Reverse Hammer Pattern

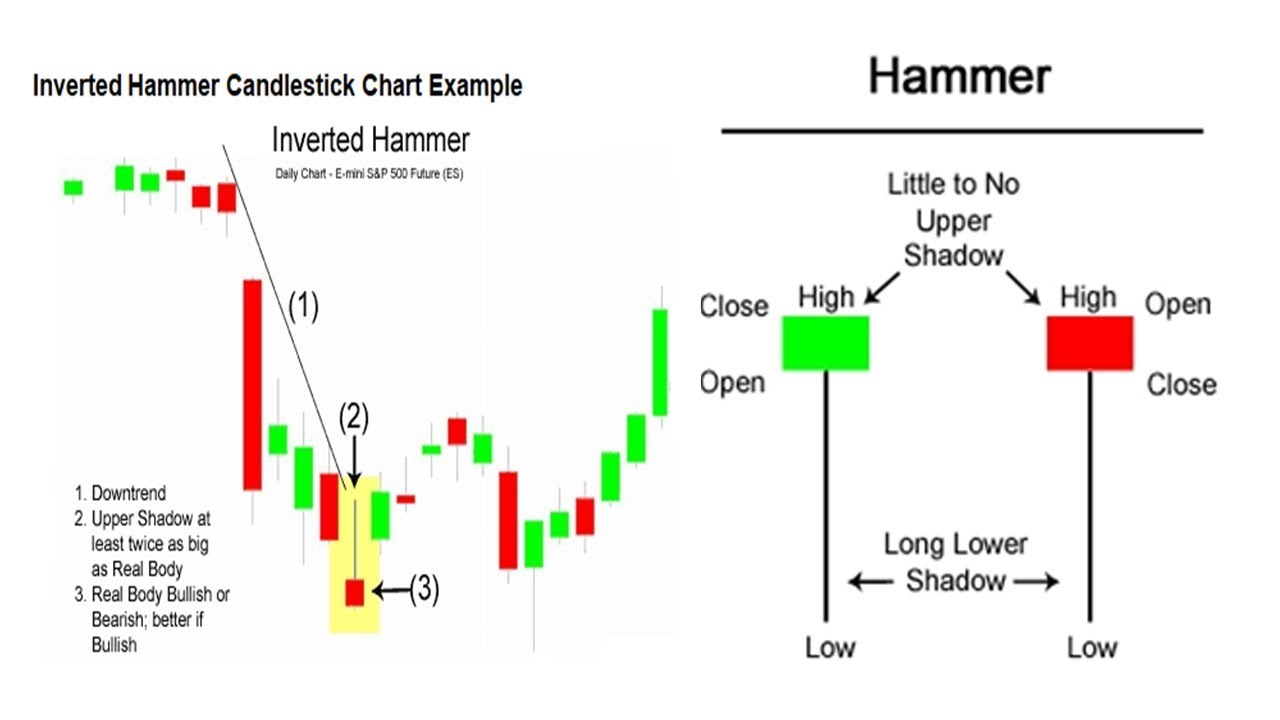

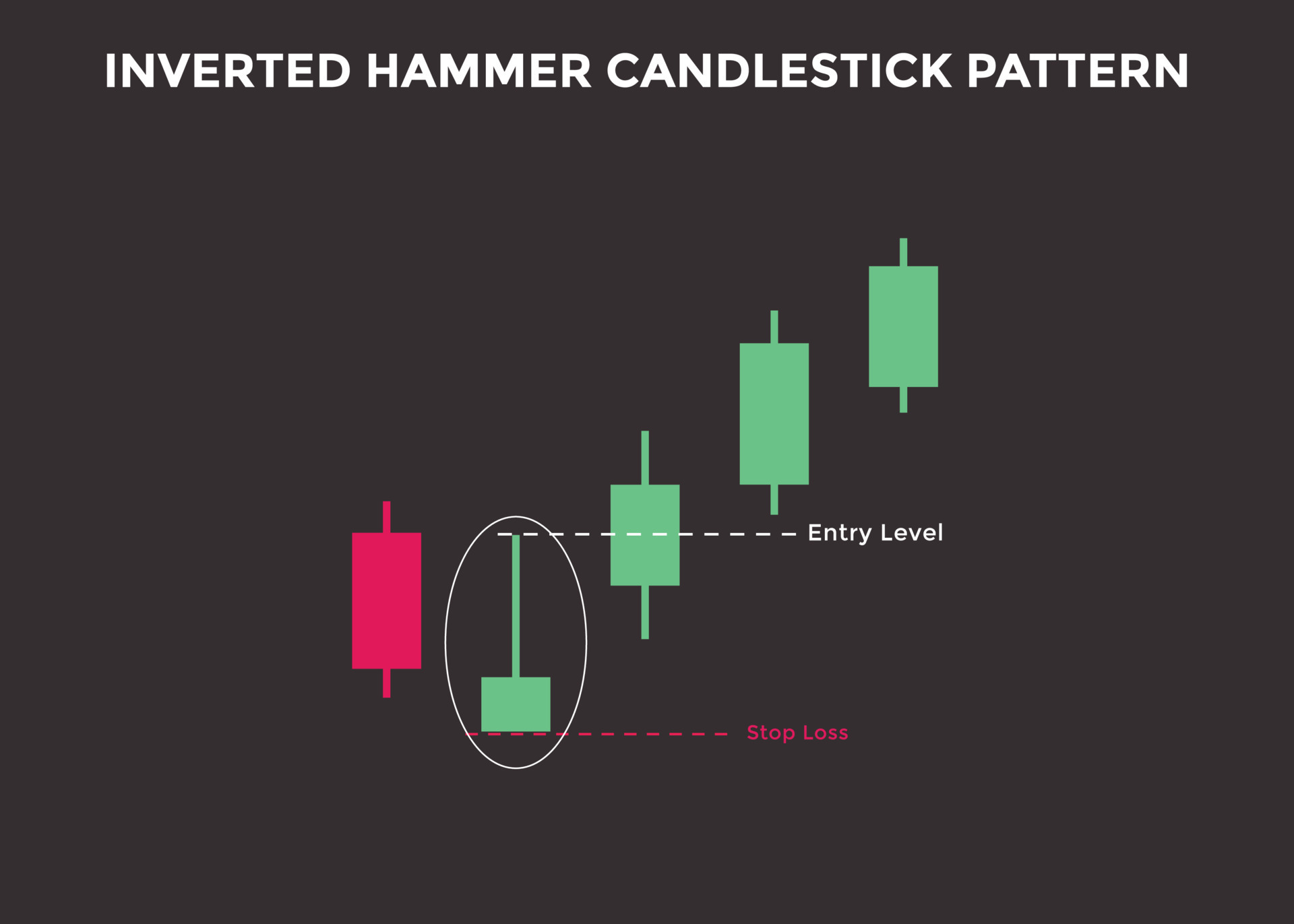

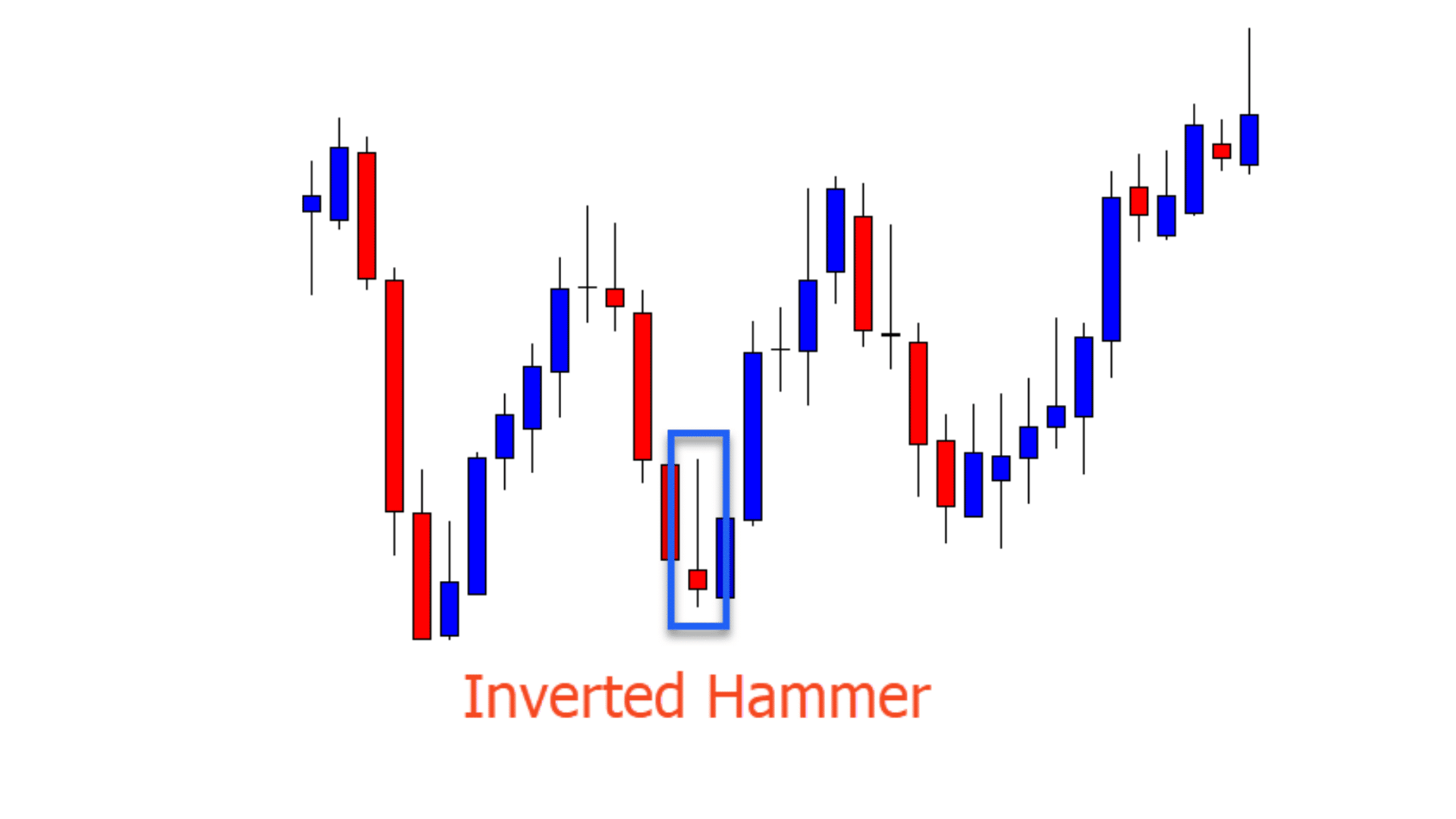

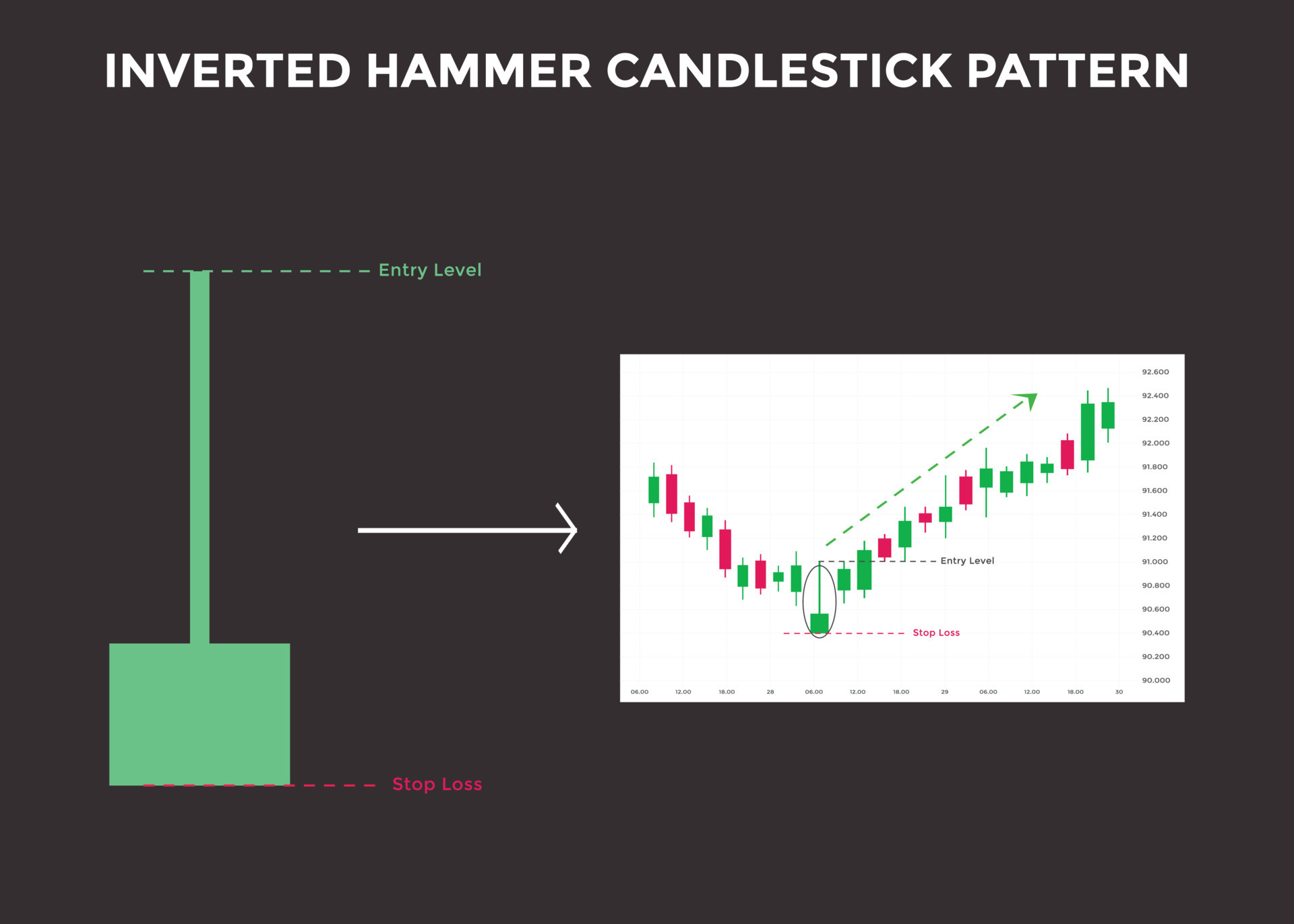

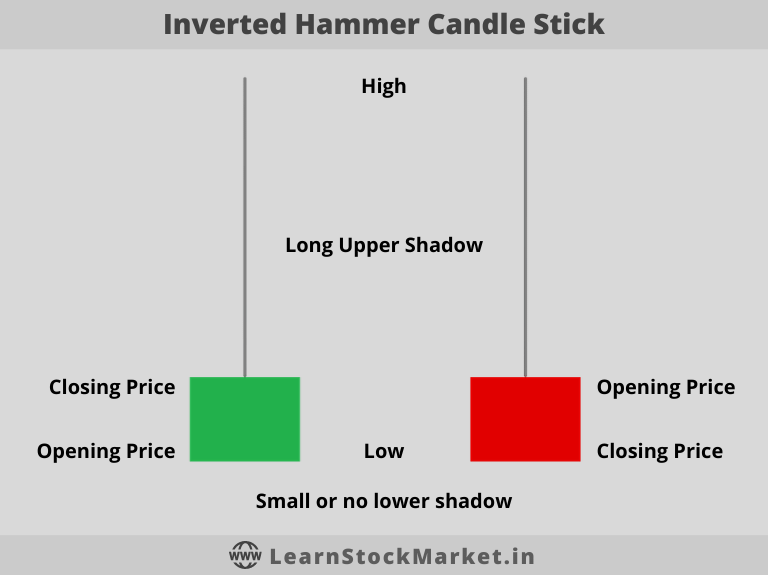

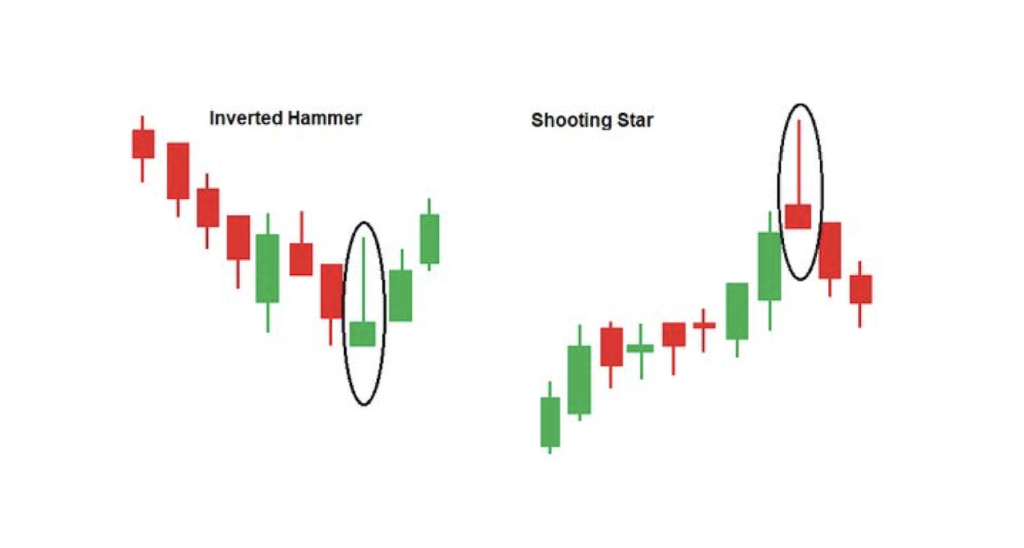

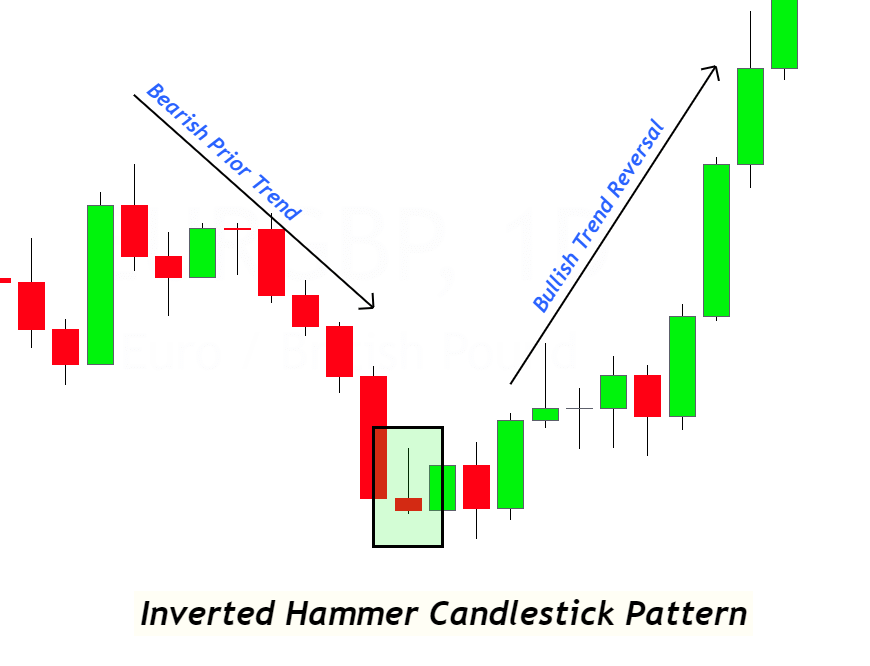

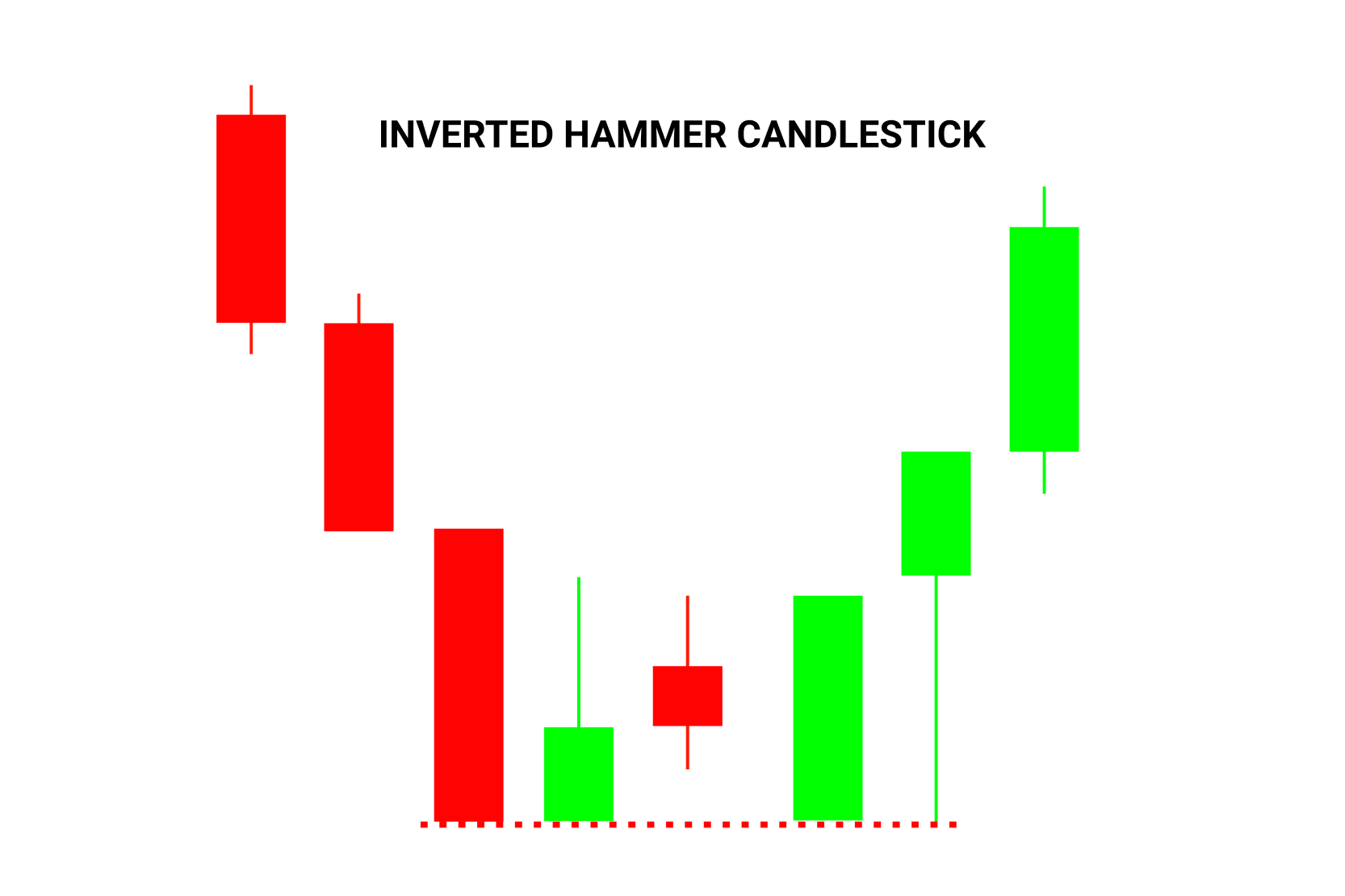

Reverse Hammer Pattern - This article will focus on the other six patterns. After a downtrend, the hammer can signal to traders that the downtrend could be over and that short positions could. Web tyrese haliburton did a little bit of everything with 20 points, six rebounds and five assists as one of six pacers to score in double figures. On the call side, the maximum open interest was seen at 23,000. Both are reversal patterns, and they occur at the bottom of a downtrend. Web considered a bullish pattern during a downtrend. Web the inverted hammer is a reversal pattern at the end of a downtrend. Web the inverted hammer candlestick pattern is a unique stock chart pattern that showcases a trend reversal. It is often referred to as a bullish pin bar, or bullish rejection candle.at its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. Other indicators such as a trendline break or confirmation candle should be used to generate a potential buy signal. The shooting star, hanging man pattern, and bearish engulfing are common bearish. Web the hammer candlestick appears at the bottom of a down trend and signals a bullish reversal. The bullish hammer pattern hints at a potential reversal of a downtrend.. Web inverted hammer is a single candle which appears when a stock is in a downtrend. The selling pressure was strong enough to reverse the uptrend. Web the inverted hammer candlestick pattern, also known as the inverted hammer candlestick formation, is a bullish reversal that forms at the bottom of downtrends. Web tyrese haliburton did a little bit of everything. Web the bearish hammer sometimes hints that buying pressure is waning and the uptrend could be ending. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. Both are reversal patterns, and they occur at the bottom of a downtrend. Web inverted hammer is a single candle which. Web bullish reversal patterns appear at the end of a downtrend and signal the price reversal to the upside. The inverted hammer candle is green in colour, and it creates a bottom. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. Web with. The inverted hammer pattern indicates that the bears initially pushed the price lower, but the bulls managed to regain control and push the price higher. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web what is the inverted hammer candlestick pattern? The shooting star, hanging man pattern,. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. This is a reversal candlestick pattern that appears at the bottom of a downtrend and signals a potential bullish reversal. On the call side, the maximum open interest was seen at 23,000. As the name implies, it has the appearance of an inverted. It signifies a shift in market sentiment from bearish to bullish and potential. This is a reversal candlestick pattern that appears at the bottom of a downtrend and signals a potential bullish reversal. To identify the hammer candlestick pattern, consider the following points: Boost your trading knowledge by learning the top 10 candlestick patterns. The hammer helps traders visualize where. It often appears at the bottom of a downtrend, signalling potential bullish reversal. Web the polar vortex circling the arctic is swirling in the wrong direction after surprise warming in the upper atmosphere triggered a major reversal event earlier this month. The geodynamics of the study. Web the inverted hammer pattern is formed at the bottom of the downtrend and. Web identifying the hammer candlestick is easy. A hammer shows that although there were selling pressures during the day, ultimately a strong buying pressure drove the price back up. The inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. Web the hammer. Web some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. As to its appearance, the inverted hammer has a small body that’s found in the lower half of the range, with a long wick to the upside. As such, the market is considered to initiate a bullish trend after forming the pattern. The inverted hammer. The bullish hammer pattern hints at a potential reversal of a downtrend. Web the inverted hammer is a reversal pattern at the end of a downtrend. Web some examples of bullish candles are the hammer, inverted hammer, and bullish engulfing patterns. The inverted hammer pattern indicates that the bears initially pushed the price lower, but the bulls managed to regain control and push the price higher. Web a downtrend has been apparent in utz brands (utz) lately. To identify the hammer candlestick pattern, consider the following points: The pattern signals that bears are losing their grip on the market, and bulls are starting to take control. Web it is important to note that the inverted pattern is a warning of potential price change, not a signal, by itself, to buy. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. The candle has a long lower shadow, which should be at least twice the length of the real body. Web an inverted hammer candlestick is a pattern that appears on a chart when there is a buyer’s pressure to push the price of the stocks upwards. For a complete list of bullish (and bearish) reversal patterns, see greg morris' book, candlestick charting explained. Web hammer (1) inverted hammer (1) morning star (3) bullish abandoned baby (3) the hammer and inverted hammer were covered in the article introduction to candlesticks. It is often referred to as a bullish pin bar, or bullish rejection candle.at its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase. Find the inverted hammer candlestick pattern at the bottom of a downtrend with a long upper shadow, short lower shadow, and small body. Both are reversal patterns, and they occur at the bottom of a downtrend.

Inverted Hammer Candlestick How to Trade it ForexBoat Trading

Tutorial on How to Trade the Inverted Hammer signalHammer and inverted

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

Inverted Hammer Candlestick Pattern Quick Trading Guide

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

Inverted Hammer Candlestick Pattern (Bullish Reversal)

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Bullish Inverted Hammer Candlestick Pattern ForexBee

Hammer Candlestick Pattern A Powerful Reversal Signal Forex

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Web What Is The Inverted Hammer Candlestick Pattern?

Web The Inverted Hammer Candlestick Pattern Is A Unique Stock Chart Pattern That Showcases A Trend Reversal.

As The Name Implies, It Has The Appearance Of An Inverted Hammer — A Small Body At The Lower End And A Long Upper Shadow.

Web The Inverted Hammer Candle Pattern Is Just One Of Many Candlestick Patterns Trades Should Know.

Related Post: