Rounded Bottom Pattern

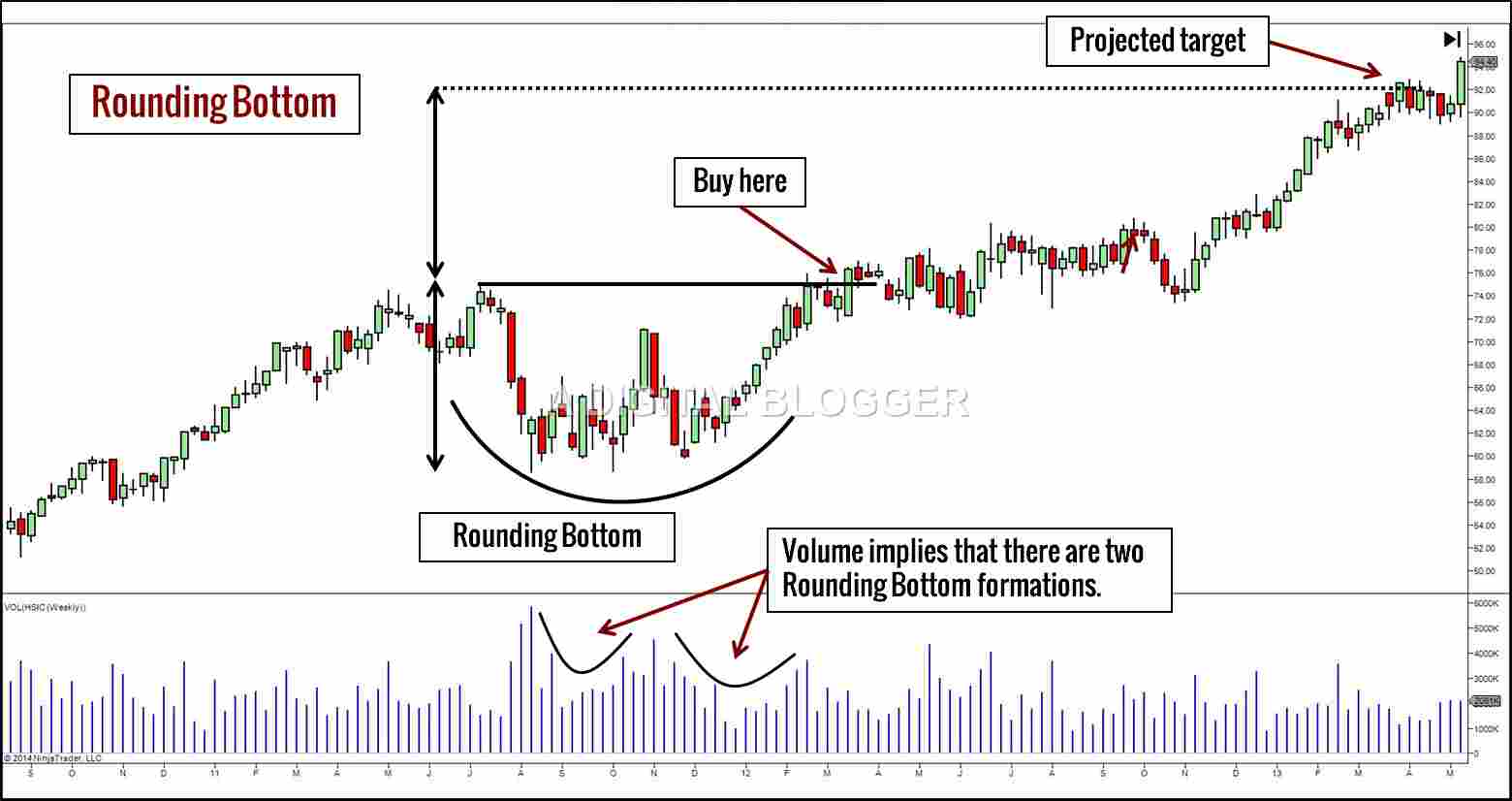

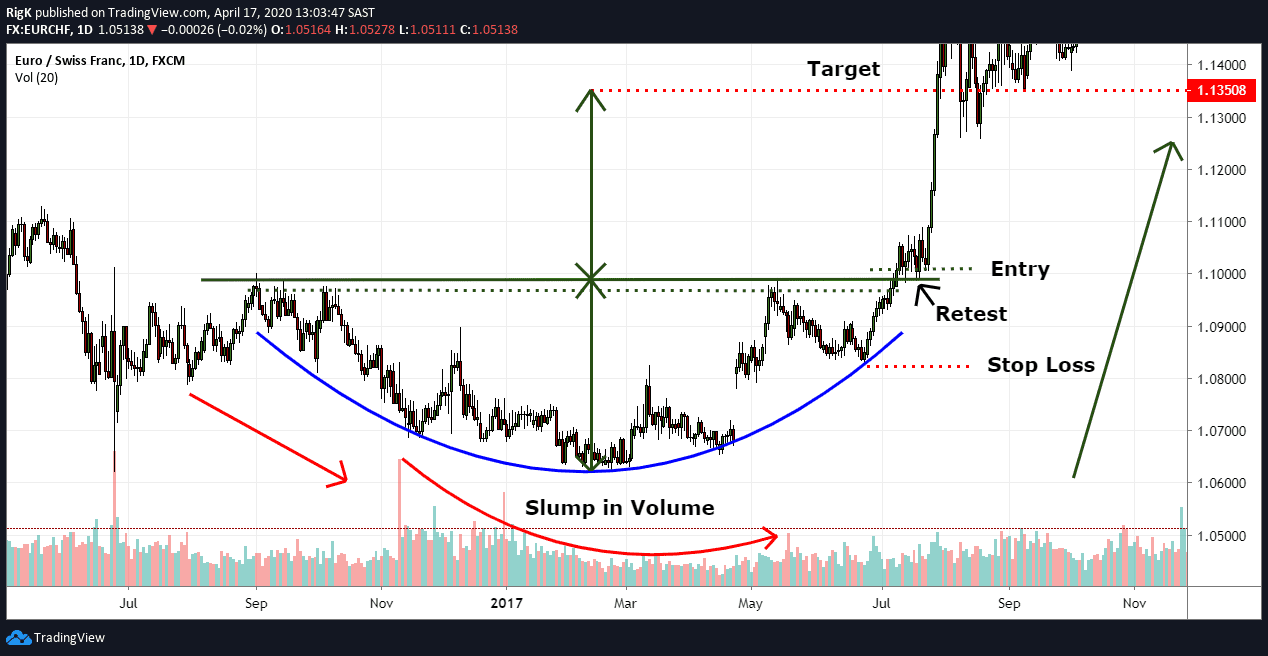

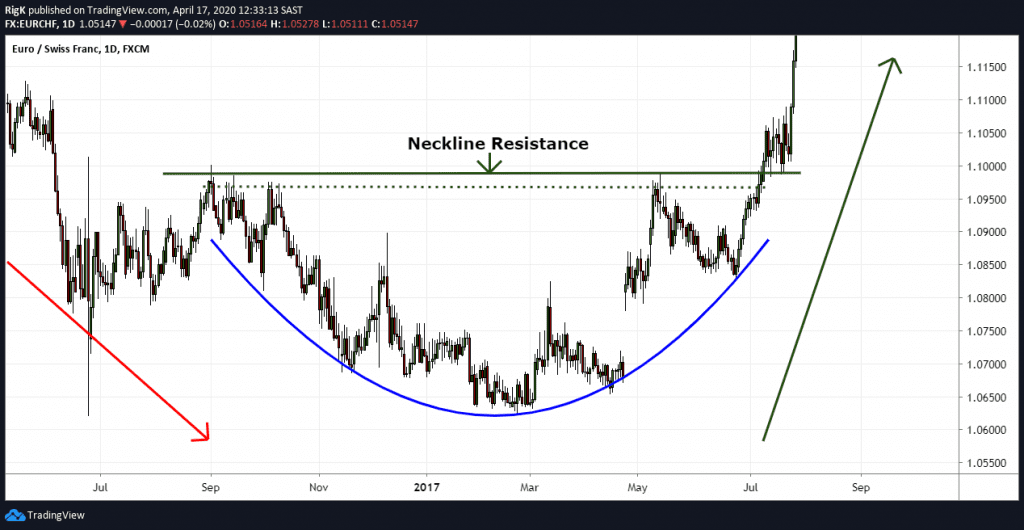

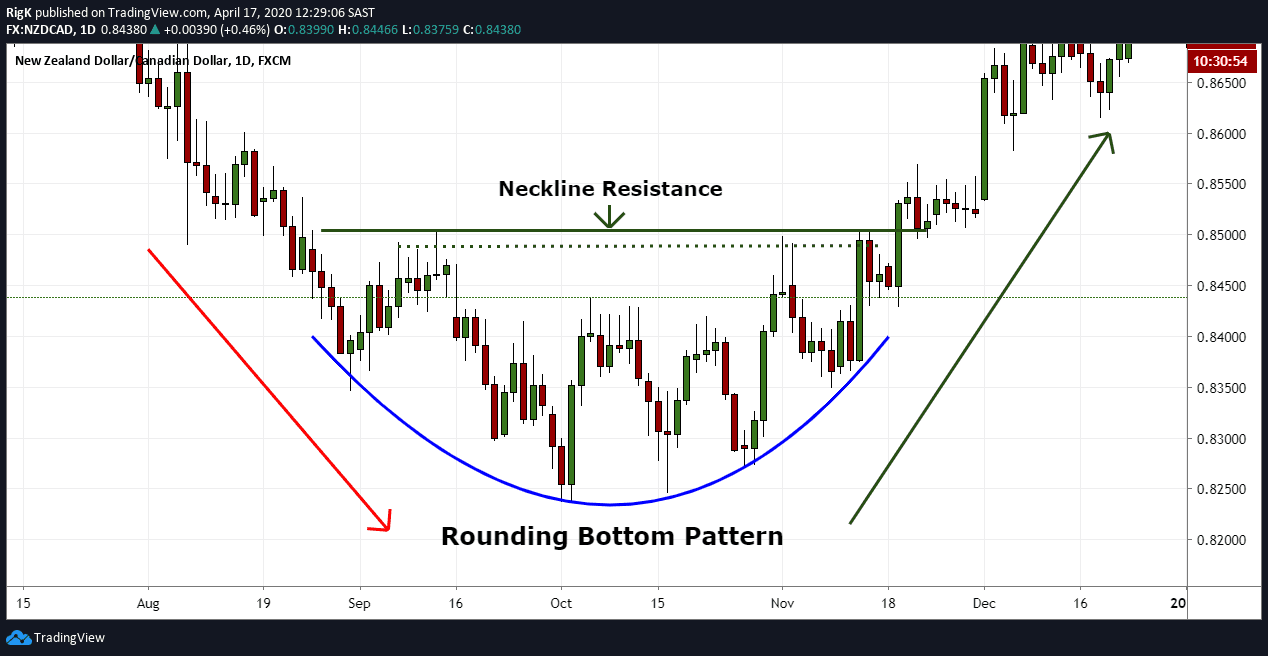

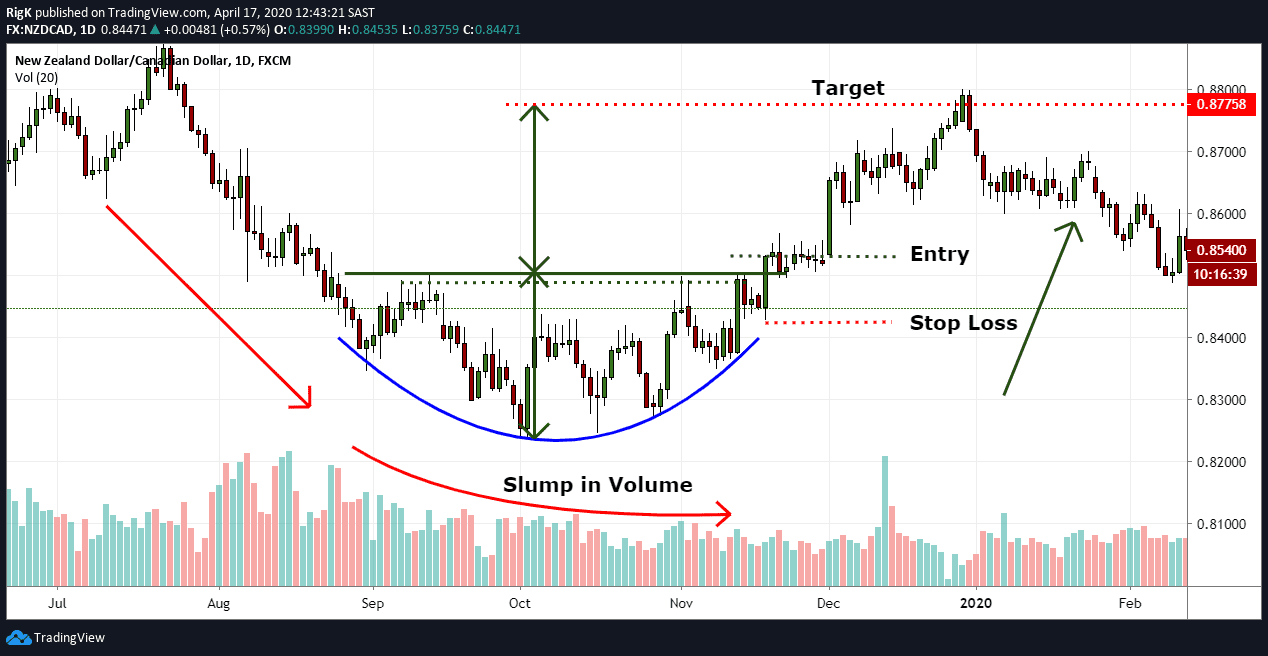

Rounded Bottom Pattern - This pattern is indicated by: Rounding bottoms are found at. Then there is a bottom formed. Web the rounded bottom pattern usually forms after a prolonged downtrend, when the market is in a bearish mood and the sellers are in control. Web rounding bottom pattern meaning. Like a roller coaster, stocks go up and down in price daily. As sellers start losing momentum, the price starts consolidating, making a. We rarely see them soaring; Stock passes all of the below filters in cash segment: A) identify a potential rounded bottom pattern. A) identify a potential rounded bottom pattern. Web a rounding bottom is a chart pattern that's used in technical analysis. Rounding bottom top can be identified with certain characteristics and key components: As the downtrend continues, the price levels off and starts forming a gentle, rounded curve. Here's a description of how it looks: This pattern is indicated by: Web a rounded bottom or saucer pattern is not a common pattern, but is highly reliable as a reversal pattern with bullish implications. It is a trend reversal pattern used in technical analysis to identify the end of a downward trend and the gradual price shift from a bearish to a bullish trend. It find. Web the rounded bottom pattern usually forms after a prolonged downtrend, when the market is in a bearish mood and the sellers are in control. The rounded top pattern appears as an inverted 'u' shape and is often referred to as an ‘inverse saucer’ in some technical analysis books. Web rounding bottom breakout, technical analysis scanner. What is rounding bottom. This pattern is indicated by: Stocks forming round bottom pattern with rsi (14) above 50 and trading above supertrend. Web rounding bottom pattern meaning. Web the rounded top and bottom are reversal patterns designed to catch the end of a trend and signal a potential reversal point on a price chart. We rarely see them soaring; Like a roller coaster, stocks go up and down in price daily. They need time to pause and digest, and that’s exactly what this pattern does. Web rounding bottom pattern meaning. Be careful midway through the turn since price sometimes shoots up only to drop back down. Web rounding bottom breakout, technical analysis scanner. It means that investor expectations and market sentiment shift from bearish to bullish. It is also referred to as saucer bottom pattern. Stock passes all of the below filters in nifty 200 segment: Stocks forming round bottom pattern with rsi (14) above 50 and trading above supertrend. Web unlike the sharp and angular patterns commonly seen, the rounded bottom reveals. Stocks forming round bottom pattern with rsi (14) above 50 and trading above supertrend. It is also referred to as a saucer bottom, and represents a long consolidation period that turns from a bearish bias to a bullish bias. Web identifying the pattern. Web the rounded bottom pattern usually forms after a prolonged downtrend, when the market is in a. Here's a description of how it looks: Web identifying the pattern. Web rounding bottom breakout, technical analysis scanner. C) confirm a rounded bottom breakout. Stock passes any of the below filters in cash segment: Both these patterns are designed to identify the end of a price trend, and technical traders use them frequently to supplement their hypothesis of an upcoming reversal in trend. Rounding bottom top can be identified with certain characteristics and key components: Web what is a rounding bottom pattern? Web the rounding bottom chart pattern, also known as the saucer bottom. It is also referred to as saucer bottom pattern. Web the rounding bottom pattern is a long term reversal pattern that is best suited for weekly charts. Be careful midway through the turn since price sometimes shoots up only to drop back down. Web unlike the sharp and angular patterns commonly seen, the rounded bottom reveals a more gentle and. D) enter a long trade on the breakout. Web unlike the sharp and angular patterns commonly seen, the rounded bottom reveals a more gentle and curved transition in prices, indicative of a gradual change in market sentiment. Stocks forming round bottom pattern with rsi (14) above 50 and trading above supertrend. We can see the fluctuations in volume, after the price reaches the bottom it diminished, and after the rally, it gained. Web metropolis has made a rounding bottom pattern in a daily timeframe. Web rounding bottom pattern meaning. A rounding bottom regarding stock charts indicates a positive market reversal. A) identify a potential rounded bottom pattern. Web rounding bottoms are chart patterns that are difficult to spot unless you look on the weekly scale. It represents a protracted period of consolidation that shifts from a bearish to bullish trend. Be careful midway through the turn since price sometimes shoots up only to drop back down. Both these patterns are designed to identify the end of a price trend, and technical traders use them frequently to supplement their hypothesis of an upcoming reversal in trend. Stock passes all of the below filters in cash segment: Like a roller coaster, stocks go up and down in price daily. It is also referred to as a saucer bottom, and represents a long consolidation period that turns from a bearish bias to a bullish bias. Web a rounding bottom is a chart pattern used in technical analysis.

How to Trade Rounding Top and Rounding Bottom Chart Patterns Forex

Rounding Bottom Pattern Step By Step Guide to Use Rounding Bottom

How To Trade Chart Patterns A StepByStep Guide Pro Trading School

The Rounding Bottom Pattern Definition & Examples (2023)

The Rounding Bottom Pattern Definition & Examples (2023)

The Rounding Bottom Pattern Definition & Examples (2023)

Analyzing Chart Patterns Round Bottoms

What is the Rounding Bottom Pattern? StepbyStep Guide to Trade it!

The Rounding Bottom Pattern Definition & Examples (2023)

Analyzing Chart Patterns Round Bottoms

The Rounded Top Pattern Appears As An Inverted 'U' Shape And Is Often Referred To As An ‘Inverse Saucer’ In Some Technical Analysis Books.

The Strongest Confirmation Of The Pattern Comes From The Volume Indicator.

Scanner Guide Scan Examples Feedback.

Here's A Description Of How It Looks:

Related Post: