Reversal Patterns Cheat Sheet

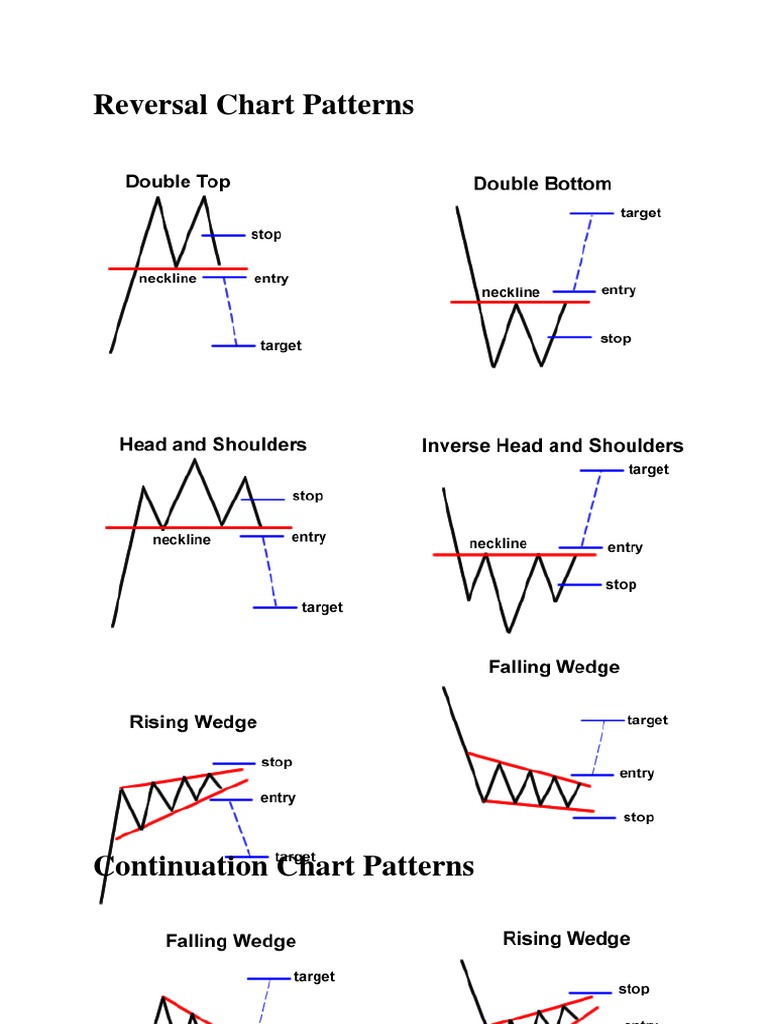

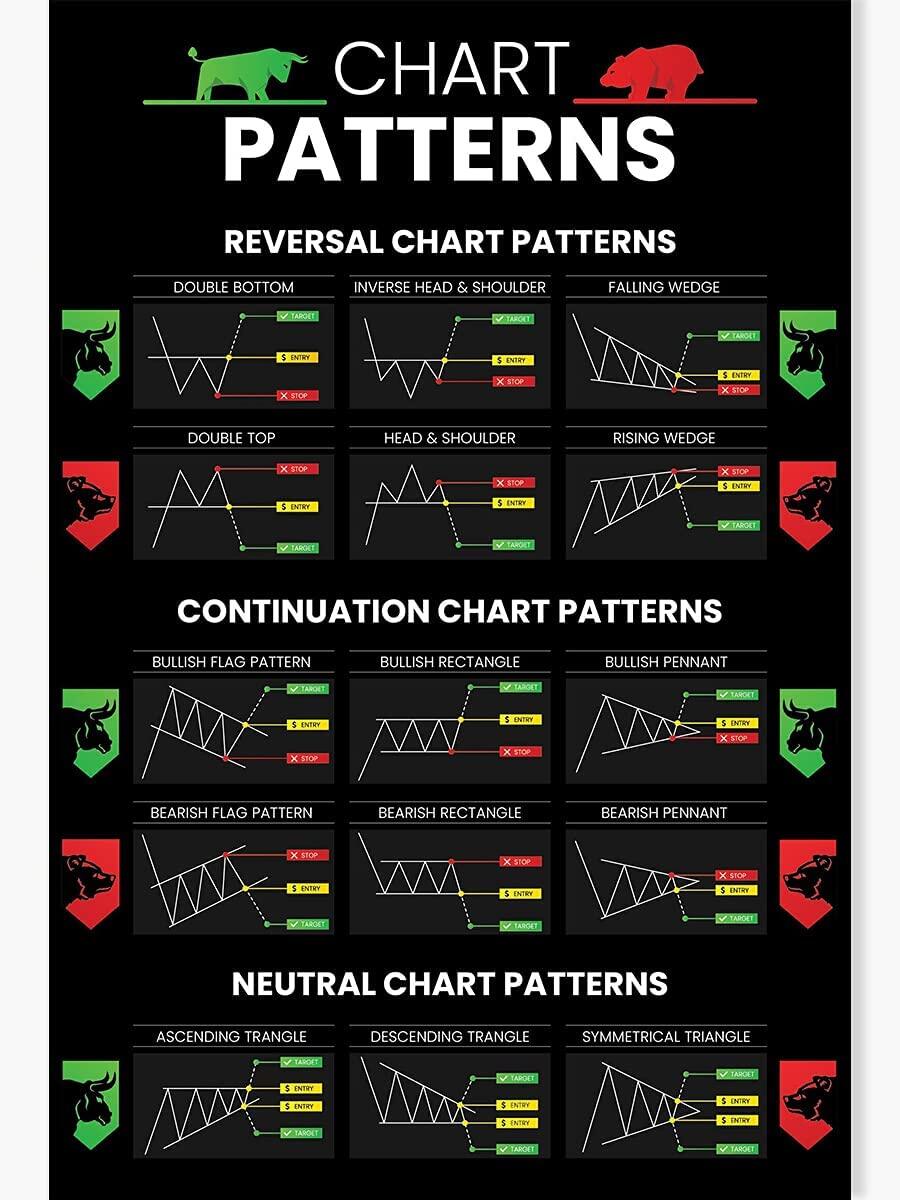

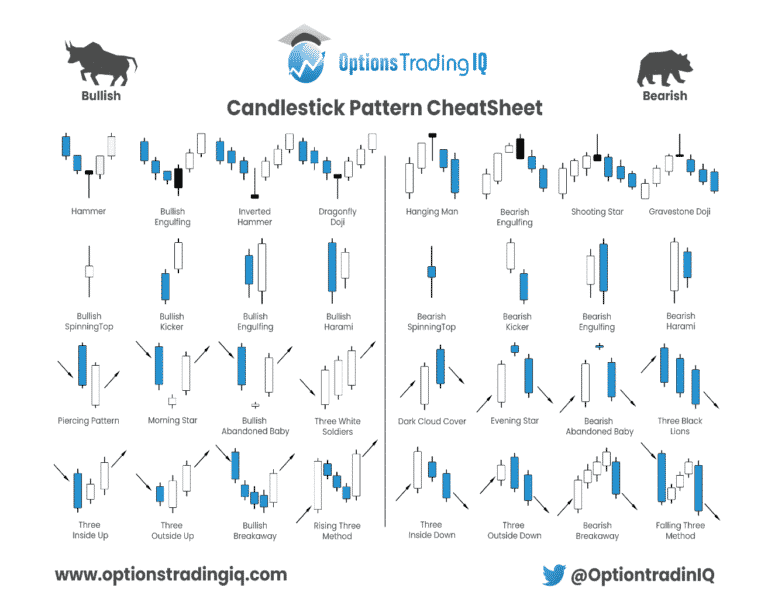

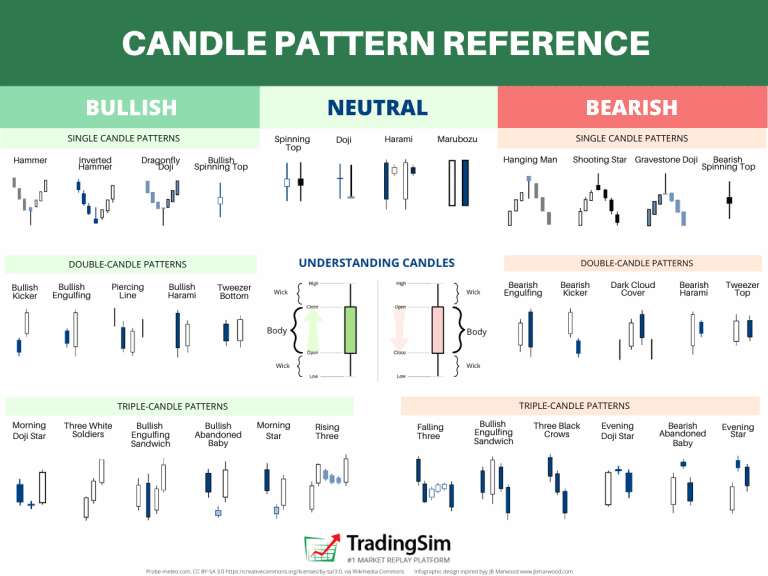

Reversal Patterns Cheat Sheet - Web bullish reversal patterns. A pattern formed during an uptrend signals a trend reversal where the price will head. Traders know that the keys to successful market trend identification lie in. Web these patterns serve to indicate that the ongoing trend is about to change the course. I'll explain what each reversal. Web reversal patterns indicate a change in the direction, or the reverse of a stock’s price trend. Web there are three types of chart patterns, which include reversal, continuation, and bilateral chart patterns. Web in this article, we'll explore: Web reversal candlestick patterns indicate price may soon reverse and change direction. O(n), where n is the number of digits in the integer. Web reversal patterns are those chart formations that signal that the ongoing trend is about to change course. Examples include head and shoulders, double tops and bottoms, and trend line breaks. All reversal chart patterns like the hammer, hanging man, and morning/evening star formations. A pattern formed during an uptrend signals a trend reversal where the price will head. Web. Web these patterns serve to indicate that the ongoing trend is about to change the course. The head and shoulders pattern is a bearish reversal pattern consisting of. Web here's a quick cheat sheet for some common chart patterns: As the name suggests, reversal patterns signal a shift in the trend direction. How to find high probability bearish reversal setups. O(n), where n is the number of digits in the integer. They are chart patterns that signal a trader about a change in an existing trend. Examples of reversal patterns include double top and double bottoms. Web there are three types of chart patterns, which include reversal, continuation, and bilateral chart patterns. I'll explain what each reversal. These chart patterns are decided based on. Web reversal patterns indicate a change in the direction, or the reverse of a stock’s price trend. Web here's a quick cheat sheet for some common chart patterns: O(n), where n is the number of digits in the integer. Web there are three types of chart patterns, which include reversal, continuation, and bilateral. Web reversal patterns indicate a change in the direction, or the reverse of a stock’s price trend. Web in this article, we'll explore: Web reversal candlestick patterns indicate price may soon reverse and change direction. The head and shoulders pattern is a bearish reversal pattern consisting of. Web the hammer is another reversal pattern that is identical to the the. The only difference is the context. Web these patterns serve to indicate that the ongoing trend is about to change the course. Examples of reversal patterns include double top and double bottoms. They signify periods where the bulls and bears could not. Examples include head and shoulders, double tops and bottoms, and trend line breaks. Web reversal patterns bullish triple bottom triple top cup & handle inverted cup & handle ascending triangle descending triangle bullish symmetrical triangle bearish. The head and shoulders pattern is a bearish reversal pattern consisting of. How to find high probability bearish reversal setups. These chart patterns are decided based on. Web chart pattern forms during type of signal next move; Web reversal patterns indicate a change in the direction, or the reverse of a stock’s price trend. The hammer occurs at the end of a selloff,. O(n), where n is the number of digits in the integer. Now, the only difference is that advanced. Web these patterns serve to indicate that the ongoing trend is about to change the course. Now, the only difference is that advanced. If a reversal chart pattern forms during an uptrend, it hints that the. O(n), where n is the number of digits in the integer. Web chart pattern forms during type of signal next move; The hammer occurs at the end of a selloff,. All reversal chart patterns like the hammer, hanging man, and morning/evening star formations. I'll explain what each reversal. Understand the differences between reversal patterns, signaling trend shifts, and. O(n), where n is the number of digits in the integer. These chart patterns are decided based on. Understand the differences between reversal patterns, signaling trend shifts, and. How to find high probability bearish reversal setups. Web here's a quick cheat sheet for some common chart patterns: Web reversal patterns bullish triple bottom triple top cup & handle inverted cup & handle ascending triangle descending triangle bullish symmetrical triangle bearish. Web there are three types of chart patterns, which include reversal, continuation, and bilateral chart patterns. Web in this article, we'll explore: They are chart patterns that signal a trader about a change in an existing trend. Examples include head and shoulders, double tops and bottoms, and trend line breaks. If a reversal chart pattern forms during an uptrend, it hints that the. O(n), where n is the number of digits in the integer. Web chart pattern forms during type of signal next move; Web learn what makes up chart patterns and master how to identify them. Web these patterns serve to indicate that the ongoing trend is about to change the course. All reversal chart patterns like the hammer, hanging man, and morning/evening star formations. Web bearish reversal candlestick patterns. Web essential reversal patterns cheat sheet guide.

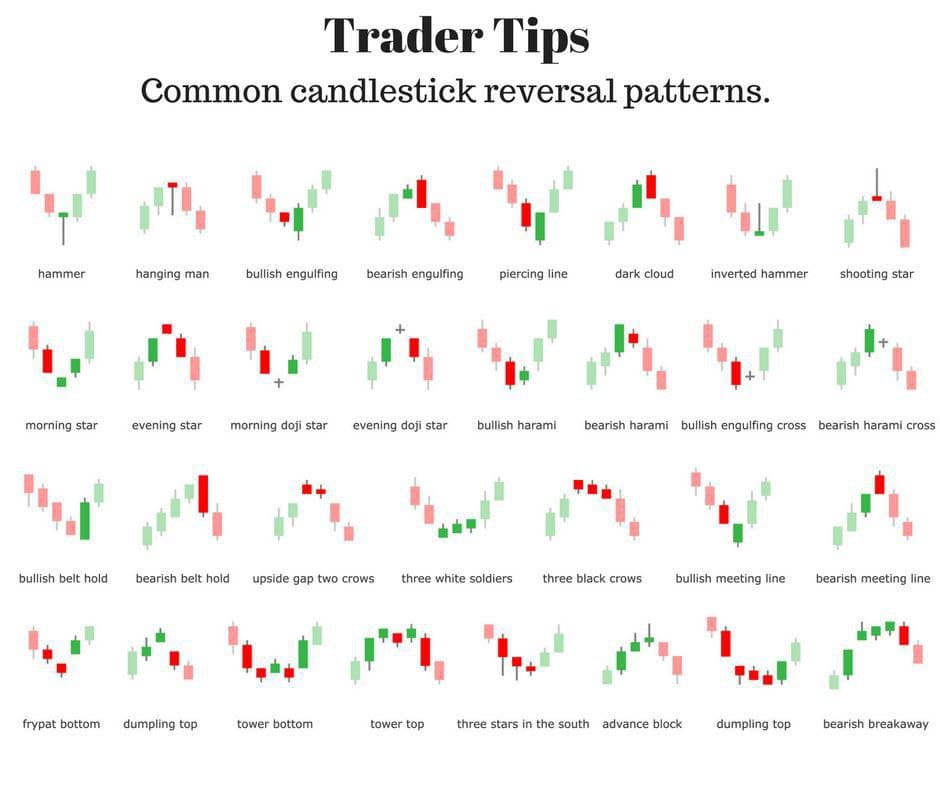

Candlestick Patterns Trading for Traders Poster Reversal Continuation

Candlestick Reversal Patterns Cheat Sheet

Cheat Sheet Candlestick Patterns PDF Free

Centiza Candlestick Patterns Trading for Traders Poster

CandlestickReversalandContinuationPatterns TRESORFX

REVERSAL PATTERNS Technical Chart Analysis 101

What are Reversal Patterns and their Types? Espresso Bootcamp

Candlestick Reversal Patterns Cheat Sheet Pdf Candle Stick Trading My

Trader Tips Common candlestick reversal patterns Profit Myntra

Reversal Chart Patterns

These Chart Patterns Are Decided Based On.

Traders Know That The Keys To Successful Market Trend Identification Lie In.

Now, The Only Difference Is That Advanced.

Web There Are 12 Reversal Candlestick Patterns Cheat Sheet So Far That Are Used In Technical Analysis To Predict A Trend Reversal.

Related Post: