Shooting Star Stock Pattern

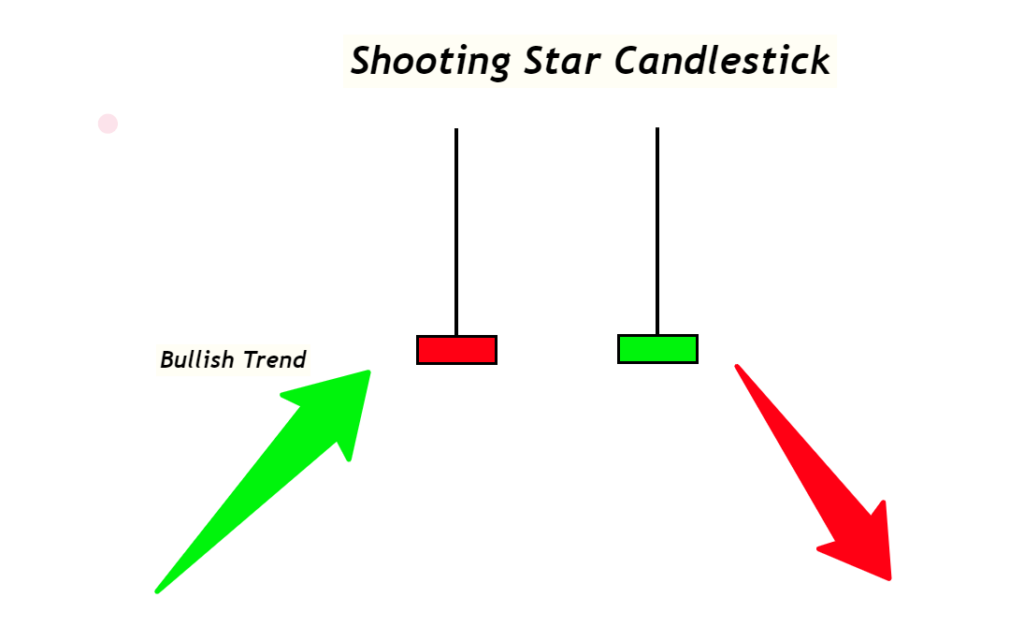

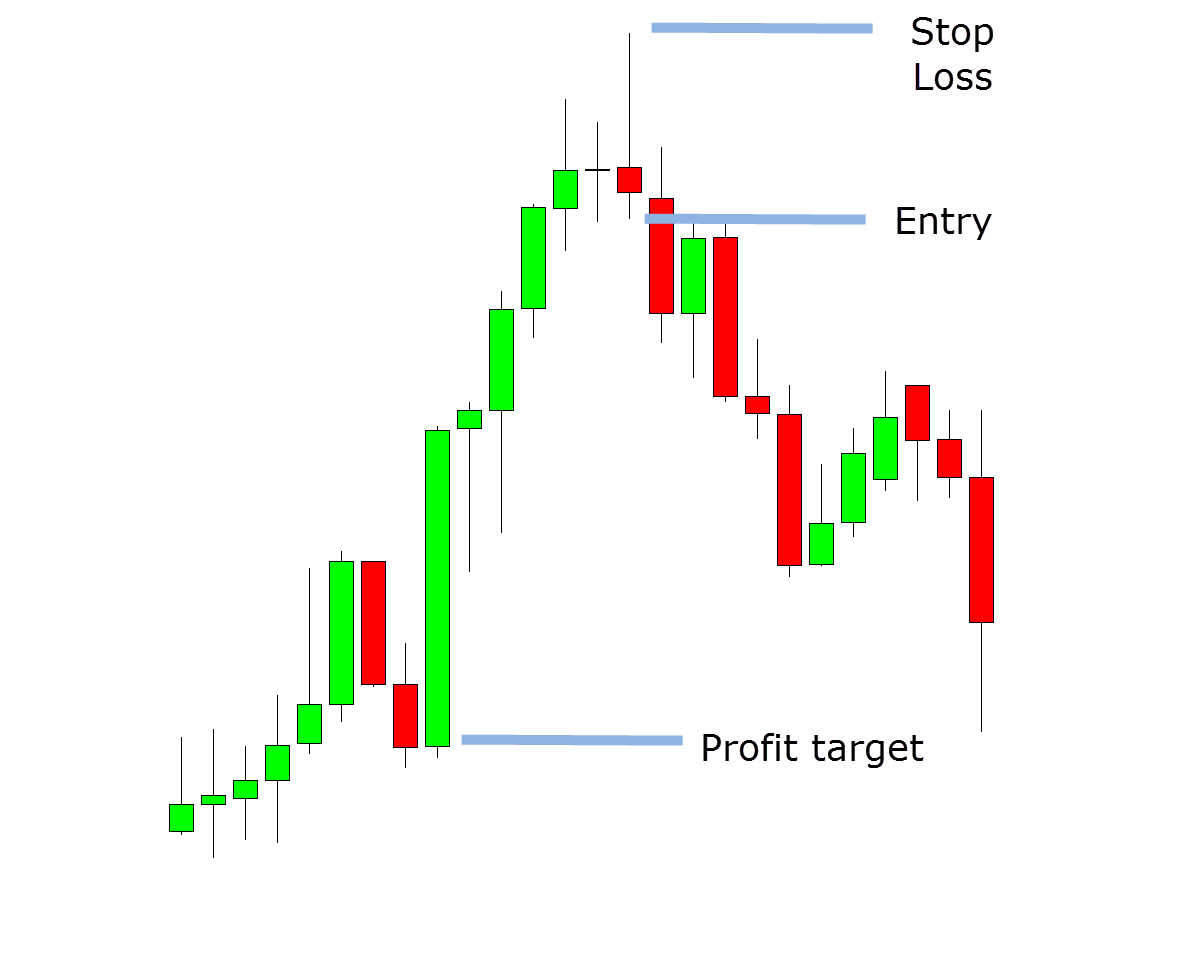

Shooting Star Stock Pattern - Web shooting star candlestick pattern is a bearish reversal candlestick pattern. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the market close. Once the formation of the shooting star pattern has. This pattern is characterized by a long upper shadow and a small. Web shooting star (1) it is important to remember the following guidelines relating to bearish reversal patterns: Web a shooting star pattern is a powerful bearish reversal candlestick pattern that occurs after an uptrend in trading. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. Most patterns require further bearish confirmation. Web a shooting star candlestick is a price pattern that is formed when the price of security opens and first advances and then declines and falls to a price close to the opening. Its appearance often signals the end of an uptrend, suggesting an opportune moment to exit long. Web shooting star (1) it is important to remember the following guidelines relating to bearish reversal patterns: It’s a reversal pattern and is believed to signal an imminent bearish trend reversal. Most patterns require further bearish confirmation. Web here we introduce the shooting star pattern — a notable figure in candlestick charts that traders often view as a signal of. Web shooting star (1) it is important to remember the following guidelines relating to bearish reversal patterns: It is seen after an asset’s market price is. Web here we introduce the shooting star pattern — a notable figure in candlestick charts that traders often view as a signal of bearish reversals. The shooting star is a single bearish candlestick pattern. It has a small body, and the upper wick size is at least twice the size of the body. It is formed when the price is pushed higher and immediately rejected lower so that it leaves. Its appearance often signals the end of an uptrend, suggesting an opportune moment to exit long. A shooting star is a bearish pattern that. Web shooting star candlestick pattern is a bearish reversal candlestick pattern. Web a shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. Web here we introduce the shooting star pattern — a notable figure in candlestick charts that traders often view as. The pattern is interpreted as a bearish reversal signal, showing a failed attempt to drive the. Fact checked by lucien bechard. As its name suggests, the shooting star is a small real body at the lower. A shooting star is a bearish pattern that forms in candlestick trading. After an uptrend, the shooting star pattern can signal to traders. Web a shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. Shooting star patterns are interpreted as a bearish reversal pattern. Web shooting star candlestick pattern is a bearish reversal candlestick pattern. It is formed when the price is pushed higher and. Web a shooting star pattern is a powerful bearish reversal candlestick pattern that occurs after an uptrend in trading. Web a shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. Web the shooting star is a candlestick pattern to help traders visually. It’s a reversal pattern and is believed to signal an imminent bearish trend reversal. Web a shooting star pattern is a powerful bearish reversal candlestick pattern that occurs after an uptrend in trading. Most patterns require further bearish confirmation. It is seen after an asset’s market price is. Web shooting star (1) it is important to remember the following guidelines. Web the shooting star pattern is a bearish reversal pattern that typically occurs at the top of an uptrend. Web the shooting star pattern is a major bearish trend reversal pattern that warn of a possible transition to a downtrend. This pattern is characterized by a long upper shadow and a small. It is formed when the price is pushed. It has a small body, and the upper wick size is at least twice the size of the body. Web shooting star (1) it is important to remember the following guidelines relating to bearish reversal patterns: The uptrend is nearing its end as the momentum is. It’s a reversal pattern and is believed to signal an imminent bearish trend reversal.. Web updated on october 13, 2023. Web the shooting star pattern is a major bearish trend reversal pattern that warn of a possible transition to a downtrend. Web in this article, we'll explore: Web here we introduce the shooting star pattern — a notable figure in candlestick charts that traders often view as a signal of bearish reversals. Web a shooting star candlestick is a price pattern that is formed when the price of security opens and first advances and then declines and falls to a price close to the opening. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the market close. Its appearance often signals the end of an uptrend, suggesting an opportune moment to exit long. As its name suggests, the shooting star is a small real body at the lower. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. The pattern is interpreted as a bearish reversal signal, showing a failed attempt to drive the. It’s a reversal pattern and is believed to signal an imminent bearish trend reversal. Most patterns require further bearish confirmation. Web the shooting star pattern is a bearish reversal pattern that typically occurs at the top of an uptrend. The shooting star is a single bearish candlestick pattern that is common in technical analysis. Once the formation of the shooting star pattern has. Fact checked by lucien bechard.

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

How to Trade the Shooting Star Candlestick Pattern IG Australia

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Shooting Star Candlestick Pattern How to Identify and Trade

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

How To Trade Shooting Star Candlestick Patterns

Candlestick shooting star pattern strategy ( A to Z ) YouTube

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

Web A Shooting Star Formation Is A Bearish Reversal Pattern That Consists Of Just One Candle.

Web Shooting Star Candlestick Pattern Is A Bearish Reversal Candlestick Pattern.

This Guide Will Help You Understand.

A Shooting Star Is A Bearish Pattern That Forms In Candlestick Trading.

Related Post: