Reverse W Pattern

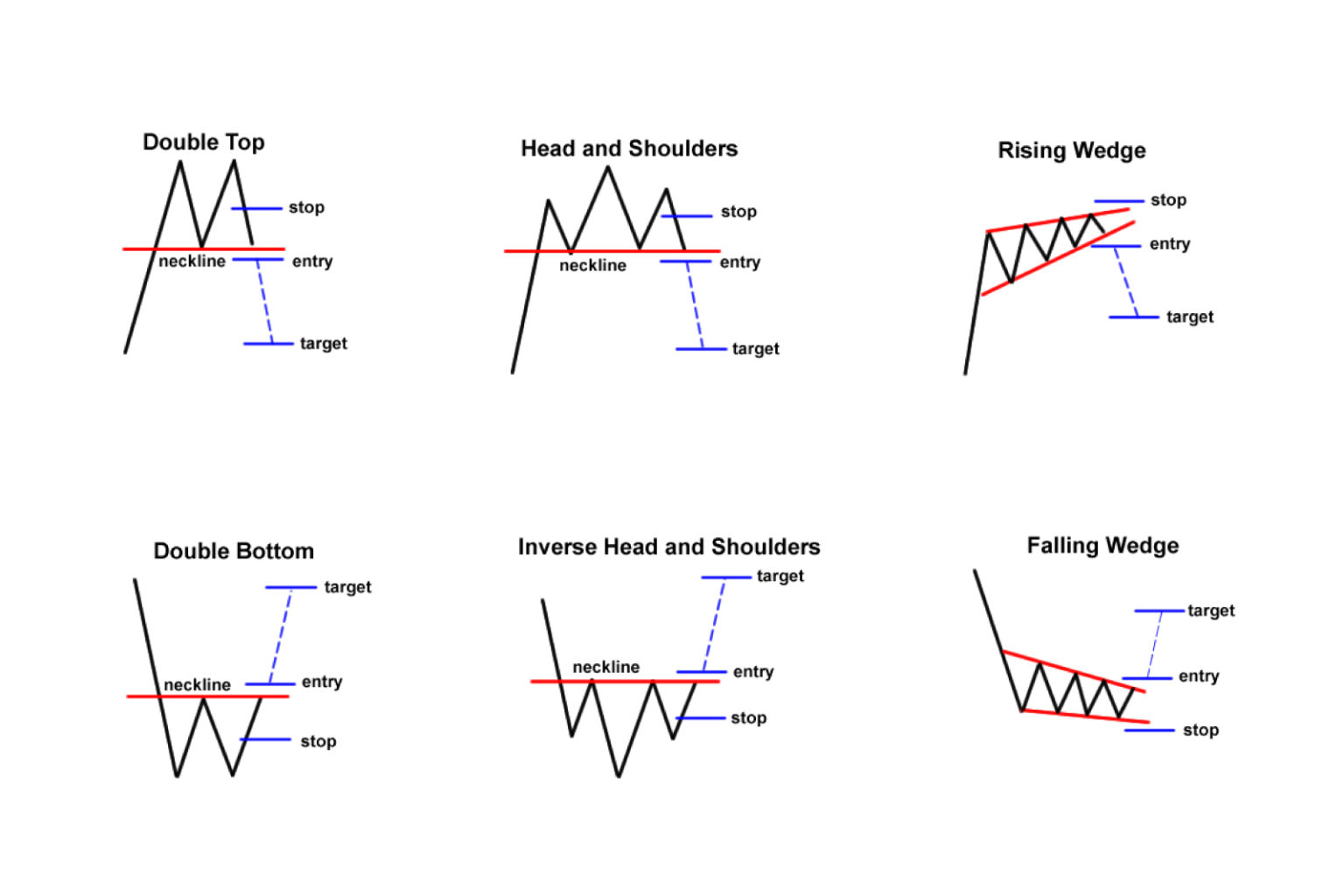

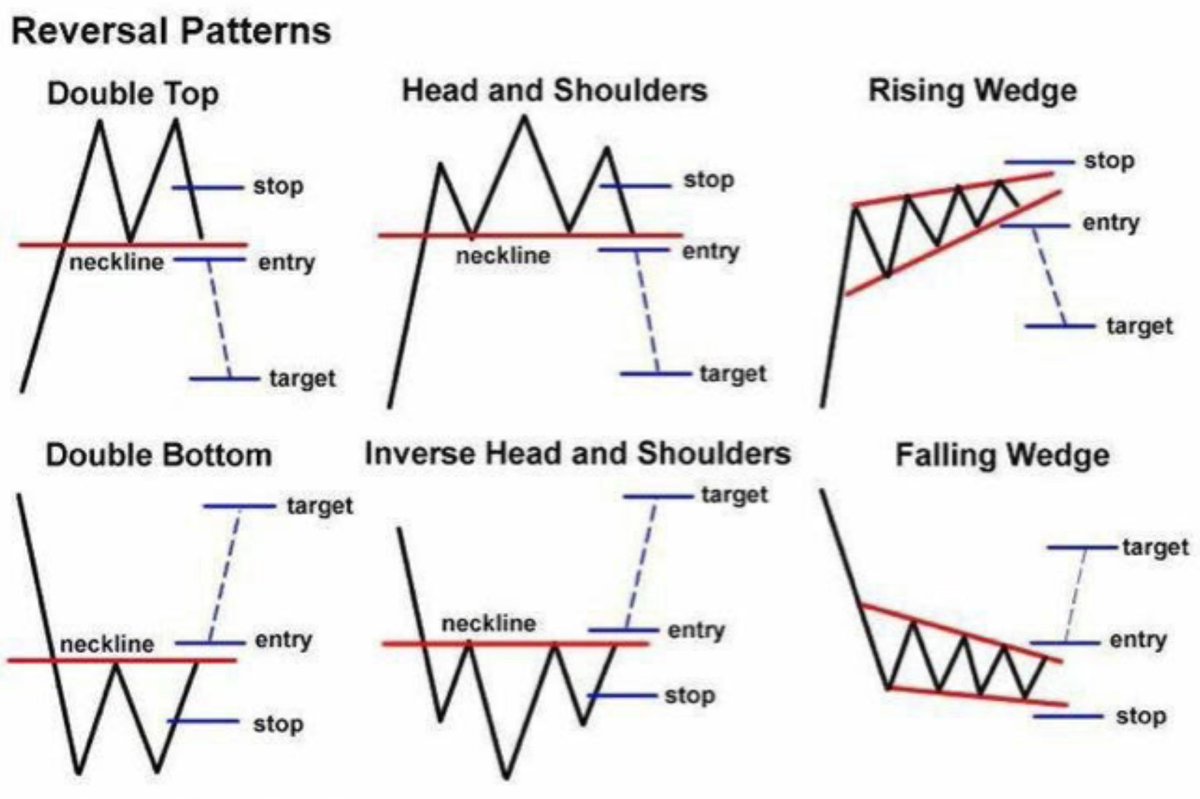

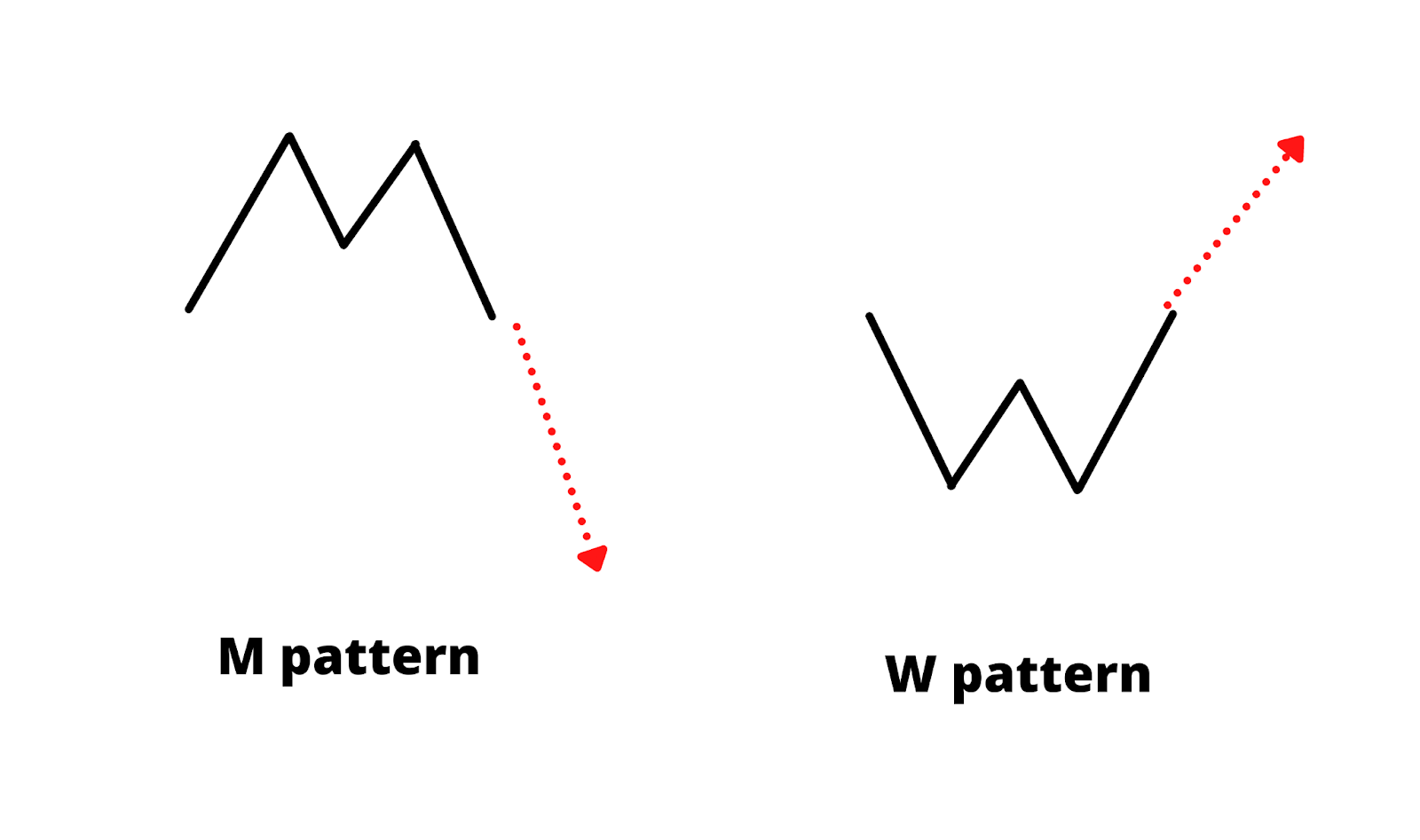

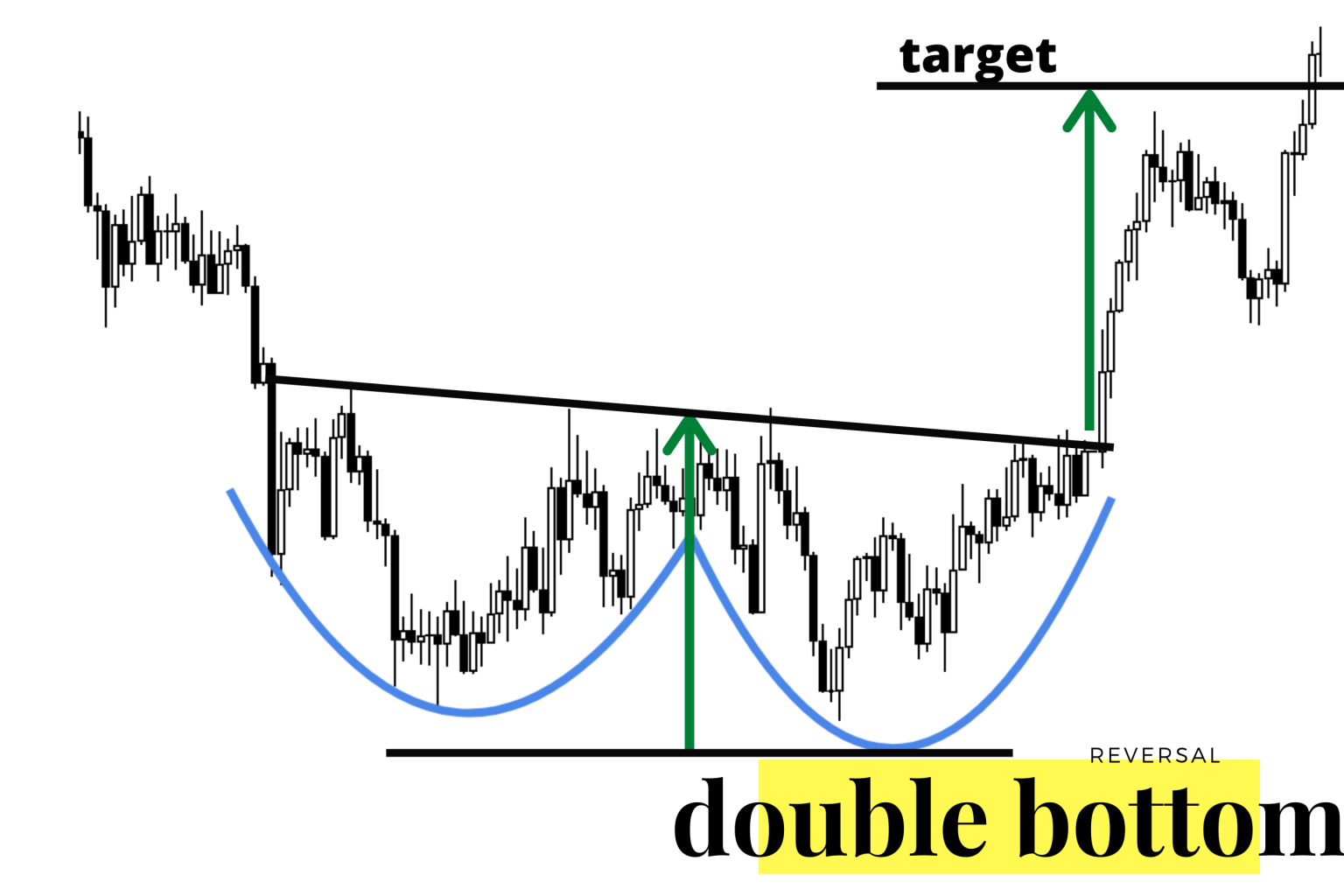

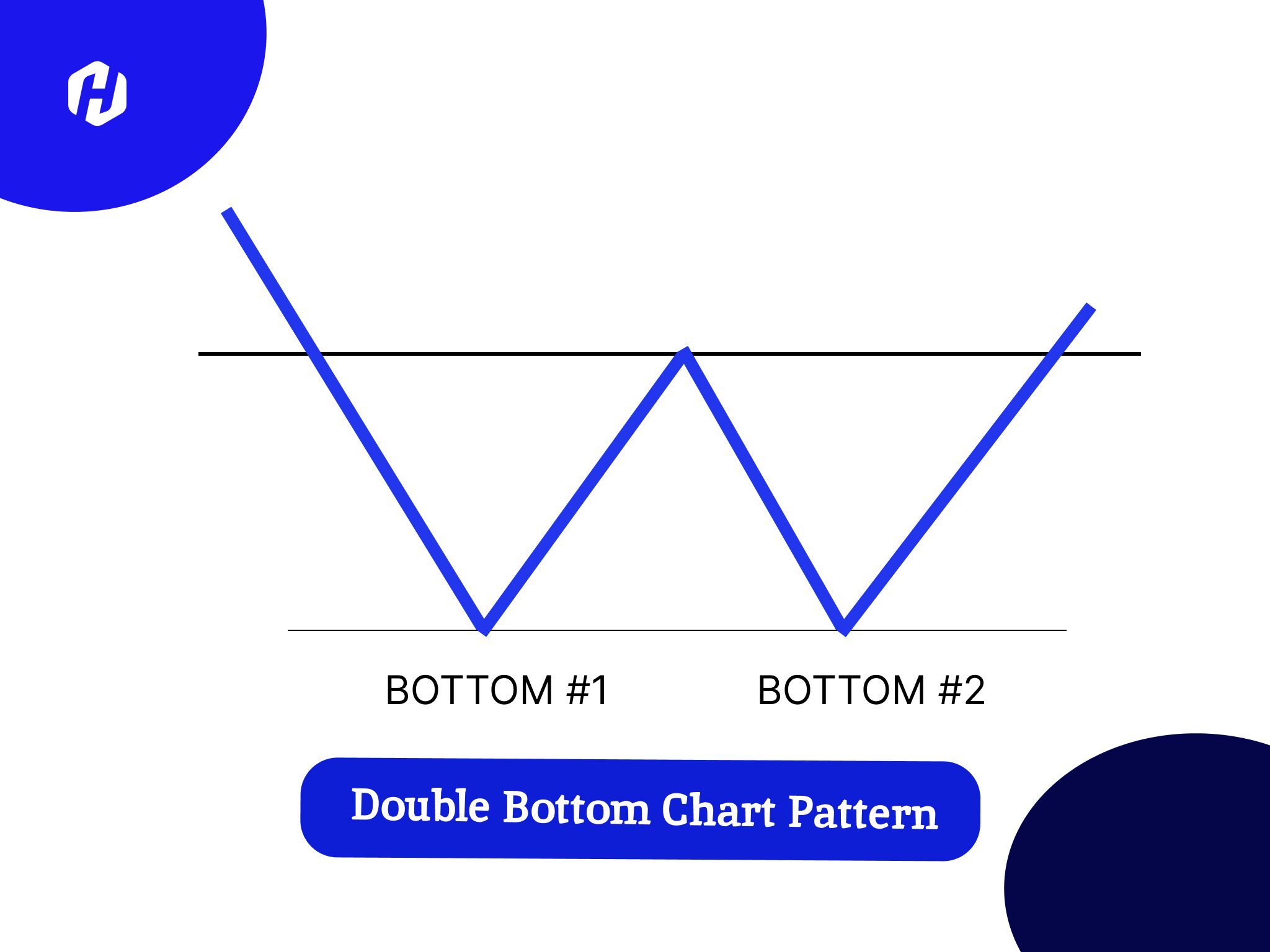

Reverse W Pattern - Web referring to the chart above, we can see a head and shoulders pattern. If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon. These patterns are significant because they help traders identify potential turning points in the price action of a security. This pattern gets its name because it looks like a w when viewed on a chart. Web all reversal chart patterns like the hammer, hanging man, and morning/evening star formations. It’s a bullish reversal pattern that can be detected at the end of a downtrend. Web orchids are a kind of horticultural plant with highly ornamental and medical value. Prior to this pattern there was an uptrend. Web w tops are a bearish reversal chart pattern that can provide traders with valuable insights into the potential direction of a stock’s price movements. Double tops and bottoms are important technical analysis patterns used by traders. Web the essential guide to reversal chart patterns. Web the w pattern, as the name suggests, resembles the letter “w” and is formed by two successive downward price movements followed by an upward movement. The double bottom and double top. This pattern gets its name because it looks like a w when viewed on a chart. Web the inverse head. Web the essential guide to reversal chart patterns. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. It is formed by drawing two downward legs followed by an upward move that retraces a significant portion of the prior decline. It is the opposite of the head. These patterns typically form when a stock’s price rises to a high point before dropping, then rises again to a lower high point before dropping once more. It is formed by drawing two downward legs followed by an upward move that retraces a significant portion of the prior decline. It is the opposite of the head and shoulders chart pattern,. The pattern is formed by two equal highs with a significant peak in between. These patterns typically form when a stock’s price rises to a high point before dropping, then rises again to a lower high point before dropping once more. But when you attempt to trade these reversal chart patterns, you find yourself caught on the wrong side of. A double bottom has a. This pattern gets its name because it looks like a w when viewed on a chart. This pattern indicates that the asset has faced support twice at a similar level and may be due for a reversal in trend. Melatonin as a multifunctional molecule, is typically involved in plant growth and. But when you attempt. Web the essential guide to reversal chart patterns. Key components of m pattern (double top): Prices are rallying higher with greater momentum to create the highest peak which is called the head.the lower peaks on either side of the head are called shoulders.a neckline is drawn by connecting the lowest points of the two troughs. Web the w pattern, as. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. It is the opposite of the head and shoulders chart pattern, which is a. Web the w pattern is a technical analysis pattern that resembles the letter “w” and is formed by two consecutive troughs followed by. These patterns typically form when a stock’s price rises to a high point before dropping, then rises again to a lower high point before dropping once more. Web the w chart pattern is a reversal chart pattern that signals a potential change from a bearish trend to a bullish trend. Web the inverted w pattern, also known as the double. It indicates a potential reversal from an uptrend to a downtrend. I'll explain what each reversal pattern indicates, with visual chart examples. If identified correctly, reversal patterns can help spot market reversals. Traders try to get out of positions that are aligned with the trend prior to a. Its shape looks like the letter w and is formed when the. These patterns typically form when a stock’s price rises to a high point before dropping, then rises again to a lower high point before dropping once more. These could be in the form of a single candle, or a group of candles lined up in a specific shape, or they could be a large structural classical chart pattern. Prior to. Traders try to get out of positions that are aligned with the trend prior to a. This pattern signifies a potential trend reversal from bearish to bullish, presenting traders with an opportunity to enter a long position at a favorable price. You’re familiar with reversal chart patterns like head and shoulders, double top, triple top, etc. Web the w pattern is a chart formation that appears as two consecutive lows separated by a peak. Web w tops are a bearish reversal chart pattern that can provide traders with valuable insights into the potential direction of a stock’s price movements. Web conversely, the w pattern, known as the double bottom, signals a bullish reversal, indicating that a current downtrend is likely to transition into an uptrend. W pattern trading is a. These patterns are significant because they help traders identify potential turning points in the price action of a security. Web reversal patterns are those chart formations that signal that the ongoing trend is about to change course. This pattern signifies a reversal of a downtrend and often indicates a bullish trend reversal. Web below are some of the key bullish reversal patterns with the number of candlesticks required in parentheses. If a reversal chart pattern forms during an uptrend, it hints that the trend will reverse and that the price will head down soon. Initial drop in price, establishing the first bottom. Web the double bottom reversal is a bullish reversal pattern typically found on bar charts, line charts, and candlestick charts. We hypothesized that disease severity might increase with the availability of inorganic n. In chile, h1n2 and h3n2 subtypes were introduced in the swine population before the h1n1 2009 pandemic, and the h1n1 was introduced from the h1n1pdm09 by successive.

"W" Pattern Trading Breakdown Double Bottom Reversal Pattern Mango

W Pattern Trading The Forex Geek

Know the 3 Main Groups of Chart Patterns FX Access

Three Types of W Patterns MATI Trader

Here are 6 reversal patterns in technical analysis. All shown in one

W Pattern Trading vs. M Pattern Strategy Choose One or Use Both? • FX

5 Chart Patterns Every Beginner Trader Should Know Brooksy

W Pattern Trading New Trader U

Panduan Lengkap Mengenai Pola W Trading Pattern HSB Investasi

W Pattern Price Action Strategy // How To Learn W Pattern Price Action

The Pattern Is Formed By Two Equal Highs With A Significant Peak In Between.

These Could Be In The Form Of A Single Candle, Or A Group Of Candles Lined Up In A Specific Shape, Or They Could Be A Large Structural Classical Chart Pattern.

Web The Inverted W Pattern, Also Known As The Double Top Pattern, Is The Opposite Of The Classic W Pattern.

It Resembles The Letter “W”.

Related Post: