Shadow Candlestick Pattern

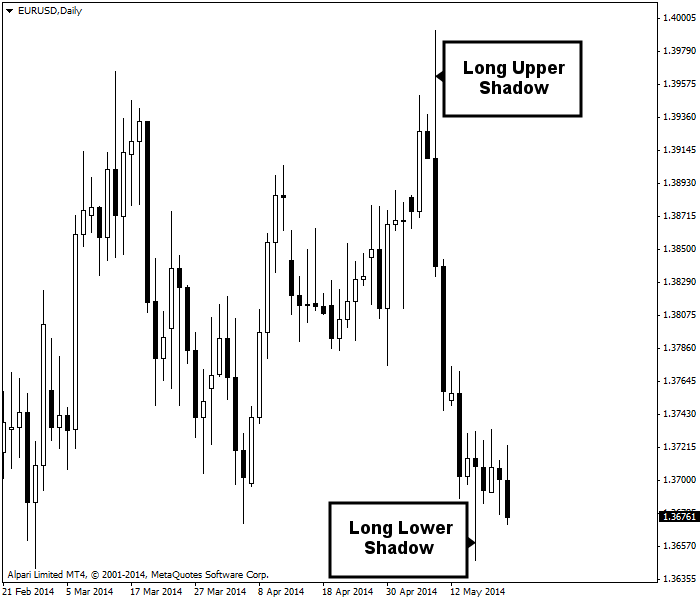

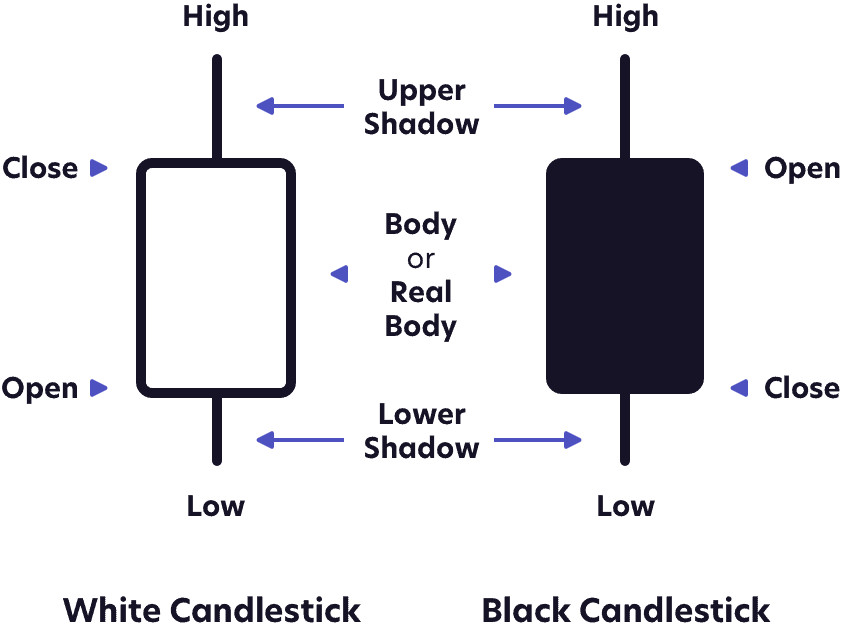

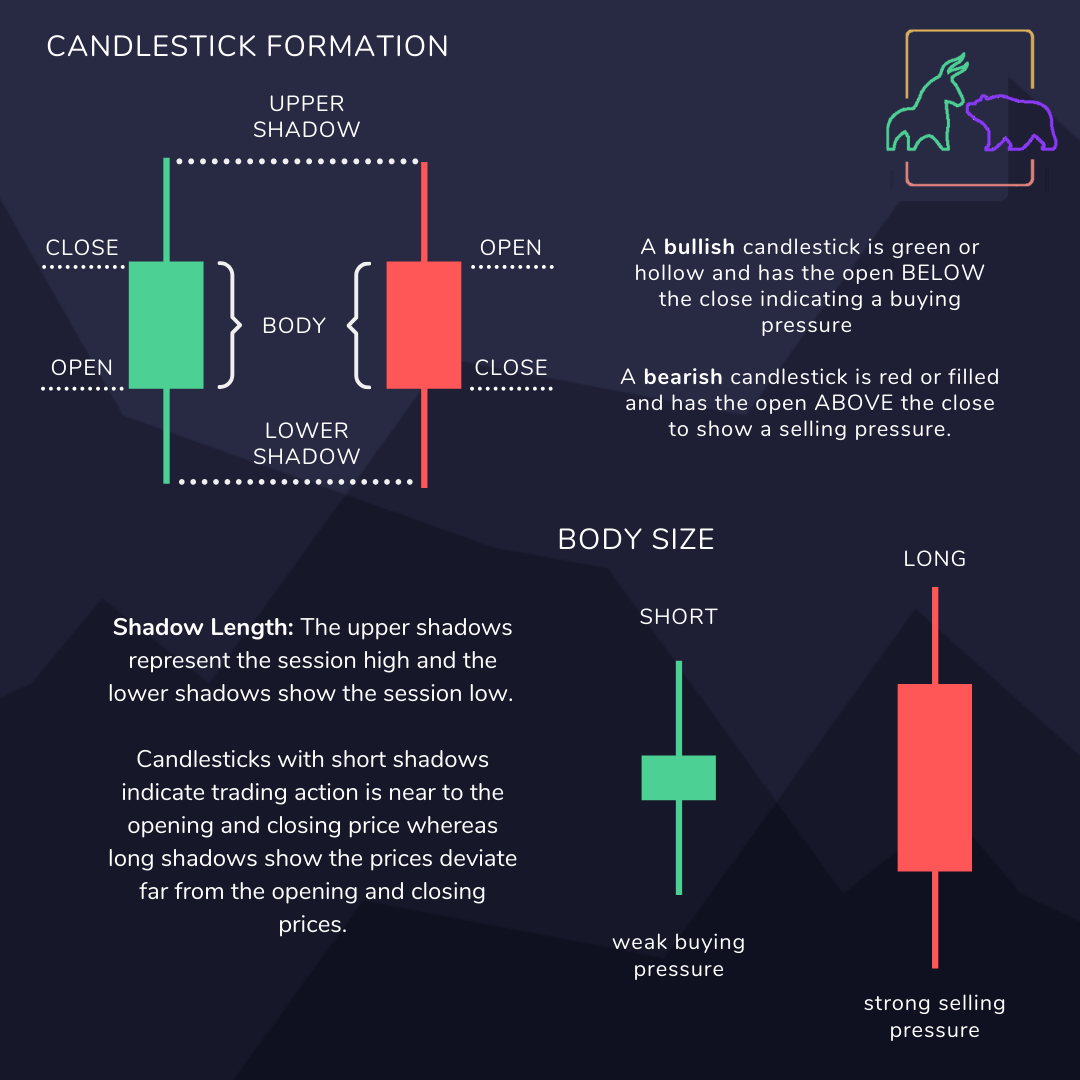

Shadow Candlestick Pattern - Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Web the marks above and below the real body are called ‘shadows’ or ‘wicks.’. To indicate buyer domination of the first part of a session, candlesticks will present with long upper shadows, as well as short lower shadows, consequently raising bidding prices. Long lower shadow is a bullish candlestick pattern. Understanding candle shadows is crucial for any trader looking to make informed decisions based on candlestick charts. They are better than other types of charts like line charts, bar charts, and kagi because of the vast amount of data they show. Generally, the long shadow should be at least twice the length of the real body, which can be either black or white. Web long lower shadow is a bullish candlestick pattern. Web the shooting star candlestick pattern consists of a single candlestick with a small body at the bottom and a long upper shadow. Web the shadows show the high and low prices of that day's trading. If the upper shadow on a down candle is short, it indicates that the open on that day was near the day's high. These show the high and low prices of the given time period. This candle can be white (or green) or black (or red). Web the shooting star candlestick pattern consists of a single candlestick with a small. These show the high and low prices of the given time period. It is a bearish reversal indicator, meaning that its appearance usually prompts a shift in the trend from bullish to bearish. The pattern features a short body on the upper end of a candle, with a long lower shadow. Web the shooting star candlestick pattern consists of a. These show the high and low prices of the given time period. Web a shadow (wick) is a line found on a candle in a candlestick chart. They are better than other types of charts like line charts, bar charts, and kagi because of the vast amount of data they show. Web the shadows show the high and low prices. Web candlestick patterns are technical trading tools that have been used for centuries to predict price direction. Understanding candle shadows is crucial for any trader looking to make informed decisions based on candlestick charts. Trading up blog > the shadow of a candlestick: Web long upper shadow is a bearish candlestick pattern. Long upper shadow candlesticks are candlesticks that form. The pattern features a short body on the upper end of a candle, with a long lower shadow. Web let’s break them down: Web a long upper shadow candlestick is a candlestick pattern that occurs when the high of the day is significantly higher than the opening and closing prices, resulting in a long upper wick. Web the lines above. Web a candle shadow is the thin line that extends above and below the body of a candlestick on a candlestick chart. Web single candlestick patterns are individual candlesticks that provide insights into market sentiment, potential trend reversals, or continuations, with patterns such as the doji, hammer, and shooting star indicating bullish or bearish market signals. Over time, individual candlesticks. Trading up blog > the shadow of a candlestick: Over time, individual candlesticks form patterns that traders can use to recognise major support and resistance levels. Long upper shadow candlesticks are candlesticks that form with a long shadow (or wick, as some call it) above the candle body. The long upper shadow must be at least twice the length of. If the upper shadow on a down candle is short, it indicates that the open on that day was near the day's high. Web the shadows show the high and low prices of that day's trading. There are dozens of different candlestick patterns with intuitive, descriptive. Web a long upper shadow candlestick is a candlestick pattern that occurs when the. A candlestick with no shadows is regarded as a strong signal of conviction by either buyers or sellers, depending on whether the direction of the candle is up or down. Generally, the long shadow should be at least twice the length of the real body, which can be either black or white. Web a long upper shadow candlestick is a. Web a shadow, or a wick, is a line found on a candle in a candlestick chart that is used to indicate where the price of a stock has fluctuated relative to the opening and closing prices. Web a shadow (wick) is a line found on a candle in a candlestick chart. Web a candle shadow is the thin line. Generally, the long shadow should be at least twice the length of the real body, which can be either black or white. The long upper shadow must be at least twice the length of the candle’s body. The bullish version of this pattern is the long lower shadow pattern. Long lower shadow is a bullish candlestick pattern. Candlesticks patterns are used by traders to gauge the. Web long shadow candlesticks are a popular pattern in technical trading, offering potential clues to market sentiment and future price direction. These attributes suggest that the. Trading up blog > the shadow of a candlestick: These lines represent the highest and lowest prices that a stock reached during a specific trading session. It is a bearish reversal indicator, meaning that its appearance usually prompts a shift in the trend from bullish to bearish. Web the shadows show the high and low prices of that day's trading. Web the shooting star candlestick pattern consists of a single candlestick with a small body at the bottom and a long upper shadow. Web the long lower shadow candlestick is a technical indicator that is used by traders to identify a reversal in the market trends. These candles form frequently in forex and stocks, usually appearing towards the end of uptrends or large upswings. The pattern features a short body on the upper end of a candle, with a long lower shadow. The lower shadow in the candle is typically at least two times longer than the length of the body.

Long Lower Shadow Candlestick Chart Pattern. Set of Candle Stick Stock

What Are Candlestick Patterns? Understanding Candlesticks Basics

Japanese Candlestick Structure

Candlestick patterns for trading explained United Fintech

Trading 101 How to read candlestick patterns BullBear Blog

Mastering and Understanding Candlesticks Patterns

Japanese Candlesticks Candlestick Shadows

Long Shadow Candlesticks A Trader’s Guide TrendSpider Learning Center

Long Shadow Candlesticks A Trader’s Guide TrendSpider Learning Center

Candlestick Chart Pattern Analysis (Candlestick Basics) StockManiacs

They Tend To Form Towards The End Of Downtrends Or Significant Downturns, Signifying A Surge Of Demand From Buyers.

Web Let’s Break Them Down:

Web Candlestick Patterns Are Technical Trading Tools That Have Been Used For Centuries To Predict Price Direction.

Web Long Lower Shadow Is A Bullish Candlestick Pattern.

Related Post: