Rounding Top Pattern

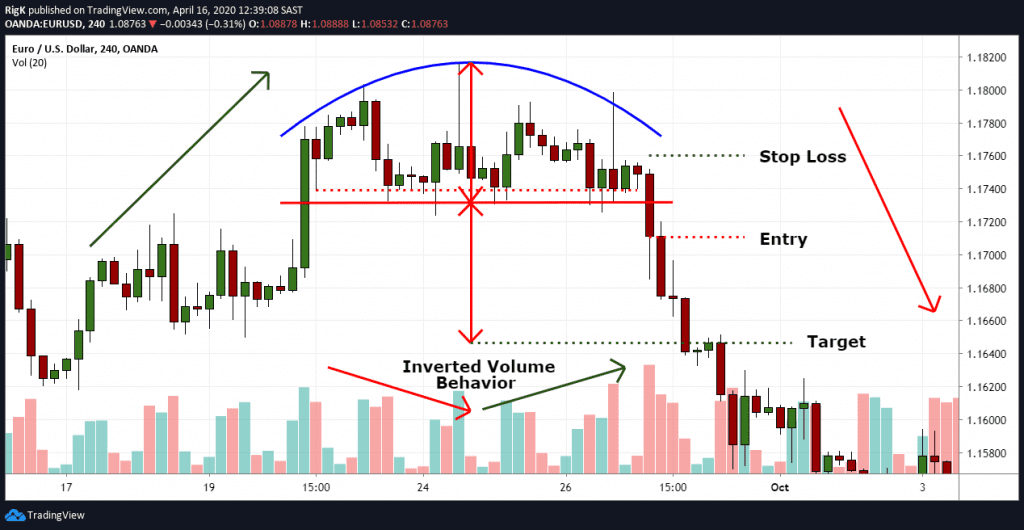

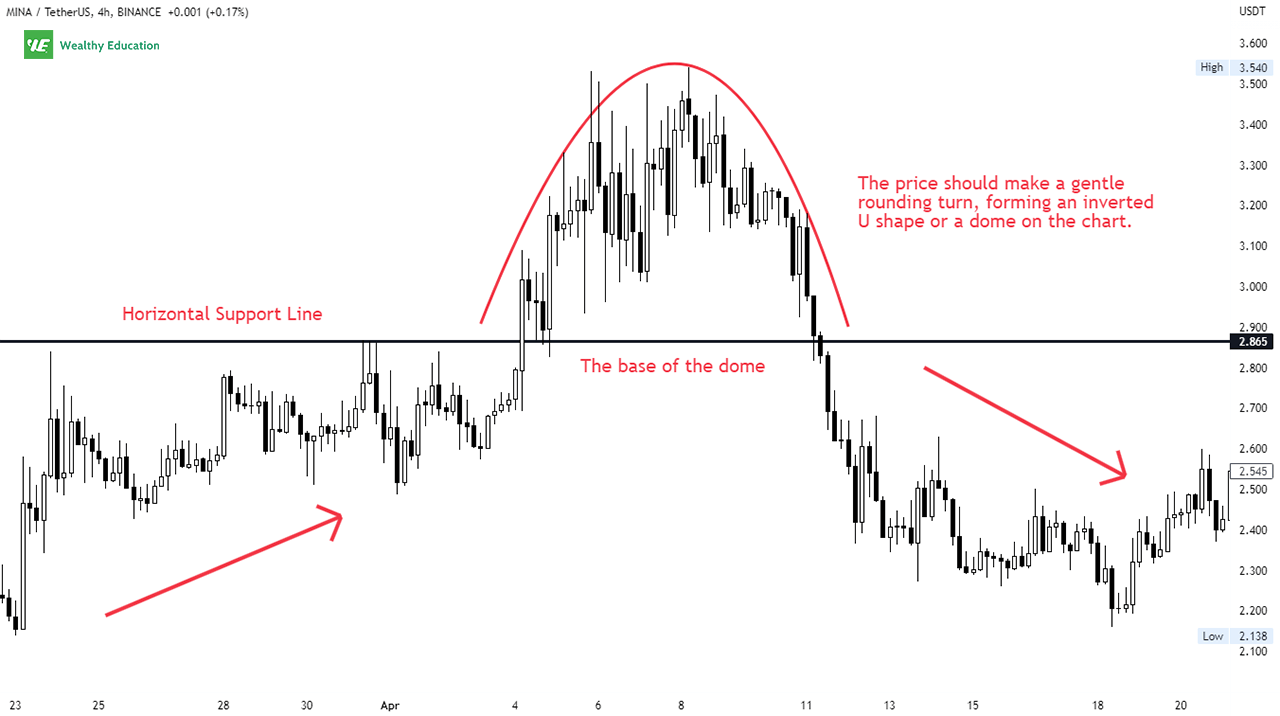

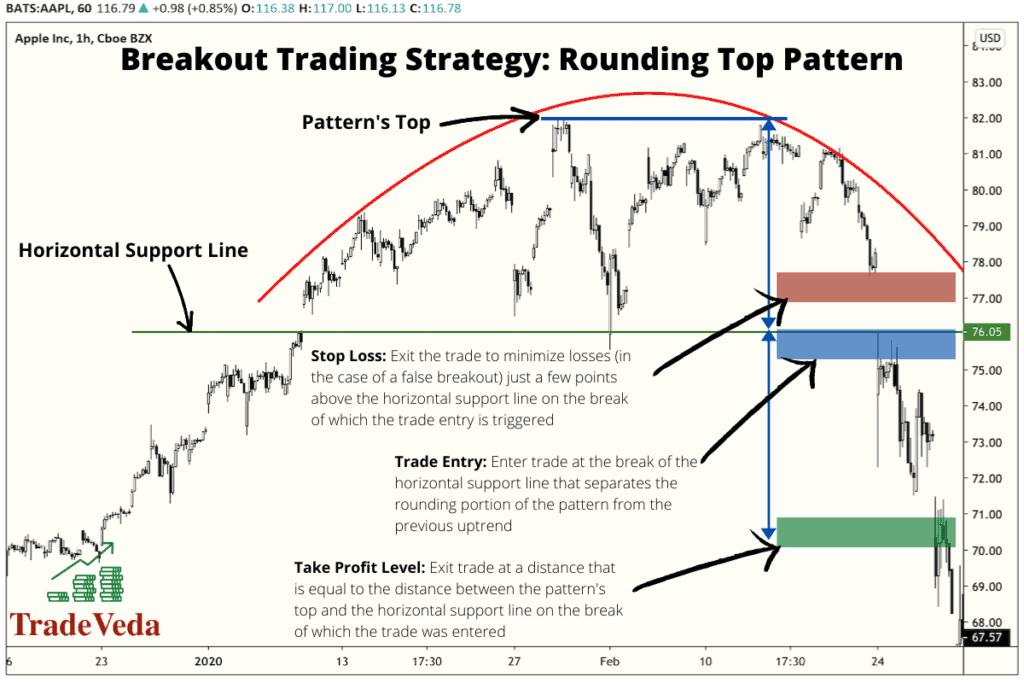

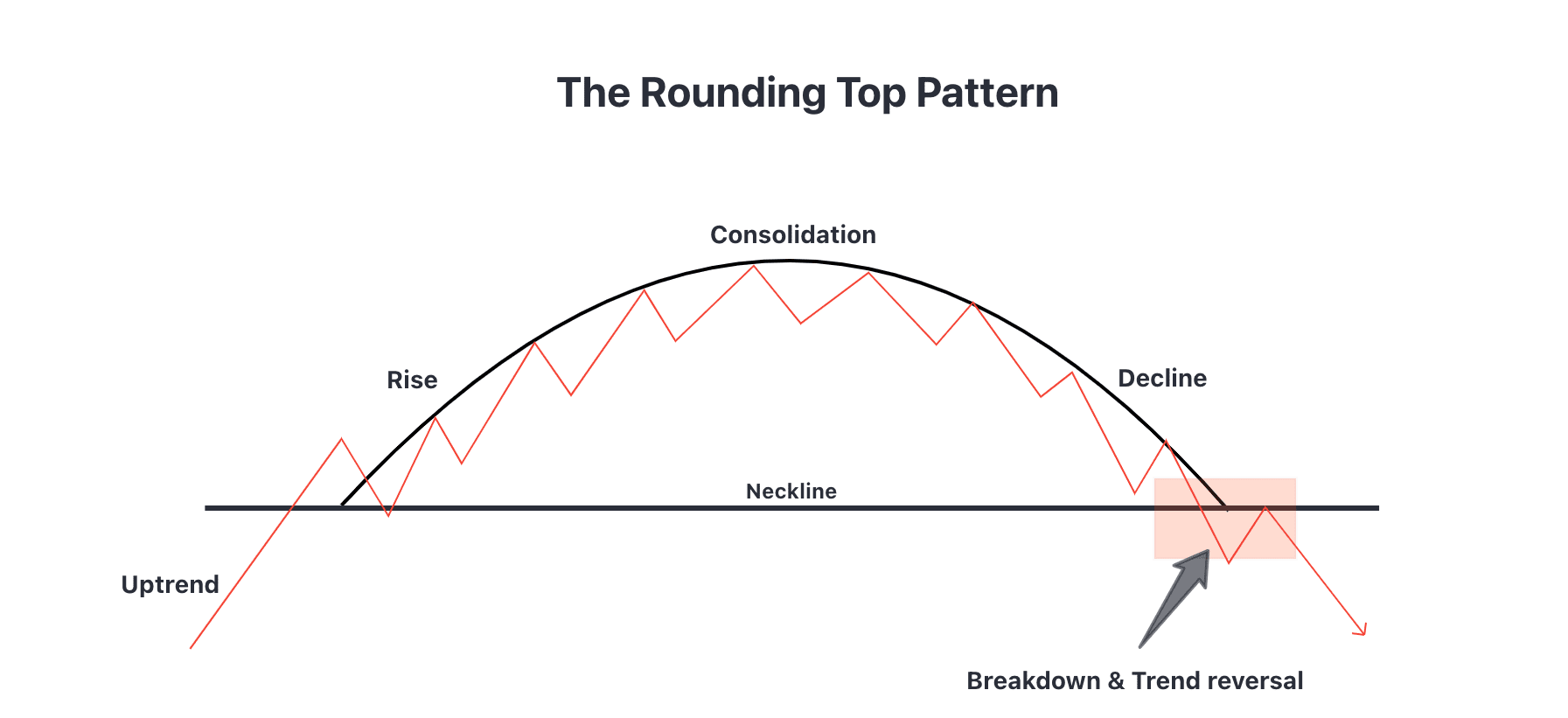

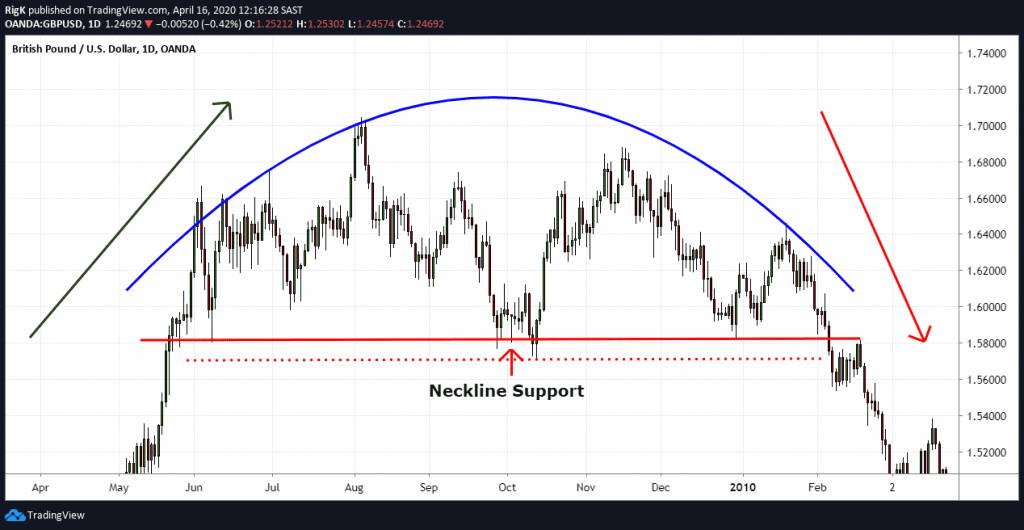

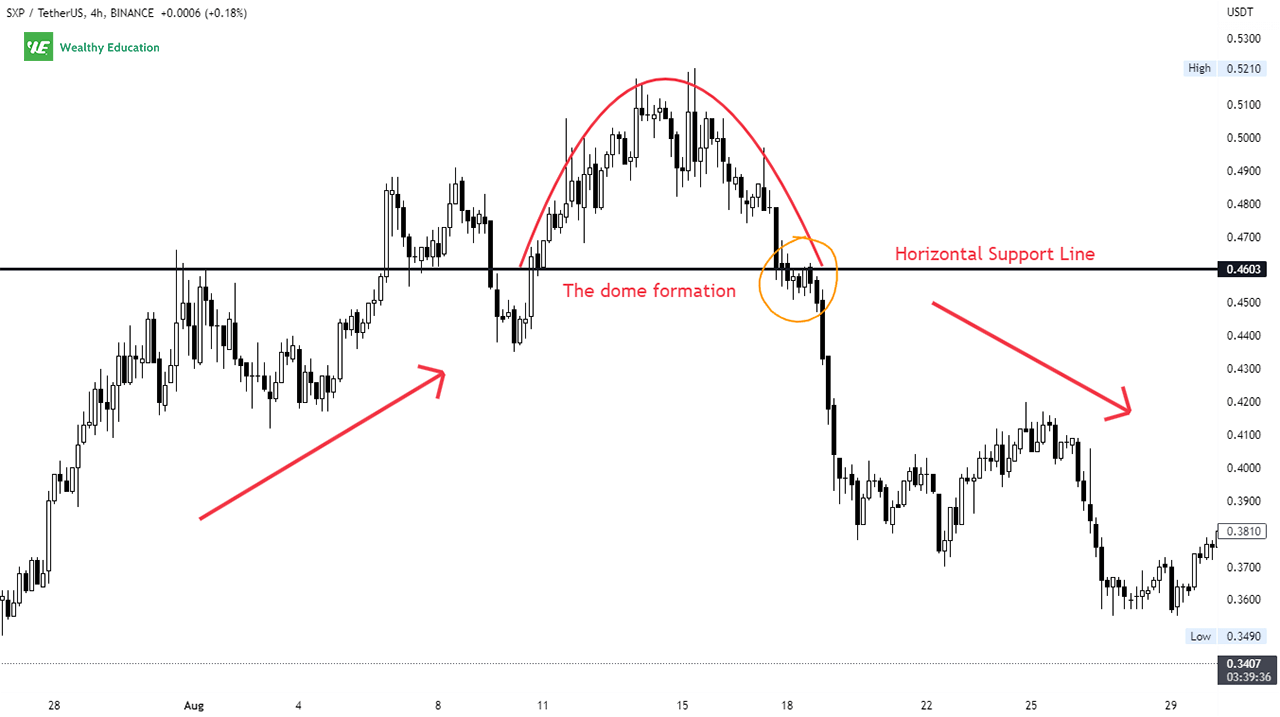

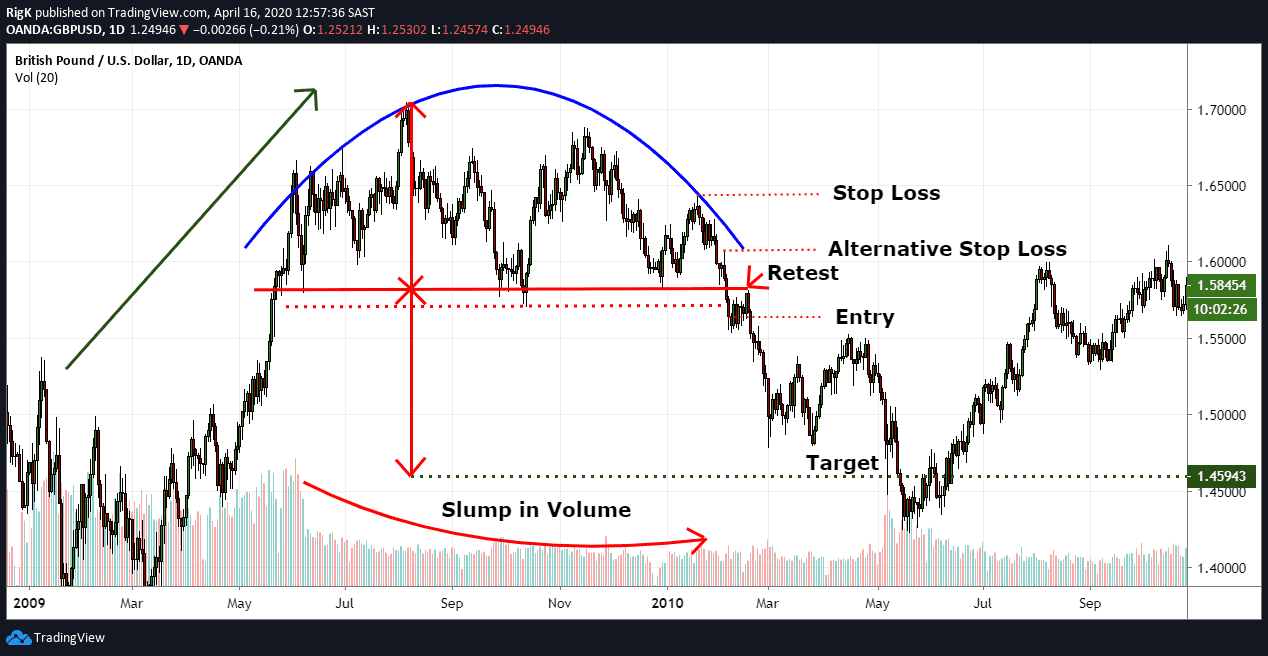

Rounding Top Pattern - Web the rounding top pattern is characterized by a gradual curve in the price action that looks like a rounded top, hence the name. It is also referred to as “inverse saucer” as it looks similar to an inverted “u” shape. It notifies traders a likely reversal point on a price chart. It's identified by a series of price movements that graphically form the shape of a u. The rounded top pattern appears as an inverted 'u' shape and is often referred to as an ‘inverse. As you can see in the gbp/usd chart below, it has the shape of an inverted parabola. Web a rounding top, also known as a “topping pattern,” is a technical chart pattern that suggests a potential reversal in an uptrend. However, in many cases, there are several bullish peaks, but they do not call into question the pattern’s validity. Web the rounded top pattern, often signaling the onset of a bearish market trend, stands out in technical analysis for its unique features and characteristics. Web a rounding top is a bearish reversal pattern that resembles the shape of an inverted “u” and signals a potential shift in market sentiment. Web the rounding top chart pattern is used in technical analysis to signal the potential end of an uptrend and consists of a rounded top (sometimes referred to as an inverse saucer) and a neckline support level where price failed to break through on numerous occasions. Web the rounding bottom pattern is a technical setup for the patient trader. Read. Observe an extended period of stalled price action. • a rounding top is a chart pattern that graphically forms the shape of an inverted u. Web identifying the pattern. Read for performance statistics, trading tactics, id guidelines and more. Rounded top pattern is represented in form of an inverted ‘u’ shape and is also known as an ‘inverse saucer’. Web the rounded top pattern, often signaling the onset of a bearish market trend, stands out in technical analysis for its unique features and characteristics. A graphical representation of a rounding top is indicated below: Web rounding tops are large chart patterns that are an inverted bowl shape. However, in many cases, there are several bullish peaks, but they do. It notifies traders a likely reversal point on a price chart. The pattern emerges with a consistent and steady rise in price, avoiding sharp spikes. The pattern is hard to find and can require extensive chart knowledge for proper identification. The peak is very rounded with a flat bottom. Web a rounding top pattern is a price action formation that. The peak is very rounded with a flat bottom. Web in technical analysis, a rounding top pattern, also known a a rounded top, is a bearish reversal price pattern that forms at the end of a bullish uptrend. Read for performance statistics, trading tactics, id guidelines and more. • ideally, volume and price will move in tandem. The rounded bullish. Web the rounding bottom pattern is a technical setup for the patient trader. Web the rounding top is a reversal pattern that occurs during an uptrend. Rounding top patterns typically emerge at the end of prolonged uptrends, signifying a possible trend reversal. The pattern emerges with a consistent and steady rise in price, avoiding sharp spikes. Web a rounding top. Web a rounding top pattern is a price action formation that resembles an inverted u shape and signals a potential reversal in a bullish trend. • a rounding top is a chart pattern that graphically forms the shape of an inverted u. The pattern is hard to find and can require extensive chart knowledge for proper identification. Web the rounded. It is also referred to as “inverse saucer” as it looks similar to an inverted “u” shape. Web a rounding top is a price pattern used in technical analysis. It occurs when a stock makes a sharp move up, then pulls back and forms the rounded peak. The peak is very rounded with a flat bottom. Rounded top pattern is. Web the rounded top pattern, often signaling the onset of a bearish market trend, stands out in technical analysis for its unique features and characteristics. Differing from the rounding bottom, the target price will be calculated using the classic balance rule. The rounded bullish peaks mark the end of one trend and the start of another. Follow the steps below. Web a rounding top pattern is a bearish reversal pattern, most commonly found at the top of a trend ahead of a reversal. Web the rounding bottom pattern is a technical setup for the patient trader. As sellers start losing momentum, the price starts consolidating, making a rounded. It notifies traders a likely reversal point on a price chart. This. Web in technical analysis, a rounding top pattern, also known a a rounded top, is a bearish reversal price pattern that forms at the end of a bullish uptrend. Web a rounding top can be a bullish continuation pattern but also a downward continuation pattern. Web the rounding top pattern is characterized by a gradual curve in the price action that looks like a rounded top, hence the name. Web one type of chart pattern that is often used to identify potential reversal points on a price chart is the rounding bottom or top. Traders may need to employ other indicators and solid risk management strategies to trade it profitably. Web a rounded top chart pattern, also known as a rounding top or an inverted rounding bottom pattern , is a technical analysis pattern that appears on price charts. Rounding bottoms form an inverted ‘u’ shape and indicate the end of an uptrend while rounding tops appear as a clear ‘u’ formation and signal the end of a downtrend. Read for performance statistics, trading tactics, id guidelines and more. Rounded tops establish strong resistance by slowly grinding against it, creating a rounded pattern until price action reverses. The rounded bullish peaks mark the end of one trend and the start of another. The peak is very rounded with a flat bottom. Rounding bottom top can be identified with certain characteristics and key components: Web what is a rounding top? The lower lows are formed in the downtrend, indicating heavy selling in stock or security. • a rounding top is a chart pattern that graphically forms the shape of an inverted u. It is also referred to as “inverse saucer” as it looks similar to an inverted “u” shape.

Rounding Top Pattern The Definitive Trading Guide For Stocks

The Rounding Top Chart Pattern (Explained With Examples)

How to Trade Rounding Top and Rounding Bottom Chart Patterns Forex

Rounding Top Pattern (Updated 2023)

breakouttradingstrategyroundingtoppattern TradeVeda

Rounding top chart pattern Best guide with 2 examples!

The Rounding Top Chart Pattern (Explained With Examples)

Rounding Top Pattern (Updated 2023)

The Rounding Top Chart Pattern (Explained With Examples)

The Rounding Top Chart Pattern (Explained With Examples)

Web Rounding Tops Are Large Chart Patterns That Are An Inverted Bowl Shape.

However, In Many Cases, There Are Several Bullish Peaks, But They Do Not Call Into Question The Pattern’s Validity.

It Notifies Traders A Likely Reversal Point On A Price Chart.

Both These Patterns Are Designed To Identify The End Of A Price Trend, And Technical Traders Use Them Frequently To Supplement Their Hypothesis Of An Upcoming Reversal In Trend.

Related Post: