Single Candlestick Patterns

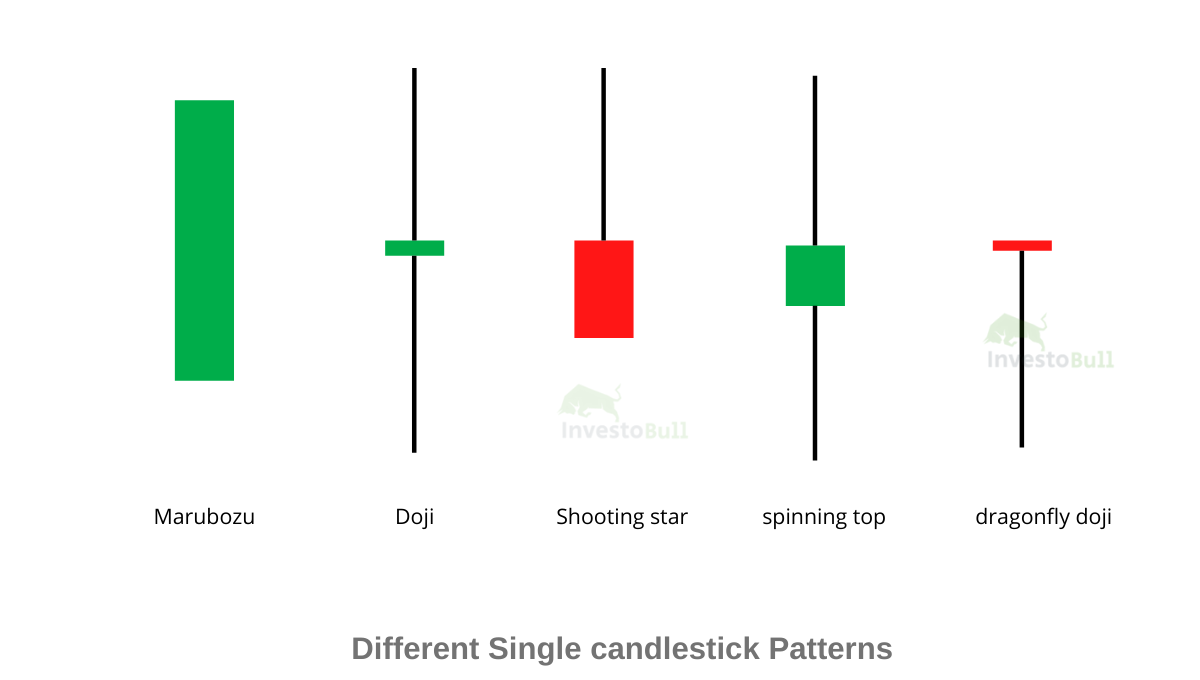

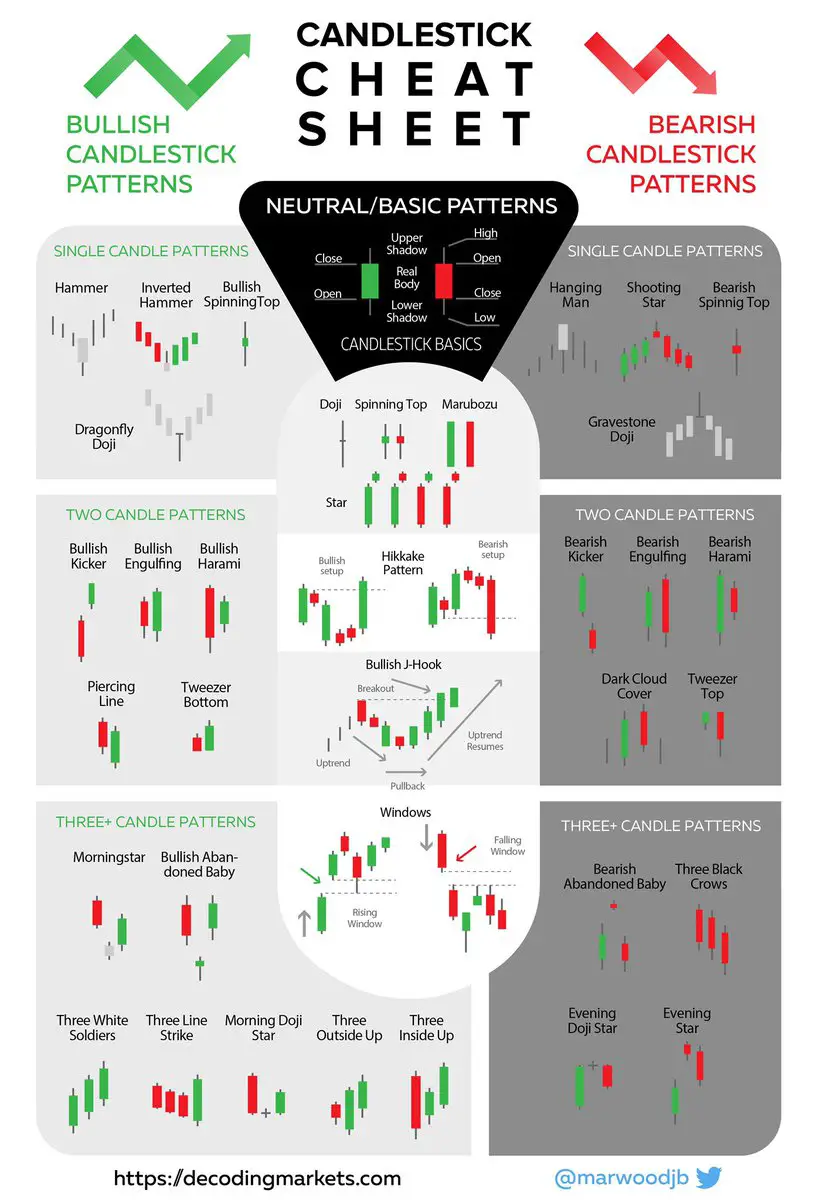

Single Candlestick Patterns - Web single candlestick patterns are individual candlestick formations that provide trading signals within a single candle. These patterns are easy to understand and provide clear signals, which can try to help traders make more informed trading decisions. Learn how to trade the shooting star; Web candlestick patterns pdf free🔥 | chart patters pdf free all single candlesticks |technical analysishello friends,in this channel, we all will learn about fu. Web remember the rules based on which candlesticks work. Candlestick charts are a technical tool that packs data for multiple time frames into single price bars. Here are the four basic single japanese candlestick patterns: One needs to pay some attention. When these types of candlesticks appear on a chart, they can signal potential market reversals. Web a bullish hammer is a single candle pattern that hints at a turn during an established downtrend. Web remember the rules based on which candlesticks work. Critical components like the candle's body and wicks (or shadows) provide insights into the opening, closing, and high and low prices. It looks like this on your charts: Web in the previous video, you got a quick overview of the types of candlestick patterns and the key rules you need to. A doji is a single candle that is characterized by having little or no real body, with the upper and lower shadows indicating the trading range for that period. The standard doji looks like a plus sign. A gravestone doji happens when a price has a small lower shadow and an extremely long upper shadow. The doji and spinning top. In conclusion, single candlestick patterns can be a useful tool in forex trading for identifying potential price reversals or continuations. The interpretation of the paper umbrella changes based on where it appears on the chart. Bullish closing marubozu candlestick pattern. When these types of candlesticks appear on a chart, they can signal potential market reversals. Now that you’re familiar with. Watch this video and discover the secrets of single. Web a bullish hammer is a single candle pattern that hints at a turn during an established downtrend. Shooting star and inverted hammer. Web single candlestick patterns are individual candlesticks that provide insights into market sentiment, potential trend reversals, or continuations, with patterns such as the doji, hammer, and shooting star. Web in the previous video, you got a quick overview of the types of candlestick patterns and the key rules you need to remember, in this video we dive deeper int. When these types of candlesticks appear on a chart, they can signal potential market reversals. The lack of a real body, combined with equal or. Web single candlestick patterns. Web the doji candlestick pattern is a type of candlestick formation in forex trading that is used to indicate potential market reversals. Web here’s how to identify the black marubozu candlestick pattern: Web the takuri candlestick pattern is a single candle bullish reversal pattern. Here are the four basic single japanese candlestick patterns: Marubozu is the only pattern that violates. This pattern illustrates how a downtrend is opposed by the bulls and the candle eventually closes near its. Web a guide to single candlestick patterns: Watch this video and discover the secrets of single. Buy around the closing price of a bullish marubozu. Web in the example above, the proper entry would be below the body of the shooting star,. A paper umbrella consists of two trend reversal patterns, namely the hanging man and the hammer. Web as the name suggests, a single candlestick pattern is formed by just one candle. Marubozu is the only pattern that violates rule number 3, i.e. Web single candlestick patterns are individual candlestick formations that provide trading signals within a single candle. One needs. 6 how to trade shooting star candlestick patterns. Whether you’re a seasoned trader or just starting out, understanding these patterns can greatly enhance your ability to predict market trends and make profitable trades. Critical components like the candle's body and wicks (or shadows) provide insights into the opening, closing, and high and low prices. Web the doji candlestick pattern is. Shooting star and inverted hammer. Now that you’re familiar with basic candlestick patterns like spinning tops, marubozus, and dojis, let’s learn how to recognize single candlestick patterns. Watch this video and discover the secrets of single. Web candlestick patterns pdf free🔥 | chart patters pdf free all single candlesticks |technical analysishello friends,in this channel, we all will learn about fu.. This makes them more useful than traditional open, high, low. The following image shows how it appears on a chart: Whether you’re a seasoned trader or just starting out, understanding these patterns can greatly enhance your ability to predict market trends and make profitable trades. Web a bullish hammer is a single candle pattern that hints at a turn during an established downtrend. If you want to become a successful stock market trader, it is very important that you learn to read and understand candlesticks or candles.these candlesticks are basically a style of technical chart used to describe price movements of a stock, derivative, or currency. Let’s look at a single candle pattern named the bullish closing marubozu. It signals a buying opportunity. Web remember the rules based on which candlesticks work. A picture is worth a thousand words, so let’s use a few to shine a light on candlesticks. The standard doji looks like a plus sign. Web single candlestick patterns are individual candlesticks that provide insights into market sentiment, potential trend reversals, or continuations, with patterns such as the doji, hammer, and shooting star indicating bullish or bearish market signals. Web candlestick pattern explained. The doji and spinning top candles are typically found in a sideways consolidation patterns where price and trend are still trying to be discovered. Web here’s how to identify the black marubozu candlestick pattern: Web each candlestick pattern has a distinct name and a traditional trading strategy. In conclusion, single candlestick patterns can be a useful tool in forex trading for identifying potential price reversals or continuations.

The Ultimate Guide To Candlestick Patterns Vrogue

How To Read Single Candlestick Patterns? tube zero

What are Single Candlestick Patterns? Espresso Bootcamp

Most Important Single Candlestick Patterns To Know Forex Training Group

Introduction to Candlestick Patterns

Single Candlestick Patterns u/sherbazar

![Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim](https://f.hubspotusercontent10.net/hubfs/20705417/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Candlestick Patterns Explained [Plus Free Cheat Sheet] TradingSim

Single Candlestick Patterns The Forex Geek

The Ultimate Candle Pattern Cheat Sheet New Trader U

How To Read Single Candlestick Patterns? tube zero

It Looks Like This On Your Charts:

The Interpretation Of The Paper Umbrella Changes Based On Where It Appears On The Chart.

Critical Components Like The Candle's Body And Wicks (Or Shadows) Provide Insights Into The Opening, Closing, And High And Low Prices.

Web A Doji Pattern Is A Single Candlestick That Is Formed When An Asset’s Price Closes Where It Opens.

Related Post: