Rising Wedge Chart Pattern

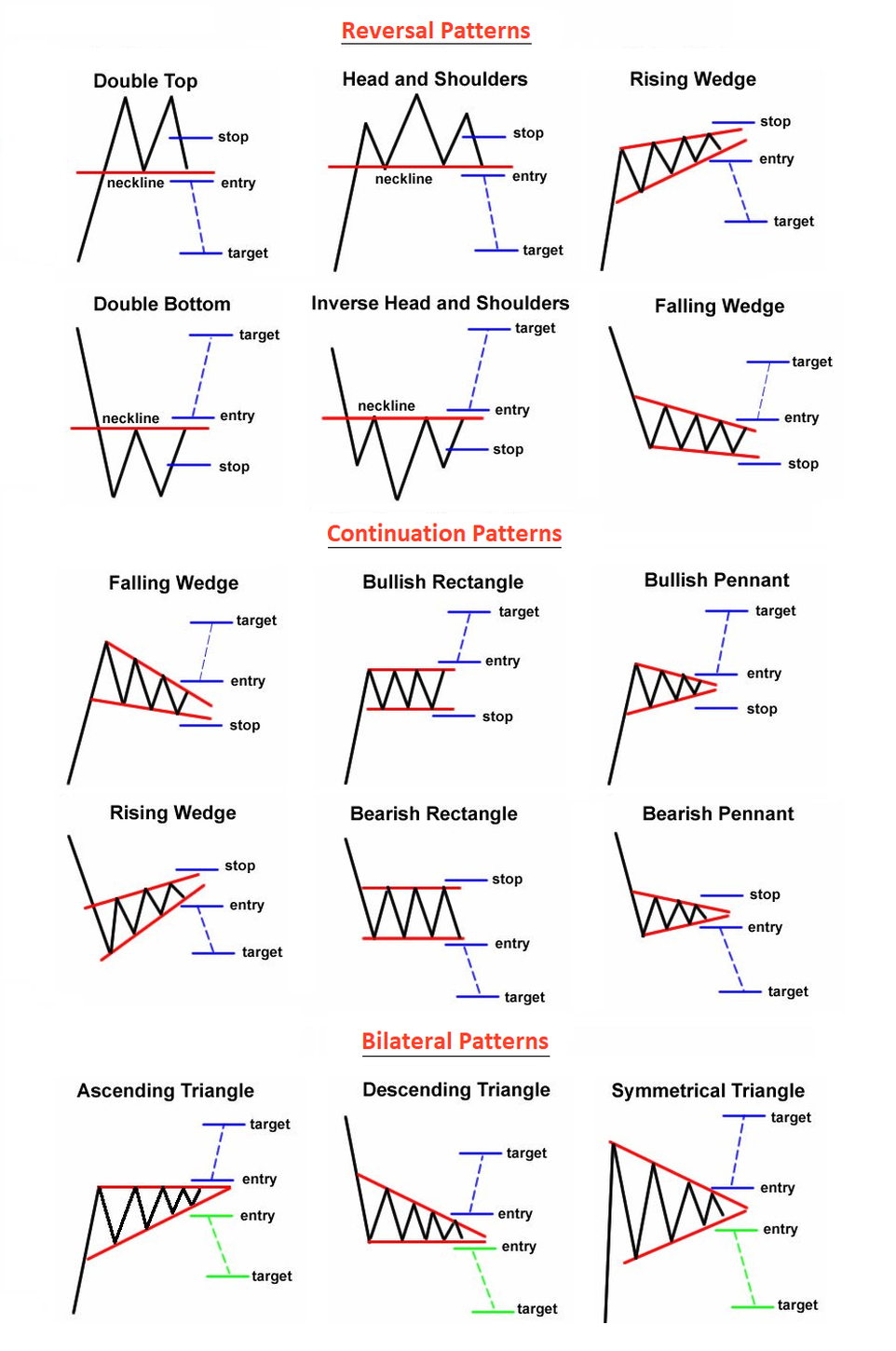

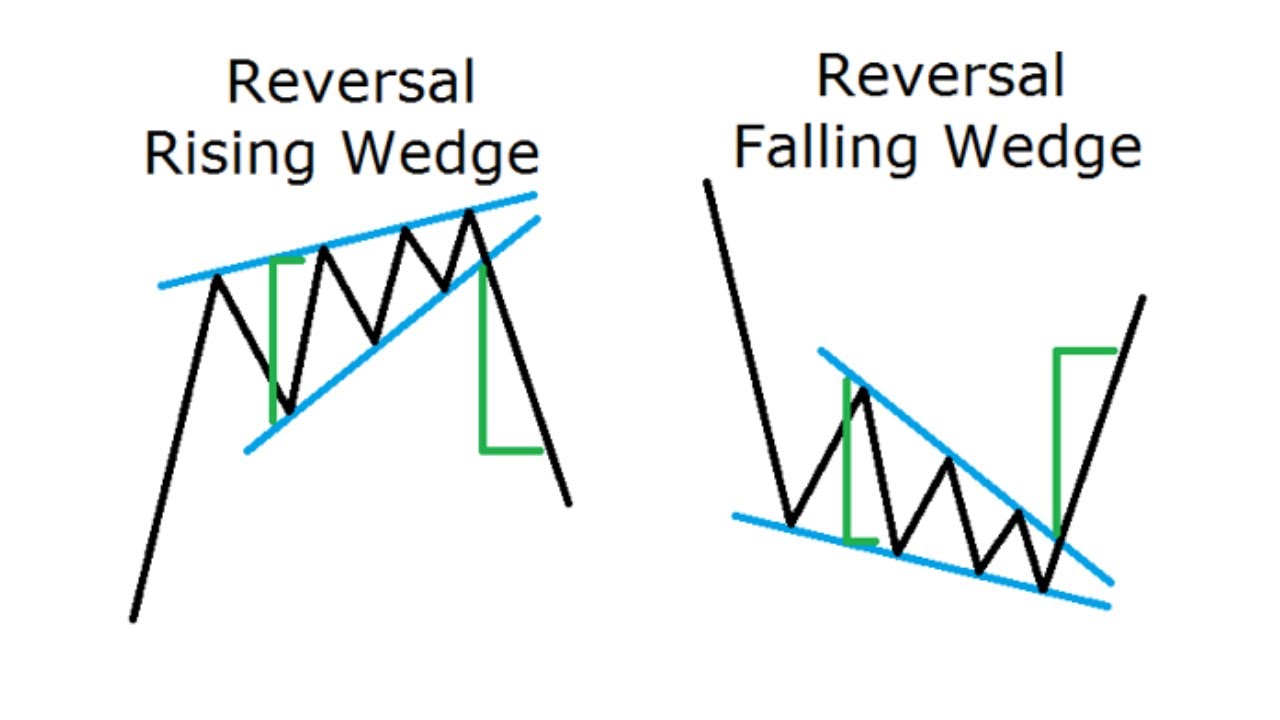

Rising Wedge Chart Pattern - In contrast to symmetrical triangles, which have no definitive slope and no bullish or bearish bias, rising wedges definitely slope up and have a bearish bias. The pattern indicates the end of a bullish trend and is a frequently occurring pattern in financial markets. It has also continued shedding. To form a rising wedge, the support and resistance lines both have to point in an upwards direction and the support line has to be steeper than resistance. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. A rising wedge can be both a continuation and reversal pattern, although the former is more common and more efficient as it follows the. Web paypal share price has formed a rising wedge pattern on the daily and weekly charts. The upper line is typically the resistance level, while the lower trend line. Web monitor these levels amid breakout from rising wedge. Web the forex rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two rising trend lines. Web the first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than the upper trend line. Identifying the rising wedge pattern in an uptrend. This pattern is identified by converging trendlines that slope upward, with the lower trendline rising at a steeper angle than the upper trendline.. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. It’s the opposite of the falling (descending) wedge pattern (bullish), as these two constitute a popular wedge pattern. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. The. Wedges can serve as either continuation or reversal patterns. A rising wedge can be both a continuation and reversal pattern, although the former is more common and more. Web rally above 65,704 should put the bulls back in charge. Identifying the rising wedge pattern in an uptrend. A rising wedge is a bearish chart pattern (said to be of reversal). Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Identifying the rising wedge pattern in an uptrend. Web there are two types of wedge pattern: Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. A rising wedge is. What is a rising wedge? It is formed by two converging bullish lines. Web a wedge pattern is a signal formed on a price chart when two distinct trend lines appear to converge with each successive trading session. On the upside, a breakout of the top line of the wedge will be a sign of strength but a move above. The rising wedge is formed when a stock’s price rises, but instead of continuing its upward trajectory, it contracts as the trading. In the intricate tapestry of trading, chart patterns like the rising wedge offer just that—a glimpse into what might lie ahead. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as. The arm share price has traded within a narrow rising wedge since mid april—a chart pattern technical analysts typically interpret as having. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows. A rising wedge is confirmed/valid if it has good oscillation between the two. A rising wedge is confirmed/valid if it has good oscillation between the two bullish lines. Web a rising wedge is a bearish chart pattern that’s found in a downward trend, and the lines slope up. A rising wedge is formed when the price consolidates between upward sloping support and resistance lines. Web the rising wedge pattern is a very common. The pattern can break out up or down but is primarily considered bearish. A rising wedge is formed when the price consolidates between upward sloping support and resistance lines. Wedges can serve as either continuation or reversal patterns. The pattern indicates the end of a bullish trend and is a frequently occurring pattern in financial markets. Written by internationally known. To form a rising wedge, the support and resistance lines both have to point in an upwards direction and the support line has to be steeper than resistance. Explained (2024) by tyler corvin. The rising (or ascending) wedge and the falling (or descending wedge). Web a rising wedge is a chart pattern characterized by two rising trend lines running in. In contrast to symmetrical triangles, which have no definitive slope and no bullish or bearish bias, rising wedges definitely slope up and have a bearish bias. Web a rising wedge is a bearish pattern when it appears at the top of a mature uptrend. Web a rising wedge is a bearish chart pattern that’s found in a downward trend, and the lines slope up. Web the rising (ascending) wedge pattern is a bearish chart pattern that signals a highly probable breakout to the downside. Web the rising wedge chart pattern is a recognisable price move that’s formed when a market consolidates between two converging support and resistance lines. Wedges can serve as either continuation or reversal patterns. Web wedge patterns are usually characterized by converging trend lines over 10 to 50 trading periods. Web there are two types of wedge pattern: To form a rising wedge, the support and resistance lines both have to point in an upwards direction and the support line has to be steeper than resistance. The rising (or ascending) wedge and the falling (or descending wedge). The rising wedge is a bearish chart pattern that occurs at the end of a bullish uptrend and usually represents a trend reversal. Web the forex rising wedge (also known as the ascending wedge) pattern is a powerful consolidation price pattern formed when price is bound between two rising trend lines. Web the first is rising wedges where price is contained by 2 ascending trend lines that converge because the lower trend line is steeper than the upper trend line. The rising wedge is formed when a stock’s price rises, but instead of continuing its upward trajectory, it contracts as the trading. On the upside, a breakout of the top line of the wedge will be a sign of strength but a move above the recent swing high at 65,523 and the. Web the rising wedge is a bearish pattern that begins wide at the bottom and contracts as prices move higher and the trading range narrows.

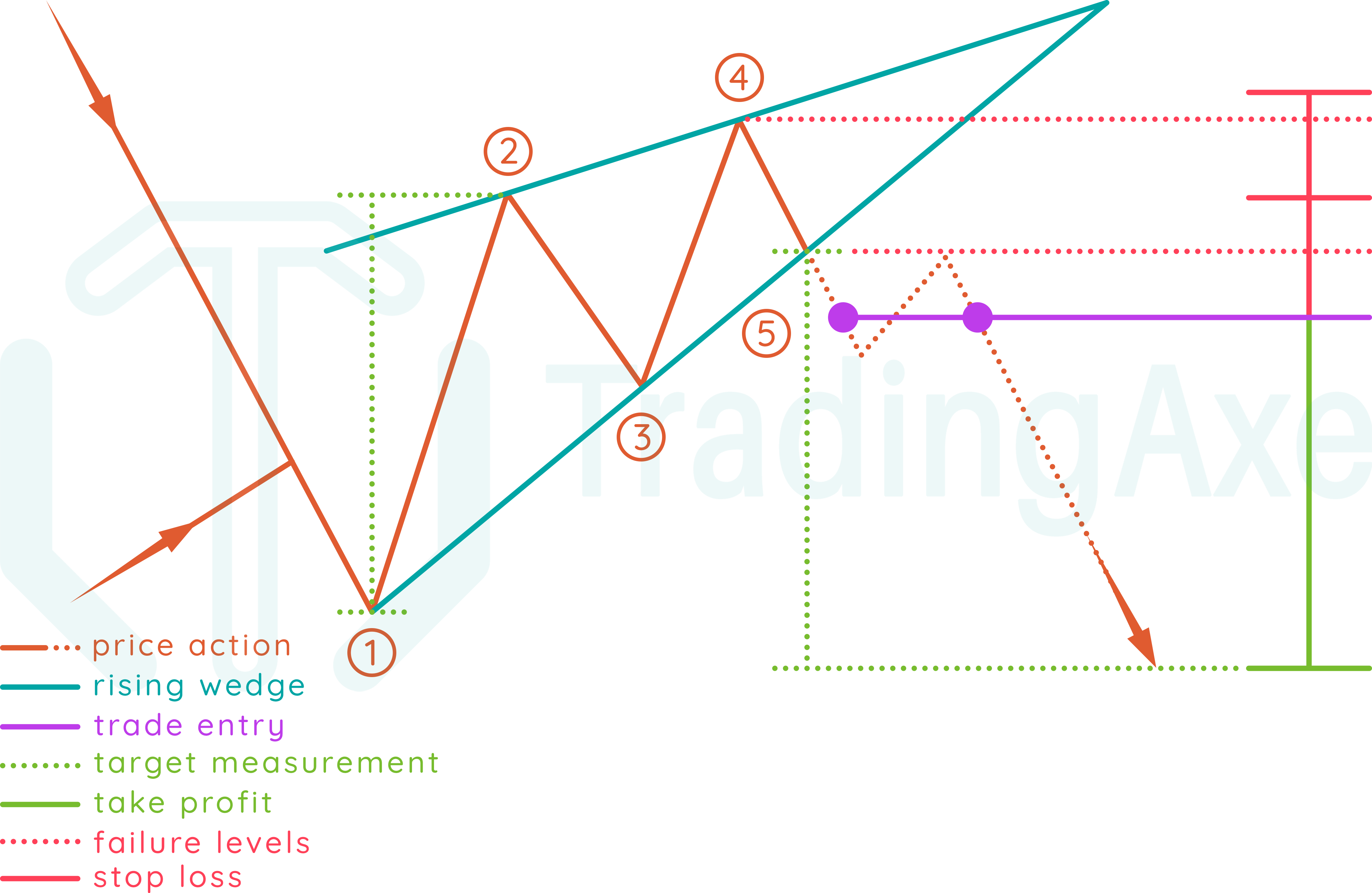

How To Trade Rising Wedge Chart Pattern TradingAxe

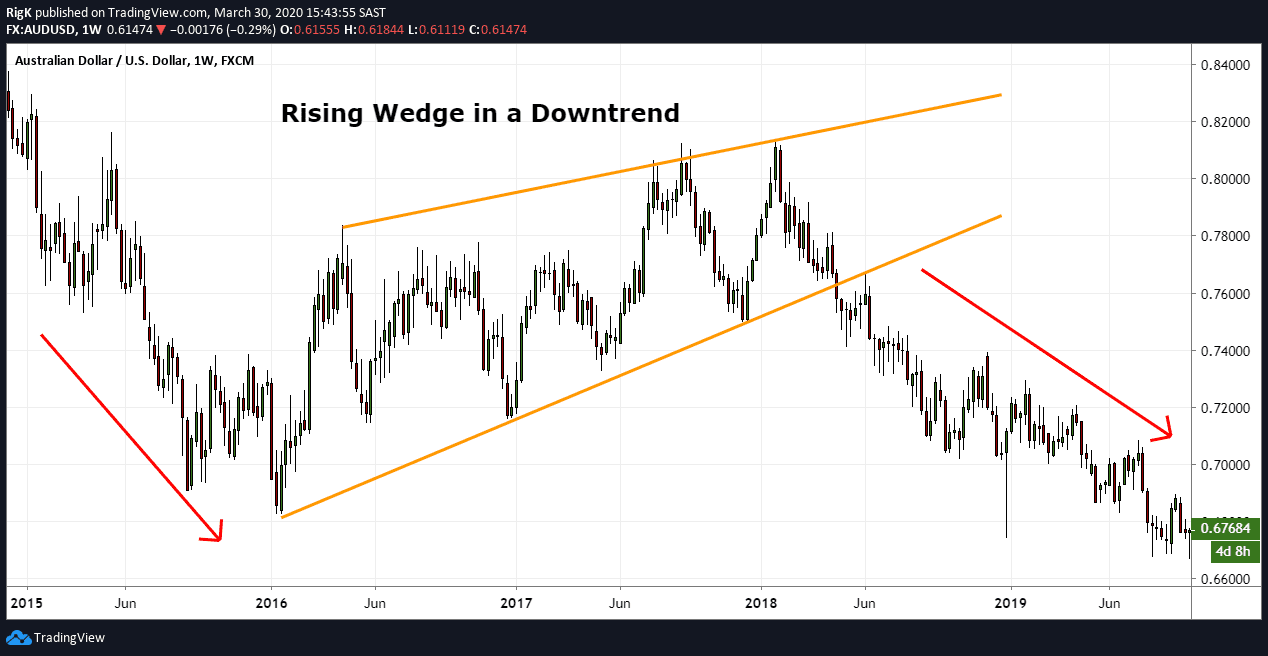

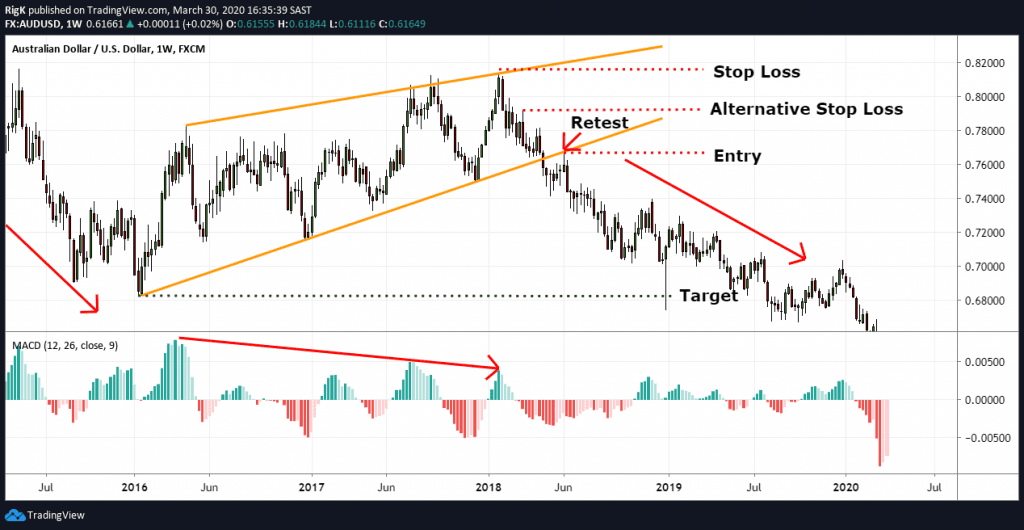

The Rising Wedge Pattern Explained With Examples

How to Trade the Rising Wedge Pattern Warrior Trading

Chart Patterns Rising Wedge

Using the Rising Wedge Pattern in Forex Trading

The Rising Wedge Pattern Explained With Examples

Rising Wedge Chart Pattern

Rising Wedge Chart Pattern Best Analysis

Falling Wedge and Rising Wedge Chart Patterns

Rising Wedge Pattern How to Identify a Selling Opportunity Bybit Learn

It Consists Of Converging Trendlines That Slope Upward, With The Lower Trendline Rising At A Steeper Angle Than The Upper One.

Web Rally Above 65,704 Should Put The Bulls Back In Charge.

Web The Rising (Ascending) Wedge Pattern Is A Bearish Chart Pattern That Signals An Imminent Breakout To The Downside.

The Arm Share Price Has Traded Within A Narrow Rising Wedge Since Mid April—A Chart Pattern Technical Analysts Typically Interpret As Having.

Related Post: