Sample Balance Sheet Template

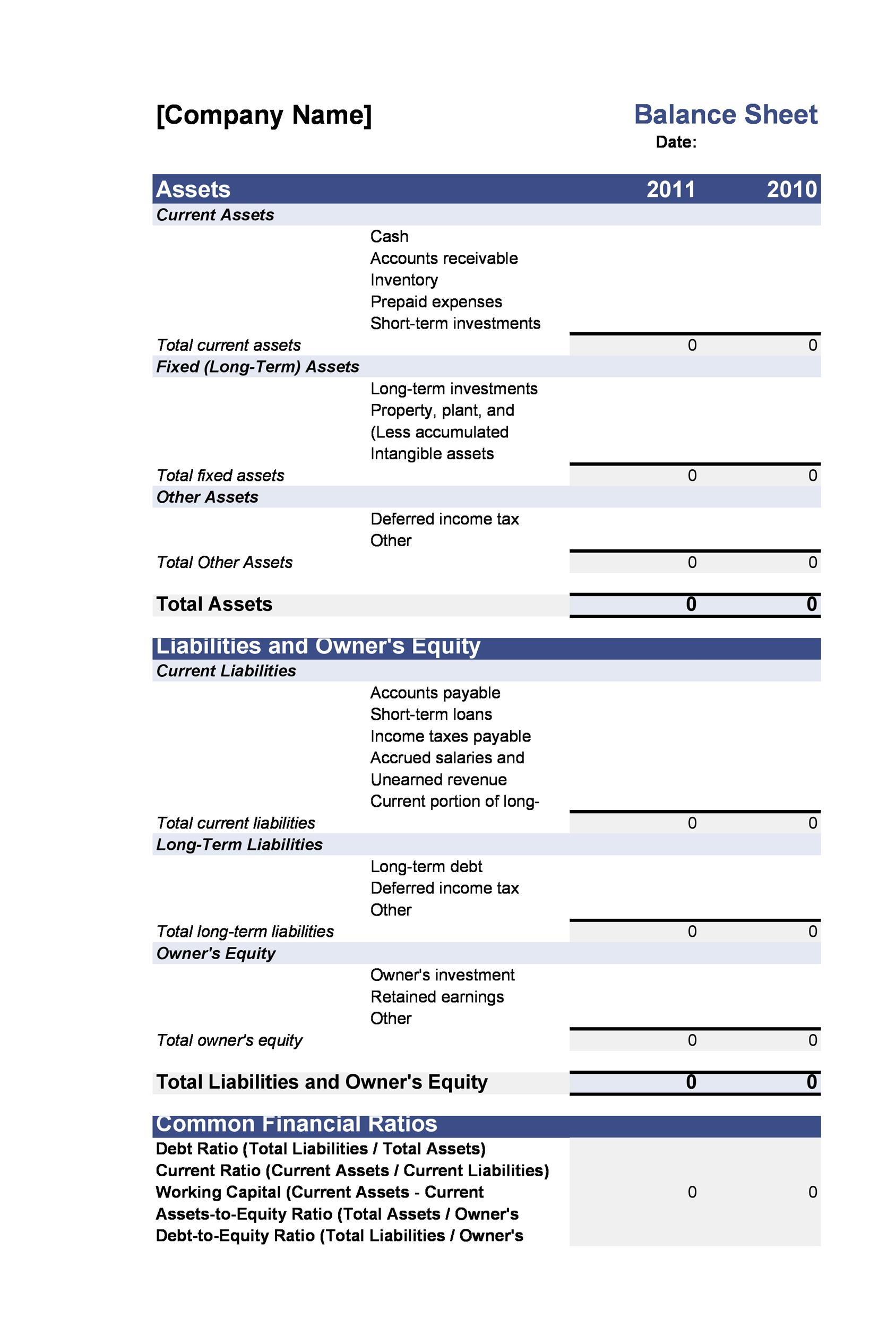

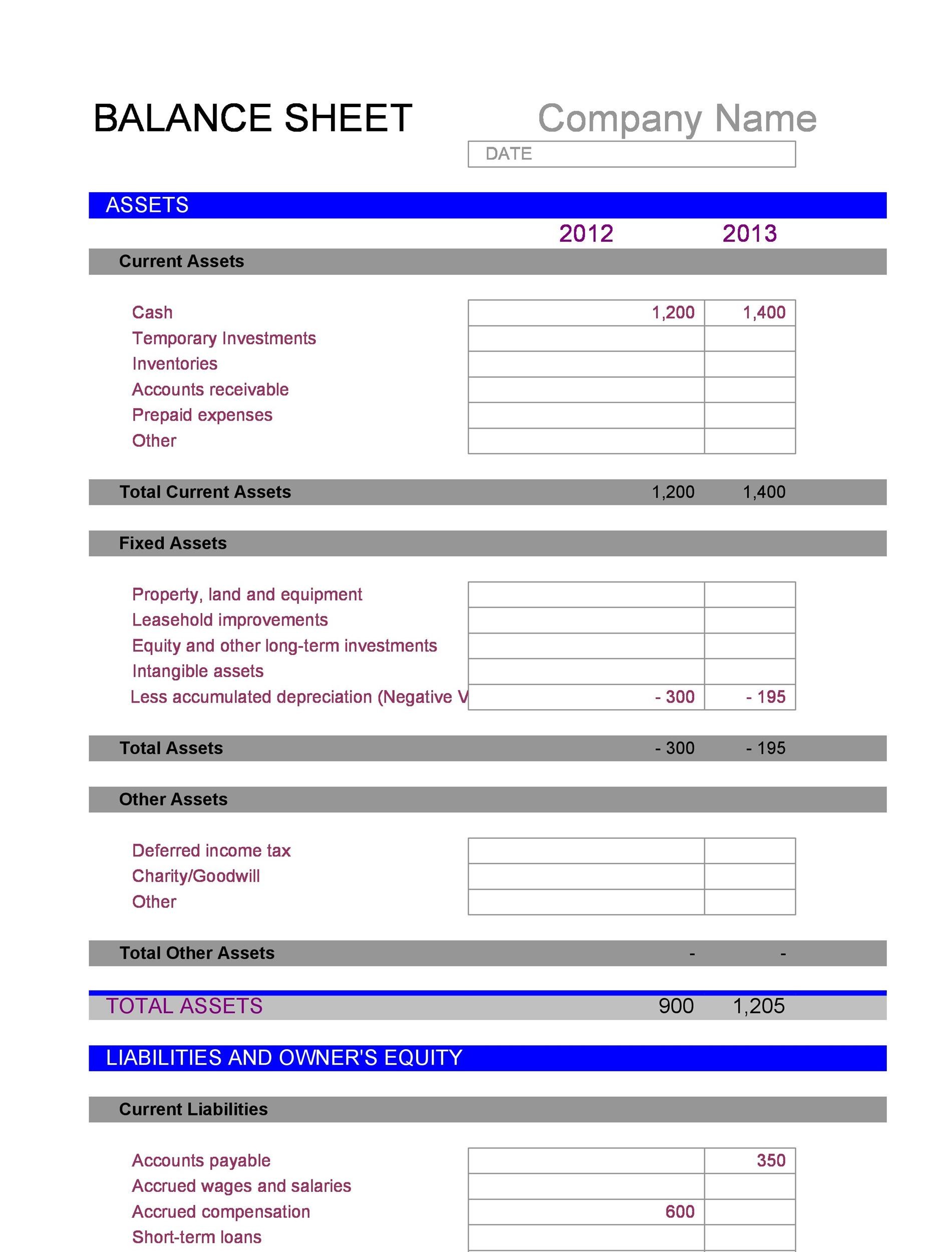

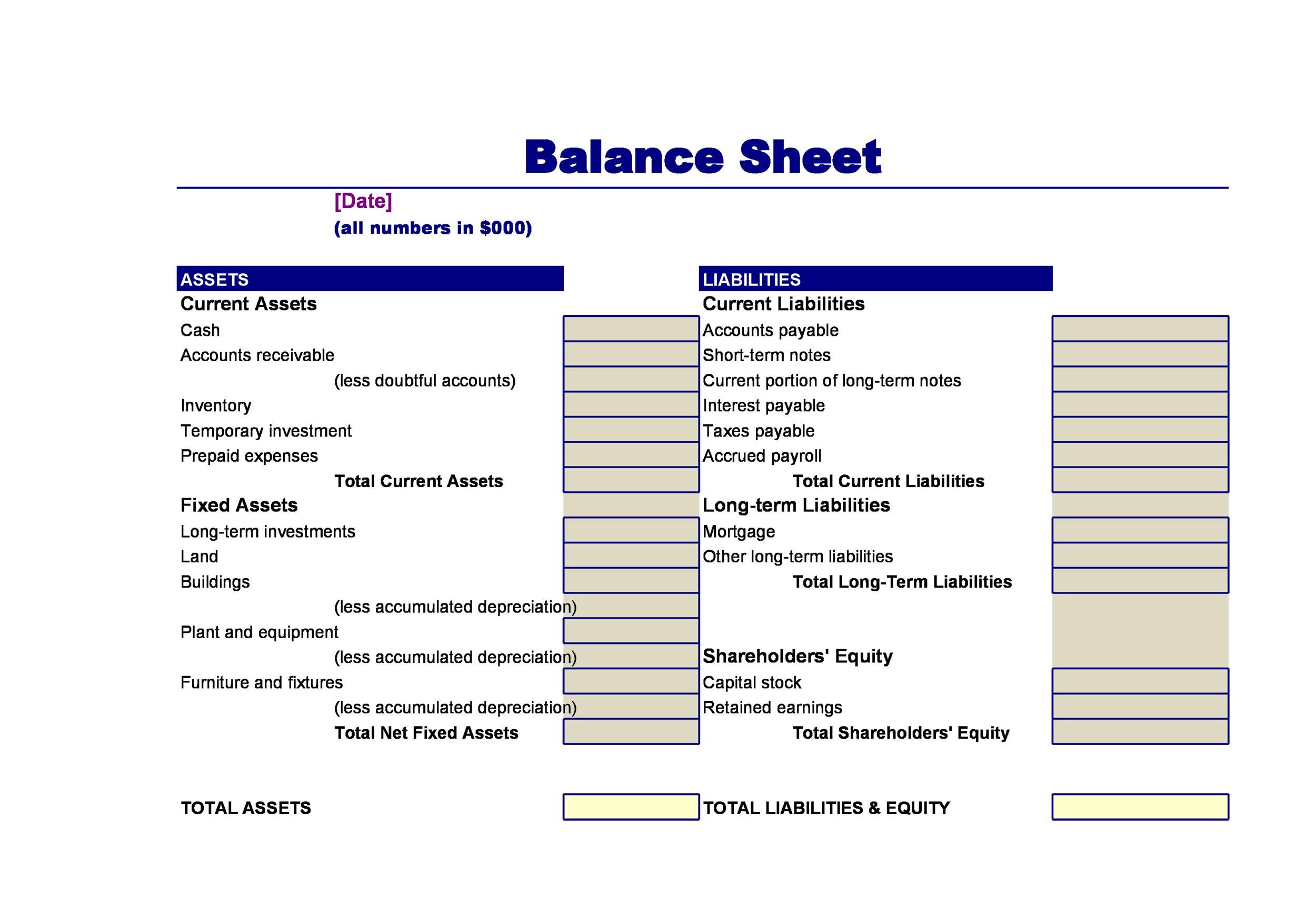

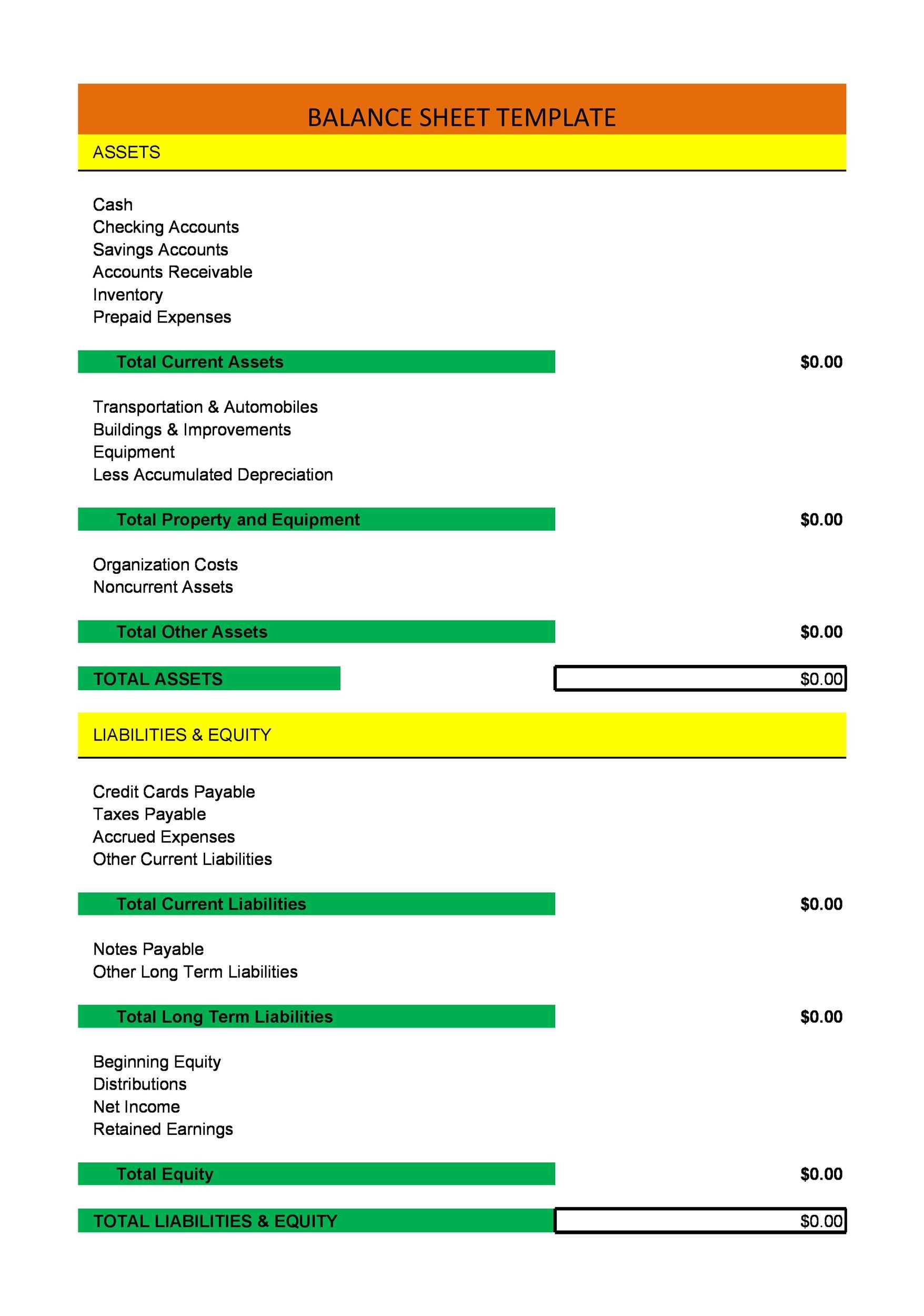

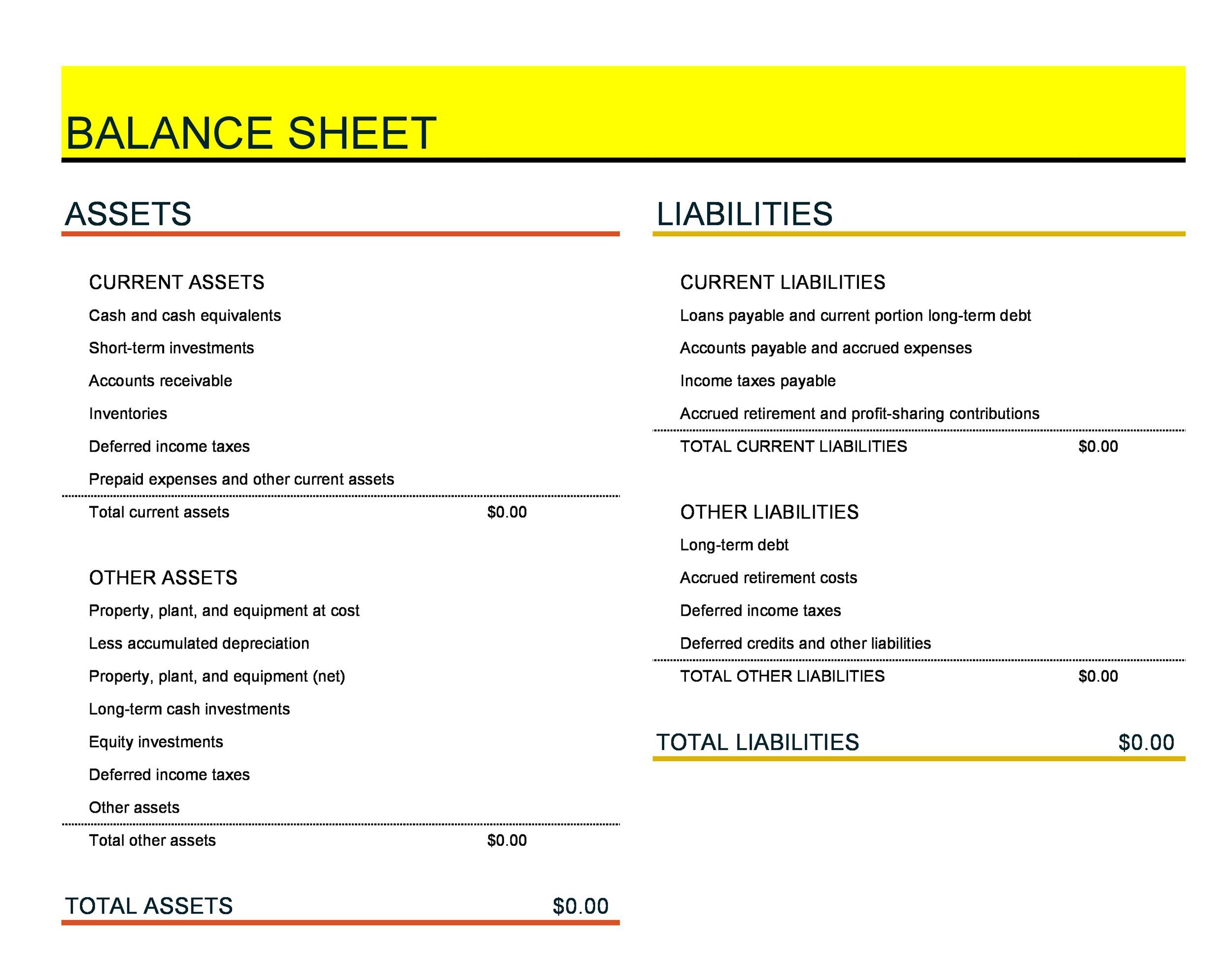

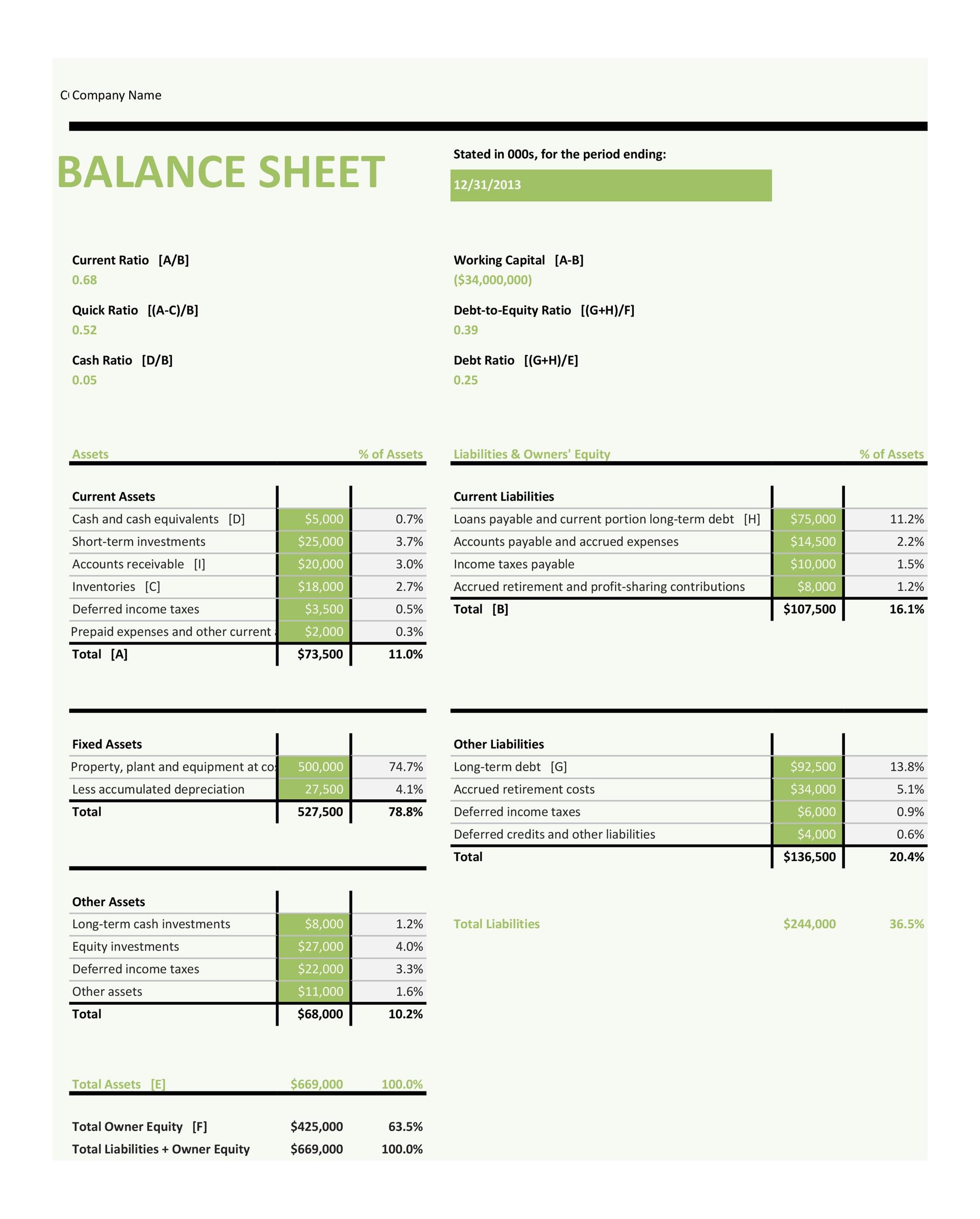

Sample Balance Sheet Template - Whatever a business owns — its assets — have been financed by either taking on debt (liabilities), or through. Disclaimer any articles, templates, or information provided by smartsheet on the website are for reference only. Within each section, identify specific accounts relevant to your business, such as cash, accounts receivable, accounts payable, etc. The three main sections will be assets, liabilities, and equity. Download a simple balance sheet template Web your firm's balance sheet likely has more lines than this template. The left side of the balance sheet outlines all of a company’s assets. Enter your api key at extensions > claude for sheets™ > enter your anthropic api key. Web a company’s balance sheet is one of three financial statements used to give a detailed picture of the health of a business. Sample balance sheet templates provide a structured format with predefined sections and categories, making it easier to organize and classify assets, liabilities, and equity. A demonstration or example of a balance sheet, showcasing the typical layout and categories of assets, liabilities, and equity. Web click the blue install button and accept the permissions. Web a company’s balance sheet is one of three financial statements used to give a detailed picture of the health of a business. Save your precious time7m users worldwidesave money in. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position. We recommend combining categories to fit into this compressed format for clarity and ease of analysis. Print out your completed balance sheet or save it and email it as an attachment. Web balance sheet template. Save your. Web free balance sheet template in financial accounting, a balance sheet serves as a reference document for investors and other stakeholders to get an idea of the financial health of a business. The template will then calculate your resulting balance or net worth. Save your precious time7m users worldwidesave money in legal fees You can simply customize the template by. Featuring a range of structured frameworks, these templates allow you to clearly illustrate your company's assets, liabilities, and equity. Web the balance sheet example from freshbooks makes calculating your business equity simple. For projections, we recommend condensing your numbers. Web for your manufacturing business plan, provide a snapshot of your financial statement (profit and loss, balance sheet, cash flow statement),. While we strive to keep the. As the name suggests, the equation balances out, with assets on the one side being equal to the sum of liabilities and equity on the other. You may need to wait or refresh for “enter your anthropic api key” to appear as an option. Web basic balance sheet template. Our free downloadable balance sheet. You can use word processing programs like microsoft word, google docs or excel. Maximize tax deductionssave timetrack inventorymanage sales tax Web generally, a balance sheet template is the financial status statement of a company that lists its liabilities, assets, and the owner’s equity at a specific time period. Web for your manufacturing business plan, provide a snapshot of your financial. After you see the green ‘verified’ checkmark appear, claude will be activated. Web download a small business balance sheet template with sample data for excel | adobe pdf | google sheets. With this information, you can make adjustments that could either increase your assets or make sure you aren’t drowning in debt. Download a blank small business balance sheet template. While we strive to keep the. Web generally, a balance sheet template is the financial status statement of a company that lists its liabilities, assets, and the owner’s equity at a specific time period. Web the balance sheet shows a company’s assets, liabilities, and shareholder’s equity at a specific point in time. We recommend combining categories to fit into this. On the right side, the balance sheet outlines the company’s liabilities. Download a simple balance sheet template Liabilities represent obligations owed by the business. It is an extremely helpful document that shows how much a business owes, how much it owns, and how much money shareholders have invested in the company. The left side of the balance sheet outlines all. A demonstration or example of a balance sheet, showcasing the typical layout and categories of assets, liabilities, and equity. Web balance sheet template. Web generally, a balance sheet template is the financial status statement of a company that lists its liabilities, assets, and the owner’s equity at a specific time period. Investors and analysts will read the balance sheet alongside. Web your firm's balance sheet likely has more lines than this template. Use the templates in microsoft excel and google sheets. Number of customers and prices, expenses, etc.). We recommend combining categories to fit into this compressed format for clarity and ease of analysis. The balance sheet adheres to the following accounting equation: Featuring a range of structured frameworks, these templates allow you to clearly illustrate your company's assets, liabilities, and equity. The balance sheet is based on the fundamental equation: Make sure to cover here _ profit and loss _ cash flow statement _ balance sheet _ use of funds Simply stated, a balance sheet example shows the net worth of your business. After you see the green ‘verified’ checkmark appear, claude will be activated. As the name suggests, the equation balances out, with assets on the one side being equal to the sum of liabilities and equity on the other. The main sections will be the same for. Web the balance sheet, also called the statement of financial position, is the third general purpose financial statement prepared during the accounting cycle. Assets liabilities and owner's equity current assets current liabilities cash accounts payable. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position. Web a typical balance sheet is divided into three main parts.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

38 Free Balance Sheet Templates & Examples Template Lab

38 Free Balance Sheet Templates & Examples Template Lab

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

38 Free Balance Sheet Templates & Examples Template Lab

38 Free Balance Sheet Templates & Examples Template Lab

Web For Your Manufacturing Business Plan, Provide A Snapshot Of Your Financial Statement (Profit And Loss, Balance Sheet, Cash Flow Statement), As Well As Your Key Assumptions (E.g.

Current Liabilities Are Listed In Order Of Due Date.

Unlock Clarity On Your Company's Financial Position And Make Informed Decisions About Investments, Financing, And Strategic Initiatives.

Assets = Liabilities + Equity.

Related Post: