Snowball Template

Snowball Template - Free printable debt snowball worksheet. The current rate is $3.99 and $9.99, respectively. Tagged debt payoff debt snowball f6f5f0 google sheets templates microsoft excel template. Squawkfox is a blog focused on helping you rewire your brain for better money management. To make this template attractive, you can play around with the colors, font styles, and much more. Web setting up the debt snowball spreadsheet is relatively simple whether you are in excel or google sheets. Once that debt is gone, take its payment and apply it to the next smallest debt (while continuing to make minimum. Web here’s how the debt snowball works: The second credit card is $9,000 at 9% interest. This spreadsheet will let you calculate results for doing the avalanche as well as the snowball. $3,000 ($70 minimum payment) 4th debt: Open a blank debt snowball calculator as shown below. Web the listing broker’s offer of compensation is made only to participants of the mls where the listing is filed. To get your copy of the debt snowball spreadsheet, simply sign up to our newsletter below! Once that debt is gone, take its payment and. Repeat until each debt is paid in full. The note on line 3 mentions that you only need to input values in cells marked yellow. Web here’s how the debt snowball method works: The magic begins when you. You make all of the minimum payments on all of your debts. After signing up, you’ll also get tips on how to get on a budget, get out of debt and start saving more! We can’t help but recommend our own debt snowball worksheet ( you can download it for free here) as a great option if you’re looking to track your debt payoff journey. Zillow has 20 photos of this $360,000. To get your copy of the debt snowball spreadsheet, simply sign up to our newsletter below! Web here’s how the debt snowball method works: $4,000 ($75 minimum payment) for example, let's say you have $1,000 to pay towards. Web debt snowball spreadsheet & calculator [free download] well kept wallet has a great debt snowball calculator that can help figure out. After signing up, you’ll also get tips on how to get on a budget, get out of debt and start saving more! In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open parenthesis. The strategy worked so well for sall that he decided to share his spreadsheet for paying back debt. Web understanding the. Debt tracker template by spreadsheetpoint. You can either print it or fill it in online as a pdf, so it works no matter which format you prefer. Just choose the strategy from a dropdown box after you enter your creditor information into. Web our debt snowball calculator makes the process easy. Then you can also use a debt reduction calculator. Get the vertex42 debt snowball spreadsheet. Web the debt snowball method is truly the simplest, most powerful way to pay off your debt. After signing up, you’ll also get tips on how to get on a budget, get out of debt and start saving more! Simply fill out the form with all your debts, enter a monthly dollar amount you. Your first credit card is $1000 at 12% interest. Debt tracker template by spreadsheetpoint. Calculate the debt snowball spreadsheet in action. Repeat until each debt is paid in full. The magic begins when you. Web the listing broker’s offer of compensation is made only to participants of the mls where the listing is filed. Avalanche achieving milestones and maintaining. Web he used the snowball method to pay off roughly $100,000 worth of debt (including his mortgage). List your debts from smallest to largest regardless of interest rate. The best part about creating a debt. In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open parenthesis. The best part about creating a debt snowball spreadsheet in excel or google sheets is it allows you to see quickly how fast you can be debt free. You start by listing your debts from smallest to largest by payoff balance. Using her. Web repeat this step for the other debts, but don’t include the extra payment yet. List your debts from smallest to largest. $3,000 ($70 minimum payment) 4th debt: To make this template attractive, you can play around with the colors, font styles, and much more. You start by listing your debts from smallest to largest by payoff balance. Debt tracker template by spreadsheetpoint. Squawkfox is a blog focused on helping you rewire your brain for better money management. Follow the steps below to set one up on your own. Web here’s how the debt snowball works: This spreadsheet will let you calculate results for doing the avalanche as well as the snowball. Simply fill out the form with all your debts, enter a monthly dollar amount you can add to your payoff plan, and click the “calculate debt snowball” button. Using her debt snowball spreadsheet, founder kerry taylor paid off. Web here’s how the debt snowball method works: The best part about creating a debt snowball spreadsheet in excel or google sheets is it allows you to see quickly how fast you can be debt free. This spreadsheet includes additional information about. You can either print it or fill it in online as a pdf, so it works no matter which format you prefer.

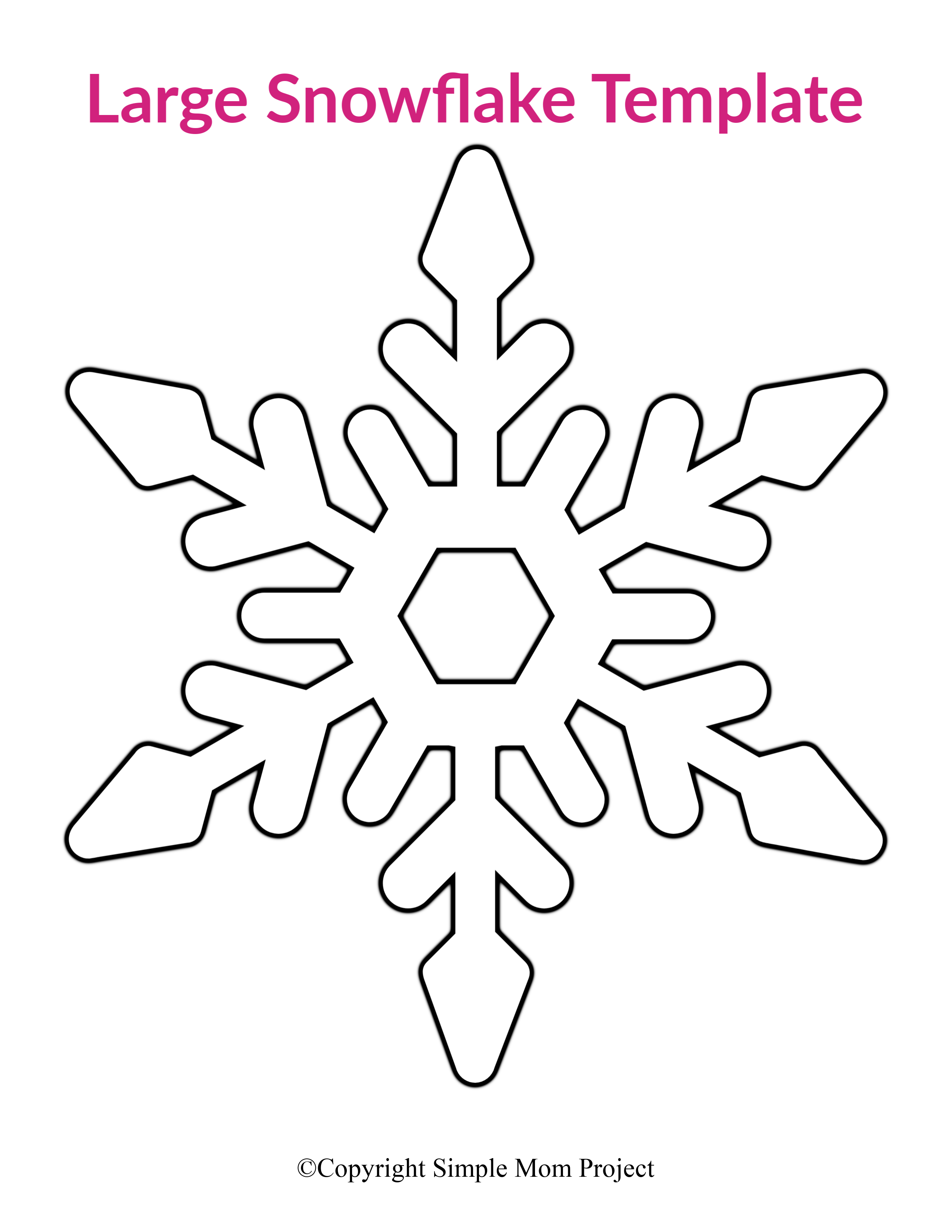

Free Printable Snowflake Templates

Free Printable Template For Snowflakes Printable Templates

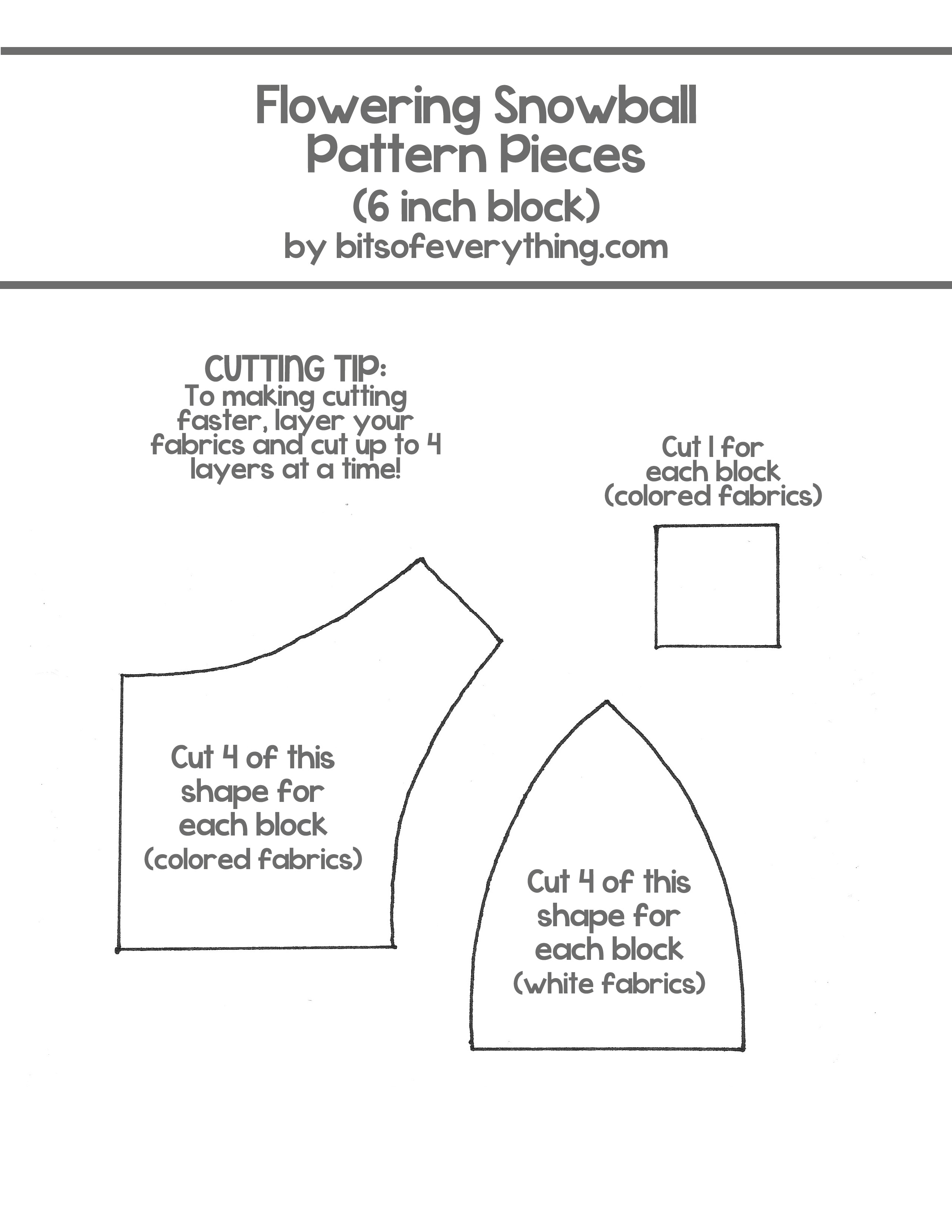

Snowball Quilt Block Tutorial

Printable Snowflake Templates to Get You Through Any Snow Day SheKnows

9 best ideas for coloring Christmas Snowball Template Printable

Snowflakes round snowball template Royalty Free Vector Image

Snowball Effect PowerPoint Template

Free Snowflake Template Easy Paper Snowflakes To Cut And Color

DIY Paper Snowflakes Template Easy CutOut Decorations

Free Printable Snowflake Stencils

Make Minimum Payments On All Your Debts Except The Smallest.

Avalanche Achieving Milestones And Maintaining.

Web When Using This Method, You Need To Make Or Download A Debt Snowball Form Or Spreadsheet.

For Over 10 Years, Undebt.it Has Helped Hundreds Of Thousands Of People All Over The World Pay Down Billions Of Dollars.

Related Post: