Reverse Head Shoulders Pattern

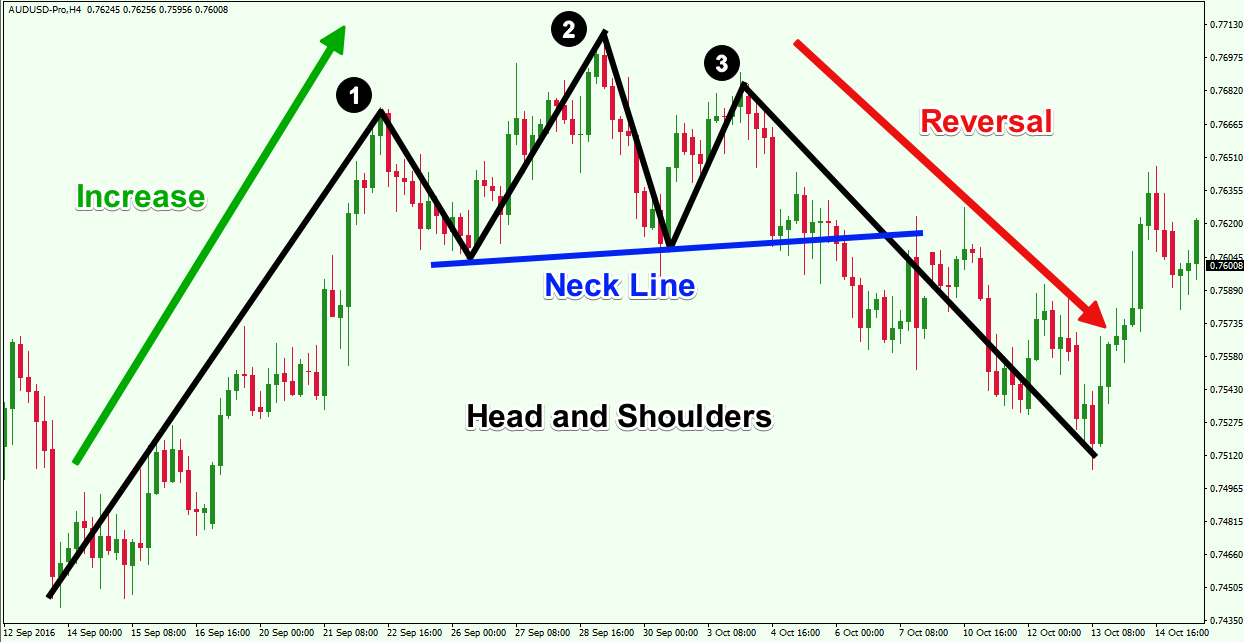

Reverse Head Shoulders Pattern - That gives you the height of the pattern. Head & shoulder and inverse head & shoulder. Web inverse head and shoulders: Web coinlog jul 14, 2021. Web the head and shoulders bottom, sometimes referred to as an inverse head and shoulders, is a reversal pattern that shares many common characteristics with the head and shoulders top, but relies more heavily on volume patterns for confirmation. An inverse head and shoulders pattern is the inverted version of a standard head and. There is a possibility that an inverse head and shoulders can form during a pause in an uptrend, but these are typically called cups, or cupst with handles. When the break out of the pattern occurs, sometimes there is a large gap. A new research paper found that various ai systems have learned the art of deception. Following this formation is a bullish. A head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. Web the inverse (reverse) head an shoulders pattern is equally useful in any trader’s arsenal and adopts the same approach as the traditional formation. Web the inverted head and shoulders pattern is confirmed when the price. Inverse head and shoulders pattern is the mirror image of head and shoulders pattern. Add the height to the breakout price to attain a profit. While the first and the third bottoms (the shoulders) need to. The pattern contains three successive peaks, with the middle peak (head) being the highest and the two outside peaks (shoulders) being low and roughly. The head and shoulders pattern is exactly what the term indicates. Web is a head and shoulders pattern bullish? Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. Howard schultz says starbucks needs to fix its stores and mobile app to reverse its fall from grace. the longtime. Web inverse head and shoulders: Web head and shoulders pattern: Web the head and shoulders bottom, sometimes referred to as an inverse head and shoulders, is a reversal pattern that shares many common characteristics with the head and shoulders top, but relies more heavily on volume patterns for confirmation. A new research paper found that various ai systems have learned. Howard schultz says starbucks needs to fix its stores and mobile app to reverse its fall from grace. the longtime former ceo wrote in a linkedin post on sunday that. The head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. The pattern contains three successive peaks, with the middle. Web what is a head and shoulders pattern in technical analysis? As a major reversal pattern, the head and shoulders bottom forms after a downtrend, with. The head and shoulders chart pattern is a price reversal pattern that helps traders identify when a reversal may be underway after a trend is exhausted. It is of two types: The pattern is. Web an inverse head and shoulders pattern is a technical analysis chart pattern that signals a potential trend reversal from a downtrend to an uptrend. Web inverse head and shoulders: The red garment's scooped neckline featured spaghetti straps and a slightly cinched waist. Web the inverse head and shoulders pattern typically indicates that a stock, cryptocurrency, future, or other asset. For instance, if the stock retreated to $35, rebounded to a new high of $37, and then retreated back to $35 before climbing. Both “inverse” and “reverse” head and shoulders patterns are the same. It typically forms at the end of a bullish trend. Standard head and shoulder patterns are an indicator of a sizable downward price reversal from a. The most common way to trade the inverse head and shoulders pattern is to immediately enter a position when the price breaks above the resistance neckline. This pattern forms a downtrend without a previous downtrend to reverse; May 6, 2024, 8:23 pm pdt. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a. As a major reversal pattern, the head and shoulders bottom forms after a downtrend, with. Web mudrex aug 18, 2020. The pattern contains three successive peaks, with the middle peak (head) being the highest and the two outside peaks (shoulders) being low and roughly equal.the reaction lows of each peak can be connected to form support, or a neckline. This. Typically, when the slope is down, it. The pattern resembles a left shoulder, head, and right shoulder, hence the term head and. An inverse head and shoulders pattern is the inverted version of a standard head and. Howard schultz says starbucks needs to fix its stores and mobile app to reverse its fall from grace. the longtime former ceo wrote in a linkedin post on sunday that. A “ neckline ” is drawn by connecting the lowest points of the two troughs. Inverse head and shoulders pattern is the mirror image of head and shoulders pattern. For instance, if the stock retreated to $35, rebounded to a new high of $37, and then retreated back to $35 before climbing. The red garment's scooped neckline featured spaghetti straps and a slightly cinched waist. This pattern forms a downtrend without a previous downtrend to reverse; While the first and the third bottoms (the shoulders) need to. “head and shoulder bottom” is also the same thing. Traders will then look for a price target by measuring the distance from the head to the neckline and applying it to the breakout point. Web the inverted head and shoulders pattern is confirmed when the price breaks above resistance created by the neckline. In theory, they foretell the slowing momentum in. The reason the inverse head and shoulders. Web you can subtract the low price of the head from the high price of the retracements.

What is Inverse Head and Shoulders Pattern & How To Trade It

How to Use Head and Shoulders Pattern (Chart Pattern Part 1)

headandshouldersreversalchartpattern Forex Training Group

Head and Shoulders Reversal Pattern Lesson 5 Part 1a Getting

Head and Shoulders Trading Patterns ThinkMarkets EN

Reverse Head And Shoulders Pattern (Updated 2022)

Must be Profit if you identify Resistance and Support Line (Part13

Inverse or Inverted Head and Shoulders Pattern Chart Patterns

How to Trade the bearish Head and Shoulders Pattern in Best Forex

What is Inverse Head and Shoulders Pattern & How To Trade It

It Resembles A Baseline With Three Peaks With The Middle Topping The Other Two.

Web An Inverse Head And Shoulders Pattern Is A Technical Analysis Chart Pattern That Signals A Potential Trend Reversal From A Downtrend To An Uptrend.

On The Other Hand, Reverse, Or Inverse Head And Shoulder Patterns Indicate A Bullish Chart Reversal From A Downward Trend To An.

Web Meghan's $275 Midi Dress Was Made By Orire, A Nigerian Designer.

Related Post: