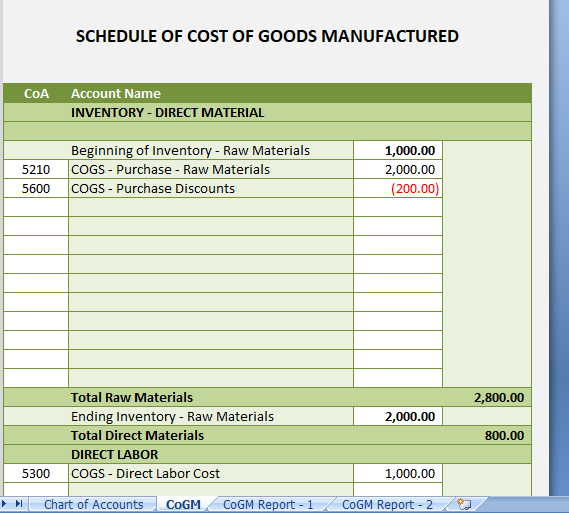

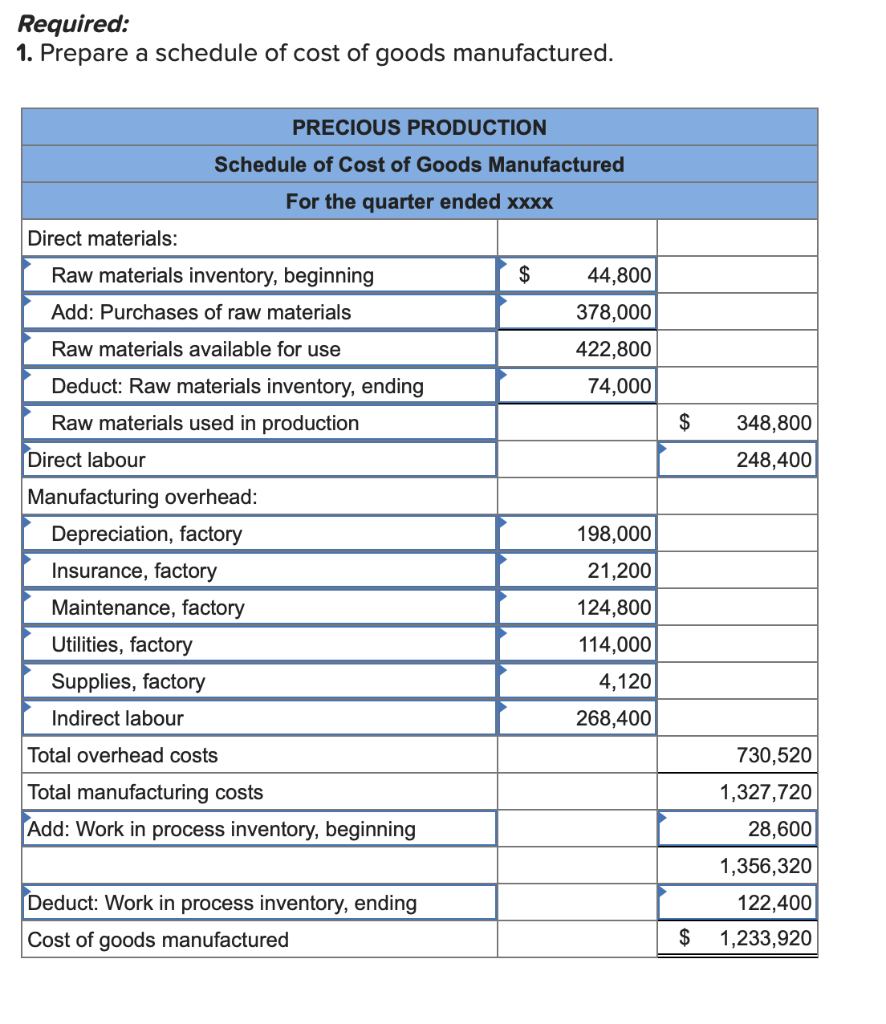

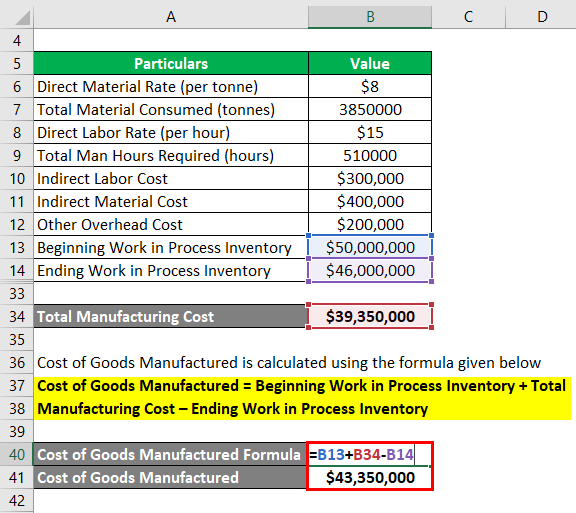

Schedule Of Cost Of Goods Manufactured Template

Schedule Of Cost Of Goods Manufactured Template - Put simply, cogm is the total cost a company has for manufacturing its products into finished goods. The cost of goods manufactured amount is transferred to the finished goods inventory account during the period and is used in calculating cost of goods sold on the income statement. Web cost of goods manufactured schedule. Web the cost of goods manufactured schedule is used to calculate the cost of producing products for a period of time. Web manufacturing costs = raw materials + direct labor costs + manufacturing overhead. Enter your name and email in the form below and download the free template now! Web a schedule of cost of goods manufactured is a financial statement that provides a detailed breakdown of the various costs incurred during the manufacturing process of a company’s products. Web the cost of goods manufactured excel template helps businesses accurately track the cost of production and provide valuable insight into the profitability of their operations. The first item to take into account when preparing a cost of goods manufactured schedule is the cost of raw materials used to manufacture the products. Labor cost = 200 x 500. Click here to download the template. Schedule of cost of goods sold; Schedule of cost of goods manufactured (cogm) report template is an excel spreadsheet to calculate cost of producing products within particular time period. Material cost = 250 x 500. First, we need to reach the direct labor cost by multiplying what is given. Put simply, cogm is the total cost a company has for manufacturing its products into finished goods. Enter your name and email in the form below and download the free template now! Labor cost = 200 x 500. A manufacturer's income statement uses the schedule of cost of goods manufactured in its cost (the cost of goods manufactured is similar. Web the cost of goods manufactured schedule is used to calculate the cost of producing products for a period of time. Remember, the cost of goods manufactured schedule is a key part of understanding the cost flow in a manufacturing company and plays an integral role in preparing an income statement for such businesses. First, we need to reach the. Click here to download the template. Beginning raw materials inventory, raw. This report is part of accounting system to calculate all direct and indirect expenses within a factory where it results will be used as reference to. Schedule of cost of goods manufactured (cogm) report template is an excel spreadsheet to calculate cost of producing products within particular time period.. Cost of goods manufactured (cogm) is a term used in managerial accounting that refers to a schedule or statement that shows the total production costs. Web cost of goods manufactured schedule. Cogm is the total cost. Click here to download the template. The cost of goods manufactured schedule is used to calculate the cost of all items produced during a. Use the information from the schedule of. Once the manufacturing costs have been added to the beginning wip inventory, the remaining step is to deduct the ending wip inventory balance. This report is part of accounting system to calculate all direct and indirect expenses within a factory where it results will be used as reference to. Label the first section. Prepare an income statement for the year ended december 31, 2012. Therefore, the cost of goods manufactured incurred by zxc inc. Labor cost = 200 x 500. Cost of goods manufactured (cogm) is a term used in managerial accounting that refers to a schedule or statement that shows the total production costs for the company during a specific period of. Prepare an income statement for the year ended december 31, 2012. Putting the above together, the formula for calculating the cost of goods manufactured (cogm) metric is. Schedule of cost of goods sold; Add up the cost of all raw materials purchased during the period. Web this cost of goods manufactured (cogs) template lays out a schedule of cogm using. First, we need to reach the direct labor cost by multiplying what is given. Therefore, the cost of goods manufactured incurred by zxc inc. Cost of goods manufactured (cogm) is a term used in managerial accounting that refers to a schedule or statement that shows the total production costs. Put simply, cogm is the total cost a company has for. Web in general, having the schedule for cost of goods manufactured is important because it gives companies and management a general idea of whether production costs are too high or too low relative to the sales they are making. Cost of goods manufactured= $5.30 million. Web the amount of overhead allocated to manufactured goods during the period. Web manufacturing costs. Cogm is the total cost. The cost of goods manufactured amount is transferred to the finished goods inventory account during the period and is used in calculating cost of goods sold on the income statement. Assume fine cabinets, inc., is a merchandising company that purchases its cabinets from a manufacturer. Web calculation of material and labor cost. Material cost = 250 x 500. The cost of goods manufactured schedule reports. Web cost of goods manufactured notes: The total derived from this schedule is then used to calculate the cost of goods sold. Web a schedule of cost of goods manufactured is a financial statement that provides a detailed breakdown of the various costs incurred during the manufacturing process of a company’s products. For example, if a company earned $1,000,000 in sales revenue for the year and incurred $750,000 in cost of goods sold. Web this cost of goods manufactured (cogs) template lays out a schedule of cogm using the amount of direct materials, direct labor, manufacturing overhead, and work in process inventory. The cost of goods manufactured schedule is used to calculate the cost of all items produced during a reporting period. Label the first section of your schedule “materials cost,” then create a line for each of the following items below the subhead: Put simply, cogm is the total cost a company has for manufacturing its products into finished goods. This report is part of accounting system to calculate all direct and indirect expenses within a factory where it results will be used as reference to. Cost of goods manufactured (cogm) is a term used in managerial accounting that refers to a schedule or statement that shows the total production costs.

How to Prepare a Cost of Goods Manufactured Schedule YouTube

Cost_Goods_Manufactured_Schedule Excel templates

Solved Problem 217 Schedule of Cost of Goods Manufactured;

Cost of Goods Manufactured Formula Examples with Excel Template

Schedule of Cost of Goods Manufactured Excel Templates

Cost of Goods Manufactured Schedule »

Cost of Goods Manufactured Schedule »

Cost of Goods Manufactured Formula Examples with Excel Template

Schedule of costs o goods manufactured

Cost of Goods Sold Statement Explanation and Examples Finance

Use The Information From The Schedule Of.

Web Cost Of Goods Manufactured Schedule.

Web The Cost Of Goods Manufactured Excel Template Helps Businesses Accurately Track The Cost Of Production And Provide Valuable Insight Into The Profitability Of Their Operations.

Web The Cost Of Goods Manufactured Schedule Is Used To Calculate The Cost Of Producing Products For A Period Of Time.

Related Post: