Reverse Head And Shoulders Pattern

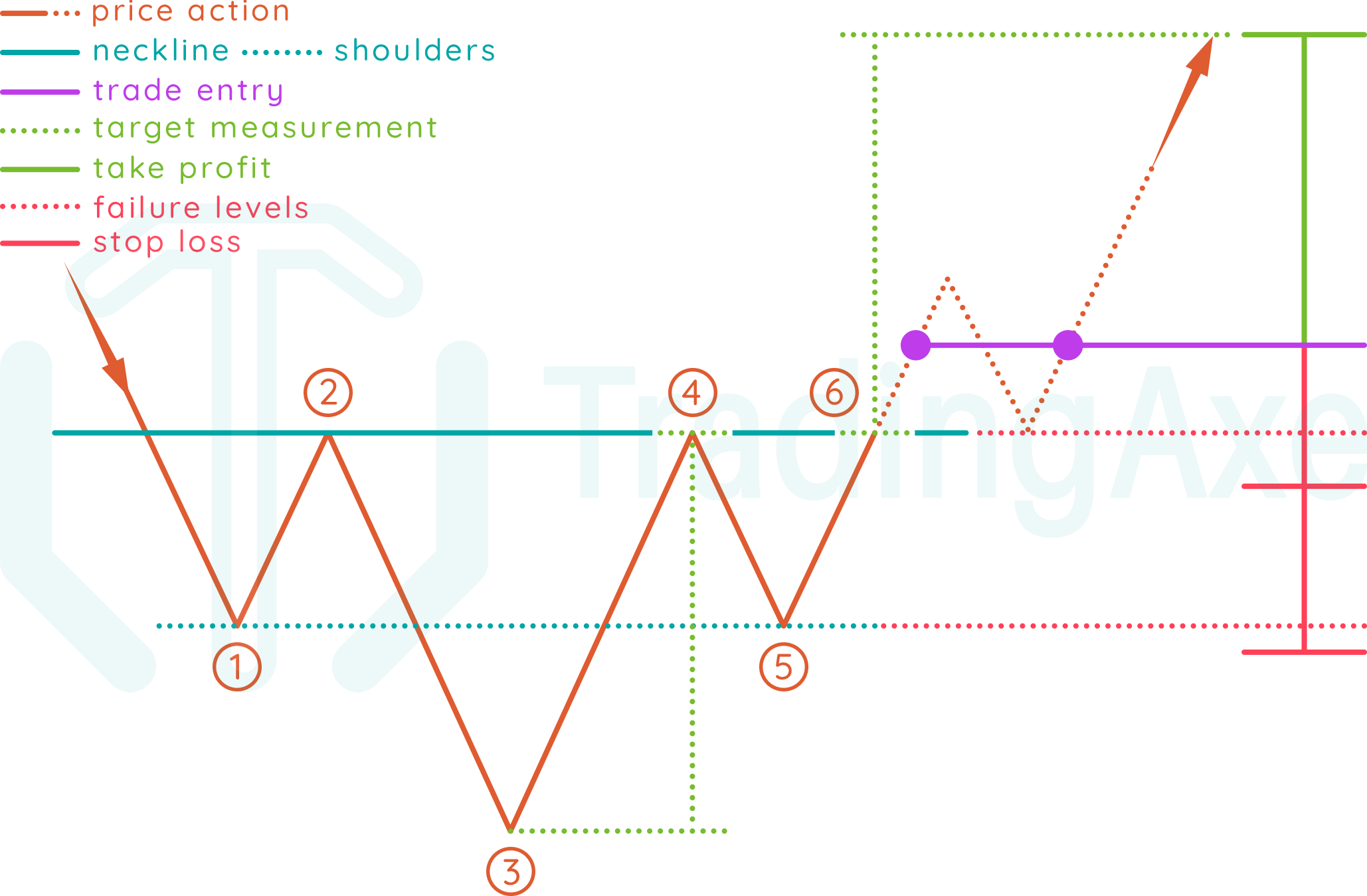

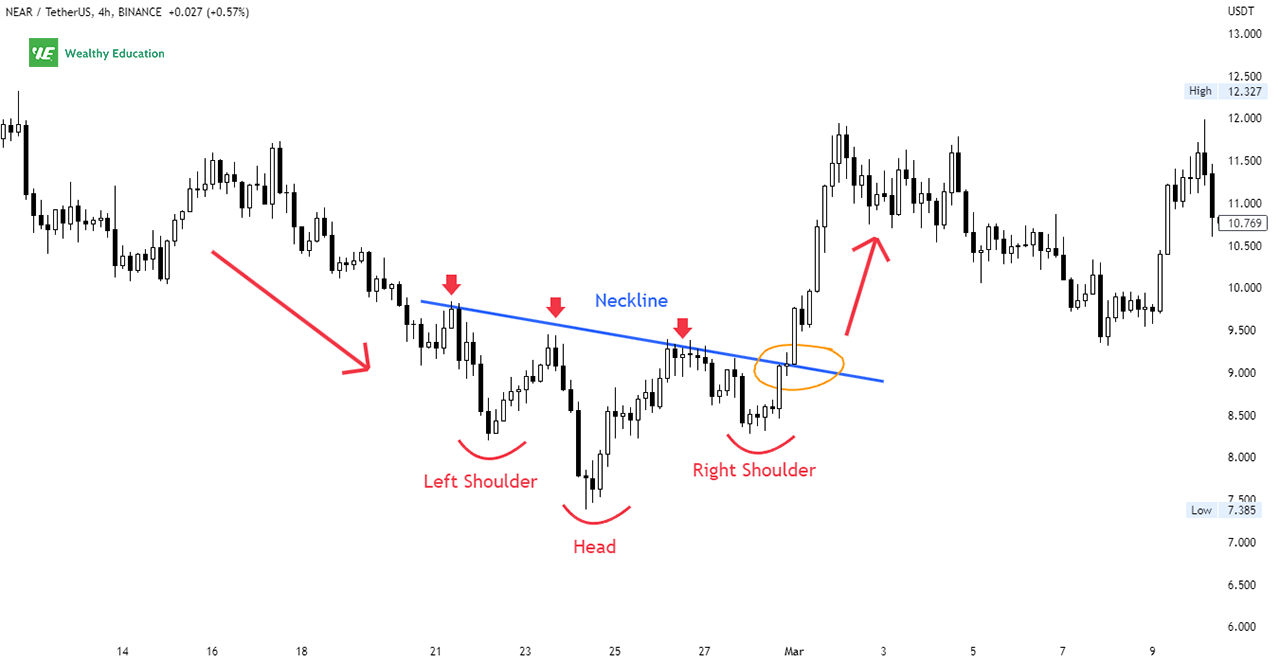

Reverse Head And Shoulders Pattern - The pattern resembles the shape of a person’s head and two shoulders in an inverted position, with three consistent lows and peaks. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend. The reaction lows of each peak can be connected to form support, or a neckline. The pattern contains three successive troughs with the middle trough (head) being the deepest and the two outside troughs (shoulders) being shallower. The lowest price of the incoming cycle. The pattern contains three successive peaks, with the middle peak ( head) being the highest and the two outside peaks ( shoulders) being low and roughly equal. The pattern appears as a head, 2 shoulders, and neckline in an inverted position. Web the inverse (reverse) head an shoulders pattern is equally useful in any trader’s arsenal and adopts the same approach as the traditional formation. Web what is an inverse head and shoulders pattern? Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. The reaction lows of each peak can be connected to form support, or a neckline. The pattern is similar to the shape of a person’s head and two shoulders in an inverted position, with. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. The head and shoulders stock. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. An inverse head and shoulders. Web inverse head and shoulders pattern is the mirror image of head and shoulders pattern. As the price rises, it goes up to make a new high, then it pulls back and falls. “head and shoulder bottom” is also the same thing. The left shoulder marks the first support level. The height of the pattern plus the breakout price should be your target price using this indicator. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low. Volume play a major role in both h&s and inverse h&s patterns. The reaction lows of each peak can be connected to form support, or a neckline. The left shoulder marks the first support level. Web a head and shoulders pattern is a bearish reversal pattern in technical analysis that signals a price reversal from a bullish to bearish trend.. Read about head and shoulder pattern here: It is the opposite of the head and shoulders chart pattern, which. Web the inverse (reverse) head an shoulders pattern is equally useful in any trader’s arsenal and adopts the same approach as the traditional formation. Traders use it to time the bottom of a downtrend and buy into an asset at the. The lowest price of the incoming cycle. The height of the pattern plus the breakout price should be your target price using this indicator. “head and shoulder bottom” is also the same thing. Web an inverse head and shoulders pattern is a technical analysis chart pattern that signals a potential trend reversal from a downtrend to an uptrend. Read about. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. Furthermore, the pattern appears at the end of a downward trend and should have a clear neckline used as a resistance level. The inverse head and shoulders pattern is a widely recognized chart pattern traders have relied. The inverse head and shoulders pattern is a technical indicator that signals a potential reversal from a downward trend to an upward trend. Web as a major reversal pattern, the head and shoulders bottom forms after a downtrend, with its completion marking a change in trend. It typically forms at the end of a bullish trend. Web the inverse head. Web as a major reversal pattern, the head and shoulders bottom forms after a downtrend, with its completion marking a change in trend. Web what is an inverse head and shoulders pattern? The left shoulder marks the first support level. Both “inverse” and “reverse” head and shoulders patterns are the same. The head and shoulders pattern is a reversal trading. Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. Read about head and shoulder pattern here: The left shoulder marks the first support level. Web the inverse head and shoulders chart pattern is a bullish chart formation that signals a potential reversal of a downtrend. Web a head. Web inverse head and shoulders patterns are bullish patterns. The height of the pattern plus the breakout price should be your target price using this indicator. Web inverse head and shoulders is a price pattern in technical analysis that indicates a potential reversal from a downtrend to an uptrend. Read about head and shoulder pattern here: It enables traders to determine the opportune moment to initiate a trade. Web a head and shoulders reversal pattern forms after an uptrend, and its completion marks a trend reversal. The reaction lows of each peak can be connected to form support, or a neckline. This pattern is formed when an asset’s price creates a low (the “left shoulder”), followed by a lower low (the “head”), and then a higher low (the “right shoulder”). Web an inverse head and shoulders pattern is a technical analysis pattern that signals a potential trend reversal in a downtrend. The head and shoulders pattern is a reversal trading strategy, which can develop at the end of bullish or bearish trends. It boasts an impressive success rate of 89%. Web the inverse head and shoulders is a technical chart pattern that signals a potential trend reversal from a downward trend to an upward trend in the price of a security or asset. “head and shoulder bottom” is also the same thing. It is the opposite of the head and shoulders chart pattern, which. The pattern is shaped with three peaks, a left shoulder peak, a higher head peak, and a right shoulder peak similar in height to the left shoulder. The left shoulder marks the first support level.

Head and Shoulders Pattern Trading Strategy Synapse Trading

How To Trade Inverted Head And Shoulders Chart Pattern TradingAxe

Reverse Head And Shoulders Pattern Stocks

Head and Shoulders Trading Patterns ThinkMarkets EN

How to Trade the Head and Shoulders Pattern Trading Pattern Basics

Must be Profit if you identify Resistance and Support Line (Part13

Head and Shoulders Reversal Pattern Lesson 5 Part 1a Getting

Inverse Head and Shoulders Pattern How To Spot It

Reverse Head And Shoulders Pattern (Updated 2023)

How to Trade the bearish Head and Shoulders Pattern in Best Forex

The Head And Shoulders Stock And.

Volume Play A Major Role In Both H&S And Inverse H&S Patterns.

It Signals That The Market May Embark On An Upward Trend Soon.

As The Price Rises, It Goes Up To Make A New High, Then It Pulls Back And Falls Below The First Support Level, Thus Creating The Head.

Related Post: