Rising Wedge Pattern Bullish Or Bearish

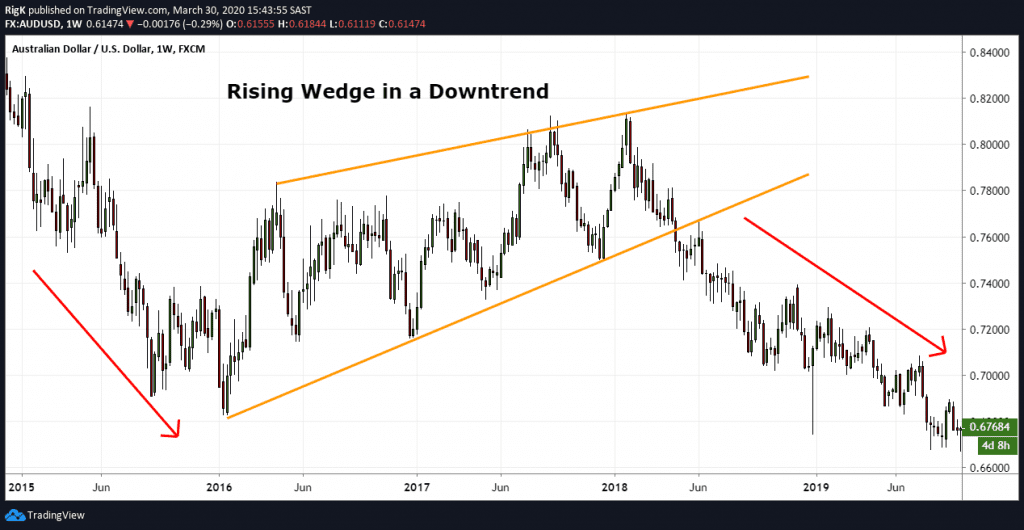

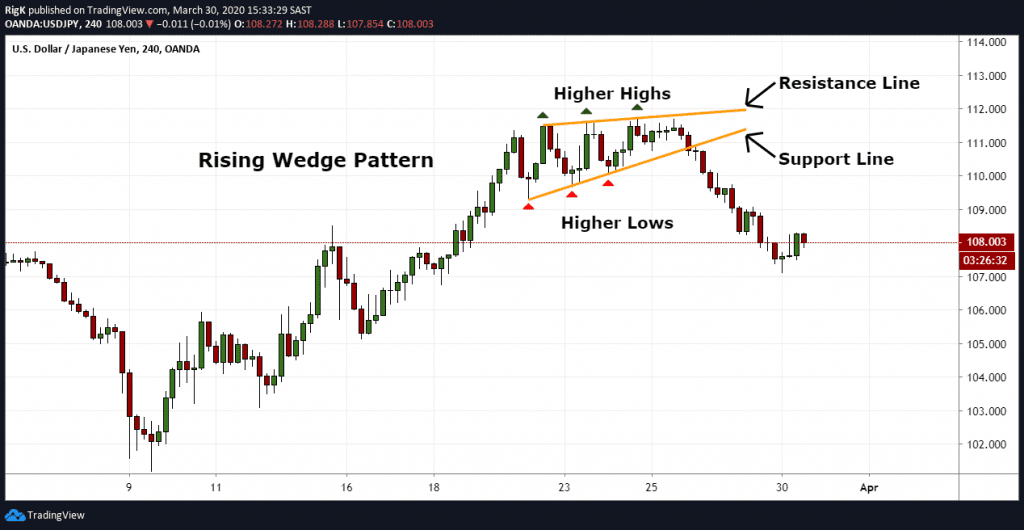

Rising Wedge Pattern Bullish Or Bearish - The significant aspect of this pattern was the breakout above. It’s the opposite of the falling (descending) wedge pattern. Web breakout ret est bearish flag pattern the bearish flag is an upside down version of the bull flag. In many cases, when the market. It is characterized by a. Also called the downward or descending wedge, this pattern results in an overall downward price. Web a rising wedge pattern consists of a bunch of candlesticks forming a big angular wedge that is increasing price. Web the head of this pattern formed at $1622.20, with shoulders completing at $1673.30 and $1810.80. It is characterized by two converging trendlines, with both the support and resistance. Wedge chart patterns consist of two converging trend lines and can indicate either a continuation or reversal pattern. Web the rising wedge pattern signals a potential bearish reversal in an uptrend. It has the same structure as the bull flag but inverted. It is a narrowing range of prices with higher highs and higher lows, surrounded by two converging trendlines. Web breakout ret est bearish flag pattern the bearish flag is an upside down version of the bull. Web 🎲 methodology or trading for chart patterns while traditional perspectives often prescribe specific trading biases to diverging patterns—for instance, labeling rising wedges as. Web the rising wedge pattern is the former, which is typically associated with downtrends and bearish results. It is a bullish candlestick pattern that turns. It forms when converging trendlines slope upward, with the lower trendline. Web the rising (ascending) wedge pattern is a bearish chart pattern that signals a highly probable breakout to the downside. Web the rising (ascending) wedge pattern is a bearish chart pattern that signals an imminent breakout to the downside. Web the falling wedge is the exact opposite of the upward wedge. It forms when converging trendlines slope upward, with the. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. The two converging lines will further confine the price. The rising wedge pattern is a technical analysis tool that signals a possible bearish reversal in the security's price. Web the rising (ascending) wedge pattern is a bearish chart pattern that signals a highly. Also called the downward or descending wedge, this pattern results in an overall downward price. Web the rising (ascending) wedge pattern is a bearish chart pattern that signals a highly probable breakout to the downside. Wedges can serve as either continuation or reversal patterns. Web the rising wedge pattern is a bearish chart formation after an uptrend. Web 🎲 methodology. Web the rising wedge pattern is the former, which is typically associated with downtrends and bearish results. It is a bullish candlestick pattern that turns. It is characterized by two converging trendlines, with both the support and resistance. Web the rising (ascending) wedge pattern is a bearish chart pattern that signals an imminent breakout to the downside. Rising and falling. Web the rising wedge pattern signals a potential bearish reversal in an uptrend. It’s the opposite of the falling (descending) wedge. Wedges can serve as either continuation or reversal patterns. Also called the downward or descending wedge, this pattern results in an overall downward price. Trading strategies using wedge patterns. Also called the downward or descending wedge, this pattern results in an overall downward price. Web the rising wedge pattern is a bearish chart formation after an uptrend. Web a rising wedge is a bearish pattern that signals that the market is going to continue downwards , or turn bearish, depending on the previous trend direction. Wedge chart patterns consist. Web the first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than the upper trend line. Web the rising wedge pattern is a bearish chart formation after an uptrend. Also called the downward or descending wedge, this pattern results in an overall downward price. The two converging. Web a rising wedge pattern consists of a bunch of candlesticks forming a big angular wedge that is increasing price. Web the rising (ascending) wedge pattern is a bearish chart pattern that signals an imminent breakout to the downside. The two converging lines will further confine the price. The pattern is often accompanied by declining volume and a breakout below. Web a rising wedge is a bearish chart pattern that’s found in a downward trend, and the lines slope up. Rising and falling wedges are a technical chart pattern used to predict trend continuations and trend reversals. Web the head of this pattern formed at $1622.20, with shoulders completing at $1673.30 and $1810.80. Web the first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than the upper trend line. Web 🎲 methodology or trading for chart patterns while traditional perspectives often prescribe specific trading biases to diverging patterns—for instance, labeling rising wedges as. Web the rising wedge pattern is the former, which is typically associated with downtrends and bearish results. Wedge chart patterns consist of two converging trend lines and can indicate either a continuation or reversal pattern. It is characterized by two converging trendlines, with both the support and resistance. Web a rising wedge is a bearish pattern that signals that the market is going to continue downwards , or turn bearish, depending on the previous trend direction. Web the rising (ascending) wedge pattern is a bearish chart pattern that signals an imminent breakout to the downside. It forms when converging trendlines slope upward, with the lower trendline steeper than. Wedges can serve as either continuation or reversal patterns. The two converging lines will further confine the price. The significant aspect of this pattern was the breakout above. In many cases, when the market. Also called the downward or descending wedge, this pattern results in an overall downward price.

The Rising Wedge Pattern Explained With Examples

How to understand the falling wedge and rising wedge for COINBASE

Rising And Falling Wedge Patterns The Complete Guide

The Rising Wedge Pattern Explained With Examples

5 Chart Patterns Every Beginner Trader Should Know Brooksy

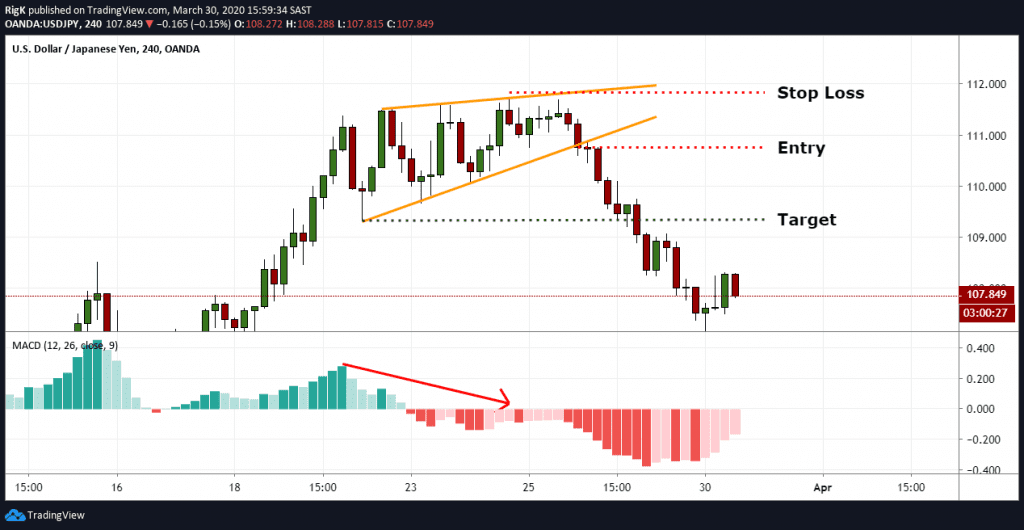

Using the Rising Wedge Pattern in Forex Trading

How to Trade the Rising Wedge Pattern

Rising Wedge Pattern How to Identify a Selling Opportunity Bybit Learn

The Rising Wedge Pattern Explained With Examples

Ascending Wedge Pattern Advanced Forex Strategies

It’s The Opposite Of The Falling (Descending) Wedge.

It Is A Bullish Candlestick Pattern That Turns.

Web Breakout Ret Est Bearish Flag Pattern The Bearish Flag Is An Upside Down Version Of The Bull Flag.

It’s The Opposite Of The Falling (Descending) Wedge Pattern.

Related Post: