Simple Dcf Excel Template

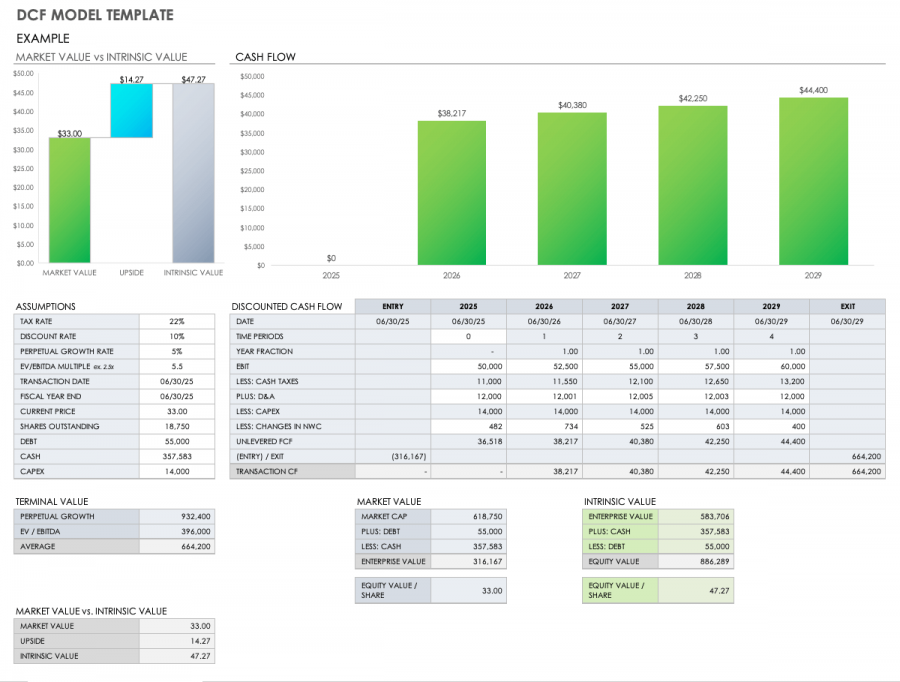

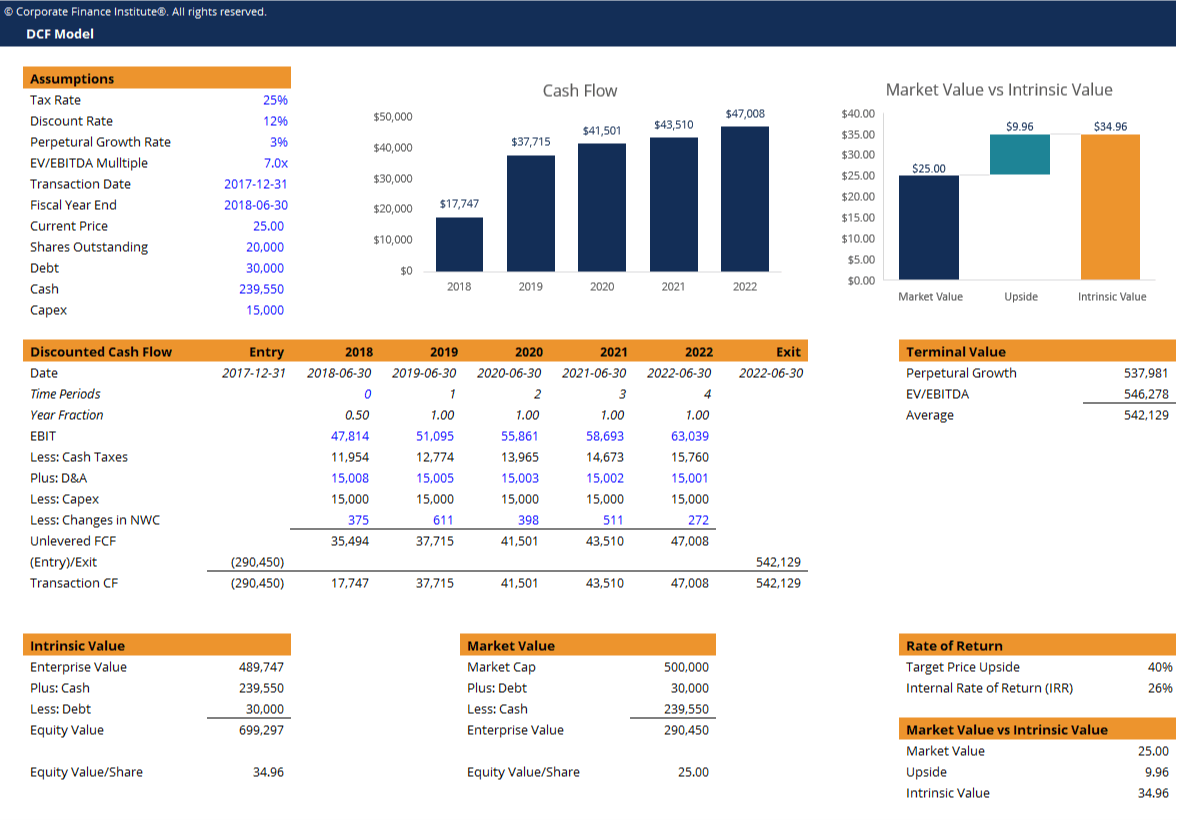

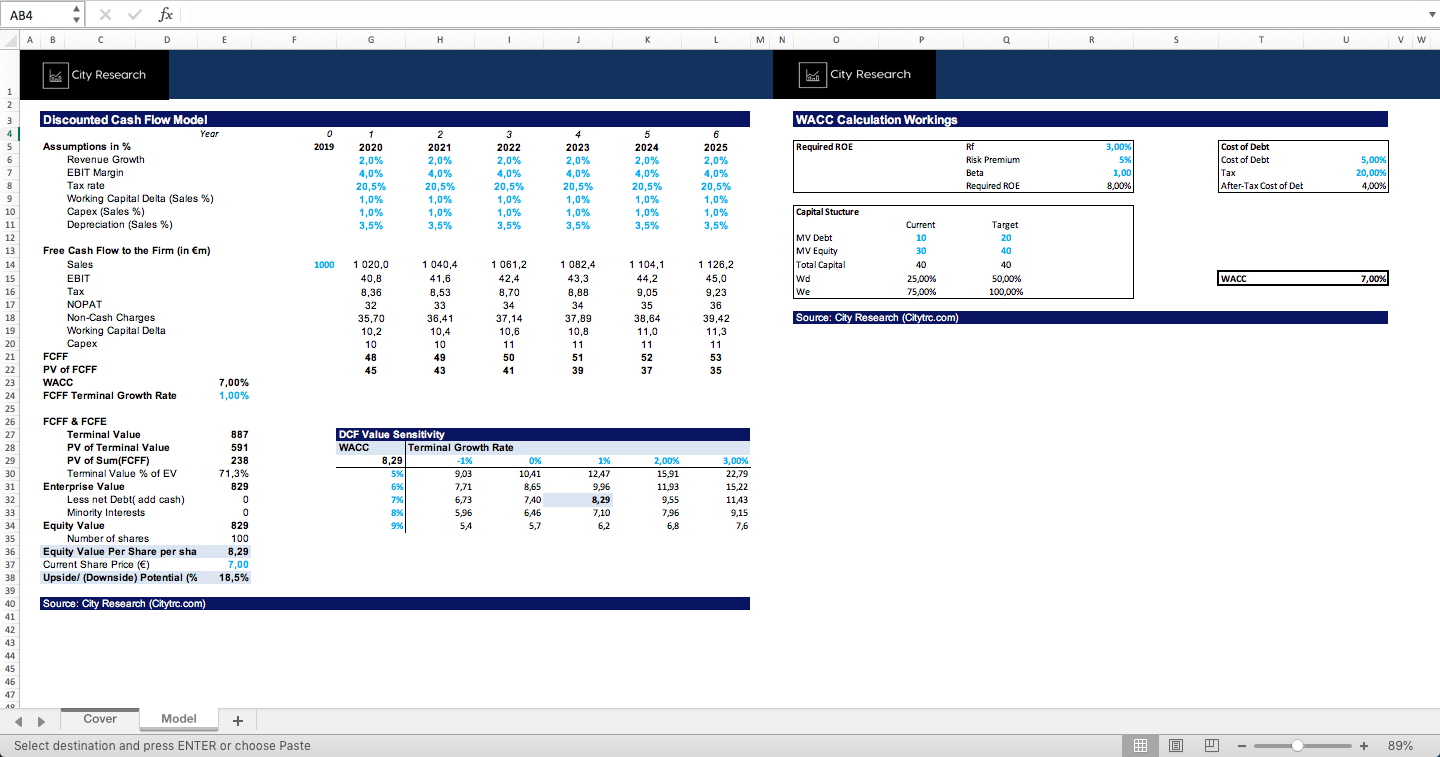

Simple Dcf Excel Template - All included here with examples and real life case studies. Discount the projection period and terminal cash flows to the present using the discount rate. Enter your name and email in the form below and download the free. How to build dcf model excel structures? Understand discounted cash flow principles and perform accurate valuations in excel. Forecast the company's key financials and calculate the corresponding free cash flows. This dcf model training guide will. All that’s really necessary here is to map out the payment schedule, including how much cash you’ll receive every year. Forecast future cash flows and determine the present value of these cash flows by discounting. Now that we’ve gone over how to calculate discounted cash flow in excel, we can set up the template. Web elevate your investment analysis with our free dcf model template. Multi location (franchise model) additional free template resources: Reviewed by rebecca baldridge |. Spreadsheet template freespreadsheets for freetemplates for free Forecast future cash flows and determine the present value of these cash flows by discounting. This guide will teach you how to get and use a free dcf template in excel. Web a simple dcf model excel template quantifies a company’s value by forecasting its cash flows. Forecast future cash flows and determine the present value of these cash flows by discounting. All included here with examples and real life case studies. Exinfm ( link). Performing dcf calculations in excel requires setting up cash flows and discounting them to present value. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and discounting them to arrive. How to build a dcf model: This guide will teach you how to get and use. Discounted cash flow (dcf) model template. Below this column header you’ll be calculating the net present value. Web elevate your investment analysis with our free dcf model template. Designed for clarity and ease of use, making dcf analysis accessible for all. Now that we’ve gone over how to calculate discounted cash flow in excel, we can set up the template. It comes complete with an example of a dcf model. How to build dcf model excel structures? Now that we’ve gone over how to calculate discounted cash flow in excel, we can set up the template. The discounted cash flow model, or “dcf model”, is a type of financial model that values a company by forecasting its cash flows and. Hit enter to get the npv value in e2. Web 1 excel model. Now, in the destination cell, which is e2 in the current exercise, enter the following formula: This dcf model training guide will. Calculating unlevered free cash flows (fcf) key dcf assumptions. Today, we’ll explore one of the key financial tools: It comes complete with an example of a dcf model. Join 307,012+ monthly readers mergers & inquisitions Input the valuation date, discount rate, perpetual growth rate, and tax rate. Calculating unlevered free cash flows (fcf) key dcf assumptions. Download the free dcf model template. All included here with examples and real life case studies. Hit enter to get the npv value in e2. Now, in the destination cell, which is e2 in the current exercise, enter the following formula: Web by gerard kelly |. Below this column header you’ll be calculating the net present value. Forecast future cash flows and determine the present value of these cash flows by discounting. This video opens with an explanation of the objective of a discounted cash flow (“dcf”) model. This guide will teach you how to get and use a free dcf template in excel. Use our. Get a quick look of discounted cash flow equity valuation based on the assumptions of operating performance of a company. Now that we’ve gone over how to calculate discounted cash flow in excel, we can set up the template. Designed for clarity and ease of use, making dcf analysis accessible for all. This guide will teach you how to get. Get a quick look of discounted cash flow equity valuation based on the assumptions of operating performance of a company. 1000s of global customershighly customizablesince 200024x7 support Web template for multifamily property. Web elevate your investment analysis with our free dcf model template. Enter your name and email in the form below and download the free. Calculating unlevered free cash flows (fcf) key dcf assumptions. Users download it to estimate an investment’s worth using net present value (npv). Discount the projection period and terminal cash flows to the present using the discount rate. Web by gerard kelly |. Now that we’ve gone over how to calculate discounted cash flow in excel, we can set up the template. Web creating a template to calculate discounted cash flow in excel. Exinfm ( link) a webpage with “100+ excel spreadsheets.” macabacus ( link) How to build a dcf model: A basic dcf model involves projecting future cash flows and discounting them back to the present using a discount rate that reflects the riskiness of the capital. Here’s an example scenario of receiving $100,000. This dcf model training guide will.

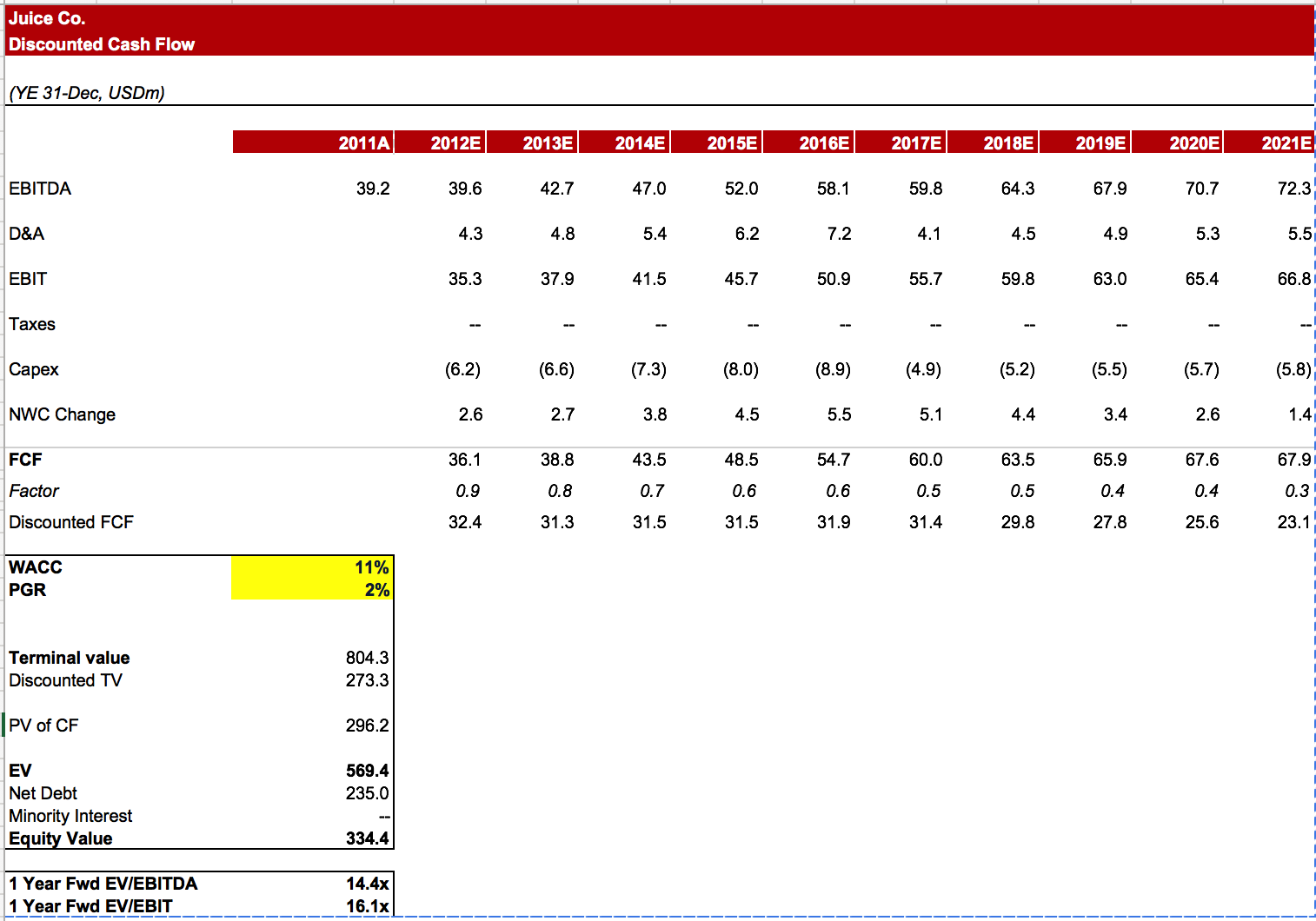

Discounted Cash Flow Excel Template Free DCF Valuation Model in Excel

Free Discounted Cash Flow Templates Smartsheet

DCF Model Template Download Free Excel Template

![Free DCF Template Excel [Download & Guide] Wisesheets Blog](https://cdn-eaclf.nitrocdn.com/osNuHhBvVdZeEkSNJhSMrIuyqQJMcjPL/assets/static/optimized/rev-09e077f/wp-content/uploads/2022/07/Screen-Shot-2022-07-03-at-11.57.05-AM-1024x539.png)

Free DCF Template Excel [Download & Guide] Wisesheets Blog

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

DCF model tutorial with free Excel

Simple Dcf Excel Template

Dcf Model Template

How to Build DCF Model Excel Training Guide

Discounted Cash Flow (DCF) Model Free Excel Template Macabacus

Web Discounted Cash Flow Template.

This Dcf Model Template Provides You With A Foundation To Build Your Own Discounted Cash Flow Model With Different Assumptions.

The Discounted Cash Flow Model, Or “Dcf Model”, Is A Type Of Financial Model That Values A Company By Forecasting Its Cash Flows And Discounting Them To Arrive.

Performing Dcf Calculations In Excel Requires Setting Up Cash Flows And Discounting Them To Present Value.

Related Post: