Shooting Star Candlestick Patterns

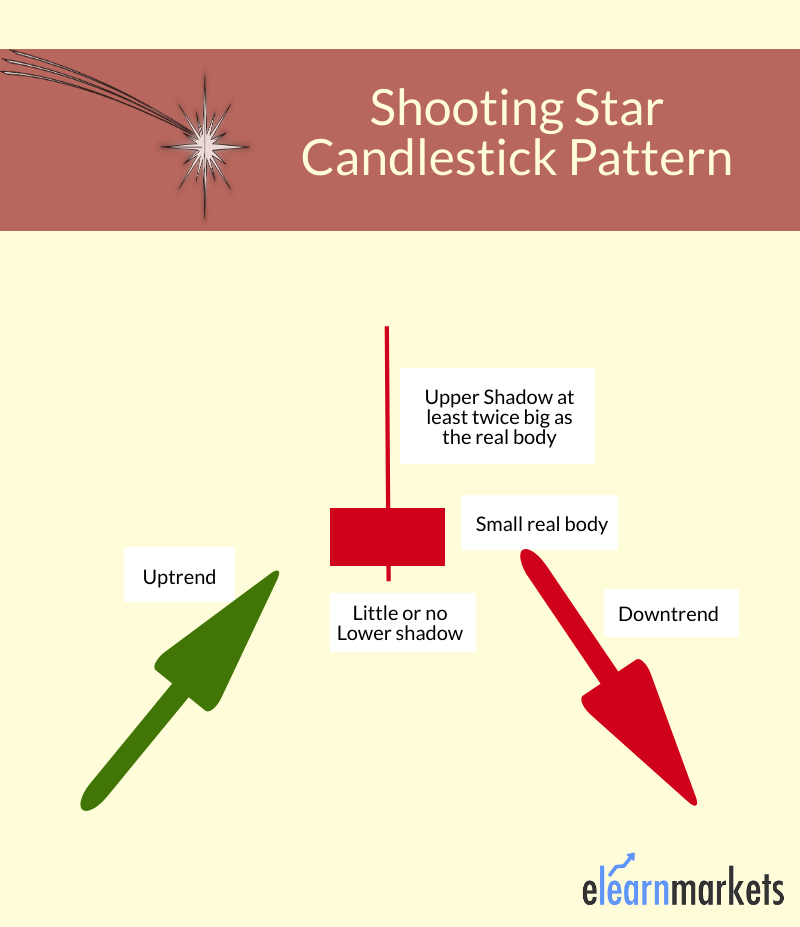

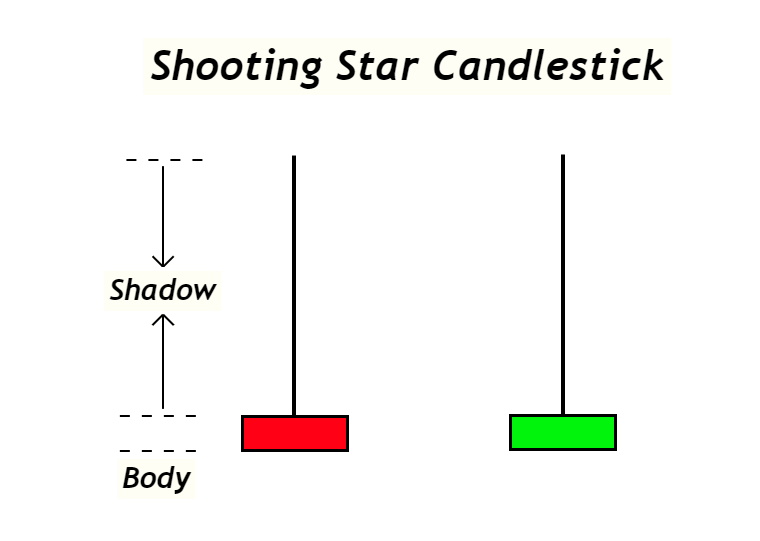

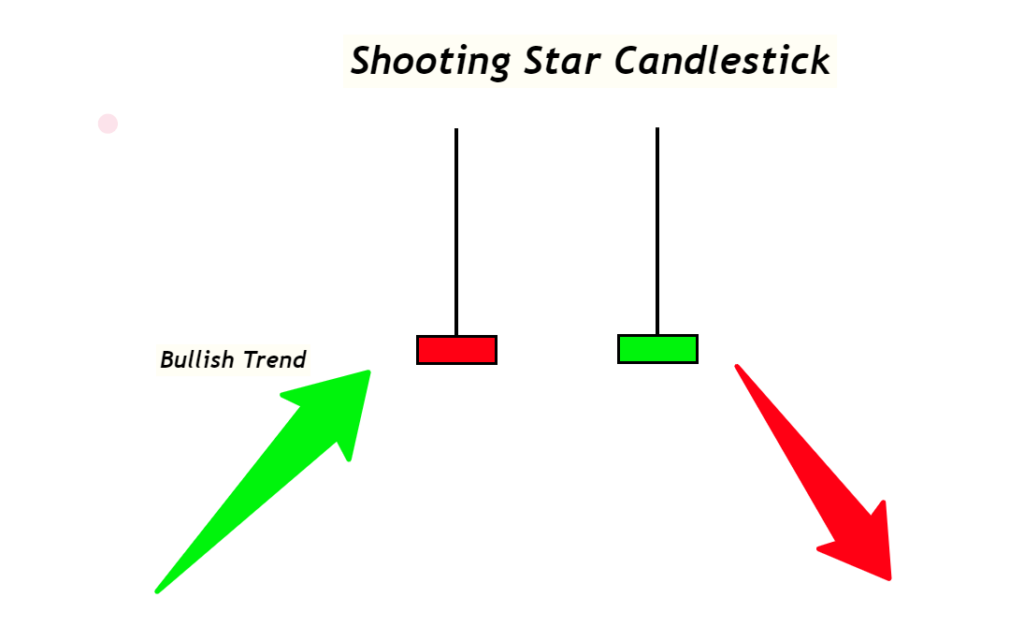

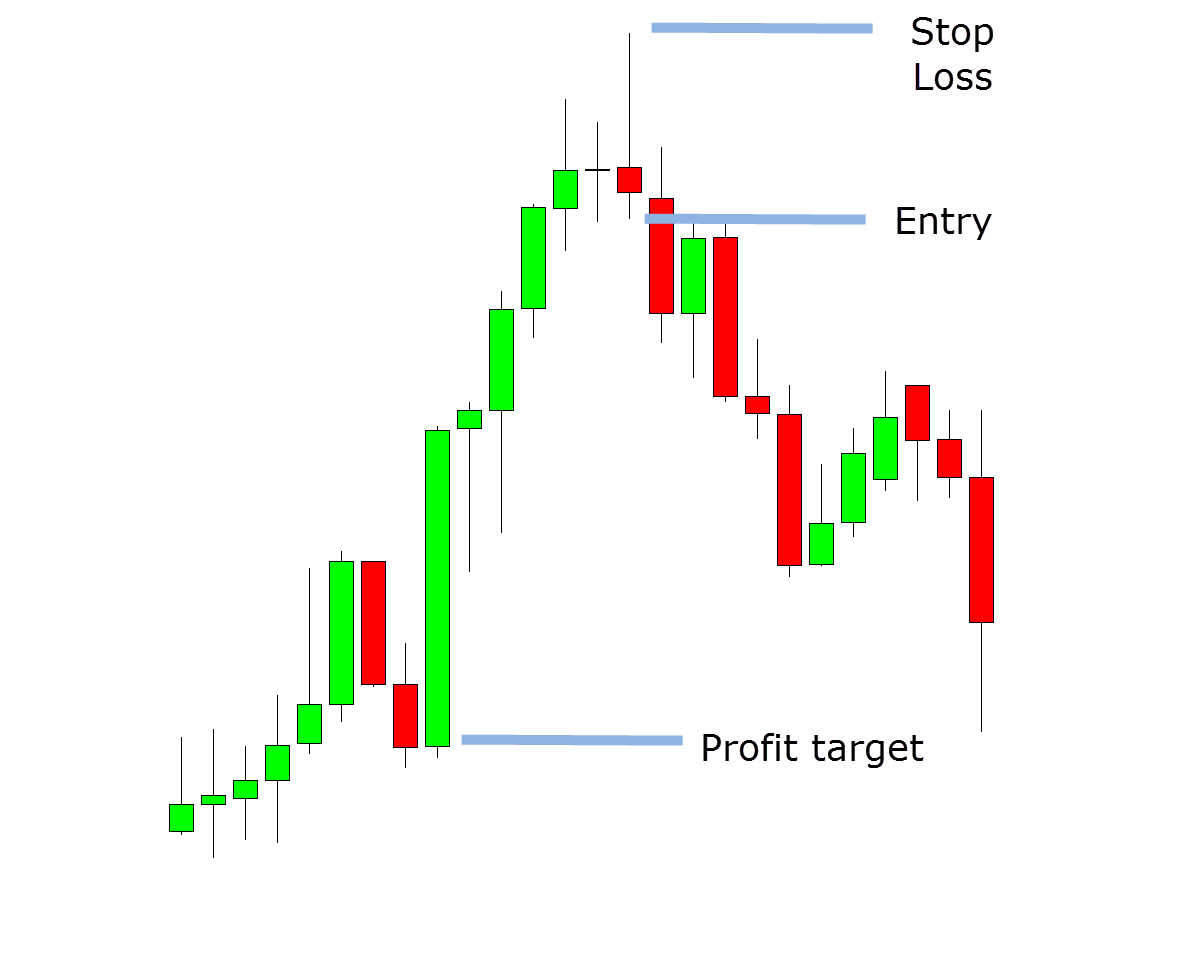

Shooting Star Candlestick Patterns - Web identify a bullish uptrend. The candlestick can mark a top (but is often retested). It consists of three candles: It is a bearish reversal indicator, meaning that its appearance usually prompts a shift in the trend from bullish to bearish. Technical indicators paint a bleak picture for solana. The shooting star is sometimes referred to as the “ shooting star japanese. Web the shooting star signifies a potential price top and reversal. In both cases, the shadows should be at least two times. Find a candlestick pattern at the top of the uptrend with a long upper shadow, short lower shadow, and small body. The first candle is a large bearish can. Web a shooting star has a small body near the bottom of the candlestick, with a long wick. The second candle has a long upper shadow and does not have the lower one. The shooting star candlestick pattern is recognized if: Web the shooting star is a bearish reversal pattern that forms after an advance and in the star position,. Considered a bearish pattern in an uptrend. Web traders use shooting star candlestick patterns to forecast upcoming bearish trends, interpreting the price decline as a sign of sellers dominating the market. It consists of three candles: However in order to evaluate potential sell signals other indicators must be. This bearish reversal candle looks like the inverted hammer except that it. In both cases, the shadows should be at least two times. It has no lower wick or sometimes has a smaller wick. Web trading the shooting star pattern. Technical indicators paint a bleak picture for solana. This candlestick pattern is characterized by its long upper shadow and a short lower shadow, with the candle body closer to the lower point. Web the shooting star candlestick pattern, a crucial tool in a trader’s arsenal, is a significant reversal indicator predominantly found at the end of an uptrend. The shooting star candlestick pattern is recognized if: The first candle is bullish and continues the uptrend; Web a shooting star candlestick pattern occurs when the price of a security increases significantly after opening. Web the shooting star pattern is a bearish reversal pattern that consists of just one candlestick and forms after a price swing high. Web variants of the shooting star candlestick pattern. Considered a bearish pattern in an uptrend. As long as it’s small you’re good to go. However in order to evaluate potential sell signals other indicators must be. Alan santana, a prominent crypto analyst, points to the emergence of bearish candlestick patterns like shooting stars and inverted hammers, alongside declining trading volume. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting. Trading this reversal pattern is fairly simple. Before trading a shooting star pattern, it’s essential. Before trading a shooting star pattern, it’s essential to wait for confirmation. The second candle is short and gaps up from the first candle; It consists of three candles: Find a candlestick pattern at the top of the uptrend with a long upper shadow, short lower shadow, and small body. These signals suggest a potential loss of momentum. Web a shooting star candlestick pattern occurs when the assets market price is pushed up quite significantly, but then rejected and closed near the open price. Trading this reversal pattern is fairly simple. The second candle has a long upper shadow and does not have the lower one. In both cases, the shadows should be at least two times. Normally. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting. The blue arrows on the image measure and apply three times the size of the shooting star candle pattern. The long upper shadow must be at least twice the length of the candle’s body. As its name suggests, the. Shooting star candlestick pattern #shooting #shootingstar #candlestickpatterns #candles #buy #sell. Long upper shadow a black or white candlestick with an upper shadow that has a length of 2/3 or more of the total range of the candlestick. Web the shooting star candlestick pattern, a crucial tool in a trader’s arsenal, is a significant reversal indicator predominantly found at the end. It can be recognized from a long upper shadow and tight open, close, and low prices — just like the shooting. A shooting star is a single candlestick pattern that is found in an uptrend. Web shooting star patterns indicate that the price has peaked and a reversal is coming. The shooting star is sometimes referred to as the “ shooting star japanese. A shooting star is a hanging man flipped upside down. Eur/usd shooting star candlestick pattern: The second candle has a long upper shadow and does not have the lower one. Their upper wick is formed as buyers drive prices up at some point during the day. The long upper shadow must be at least twice the length of the candle’s body. Web the morning star pattern is a bullish candlestick pattern found in financial charts. Wait until the price reverse and use other technical analysis tools to confirm the trend reversal (rsi and macd) enter a short sell position. Web in technical analysis, a shooting star candlestick is a bearish reversal pattern that forms after an uptrend. Web a shooting star candlestick pattern occurs when the price of a security increases significantly after opening and then drops rapidly towards the market close to a price level that is close to the opening price. This is just an inverted hammer candle called a shooting star. Normally considered a bearish signal when it. It is considered to be one of the most useful candlestick patterns due to its effectiveness.

What Is Shooting Star Candlestick? How To Use It Effectively In Trading

What Is Shooting Star Candlestick With Examples ELM

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

Candlestick Patterns The Definitive Guide (2021)

Shooting Star Candlestick Pattern How to Identify and Trade

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

Shooting Star Candlestick Pattern How to Identify and Trade

The Candlestick Can Mark A Top (But Is Often Retested).

The Shooting Star Candlestick Pattern Is Recognized If:

Web Trading The Shooting Star Pattern.

The First Candle Is Bullish And Continues The Uptrend;

Related Post: