Shooting Star Candle Pattern

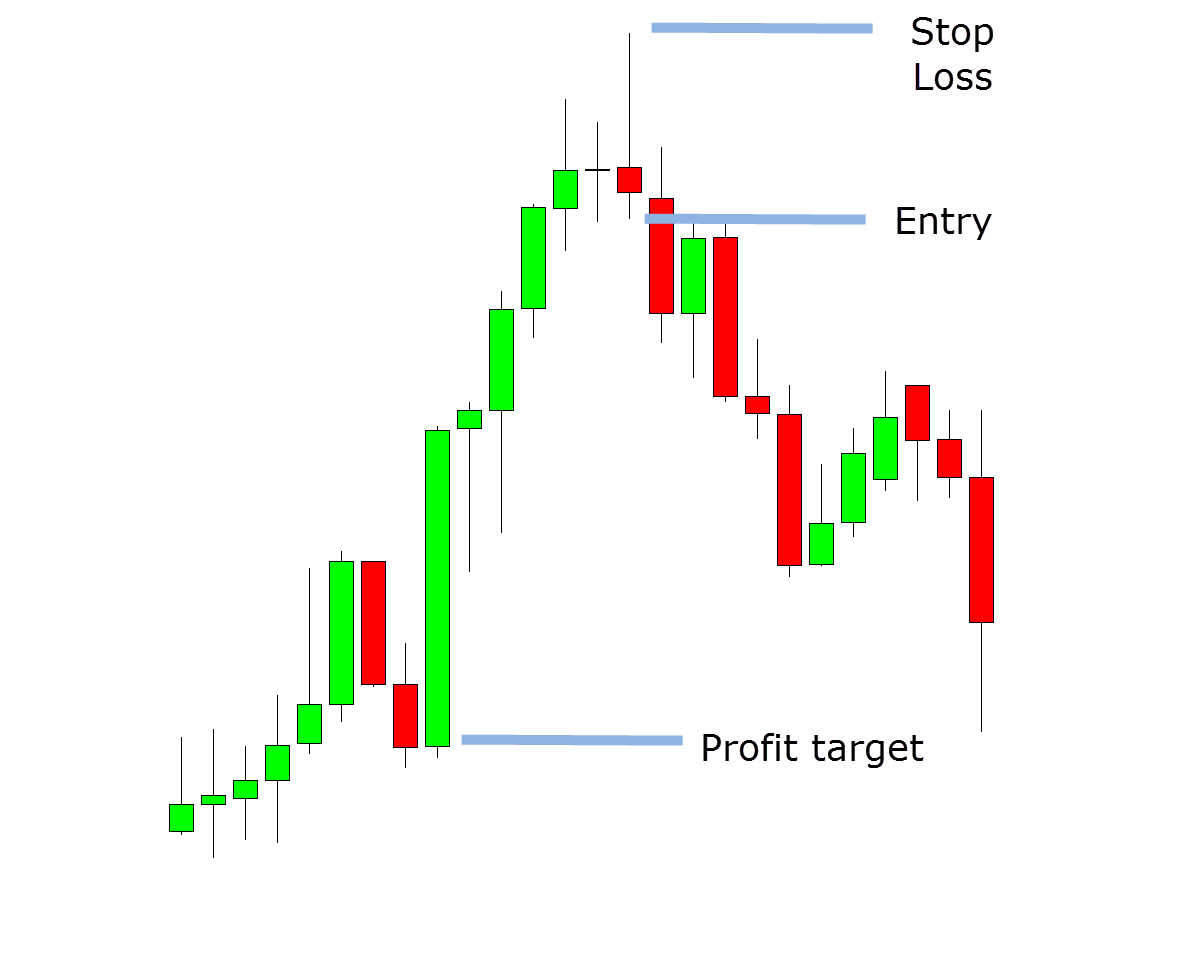

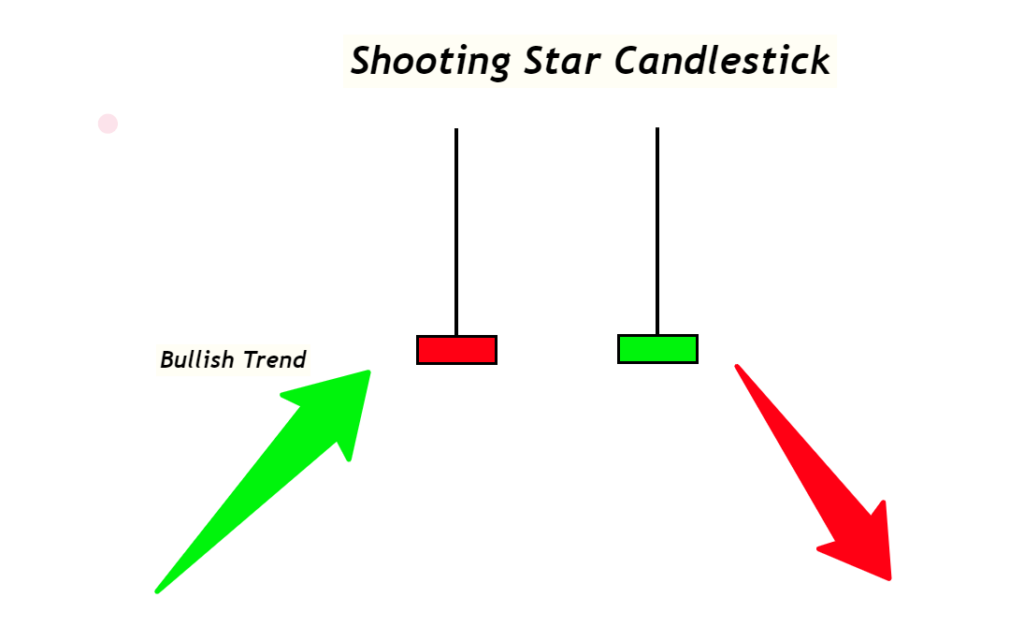

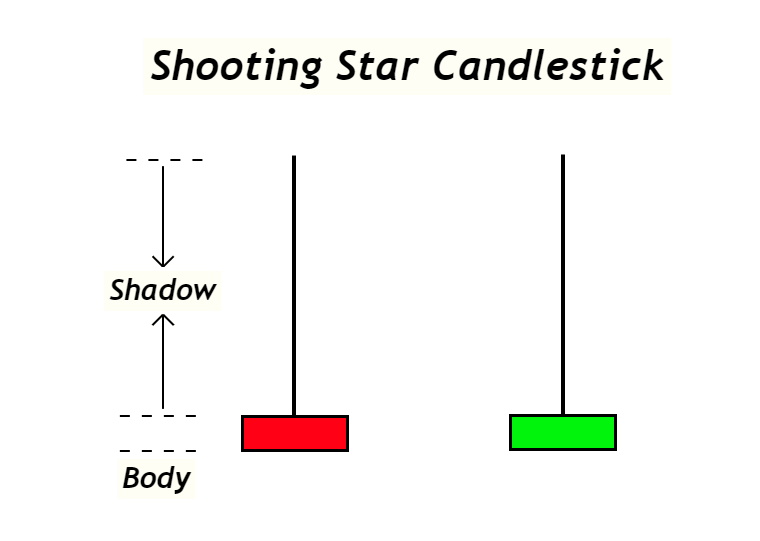

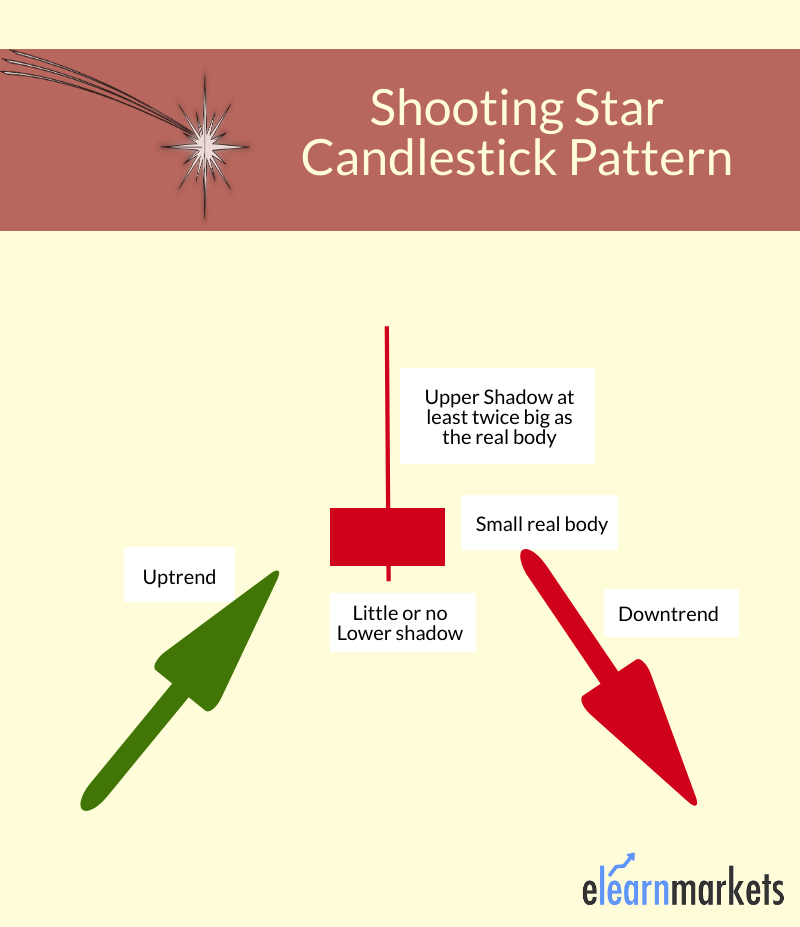

Shooting Star Candle Pattern - It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. It’s considered to be a signal that the uptrend is about to reverse and turn into a downtrend. Web the shooting star forex pattern is a singular, bearish candlestick that can appear after an uptrend. Web a shooting star candlestick is a price pattern that is formed when the price of security opens and first advances and then declines and falls to a price close to the opening price. Web a shooting star candlestick is typically found at the peak of an uptrend or near resistance levels. Web what is a shooting star candlestick pattern? This pattern forms when a price opens and advances substantially to the upside, then closes near the opening price again with a small green or red body, and with little or. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. That being said, you can also have variations of the two. As its name suggests, the shooting star is a small real body at the lower end of the price range with a long upper shadow. Web what is a shooting star candlestick pattern and how does it work? A shooting star is a type of candlestick with a long upper shadow, little or no lower shadow, and a small real. These signals suggest a potential loss of momentum. This pattern is easy to understand and can be combined with other technical indicators to take trades. Web a shooting star candlestick pattern is a bearish reversal pattern that occurs at the end of an uptrend. The shooting star is actually the hammer candle turned upside down, very much like the inverted. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. The first line of the pattern is a candle with a white body appearing as a long line. After an uptrend, the shooting star pattern can signal. It consists of a small body with a long upper shadow indicating the price increase and a short or no lower shadow indicating the price drop. Web a shooting star candlestick is a pattern seen on price charts when an asset’s price initially rises after opening but then falls back near the opening price by the market close. Web what. Shooting star a black or white candlestick that has a small body, a long upper shadow and little or no lower tail. It can be one of the following candles: Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. The price closes at the bottom ¼ of the range. Here’s. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. The small body indicates that there was little price difference between the open and close price, while the long upper shadow shows that the prices extended significantly upwards but then fell, suggesting selling pressure. That being said, you can also. A shooting star loses its luster. It can be one of the following candles: It is seen after an asset’s market price is pushed up quite significantly but then gets rejected at higher prices, which indicates that the price may be about to decline. These signals suggest a potential loss of momentum. It comes after an uptrend and marks the. The first line of the pattern is a candle with a white body appearing as a long line. Web in financial technical analysis, a candlestick pattern is a movement in prices shown graphically on a candlestick chart that some believe can help to identify repeating patterns of a particular market movement. The small body indicates that there was little price. It is a popular reversal candlestick pattern that occurs frequently in technical analysis and is simple and easy to identify. Web the shooting star forex pattern is a singular, bearish candlestick that can appear after an uptrend. Little to no lower shadow. The price closes at the bottom ¼ of the range. Web shooting star candlestick pattern is among the. Web the shooting star pattern is a bearish reversal pattern that consists of just one candlestick and forms after a price swing high. It consists of a small body with a long upper shadow indicating the price increase and a short or no lower shadow indicating the price drop. The inverted hammer occurs at the end of a down trend.. Web a shooting star candlestick pattern is a bearish formation in trading charts that typically occurs at the end of a bullish trend and signals a trend reversal. Web the shooting star is a candlestick pattern to help traders visually see where resistance and supply is located. This pattern is easy to understand and can be combined with other technical indicators to take trades. It can be one of the following candles: The small body indicates that there was little price difference between the open and close price, while the long upper shadow shows that the prices extended significantly upwards but then fell, suggesting selling pressure. It comes after an uptrend and marks the potential. The shooting star is a powerful chart pattern that signals potential price reversals. Web the shooting star pattern is a bearish reversal pattern that consists of just one candlestick and forms after a price swing high. Web the shooting star forex pattern is a singular, bearish candlestick that can appear after an uptrend. 77k views 5 months ago candlesticks. Web what is a shooting star candlestick pattern and how does it work? Here are some identification guidelines: They are typically red or black on stock charts. Shooting star a black or white candlestick that has a small body, a long upper shadow and little or no lower tail. After an uptrend, the shooting star pattern can signal to traders that the uptrend might be over and that long positions could potentially be reduced or completely exited. Web the shooting star pattern is a bearish reversal pattern that typically occurs at the top of an uptrend.

Shooting Star Candlestick Pattern How to Identify and Trade

How to Use Shooting Star Candlestick Pattern to Find Trend Reversals

Learn How To Trade the Shooting Star Candle Pattern Forex Training Group

Shooting Star Candlestick Pattern How to Identify and Trade

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

What Is Shooting Star Candlestick? How To Use It Effectively In Trading

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

A Complete Guide to Shooting Star Candlestick Pattern ForexBee

What Is Shooting Star Candlestick With Examples ELM

Candlestick Patterns The Definitive Guide (2021)

Alan Santana, A Prominent Crypto Analyst, Points To The Emergence Of Bearish Candlestick Patterns Like Shooting Stars And Inverted Hammers, Alongside Declining Trading Volume.

The Inverted Hammer Occurs At The End Of A Down Trend.

Shooting Star Candlesticks Consist Of A Smaller Real Body With A Longer Upper Wick And No Lower Shadow.

It’s Considered To Be A Signal That The Uptrend Is About To Reverse And Turn Into A Downtrend.

Related Post: