Shooting Star Pattern

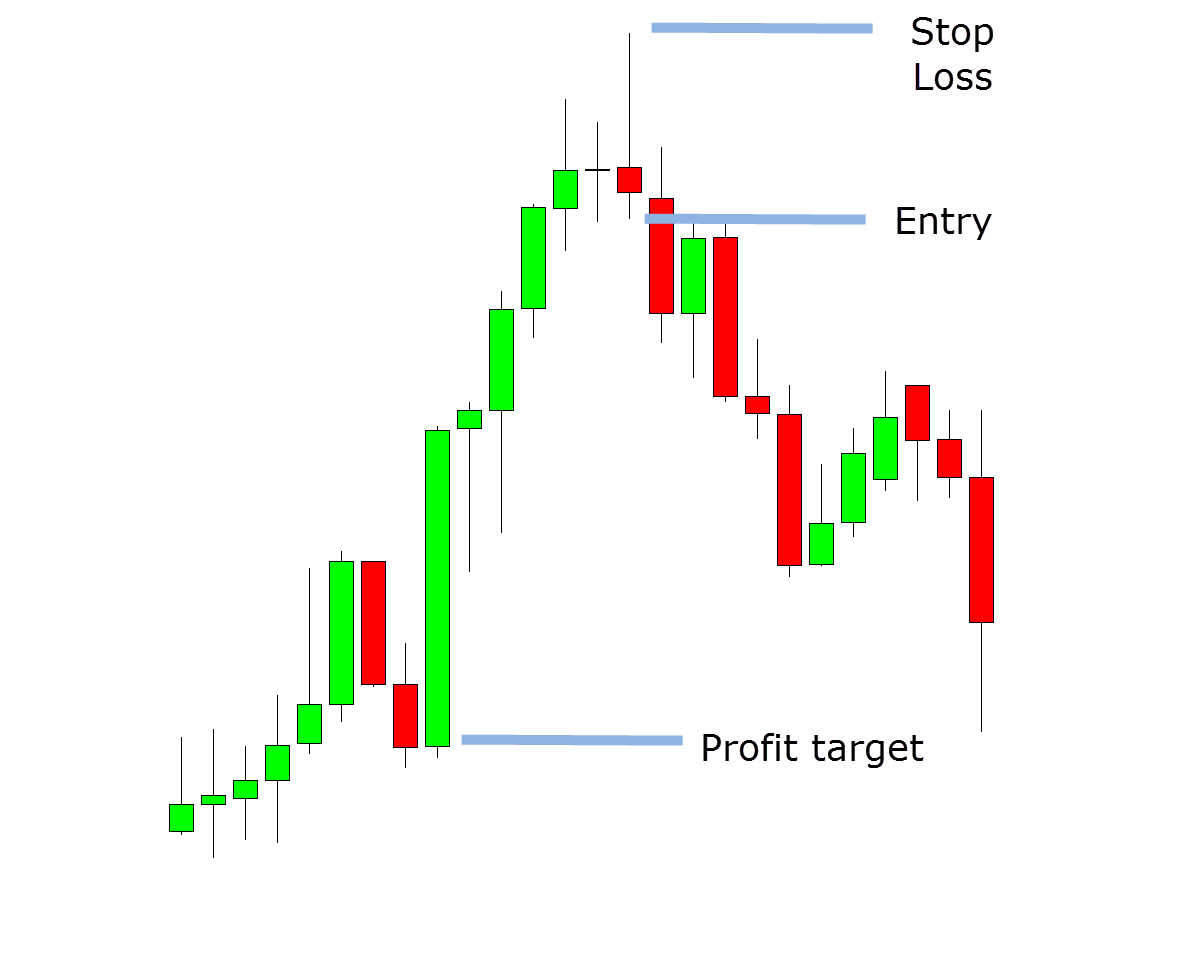

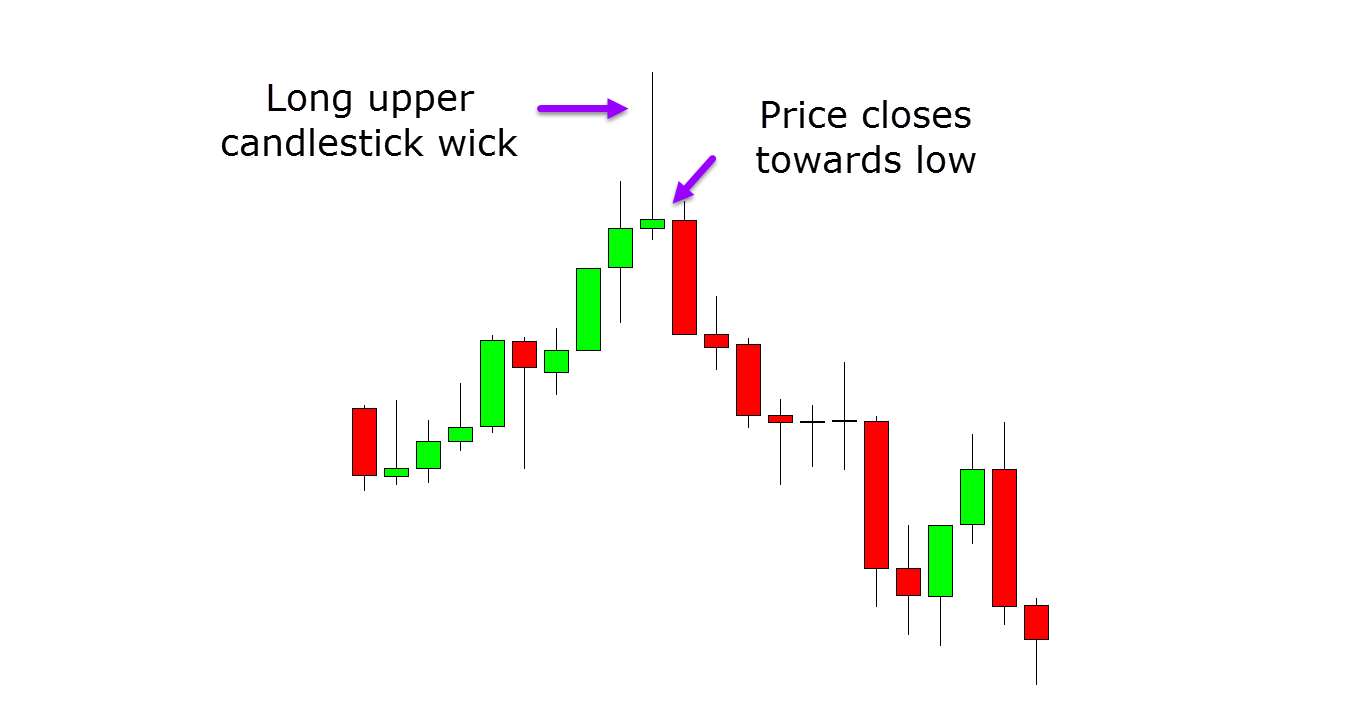

Shooting Star Pattern - Web the shooting star pattern is a bearish reversal pattern that typically occurs at the top of an uptrend. Web the shooting star is a triple candlestick pattern that is similar to the evening star in that it is a bearish top reversal pattern that may appear in an uptrend and warns of a possible trend reversal. Web image by simaah from pixabay. And toronto police service officers found a man. As to the pattern itself, a shooting star has a small body that’s located in the bottom half of the candle’s range, and has a long upper wick, with a low or absent lower wick. As its name suggests, the shooting star is a small real body at the lower end of the price range with a long upper shadow. Web a shooting star is a bearish candlestick with a long upper shadow, little or no lower shadow, and a small real body near the low of the day. It is seen after an asset’s market price is pushed up quite significantly but then gets rejected at higher prices, which indicates that the price may be about to decline. It’s composed of a small real body at the lower end of the trading range with a long upper shadow and little to no lower shadow. Here are some identification guidelines: The shooting star is a powerful chart pattern that signals potential price reversals. Web the shooting star candlestick pattern, a crucial tool in a trader’s arsenal, is a significant reversal indicator predominantly found at the end of an uptrend. Web what the shooting star candlestick pattern is. This guide will help you understand this pattern, shedding light on its structure. Shooting star candlestick patterns signal the start of a price reversal where the trend begins to turn bearish. Web news news news based on facts, either observed and verified directly by the reporter, or reported and verified from knowledgeable sources. Web shooting star a black or white candlestick that has a small body, a long upper shadow and little or. Web as outlined earlier, a shooting star is a bearish reversal pattern which signals potential change in the price direction. Long upper shadow a black or white candlestick with an upper shadow that has a length of 2/3 or more of the total range of the candlestick. Web a shooting star formation is a bearish reversal pattern that consists of. Flares and solar eruptions can impact radio communications, electric power grids, navigation signals, and. This formation is bearish because the price tried to rise sharply throughout the day, but then the seller took over and pushed the price down to the opening price. Web a shooting star candlestick is a price pattern that is formed when the price of security. Web the shooting star is a triple candlestick pattern that is similar to the evening star in that it is a bearish top reversal pattern that may appear in an uptrend and warns of a possible trend reversal. Considered a bearish pattern in an uptrend. Web shooting star candlestick pattern is a bearish reversal candlestick pattern. Web a shooting star. Trading the shooting star with pivot points. It’s a reversal pattern and is believed to signal an imminent bearish trend reversal. Shooting star candlestick patterns signal the start of a price reversal where the trend begins to turn bearish. Shooting star patterns are interpreted as a bearish reversal pattern. This pattern is formed when a security’s price advances significantly during. And toronto police service officers found a man. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the market close. Shooting stars appear in up trends but are a bearish candle. It appears after an uptrend. It’s composed of a. This candlestick has no lower wick, or sometimes it has a tiny lower wick, which is okay. Web shooting star candlestick pattern is a bearish reversal candlestick pattern. Web what the shooting star candlestick pattern is. The uptrend is nearing its end as the momentum is weakening, and the sellers are feeling more confident that they can force a. Here. This formation is bearish because the price tried to rise sharply throughout the day, but then the seller took over and pushed the price down to the opening price. Web shooting star candlestick pattern is a bearish reversal candlestick pattern. It consists of a small body with a long upper shadow indicating the price increase and a short or no. And toronto police service officers found a man. The bearish shooting star candlestick pattern appears towards the end of an uptrend to indicate a forthcoming trend reversal. Fact checked by lucien bechard. Web solar flares are powerful bursts of energy, nasa wrote in a statement on the flares. Trading the shooting star with moving averages. Fact checked by lucien bechard. Here are some identification guidelines: Trading the shooting star with rsi divergences. This candlestick has no lower wick, or sometimes it has a tiny lower wick, which is okay. Statistics to prove if the shooting star pattern really works. It consists of a small body with a long upper shadow indicating the price increase and a short or no lower shadow indicating the price drop. Trading the shooting star with moving averages. Trading the shooting star with fibonacci. It’s a reversal pattern and is believed to signal an imminent bearish trend reversal. Shooting star patterns are interpreted as a bearish reversal pattern. The bearish shooting star candlestick pattern appears towards the end of an uptrend to indicate a forthcoming trend reversal. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the market close. Web a shooting star formation is a bearish reversal pattern that consists of just one candle. Flares and solar eruptions can impact radio communications, electric power grids, navigation signals, and. Web shooting star candlestick pattern is a bearish reversal candlestick pattern. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located.

Shooting Star Candlestick Pattern How to Identify and Trade

opaqueshootingstarspattern2776036 Rising Star Iris

Shooting Star Candlestick Pattern How to Identify and Trade

Shooting star pattern background Royalty Free Vector Image

Shooting star pattern background bright fun Vector Image

Shooting Stars Silhouette Pattern Vector Download

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

Golden shooting star seamless pattern Royalty Free Vector

This Pattern Is Formed When A Security’s Price Advances Significantly During The Trading Session But Relinquishes Most Of Its Gains To Close Near The Open.

Web Updated April 4, 2024.

And Toronto Police Service Officers Found A Man.

Normally Considered A Bearish Signal When It.

Related Post: