Shooting Star Chart Pattern

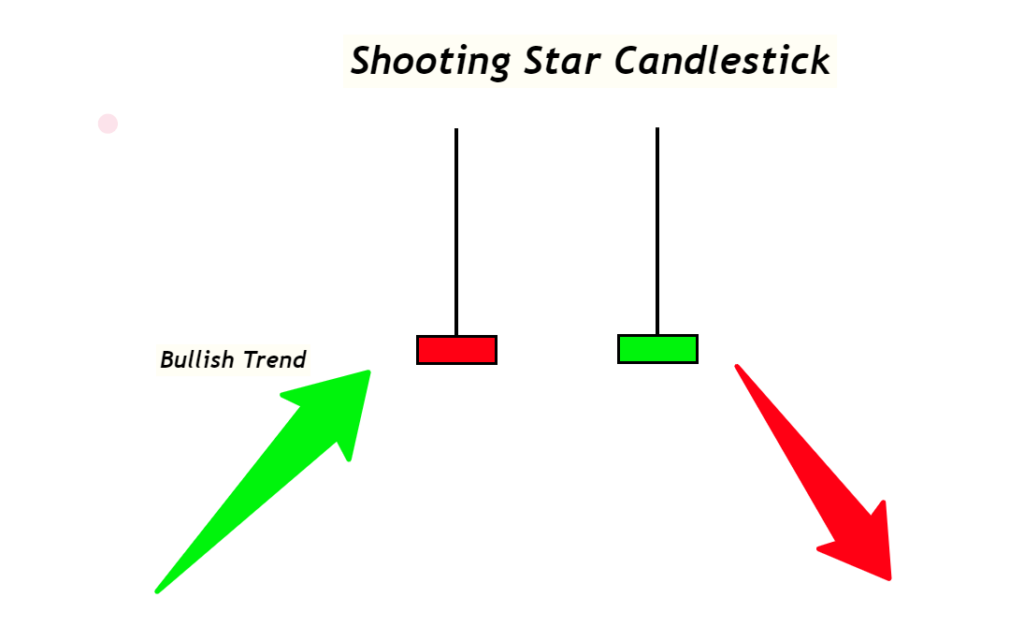

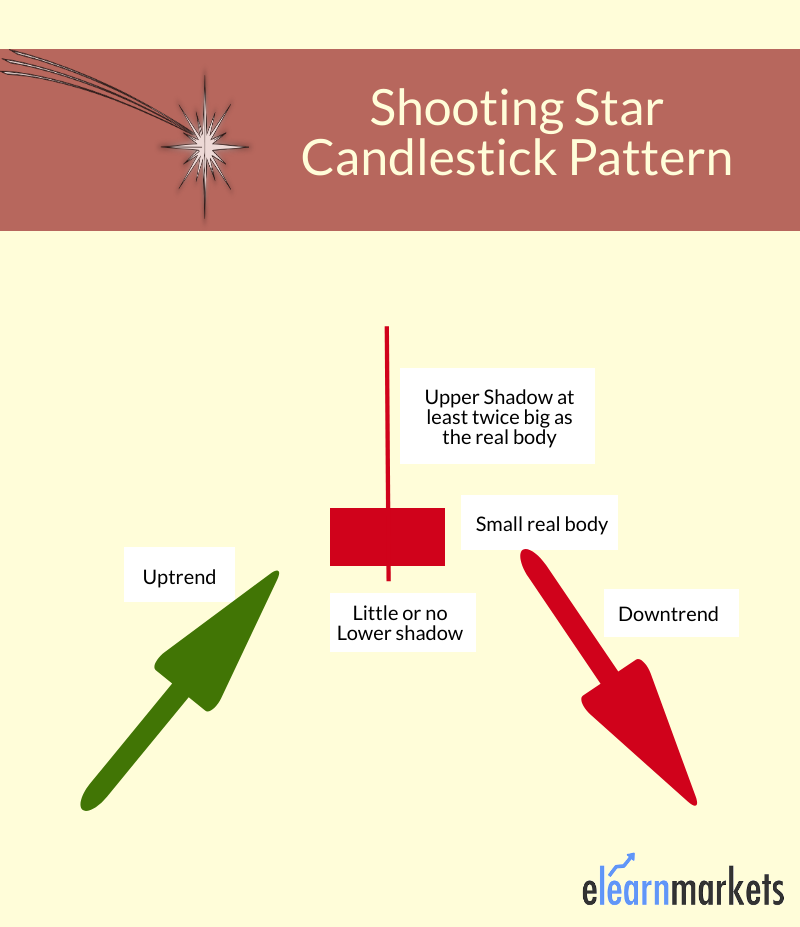

Shooting Star Chart Pattern - Candlesticks are graphical representations of price movements for a given period of time. Its long upper shadow shows a failed rally, while the small real body (red or black, depending on the chart type) indicates that sellers regained control by the close of the period. Shooting star candlesticks consist of a smaller real body with a longer upper wick and no lower shadow. (rob kinnan/usa today sports) portland. The emergence of a shooting star on a chart is a signal for potential market changes, guiding traders to make strategic choices about when to enter and exit trades. May 11, 2024 at 6:02 a.m. The patterns are calculated every 10 minutes during the trading day using delayed daily data, so the pattern may not be visible on an intraday chart. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. They are typically red or black on stock charts. Web traders who spot shooting star patterns in the candlestick price charts, wait for the following pattern the next day. (rob kinnan/usa today sports) portland. Original music by marion lozano , elisheba ittoop. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting. The patterns are calculated every 10 minutes during the trading day using delayed daily data, so the pattern may not be visible on an intraday chart.. Produced by nina feldman , clare toeniskoetter and rikki novetsky. It has no lower wick or sometimes has a smaller wick. The patterns are calculated every 10 minutes during the trading day using delayed daily data, so the pattern may not be visible on an intraday chart. Web by ben golliver. After the first bearish impulse on the chart, the. After the first bearish impulse on the chart, the price creates a. Similar to a hammer pattern, the shooting star has a long shadow that shoots higher, while the open, low, and close are near the bottom of the candle. The emergence of a shooting star on a chart is a signal for potential market changes, guiding traders to make. Web the inverted shooting star is a bullish analysis tool, looking to notice market divergence from a previously bearish trend to a bullish rally. Web the first candlestick in the shooting star must be supportive of the uptrend and, hence, must be light in color and must have a relatively large real body. Web the shooting star pattern is a. Web the image illustrates a classic shooting star trading example. A shooting star is a type of candlestick formation that results when a security's price, at some point during the day, advances well above the opening price but closes lower than. It consists of a small body with a long upper shadow indicating the price increase and a short or. The emergence of a shooting star on a chart is a signal for potential market changes, guiding traders to make strategic choices about when to enter and exit trades. Web the shooting star candlestick pattern is a bearish reversal pattern. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening. Web a shooting star candlestick pattern is a chart formation that occurs when an asset’s market price is pushed up quite significantly, but then rejected and closed near the open price. It is considered to be one of the most useful candlestick patterns due to its effectiveness. May 11, 2024 at 6:02 a.m. The second candlestick is the star, which. Web the first candlestick in the shooting star must be supportive of the uptrend and, hence, must be light in color and must have a relatively large real body. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. Web shooting star pattern meaning. The trading analysis starts with identifying the upward trend in price.. Shooting star candlesticks consist of a smaller real body with a longer upper wick and no lower shadow. A shooting star candlestick is typically found at the peak of an uptrend or near resistance levels. Web identify a bullish uptrend. The blue arrows on the image measure and apply three times the size of the shooting star candle pattern. An. Web a shooting star candlestick pattern is a chart formation that occurs when an asset’s market price is pushed up quite significantly, but then rejected and closed near the open price. Original music by marion lozano , elisheba ittoop. Cooper flagg will play at duke next season, then is expected to be the top prospect in the 2025 nba draft.. This creates a long upper wick, a small lower wick and a small body. It is considered to be one of the most useful candlestick patterns due to its effectiveness. Before trading a shooting star pattern, it’s essential to wait for confirmation. Suddenly, a shooting star candlestick appears, marked with a green circle on the chart. The trading analysis starts with identifying the upward trend in price. When this pattern appears in an ongoing uptrend, it reverses the trend to a downtrend. Shooting star candlesticks consist of a smaller real body with a longer upper wick and no lower shadow. Web a shooting star candlestick pattern is a chart formation. Produced by nina feldman , clare toeniskoetter and rikki novetsky. (rob kinnan/usa today sports) portland. Web the aspects of a candlestick pattern. Cooper flagg will play at duke next season, then is expected to be the top prospect in the 2025 nba draft. Web identify a bullish uptrend. The gap between the real bodies of the two. And always use a daily chart aggregation. The emergence of a shooting star on a chart is a signal for potential market changes, guiding traders to make strategic choices about when to enter and exit trades.

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Shooting Star Chart Pattern

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

Shooting Star Candlestick Pattern How to Identify and Trade

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

What Is Shooting Star Candlestick With Examples ELM

Shooting Star Candlestick Pattern How to Identify and Trade

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

A Shooting Star Candlestick Is Typically Found At The Peak Of An Uptrend Or Near Resistance Levels.

Original Music By Marion Lozano , Elisheba Ittoop.

They Are Commonly Formed By The Opening, High,.

Find A Candlestick Pattern At The Top Of The Uptrend With A Long Upper Shadow, Short Lower Shadow, And Small Body.

Related Post: