Seller Financing Business Contract Template

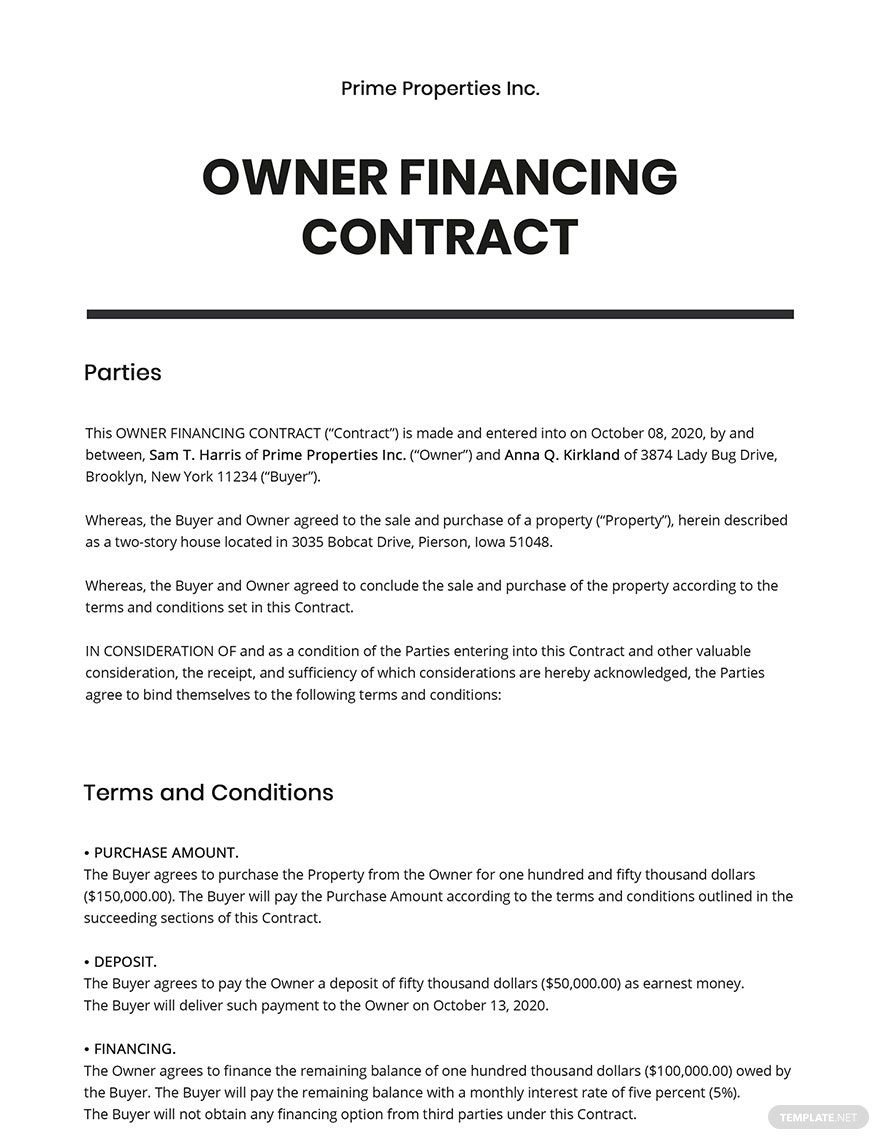

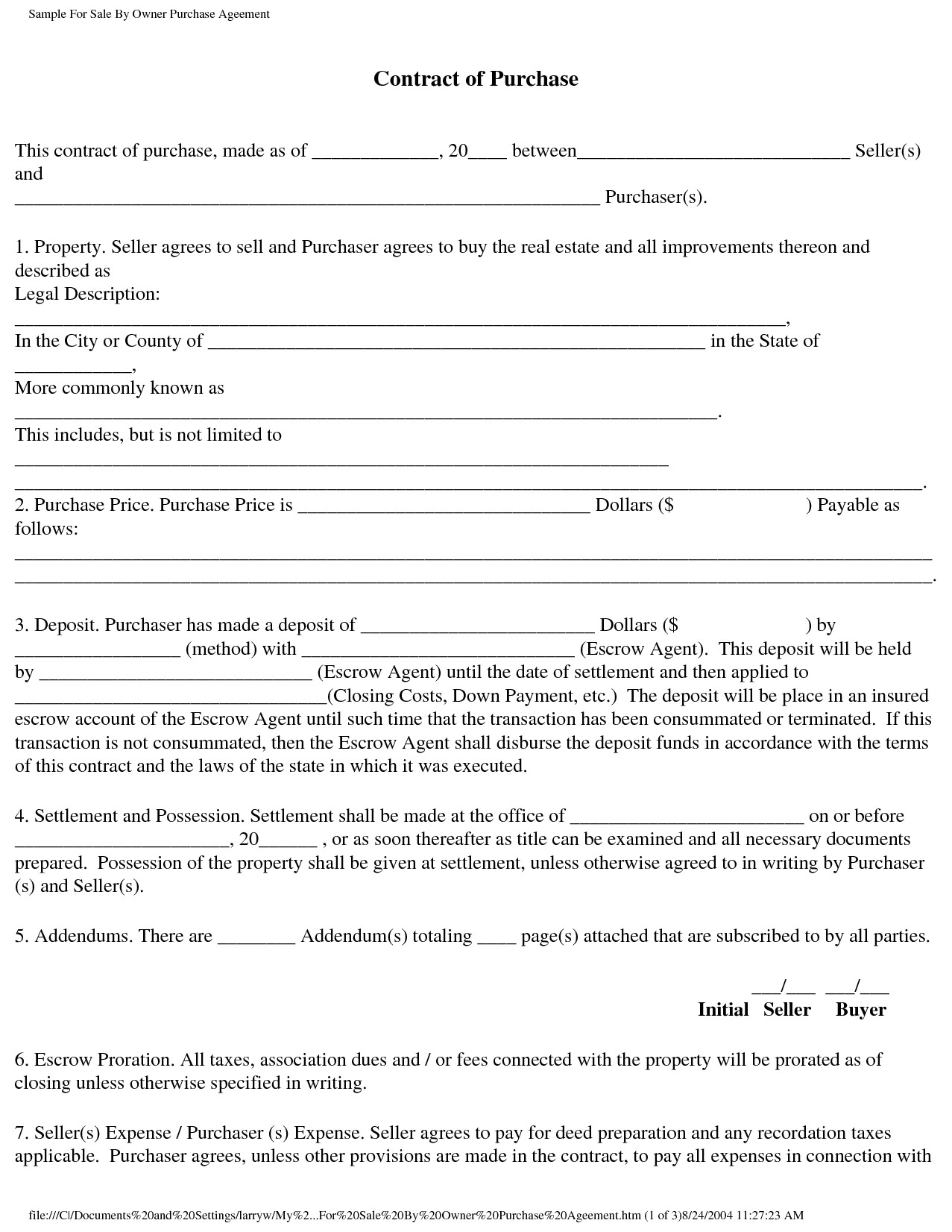

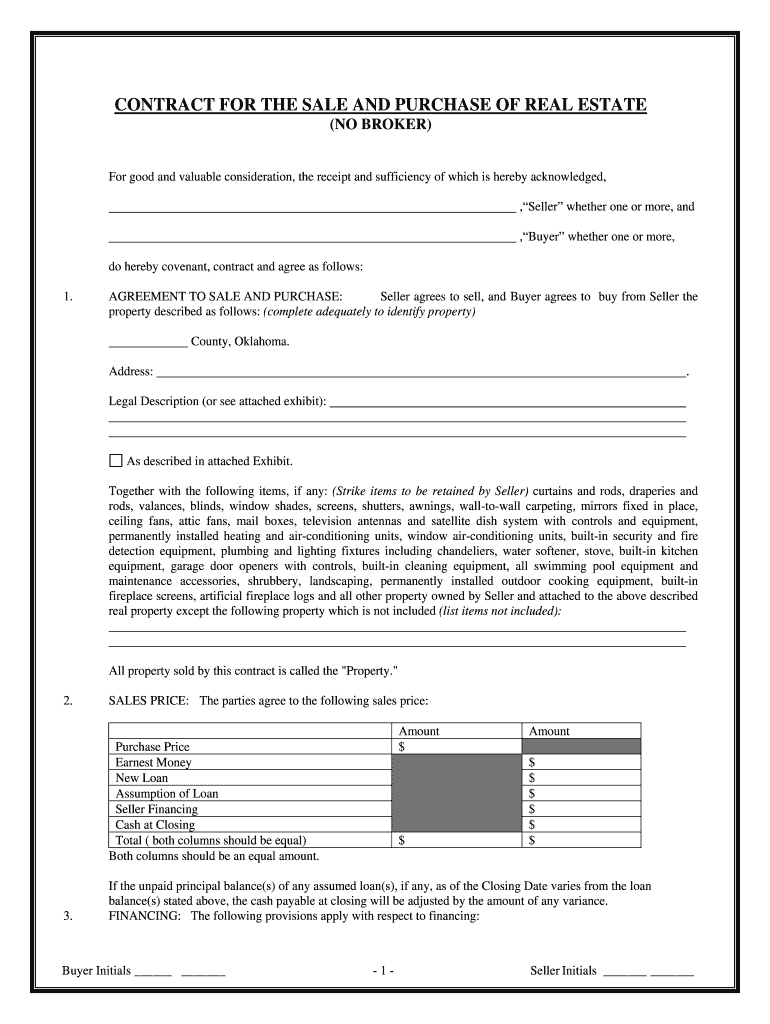

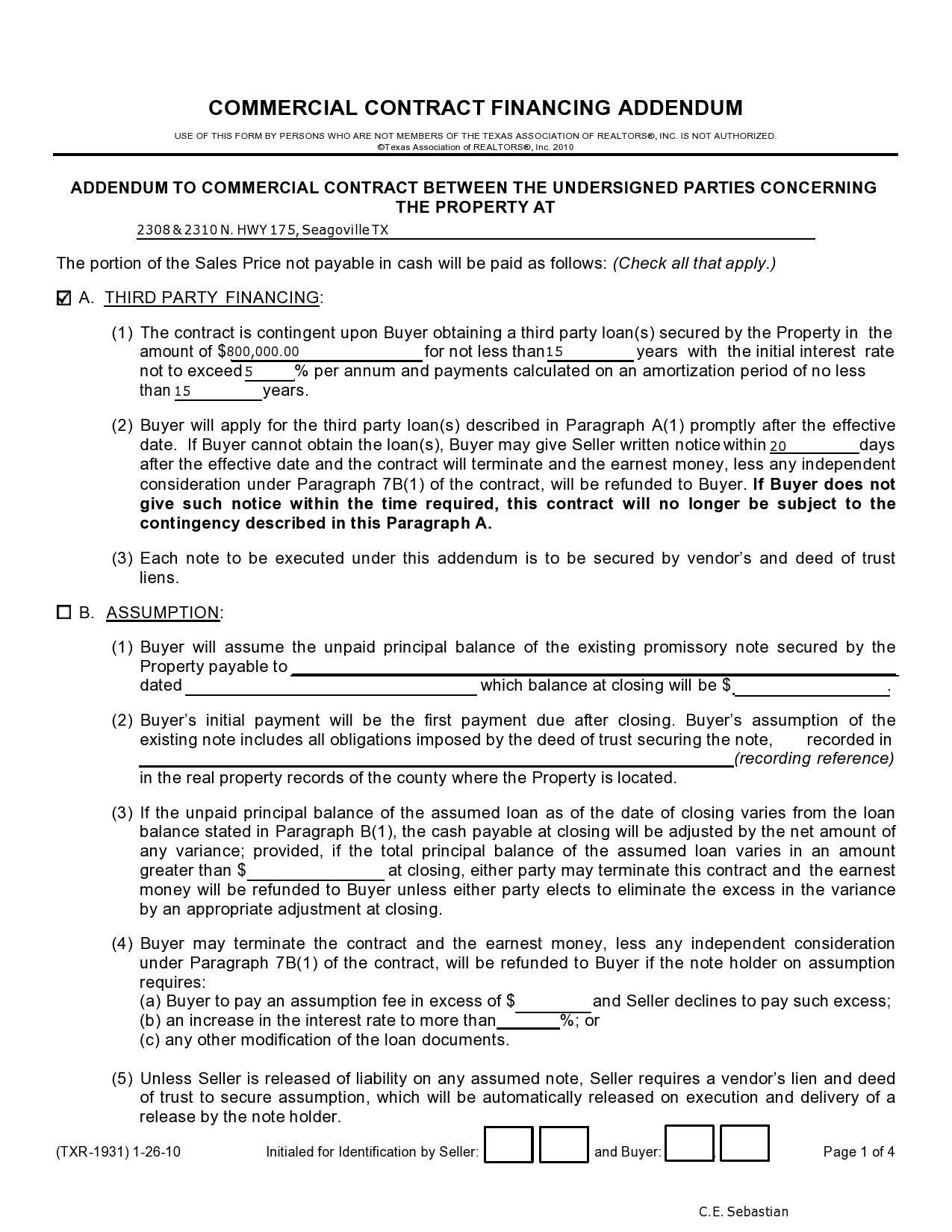

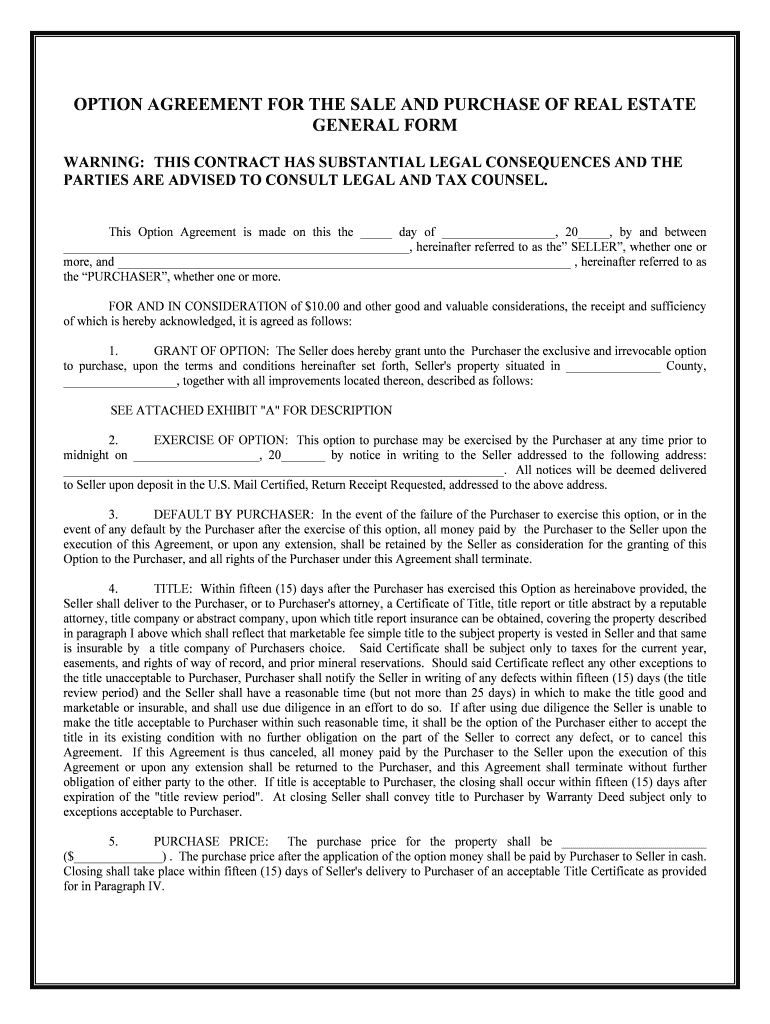

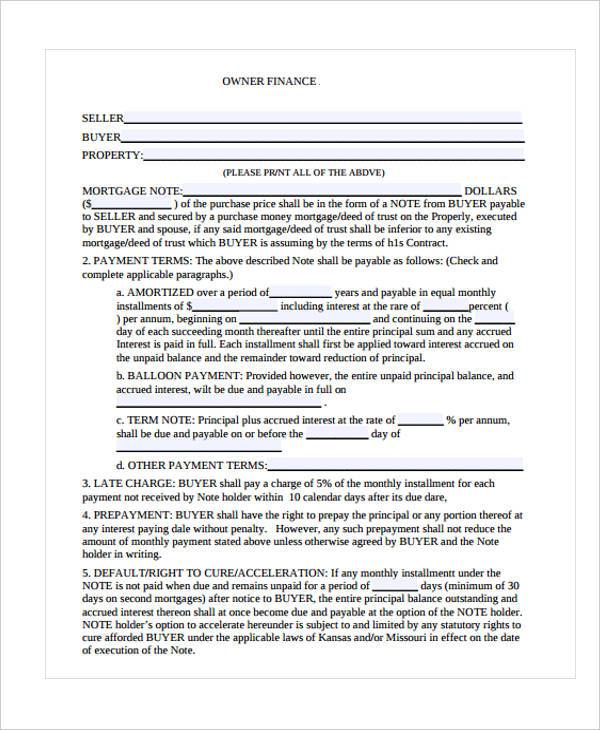

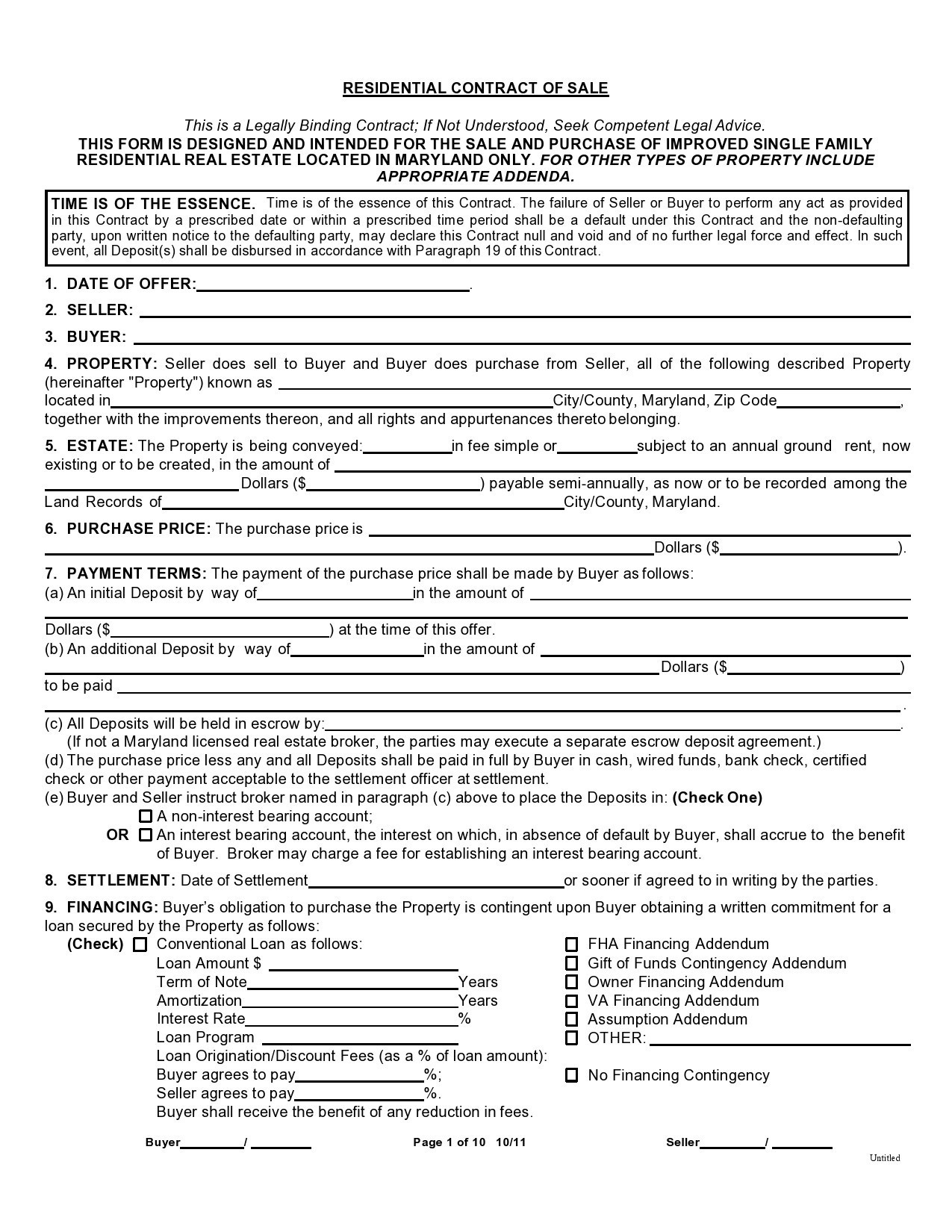

Seller Financing Business Contract Template - A promissory note that defines the amount of the loan and repayment terms. Web an owner or seller financing contract is an agreement between a buyer and seller about the seller providing finances to the buyer to let them buy the concerned real estate. Here, we’ll tell you more about seller financing—also known as owner financing in terms of real estate deals—why you should consider it, and how to tell if it’s the best way to let go of your business. Seller financing the sale of a business: The owner financing addendum is a document that can provide supplementary terms for a sale that involves the seller supplying the buyer with the necessary funds to purchase the home, i.e., a loan. Web seller financing is a financial contract where the seller of goods, property, or services offers funds to the client instead of receiving a loan from a bank. A business sale agreement is a legal document that describes and records the price and other details when a. A strategic approach to business sale deal structures. This purchase price shall be contingent upon seller financing a portion of the purchase price in an amount not less than $23,000.00 at an interest rate not to exceed 6% per year, with the whole amount, $23,000.00 due within one (1) year of the purchase closing, with monthly installments of $1,979.53. The option is a great opportunity for those who do not want to go with traditional home mortgages. A business sale agreement is a legal document that describes and records the price and other details when a. Seller financing doesn’t mean that the owner gives the buyer money to purchase their own business. Enlist the assistance of a financial advisor or business broker; Web seller financing, or seller note, occurs when an owner serves as a lender and. Set up an automated signing order. Buyer responsibilities such as home maintenance and repairs. A purchase agreement defining what is being sold to whom and for what price. Web one option to solve this problem is called seller financing (or owner financing). Web so, for both sellers and your prospective buyers, seller financing can be a lifesaver. This purchase price shall be contingent upon seller financing a portion of the purchase price in an amount not less than $23,000.00 at an interest rate not to exceed 6% per year, with the whole amount, $23,000.00 due within one (1) year of the purchase closing, with monthly installments of $1,979.53. The seller agrees to finance the balance of the. Enlist the assistance of a financial advisor or business broker; Seller financing is common in the business for sale marketplace, with business owners offering to accept payments over three to seven years for some portion of the overall business sale price. When selling your business, navigating the intricacies of payment structures is important. Include seller financing in the business for. This purchase price shall be contingent upon seller financing a portion of the purchase price in an amount not less than $23,000.00 at an interest rate not to exceed 6% per year, with the whole amount, $23,000.00 due within one (1) year of the purchase closing, with monthly installments of $1,979.53. Web seller financing, or seller note, occurs when an. The seller agrees to finance the balance of the purchase price (not including the down payment) with the buyer making payments to the seller. Web seller financing of a business purchase requires at least two important contracts: Here, we’ll tell you more about seller financing—also known as owner financing in terms of real estate deals—why you should consider it, and. Web create an owner financing contract with jotform sign. How to sell a business using installment sales. A business sale agreement is a legal document that describes and records the price and other details when a. Web updated on march 18, 2023. When selling your business, navigating the intricacies of payment structures is important. Web owner (seller) financing addendum. Ensure your collateral is secure and your contract is airtight A promissory note that defines the amount of the loan and repayment terms. Web an owner or seller financing contract is an agreement between a buyer and seller about the seller providing finances to the buyer to let them buy the concerned real estate. The. Enlist the assistance of a financial advisor or business broker; When selling your business, navigating the intricacies of payment structures is important. A strategic approach to business sale deal structures. Seller financing doesn’t mean that the owner gives the buyer money to purchase their own business. A seller financing addendum outlines the terms under which the seller of a property. Web seller financing, or seller note, occurs when an owner serves as a lender and funds a percentage of the purchase price for a business acquisition. Web seller financing is a financial contract where the seller of goods, property, or services offers funds to the client instead of receiving a loan from a bank. Web owner financing contract template for. Seller financing doesn’t mean that the owner gives the buyer money to purchase their own business. Include seller financing in the business for sale listing; In this agreement, the vendor effectively serves as the lender and provides credit to the buyer to facilitate the deal. Set up an automated signing order. This purchase price shall be contingent upon seller financing a portion of the purchase price in an amount not less than $23,000.00 at an interest rate not to exceed 6% per year, with the whole amount, $23,000.00 due within one (1) year of the purchase closing, with monthly installments of $1,979.53. Buyer responsibilities such as home maintenance and repairs. A seller financing addendum outlines the terms under which the seller of a property agrees to loan money to the buyer in order to purchase their property. Ensure your collateral is secure and your contract is airtight Seller financing is common in the business for sale marketplace, with business owners offering to accept payments over three to seven years for some portion of the overall business sale price. Web seller financing is a type of real estate agreement that allows the buyer to pay the seller in installments rather than using a traditional mortgage from a bank, credit union or other financial institution. A purchase agreement defining what is being sold to whom and for what price. Seller financing the sale of a business: In this scenario, the buyer makes an initial down payment, and the balance of the purchase price is paid over time with interest, typically from the revenue generated by the business. Web an owner financing contract is an agreement between the owner or seller of the property and the buyer. A promissory note that defines the amount of the loan and repayment terms. Web owner financing contract template for sellers.

Free Sales Contract Template in Word & PDF Signeasy

Free Free Owner Financing Contract Template Google Docs, Word

Seller Financing Business Contract Template williamsonga.us

Buyer and seller agreement Fill out & sign online DocHub

Seller Financing Contract Template

Owner Finance Contract Form Fill Out and Sign Printable PDF Template

Printable Owner Financing Contract Template Printable Templates

![43 Seller Financing Addendum Samples [Free] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2021/06/seller-financing-addendum-28.jpg)

43 Seller Financing Addendum Samples [Free] ᐅ TemplateLab

Owner Finance Agreement Template Free PRINTABLE TEMPLATES

Seller Finance Contract Template

How To Set Up A Payment Schedule In Your Favor.

Web Owner (Seller) Financing Addendum.

The Option Is A Great Opportunity For Those Who Do Not Want To Go With Traditional Home Mortgages.

How To Sell A Business Using Installment Sales.

Related Post: