Response Letter To Irs Template

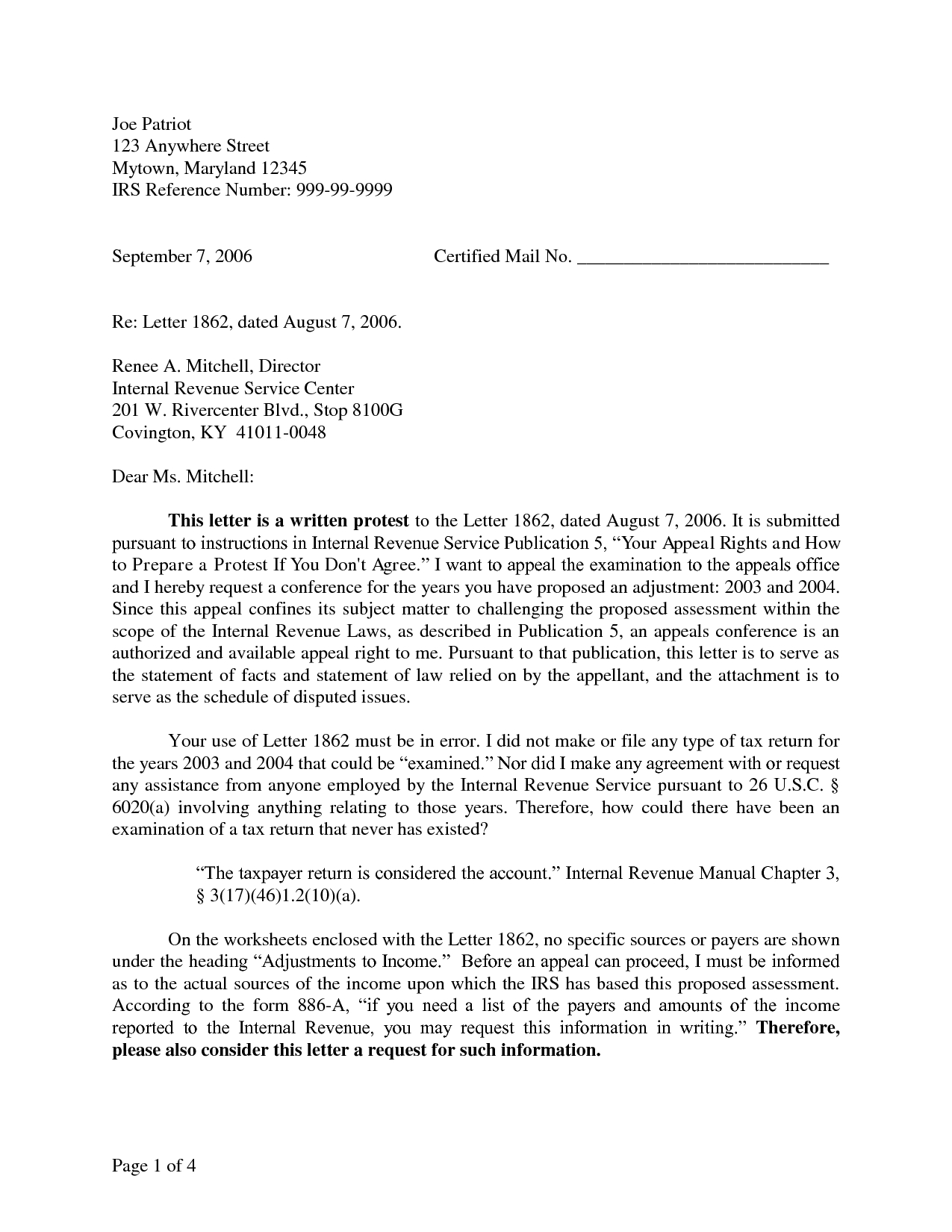

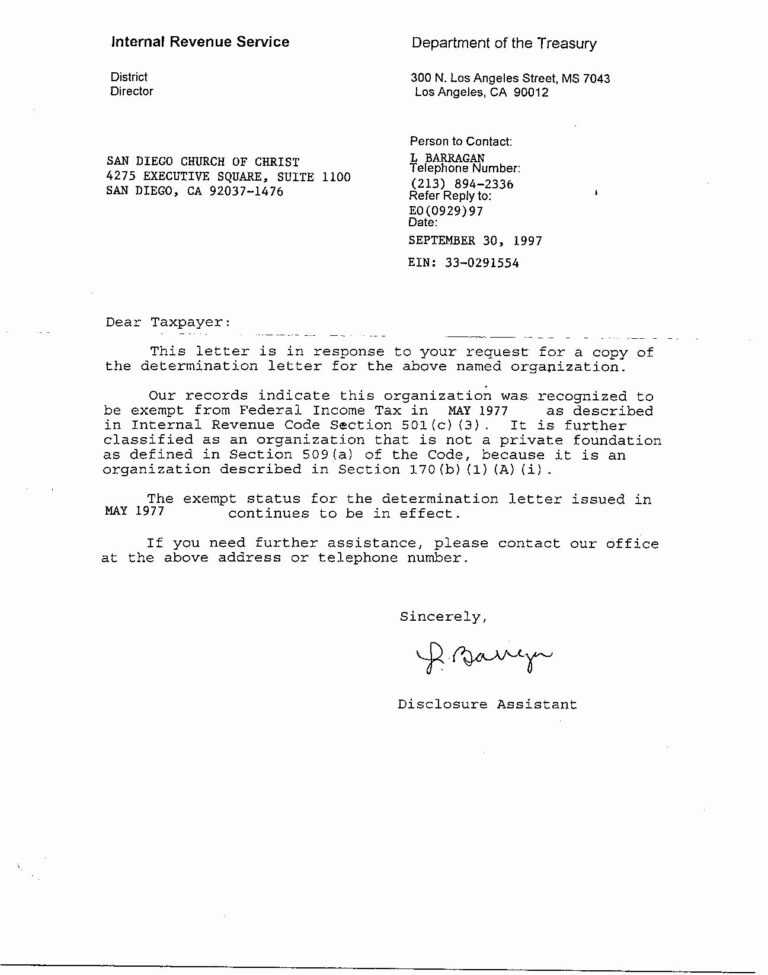

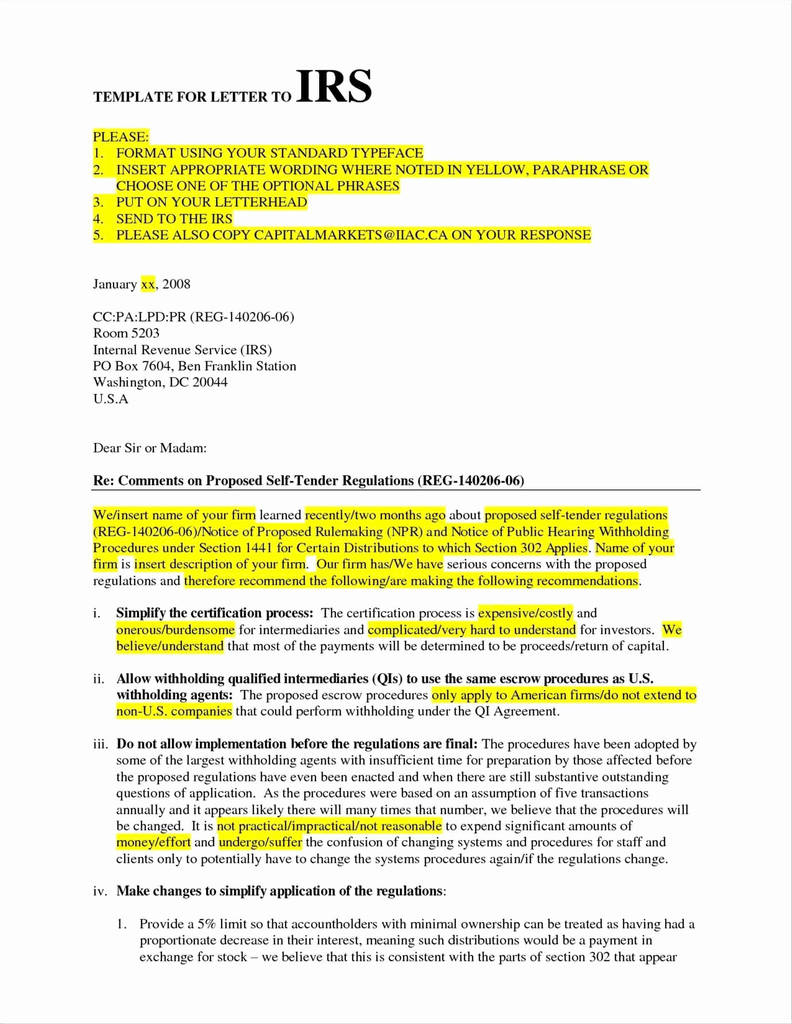

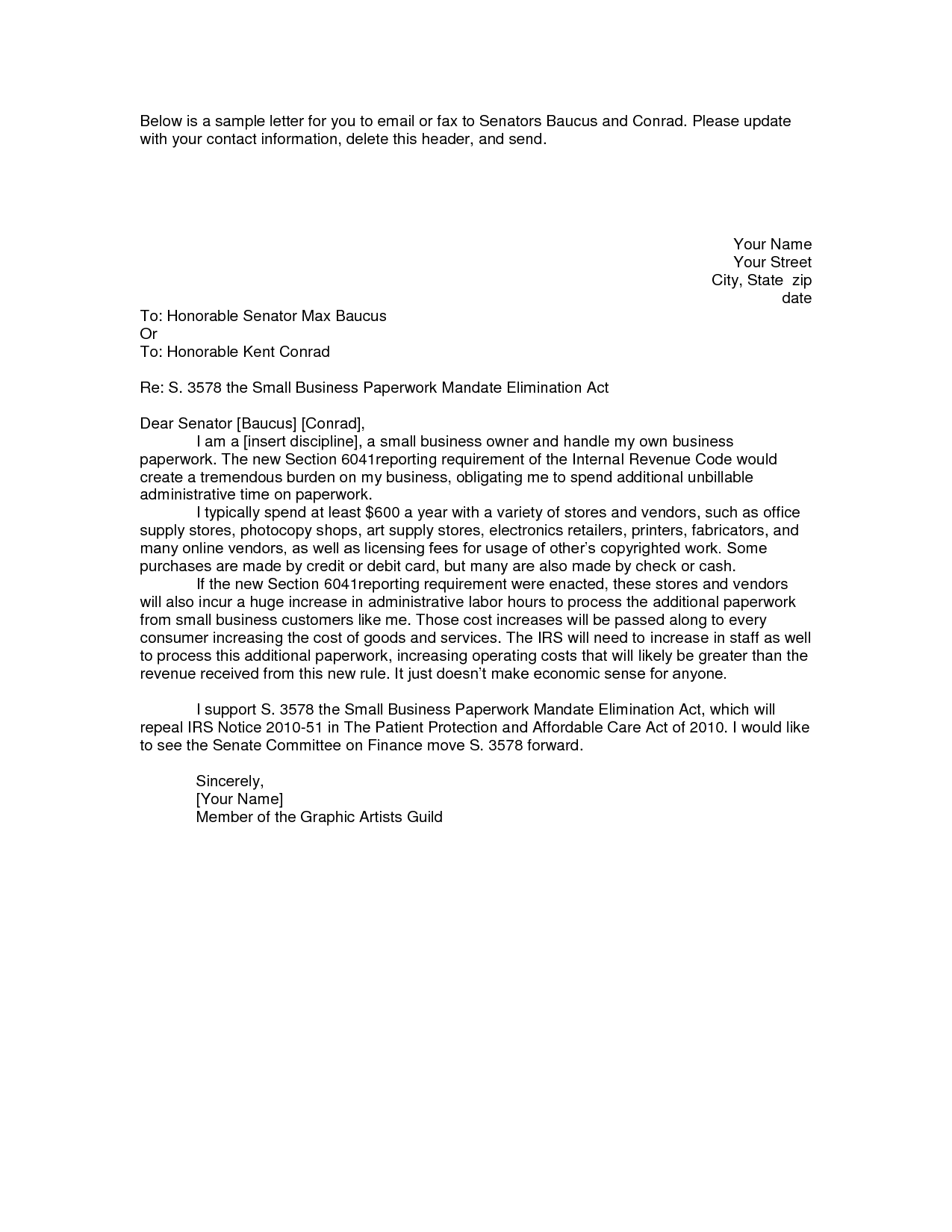

Response Letter To Irs Template - Open a blank word processing document and set the font to something readable, such as times new roman 12 point. Your letter will contain specific instructions for how to reply. Web fill out the template. Make note of any specific information or documents being requested. Web letter to the irs template. Web when the irs needs to ask a question about a taxpayer's tax return, notify them about a change to their account, or request a payment, the agency often mails a letter or notice to the taxpayer. Sample letter to the irs template. Save on finance charges and resolve tax disputes effectively. Responding to a request for information. Web an irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. A response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically to add items of unreported or incorrectly reported income. Sample letter to the irs template. Web if you’ve received an irs letter that requires a reply: Web fill. Web if you’ve received an irs letter that requires a reply: Sample letter to the irs template. A response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically to add items of unreported or incorrectly reported income. Getting mail. Responding to a request for information. Make note of any specific information or documents being requested. Once you draft your letter, you can sign, print, and download it for mailing. Web when the irs needs to ask a question about a taxpayer's tax return, notify them about a change to their account, or request a payment, the agency often mails. Web if you’ve received an irs letter that requires a reply: First read the letter in its entirety. Sample letter to the irs template. Once you draft your letter, you can sign, print, and download it for mailing. Your letter will contain specific instructions for how to reply. Your letter will contain specific instructions for how to reply. Open a blank word processing document and set the font to something readable, such as times new roman 12 point. Web fill out the template. Web an irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either. Learn how to write a persuasive letter to the irs to request a waiver of penalties. Web an irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Open a blank word processing document and set the font. Make note of any specific information or documents being requested. Open a blank word processing document and set the font to something readable, such as times new roman 12 point. (many of the links in this article redirect to a specific reviewed product. Responding to a request for information. Learn how to write a persuasive letter to the irs to. Save on finance charges and resolve tax disputes effectively. Make note of any specific information or documents being requested. Web letter to the irs template. Web fill out the template. Your letter will contain specific instructions for how to reply. (many of the links in this article redirect to a specific reviewed product. Web an irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Web letter to the irs template. Sample letter to the irs template. Web. Web letter to the irs template. Sample letter to the irs template. Learn how to write a persuasive letter to the irs to request a waiver of penalties. A response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically. Web an irs penalty response letter is a document used to file a request with the irs that a penalty levied against a taxpayer, either an individual or a business, be reduced or canceled. Web fill out the template. Responding to a request for information. Save on finance charges and resolve tax disputes effectively. Sample letter to the irs template. First read the letter in its entirety. (many of the links in this article redirect to a specific reviewed product. Getting mail from the irs is not a cause for panic but, it should not be ignored either. Web if you’ve received an irs letter that requires a reply: Once you draft your letter, you can sign, print, and download it for mailing. Make note of any specific information or documents being requested. A response to irs notice letter is a document used by a taxpayer, either an individual or a business, to respond to an irs proposing an adjustment to a tax return, specifically to add items of unreported or incorrectly reported income. Your letter will contain specific instructions for how to reply.

Response Letter To Irs Template

IRS Letter 915 What It Means and How To Respond To It SuperMoney

Irs Response Letter Template Best Template Ideas

Irs Cp2000 Response Form Pdf Lovely Ss 4 Irs Notification With Irs

IRS Audit Letter CP134B Sample 1

IRS Response Letter Template Federal Government Of The United States

Letter Template For Irs Response Why You Should Not Go To Letter

Sample Letter To Irs Free Printable Documents

Free Response to IRS Notice Make & Download Rocket Lawyer

IRS Notice CP215 Notice of Penalty Charge H&R Block

Open A Blank Word Processing Document And Set The Font To Something Readable, Such As Times New Roman 12 Point.

Web When The Irs Needs To Ask A Question About A Taxpayer's Tax Return, Notify Them About A Change To Their Account, Or Request A Payment, The Agency Often Mails A Letter Or Notice To The Taxpayer.

Web Letter To The Irs Template.

Learn How To Write A Persuasive Letter To The Irs To Request A Waiver Of Penalties.

Related Post: