Rising Triangle Pattern

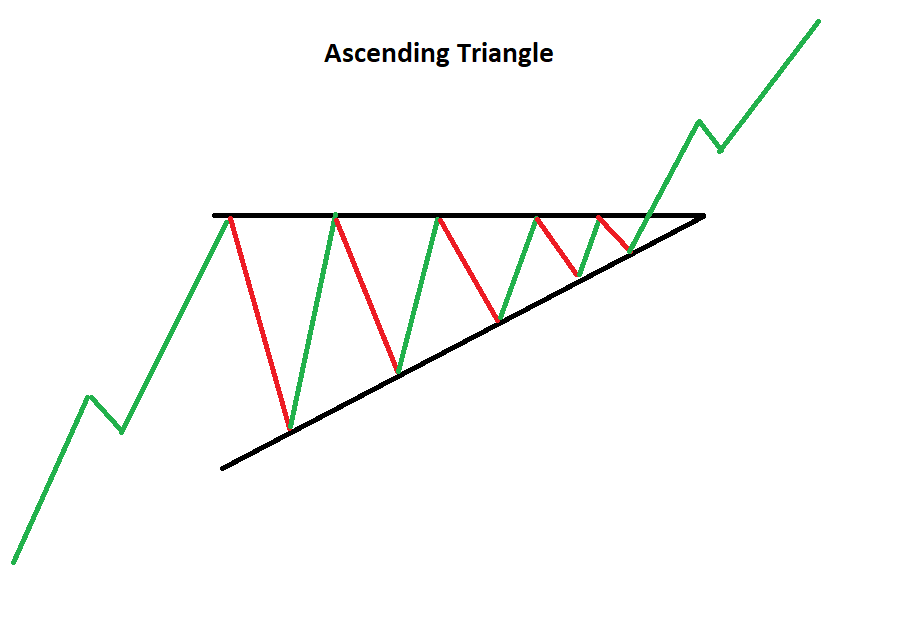

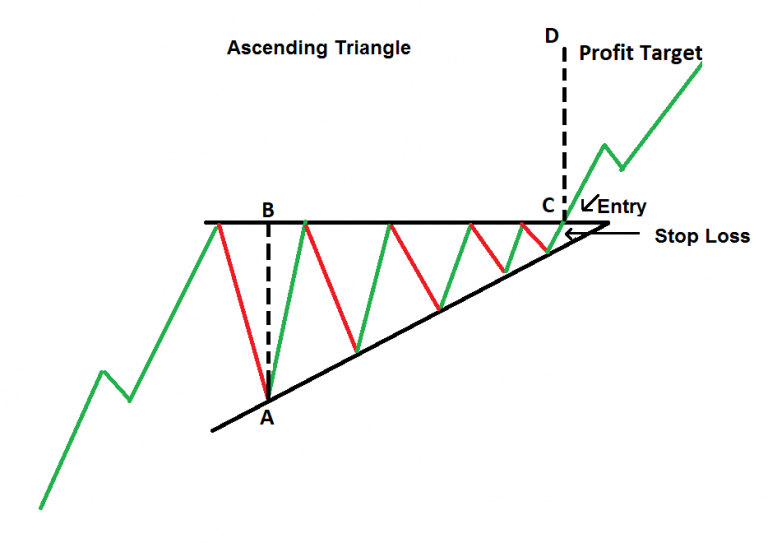

Rising Triangle Pattern - This pattern indicates that buyers. Identify the levels where the price has often closed and opened (black line). It is a bullish formation. Web the pattern is a continuation pattern of a bullish event that is taking a breather as the security attempts to climb higher. The rising bottom is formed using trend. Buyers try to push the price up, but they meet a strong resistance level, so it rebounds. Web often referred to as the ‘rising triangle’, the ascending triangle pattern is one of the top continuation classic patterns. ️ the upper trend line should be horizontal. The ascending triangle pattern is a popular chart pattern used in technical analysis to identify potential bullish breakouts in the market. The ascending triangle pattern is what i. As the price moves higher and posts higher lows, it will create a rising trendline. The ascending triangle pattern is what i. ️ there should be an existing uptrend in the price. Web an ascending triangle pattern is a bullish pattern in technical analysis that signals the market price will increase after an upside price breakout. They are usually called. ️ the upper trend line should be horizontal. As the price moves higher and posts higher lows, it will create a rising trendline. Features that help to identify the ascending triangle: The highs around the resistance price form a horizontal line, while the consecutively higher lows form an ascending line. Triangles are similar to wedges and pennants and can be. The rising bottom is formed using trend. Web the ascending triangle pattern is a popular chart pattern used by traders and investors to predict potential bullish breakouts in the financial markets. Triangles are similar to wedges and pennants and can be either a continuation pattern,. Web an ascending triangle is a bullish continuation chart pattern. They are usually called continuation. Features that help to identify the ascending triangle: Web an ascending triangle is a bullish continuation chart pattern. Buyers try to push the price up, but they meet a strong resistance level, so it rebounds. This line represents a key level of resistance. For an ascending triangle to form, the instrument should be. Two or more equal highs form a horizontal line at the top. Web the rising wedge is a technical chart pattern used to identify possible trend reversals. The second line is a horizontal resistance, also known as the ascending triangle resistance line. Web the ascending triangle formation is a very powerful chart pattern that exploits the supply and demand imbalances. For an ascending triangle to form, the instrument should be. Web the pattern is a continuation pattern of a bullish event that is taking a breather as the security attempts to climb higher. Take profit is calculated by plotting the lowest increase on the black line (see graph). They are usually called continuation patterns because the price will breakout in. The upper trendline must be. It is a bullish formation. The pattern is formed by two converging lines. An ascending triangle consists of: Web an ascending triangle pattern is a bullish pattern in technical analysis that signals the market price will increase after an upside price breakout. This classic chart pattern is. Web the pattern is a continuation pattern of a bullish event that is taking a breather as the security attempts to climb higher. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to be. ️ the lower trend line must be. The triangle’s appearance is explained as follows: The rising bottom is formed using trend. An ascending triangle consists of: Web the pattern is a continuation pattern of a bullish event that is taking a breather as the security attempts to climb higher. For an ascending triangle to form, the instrument should be. In technical analysis, triangles are the shape of continuation patterns on charts, and ascending triangles represent one pattern formation. They are usually called continuation patterns because the price will breakout in the same direction as the trend that was in place just prior to the triangle forming. ️ the lower trend line must be a rising trend line. The triangle’s. Learn how to identify ascending triangle patterns and the information these patterns can provide. It is created by price moves that allow for a horizontal line to be drawn along the swing highs and a rising trendline to be. Buyers try to push the price up, but they meet a strong resistance level, so it rebounds. It then appears in the middle of a trend. Triangles are similar to wedges and pennants and can be either a continuation pattern,. For an ascending triangle to form, the instrument should be. This pattern is easily recognizable on charts as it features a horizontal resistance line and an upward sloping support line, converging into a point or an apex. Web an ascending triangle is a bullish continuation chart pattern. The upper trendline must be. They are usually called continuation patterns because the price will breakout in the same direction as the trend that was in place just prior to the triangle forming. The second line is a horizontal resistance, also known as the ascending triangle resistance line. The triangle’s appearance is explained as follows: Web the rising wedge is a technical chart pattern used to identify possible trend reversals. Web an ascending triangle is a chart pattern used in technical analysis. Web so traders should look for the pattern while prices are in an uptrend and identify it using the triangle shape. Web the pattern is a continuation pattern of a bullish event that is taking a breather as the security attempts to climb higher.

Adolescent Technology Bearish Triangle Chart Patterns

Ascending Triangle Chart Pattern Ascending triangle, Trading charts

How To Trade Blog Triangle Pattern Characteristics And How To Trade

FXGUIDELK Binary Option Learning And Earning Sri Lanka Post

ANALISA TEKNIKAL TRIANGLE PATTERN DALAM TRADING

Ascending Triangle Pattern Screener, Downtrend, Uptrend Breakout

Ascending Triangle Chart Pattern

Ascending and Descending Triangle Patterns Investar Blog

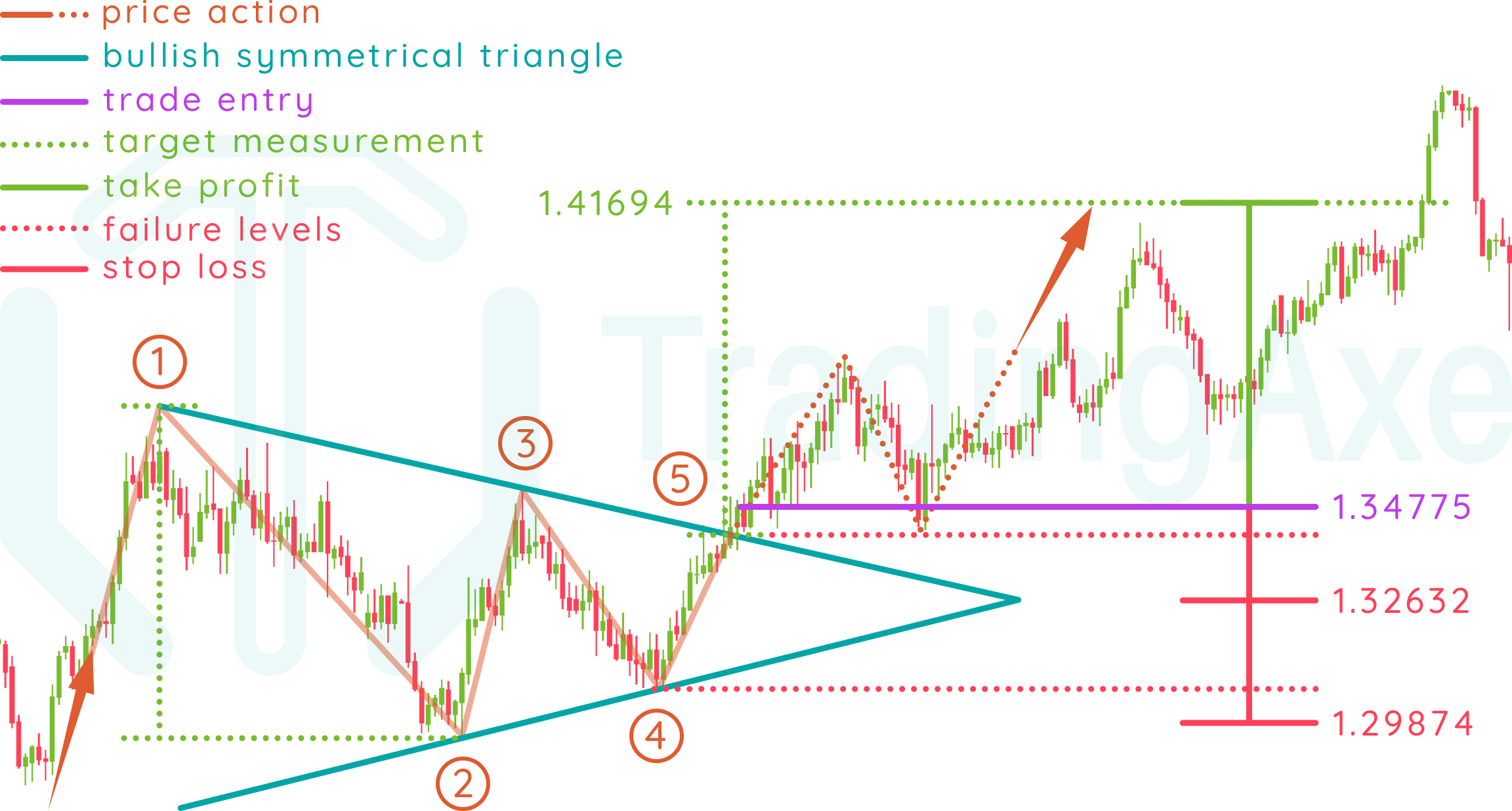

How To Trade Bullish Symmetrical Triangle Chart Pattern TradingAxe

:max_bytes(150000):strip_icc()/Triangles_AShortStudyinContinuationPatterns1-bba0f7388b284f96b90ead2b090bf9a8.png)

Triangles A Short Study in Continuation Patterns

Ascending Triangles Are Mainly A Bullish Continuation Pattern But They Are Used As Bullish Reversal Patterns On Very Rare Occasions.

Take Profit Is Calculated By Plotting The Lowest Increase On The Black Line (See Graph).

️ The Lower Trend Line Must Be A Rising Trend Line.

Web An Ascending Triangle Is A Breakout Pattern That Forms When The Price Breaches The Upper Horizontal Trendline With Rising Volume.

Related Post: