Shark Harmonic Pattern

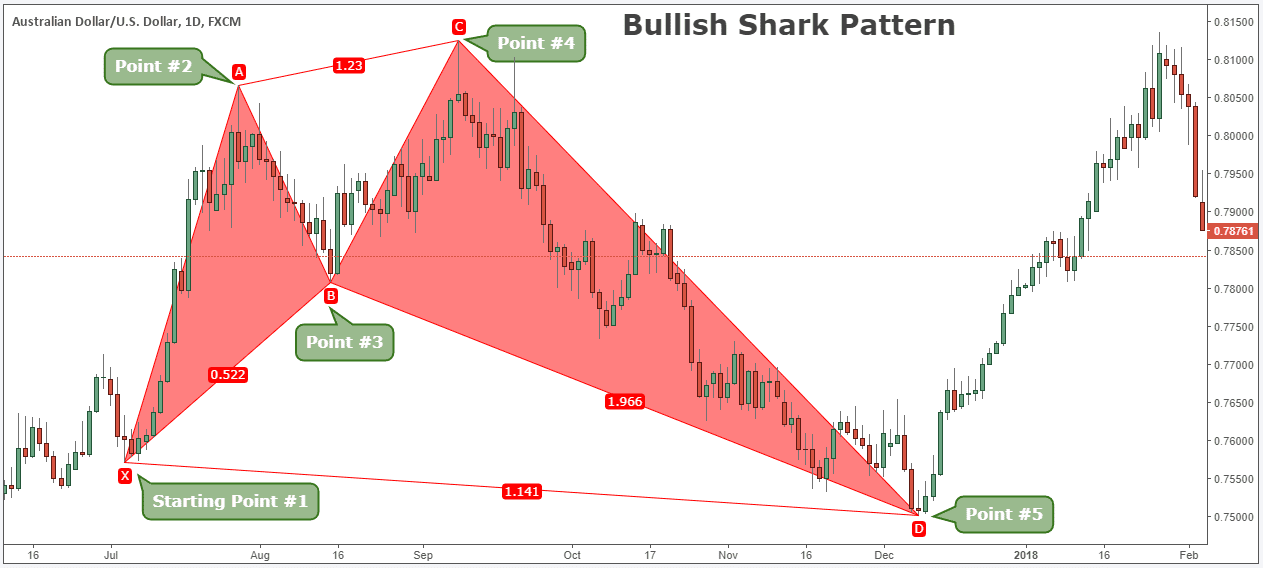

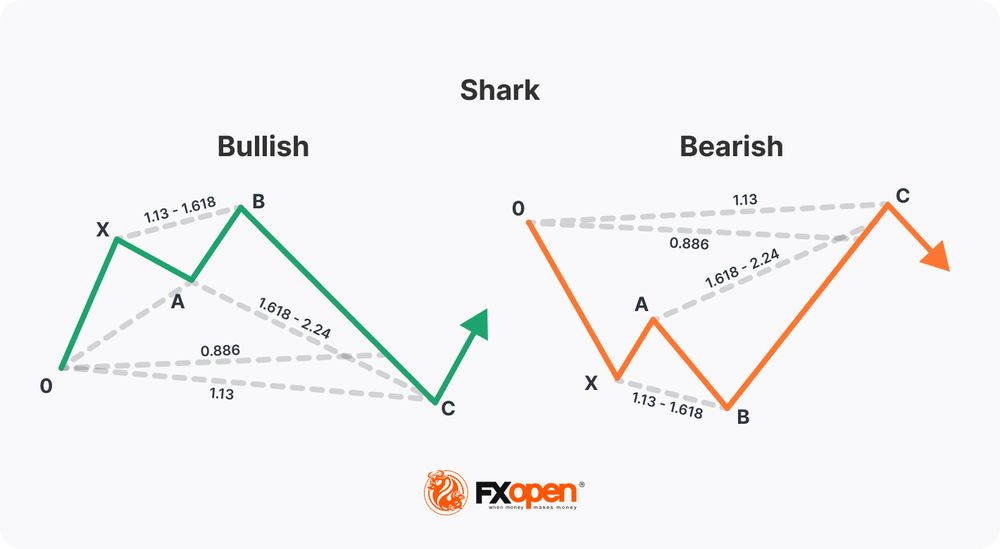

Shark Harmonic Pattern - To trade the shark harmonic pattern, a trader will be looking to enter a trade at c point, which is the 88.6% retracement of ox. Within the landscape of technical trading, savvy investors often turn to the shark harmonic pattern for its predictive power and precision in market analysis. It’s a relatively new pattern, discovered by scott carney in 2011, and is a variation of the more common gartley, bat, and butterfly patterns. The patterns are relatively new, but becoming more popular lately. Look for closest convergence of extreme harmonic. Utilizes the powerful 88.6% support/retracement as a minimum requirement. To gain a further understanding of the terminology used in this article, i would strongly encourage everyone to pick up all three of carney’s books. Each pattern happens at a reversal point, giving you the know that the trend is now ending. The ab leg carries forward with. The structure itself is made up of five. Web the shark pattern is a harmonic pattern used to predict potential reversal points in the markets. The structure of the shark pattern means that, unlike the other harmonic patterns, all trades are taken based on point c. A deep dive into its mechanism. It’s a relatively new pattern, discovered by scott carney in 2011, and is a variation of. Like other harmonic patterns, it is based on price waves and involves four swing and five swing points. Web the shark pattern, often referred to as a harmonic pattern, presents itself with five crucial swing points denoted as o, x, a, b, and c, all interconnected by four distinct legs named ox, xa, ab, and bc. Web the shark pattern. However, the shark pattern differentiates itself by labeling the swing points as o, x, a, b, and c. Like other harmonic patterns, it is based on price waves and involves four swing and five swing points. To gain a further understanding of the terminology used in this article, i would strongly encourage everyone to pick up all three of carney’s. Web “the shark pattern is a new harmonic pattern that i initially released in 2011 in my patterns into profits course. Tradingview has a smart drawing tool that allows users to visually identify. Web the shark pattern, often referred to as a harmonic pattern, presents itself with five crucial swing points denoted as o, x, a, b, and c, all. Here’s how a bullish shark pattern looks like on the chart. O, x, a, b, and c. The shark pattern was introduced in. Web the shark pattern is the newest harmonic pattern from carney’s work (2016). As with other harmonic patterns, the. To gain a further understanding of the terminology used in this article, i would strongly encourage everyone to pick up all three of carney’s books. Each pattern is based on fibonacci retracements and extensions, making it easy to identify potential price changes or trend reversals. Within the landscape of technical trading, savvy investors often turn to the shark harmonic pattern. The entry is at 88.6% of 0x. As with other harmonic patterns, the shark pattern consists of five swing points and four price swings, but the swing points are labeled differently: The structure itself is made up of five. A deep dive into its mechanism. The shark pattern was discovered in 2011 by scott carney, and it shares some of. Web the shark pattern is the newest harmonic pattern from carney’s work (2016). Web the shark harmonic pattern is a technical analysis tool used in financial markets to predict future price movements. Web the shark pattern is a harmonic pattern used to predict potential reversal points in the markets. The patterns are relatively new, but becoming more popular lately. Web. Web the shark pattern is one of the many harmonic patterns named after animals. It is as effective as other harmonic patterns and a common variation on trading this pattern is to trade the last leg to completion. Web shark harmonic pattern: Tradingview has a smart drawing tool that allows users to visually identify this price pattern on a chart.. The stop loss should be at the point c. The ab leg carries forward with. Web the shark pattern is the newest harmonic pattern from carney’s work (2016). Other harmonic patterns with animal names include the crab, the bat, and the butterfly patterns. Web this poster covers harmonic patterns such as gartley, butterfly, bat, crab, cypher, and shark patterns. The patterns are relatively new, but becoming more popular lately. To gain a further understanding of the terminology used in this article, i would strongly encourage everyone to pick up all three of carney’s books. The structure of the shark pattern means that, unlike the other harmonic patterns, all trades are taken based on point c. The shark pattern is a chart formation that is classified within the harmonic family of patterns. The pattern is named after its resemblance to a shark’s dorsal fin, with its five points representing specific price levels. It also has a particular and specific fibonacci level that the deep crab shares. To trade the shark harmonic pattern, a trader will be looking to enter a trade at c point, which is the 88.6% retracement of ox. As with other harmonic patterns, the shark pattern consists of five swing points and four price swings, but the swing points are labeled differently: Like other harmonic patterns, it is based on price waves and involves four swing and five swing points. Tradingview has a smart drawing tool that allows users to visually identify. Web the shark pattern is a harmonic pattern used to predict potential reversal points in the markets. It’s a relatively new pattern, discovered by scott carney in 2011, and is a variation of the more common gartley, bat, and butterfly patterns. O, x, a, b, and c. However, the shark pattern differentiates itself by labeling the swing points as o, x, a, b, and c. Web this poster covers harmonic patterns such as gartley, butterfly, bat, crab, cypher, and shark patterns. The shark pattern was discovered in 2011 by scott carney, and it shares some of the features of the crab and cypher patterns.![Shark Harmonic Pattern Full Guide [2022] PatternsWizard](https://patternswizard.com/wp-content/uploads/2020/06/shark.png)

Shark Harmonic Pattern Full Guide [2022] PatternsWizard

Shark Pattern Shark Harmonic Pattern Trading Strategy Shark

Harmonic Patterns Introduction to the Shark Pattern YouTube

Swimming With The Sharks Shark Harmonic Trading Strategy

How To Trade the Shark Harmonic Pattern Market Pulse

Shark Harmonic Pattern How to Trade it Like a PRO [Forex Chart

10 Best Harmonic Shark 50 Trading Pattern Swimming Strategy Forex Pops

Different Types of Harmonic Patterns Advanced Forex Strategies

How To Trade The Harmonic Shark Pattern Forex Training Group

Bearish shark trading harmonic patterns Vector Image

The Stop Loss Should Be At The Point C.

It Is A Relatively New Pattern, Having Been Developed By Scott Carney In 2011.

Here’s How A Bullish Shark Pattern Looks Like On The Chart.

It Is As Effective As Other Harmonic Patterns And A Common Variation On Trading This Pattern Is To Trade The Last Leg To Completion.

Related Post: