant as the body of the candle is so small. Conversely, in a downtrend, another top emerges, indicating possible weakening bearish momentum. Identify market trend by using trend lines or technical indicators. So if you’re looking to identify a. Web the pattern is marked by small bodies and long upper and lower shadows, illustrate market indecision. Web the spinning top is a single candlestick pattern with a relatively small real body and an upper and lower shadow that is longer than the length of its real body. Web spinning top is a japanese candlesticks pattern with a short body found in the middle of two long wicks. These paper tops are fun to decorate with contrasting details. Web a spinning top is a japanese candlestick pattern that denotes indecision in the market, usually at the end of a trend. You can practise trading using the spinning top chart pattern with an ig demo account. A small real body means that the open price and close price are close to each other.

Spinning Top Candlestick How to trade with Spinning?

How to Trade with the Spinning Top Candlestick IG International

DIY Spinning Top Optical Illusion Toys — All for the Boys

Spinning Top Candlestick Pattern How to trade & Examples Finschool

Spinning Top Candlestick Pattern Forex Trading

What is a Spinning Top Candlestick Pattern TradeSanta

Spinning Top Candlestick Pattern The Complete Overview

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

Bullish Spinning top candlestick pattern. Spinning top Bullish

Spinning Top How To Make A Spinning Top DIY Spinning Top Quilling

It Can Warn Of Price Reversal.

These Patterns Often Precede Significant Price Reversals.

Let’s Break This Pattern Down:

If You Don’t Know, Here’s What A Flag Pattern Looks Like….

Related Post: