Self Employment Printable Small Business Tax Deductions Worksheet

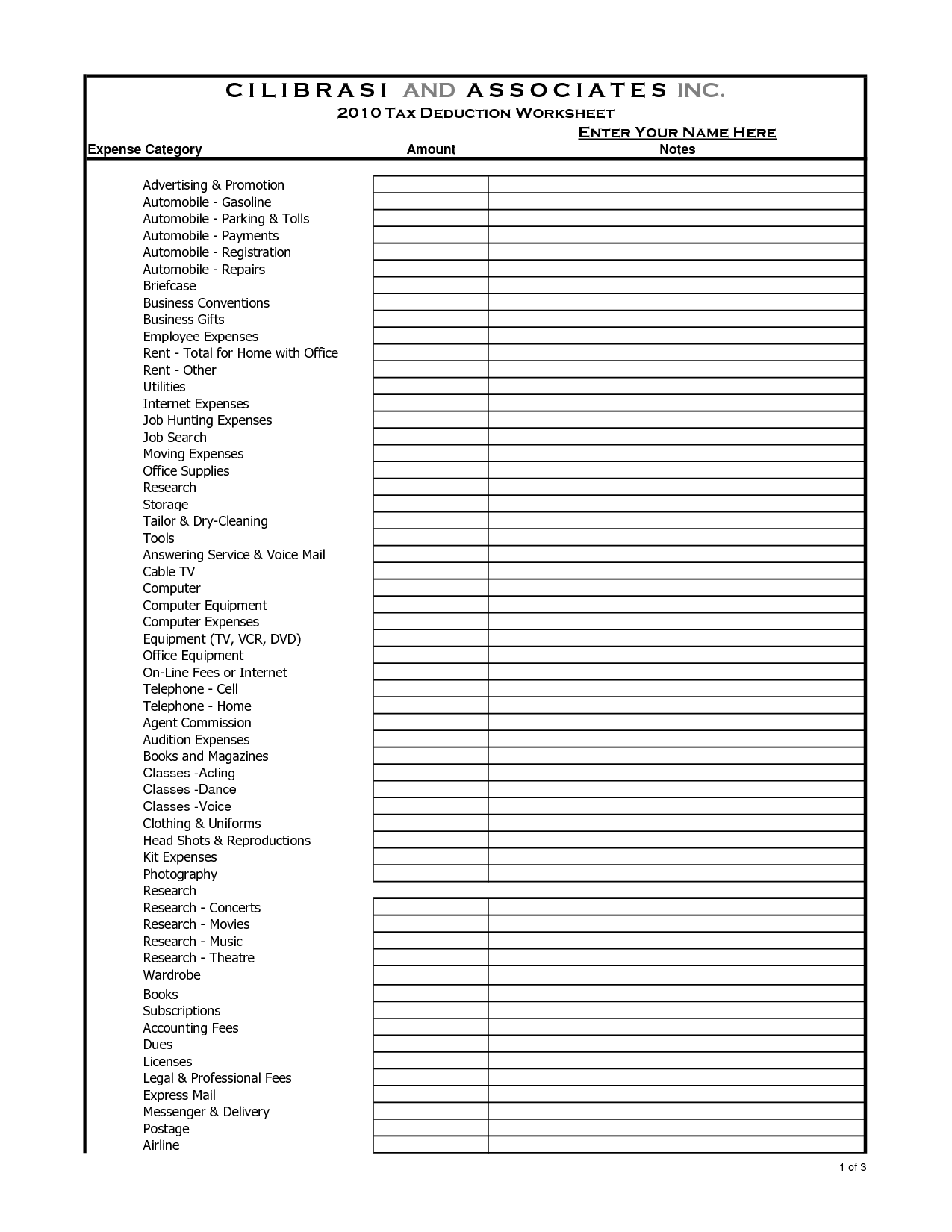

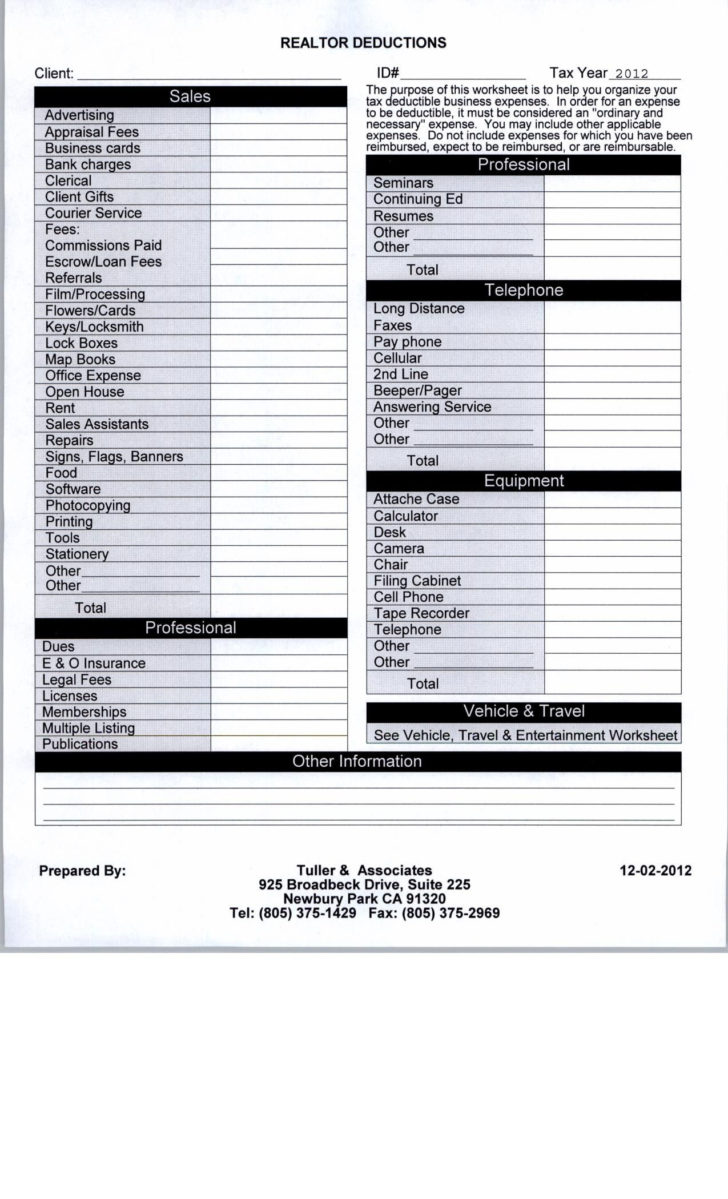

Self Employment Printable Small Business Tax Deductions Worksheet - Maximize tax deductionstrack income & expensesmanage sales taxget organized It is similar to the social security and medicare taxes withheld from the pay of most wage earners. A+ ratings with bbbover 24 yrs of experienceknowledgeable team According to fundera, on average, the effective small business tax rate is 19.8%, adding that sole proprietorships pay a 13.3% tax rate and small partnerships pay a 23.6% tax rate. Publication 505, tax withholding and estimated tax. Web with an easy web search, you can easily get a substantial selection of free, printable worksheets for a range of subjects and also grade levels such as printable. On that worksheet, the qualified income will be totaled and the total allocated to the 0% and 15% rates, as needed. For a full list, go to the publication 535 for 2022 pdf. Web small business forms and publications. Se tax is a social security and medicare tax primarily for individuals who work for themselves. Publication 505, tax withholding and estimated tax. Social security and medicare taxes and income tax withholding: Se tax is a social security and medicare tax primarily for individuals who work for themselves. Web small business forms and publications. According to fundera, on average, the effective small business tax rate is 19.8%, adding that sole proprietorships pay a 13.3% tax rate. You’ll write off a percentage of the bill based on how much you use your home internet for business. The rate increases to 67 cents per miles for 2024. The last revision was for 2022. For a full list, go to the publication 535 for 2022 pdf. Within the first year, you. On that worksheet, the qualified income will be totaled and the total allocated to the 0% and 15% rates, as needed. Costs incurred to get your business up and running are deductible business expenses. The rate increases to 67 cents per miles for 2024. It's been updated with all the latest info for you: The self‐employed tax organizer should be. Web the percentage of that $45,000 income that is taxed depends on your business’s tax rate. Depreciation and section 179 expense deduction: Use this self employed tax deduction cheat sheet to help you pull together an accurate tax return that minimizes what you might owe the irs. If you are an aspiring entrepreneur and are unsure of which tax publications. Just check off the items as you validate them with your records, or for those you’re not taking, use an “x”. Use this self employed tax deduction cheat sheet to help you pull together an accurate tax return that minimizes what you might owe the irs. Se tax is a social security and medicare tax primarily for individuals who work. Bbb a+ rated businessover 100k legal forms100% money back guarantee Web start up expenses are those expenses which would have been deductible if you were actively engaged in a trade or business, but which were incurred before the start of business. Web for 2023 the rate is 65.5 cents per mile. It has been designed to help collect and organize. The self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. This is also the final day to submit copies of these tax documents to the irs. Web irs publication 587: Web start up expenses are those expenses which would have been deductible if you were actively engaged in a trade or business, but which. It has been designed to help collect and organize the information that we will need to prepare the business portion of your income tax returns in the most efficient and timely manner possible. It's been updated with all the latest info for you: A+ ratings with bbbover 24 yrs of experienceknowledgeable team *in some cases a schedule d worksheet will. Web start up expenses are those expenses which would have been deductible if you were actively engaged in a trade or business, but which were incurred before the start of business. Do you need help with a tax issue or preparing your return, or do you need a free publication or form? Web the percentage of that $45,000 income that. Do you need help with a tax issue or preparing your return, or do you need a free publication or form? Web here are the essential small business tax dates for 2024: A+ ratings with bbbover 24 yrs of experienceknowledgeable team 15th day of 4th, 6th, and 9th months of tax year, and 15th day of 1st month after the. Depreciation and section 179 expense deduction: The self‐employed tax organizer should be completed by all sole proprietors or single member llc owners. You’ll write off a percentage of the bill based on how much you use your home internet for business. The law allows businesses to depreciate—or gradually deduct the cost of —assets such as equipment, fixtures, furniture, etc., that will last more than one year. Deadline for companies to file their information return using a 1099 or 1096. Gather documentation for expenses and deductions. However, 50% of what you pay in. Bbb a+ rated businessover 100k legal forms100% money back guarantee Social security and medicare taxes and income tax withholding: The rate increases to 67 cents per miles for 2024. Web here are the essential small business tax dates for 2024: Web tax deductions write offs self employed small business this document will list and explain the information and documentation that we will need in. A document published by the internal revenue service (irs) that provides information on how taxpayers who use. Maximize tax deductionstrack income & expensesmanage sales taxget organized Use this self employed tax deduction cheat sheet to help you pull together an accurate tax return that minimizes what you might owe the irs. Just click on the link above and make a copy in google sheets.

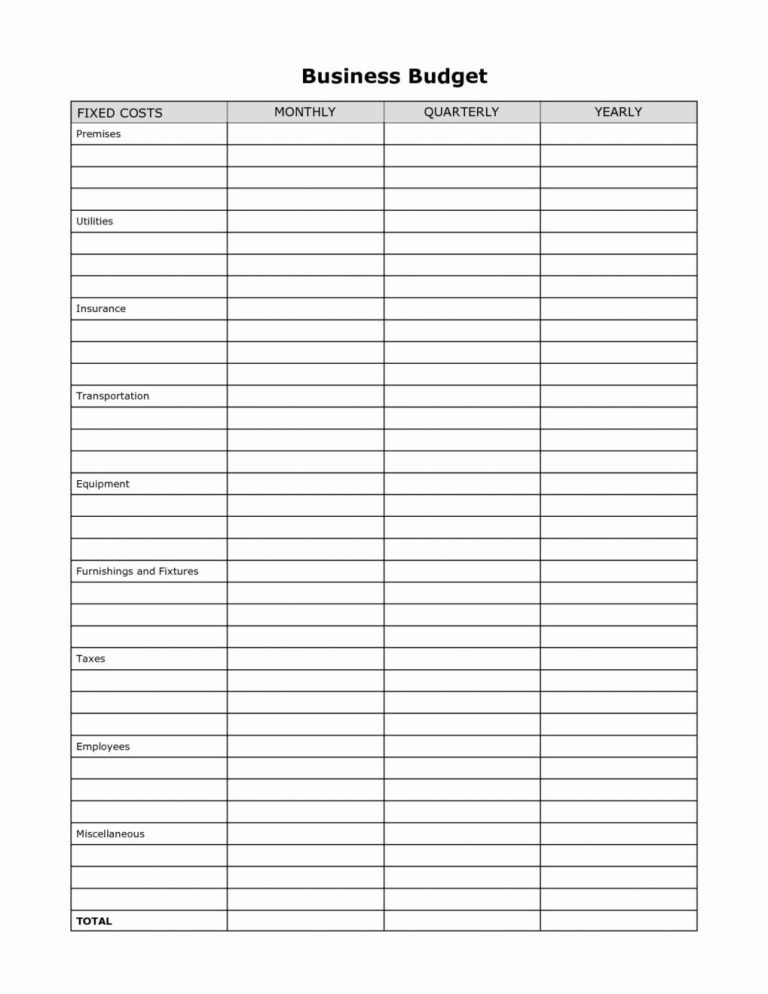

Self Employed Tax Spreadsheet in Self Employed Expense Sheet Sample

The Epic Cheat Sheet to Deductions for SelfEmployed Rockstars

Small Business Expenses Printable Self Employed Tax Deductions

Self Employment Printable Small Business Tax Deductions Worksheet

Printable Small Business Tax Deduction Worksheet Printable Monthly

The Epic Cheat Sheet to Deductions for SelfEmployed Rockstars

16 Best Images of Tax Organizer Worksheet Tax Deduction Worksheet

Self Employed Tax Deductions Worksheet 2018 Printable Ellis Sheets

The Ultimate Self Employed Deduction Cheat Sheet! Exceptional Tax

2016 Self Employment Tax And Deduction Worksheet —

A+ Ratings With Bbbover 24 Yrs Of Experienceknowledgeable Team

If There Are Multiple Vehicles, Please Attach A Separate Statement With A Breakdown Per Vehicle.

April 30, July 31, October 31, And January 31.

Just Check Off The Items As You Validate Them With Your Records, Or For Those You’re Not Taking, Use An “X”.

Related Post: