Shooting Star Pattern Stocks

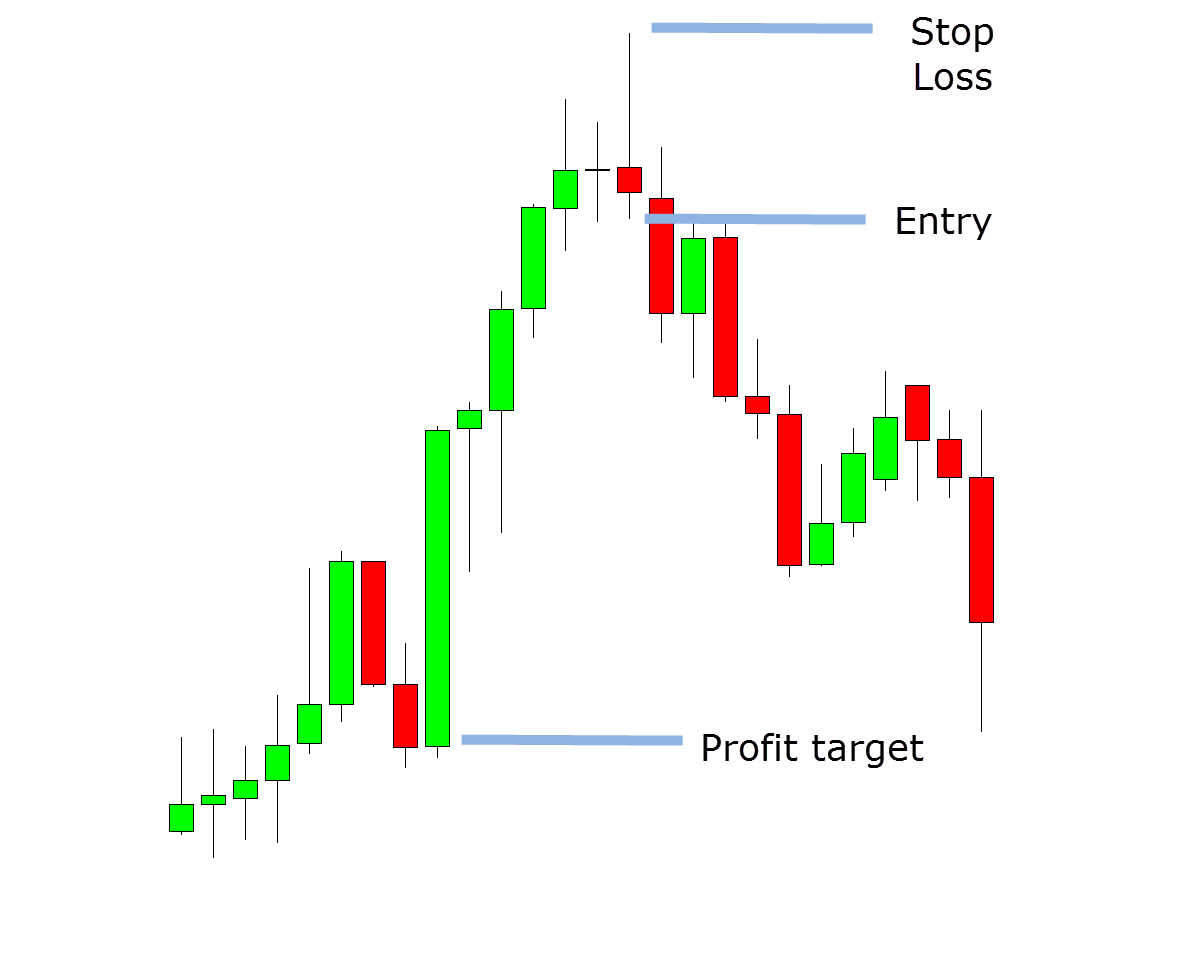

Shooting Star Pattern Stocks - In both cases, the shadows should be at least two times. The meaning of the shooting star candlestick pattern is that buying pressure is starting to dissipate and a potential trend reversal may be on the horizon. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. It is considered to be one of the most useful candlestick patterns due to its effectiveness. The price target for the shooting star is equal to the size of the pattern (the length of the candle). A shooting star is a bearish candlestick pattern having a long upper shadow and no lower shadow at all. It has a bigger upper wick, mostly twice its body size. Shooting star candlesticks consist of a smaller real body with a longer upper wick and no lower shadow. As its name suggests, the shooting star is a small real body at the lower end of the price range with a long upper shadow. A shooting star is a type of candlestick pattern that forms when the price of the security opens, rises significantly but then closes near the open price. It has a long upper shadow and a small real body near the lower end of the range. Web a shooting star pattern is formed in a stock chart when the price opens higher than the previous close, rallies during the trading session, but then reverses and closes near or below the opening price. Open an ig trading account or. Shooting star candlesticks consist of a smaller real body with a longer upper wick and no lower shadow. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting. For this reason, place the shooting star candle pattern above the upper wick of the pattern. Web a shooting star pattern. Web the inverted shooting star is a bullish analysis tool, looking to notice market divergence from a previously bearish trend to a bullish rally. Its long upper shadow shows a failed rally, while the small real body (red or black, depending on the chart type) indicates that sellers regained control by the close of the period. Web shooting star pattern. In both cases, the shadows should be at least two times. As its name suggests, the shooting star is a small real body at the lower end of the price range with a long upper shadow. This pattern is formed when a security’s price advances significantly during the trading session but relinquishes most of its gains to close near the. It has a bigger upper wick, mostly twice its body size. Web shooting star daily technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. It is considered to be one of the most useful candlestick patterns due to its effectiveness. Web shooting star candlestick patterns signal the. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting. A shooting star is a hanging man flipped upside down. There is a difference between a shooting star and an inverted hammer. As its name suggests, the shooting star is a small real body at the lower end of. Web the shooting star candlestick pattern is a bearish reversal pattern. Web technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. Web a stock chart displays a shooting star pattern when the price opens higher than it did at the close of the previous trade, rallies during. Near the bottom end of the range, it has a little true body and a large upper shadow. There is a difference between a shooting star and an inverted hammer. Web the shooting star signifies a potential price top and reversal. Web a shooting star pattern is formed in a stock chart when the price opens higher than the previous. It has a long upper shadow and a small real body near the lower end of the range. Web a shooting star pattern is formed in a stock chart when the price opens higher than the previous close, rallies during the trading session, but then reverses and closes near or below the opening price. Shooting star candlestick pattern #shooting #shootingstar. Web a shooting star pattern is formed in a stock chart when the price opens higher than the previous close, rallies during the trading session, but then reverses and closes near or below the opening price. Look for the asset you want to trade in the search bar. In both cases, the shadows should be at least two times. Web. Web a stock chart displays a shooting star pattern when the price opens higher than it did at the close of the previous trade, rallies during the trading session, and then reverses and closes close to or below the opening price. Web in technical analysis, a shooting star candlestick is a bearish reversal pattern that forms after an uptrend. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting. For this reason, place the shooting star candle pattern above the upper wick of the pattern. Bearish confirmation came when the stock declined the next day, gapped down below 50 and. Web shooting star daily technical & fundamental stock screener, scan stocks based on rsi, pe, macd, breakouts, divergence, growth, book vlaue, market cap, dividend yield etc. This is just an inverted hammer candle called a shooting star. A shooting star is a type of candlestick pattern that forms when the price of the security opens, rises significantly but then closes near the open price. Web find today's shooting star candlestick stocks. Look for the asset you want to trade in the search bar. They are typically red or black on stock charts. Since 2020, he has been a key contributor to strike platform. To be included in a candlestick pattern list, the stock must have traded today, with a current price between. Web the shooting star candle is a potent reversal pattern, often found at the end of an uptrend. Shooting star candlestick pattern #shooting #shootingstar #candlestickpatterns #candles #buy #sell. Arjun is a seasoned stock market content expert with over 7 years of experience in stock market, technical & fundamental analysis.

How to Trade the Shooting Star Candlestick Pattern IG International

Shooting Star Candlestick Pattern Trendy Stock Charts

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

What Is Shooting Star Candlestick? How To Use It Effectively In Trading

Shooting Star Candlestick Pattern How to Identify and Trade

:max_bytes(150000):strip_icc()/dotdash_Final_Shooting_Star_Definition_and_Applications_Oct_2020-01-5e47f2585218419da8e3c2585055c6a6.jpg)

Shooting Star Definition and Applications

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

Shooting Star Candlestick Pattern

Shooting Star Candlestick Pattern How to Identify and Trade

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

The Shooting Star Pattern Is A Great Tool For Novice Technical Traders Due To Its.

A Shooting Star Is A Hanging Man Flipped Upside Down.

It Has A Long Upper Shadow And A Small Real Body Near The Lower End Of The Range.

Web The Shooting Star Is Made Up Of One Candlestick (White Or Black) With A Small Body, Long Upper Shadow, And Small Or Nonexistent Lower Shadow.

Related Post: