Rental Property Proforma Template Excel

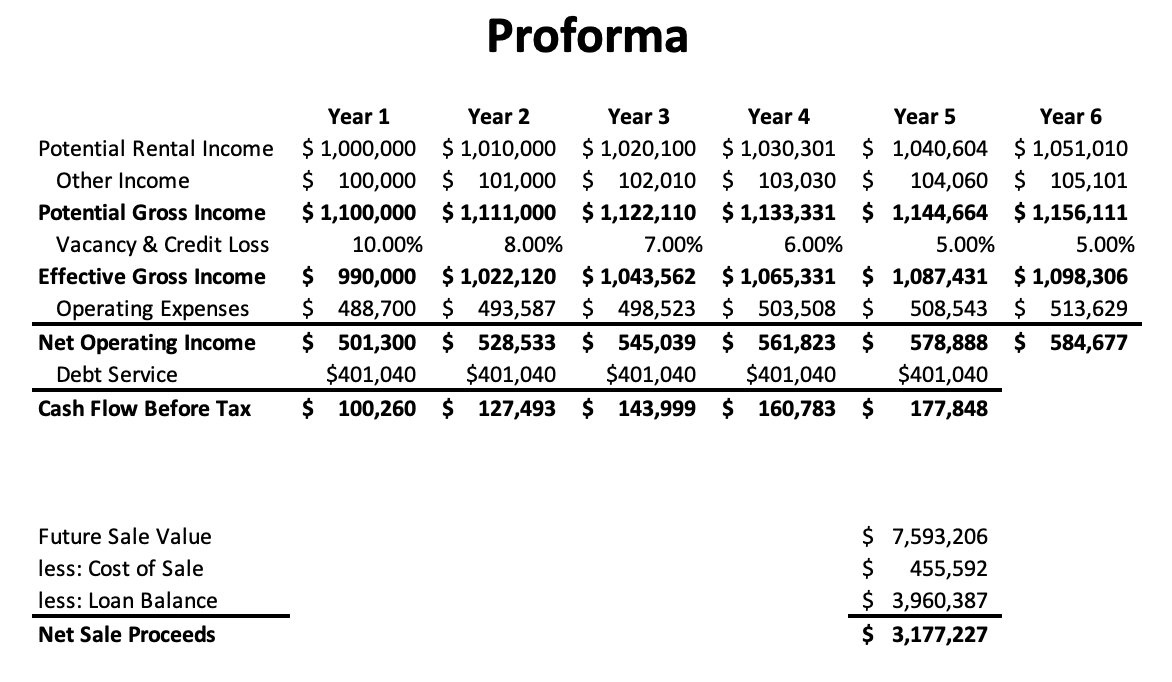

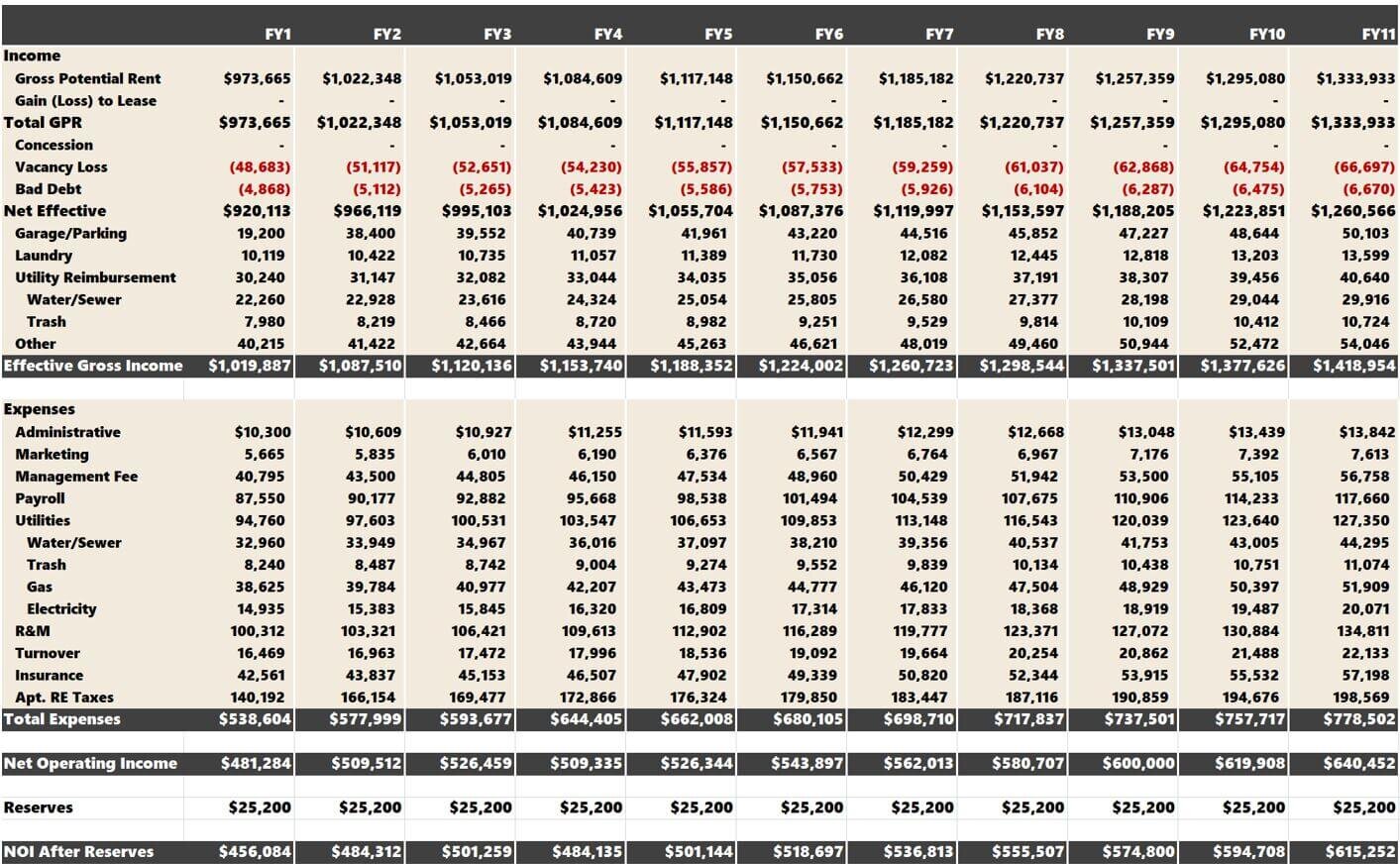

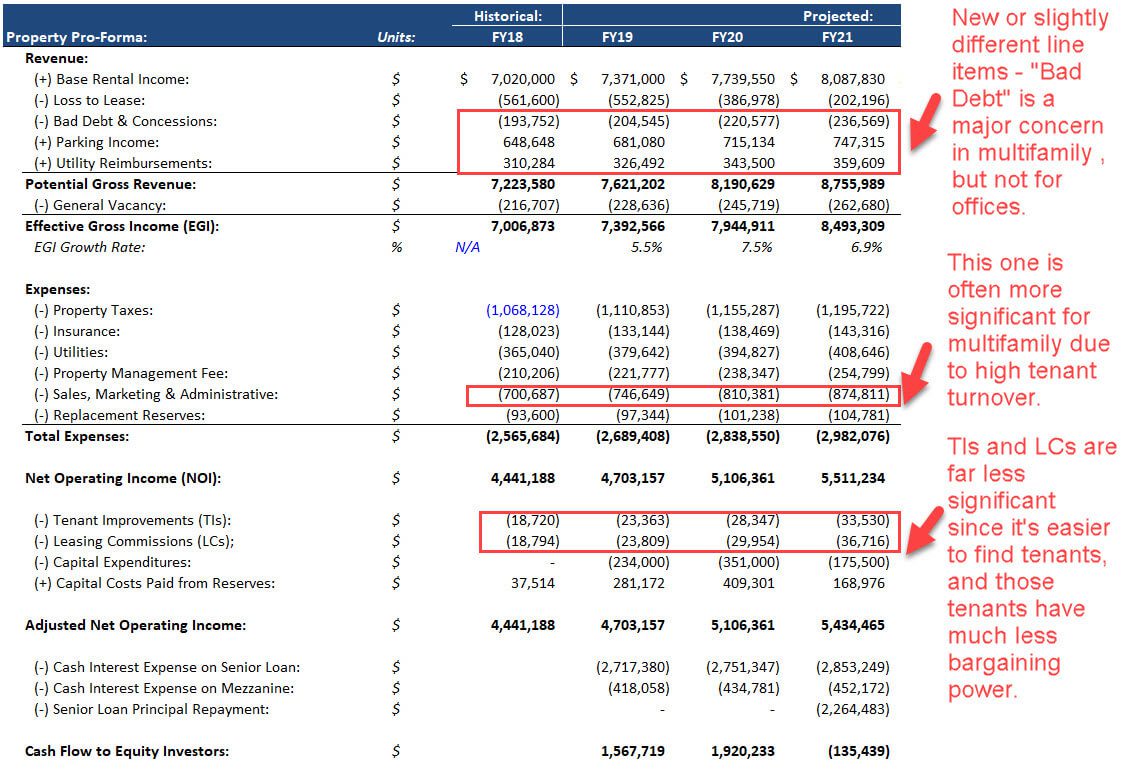

Rental Property Proforma Template Excel - $3,223 = 100% * $240,000 * 1.34%. It helps real estate investors track monthly, quarterly, or yearly income, expenses, and taxes. Repairs at 5% = $75. It is not intended for use in financing through equity syndications, which requires more complex analysis. It also shows the present value of those profits for each year, adjusted for inflation and rent increases. By analyzing these elements, investors can assess the property’s net operating income. To determine the fair market value of a rental property you can employ various estimation techniques. Our team provides both excel and google sheets for download. The template will multiply today's tax rate (1.34%) by the projected upcoming assessment. Gross monthly rental income, operating expenses, net operating income, and pretax net income. Web the proforma calculates the cumulative wealth that a property is projected to gain (or lose) over a ten year period, based on the data a user inputs in the decision sheet. Future taxes payable = reassessment % * price * tax rate. Web this template allows for the following: These financial spreadsheets use data and numbers to determine whether. Future taxes payable = reassessment % * price * tax rate. It also includes financial ratios, internal rate of return (irr), net present value (npv), and a summary tab for quick. Real estate investors have a wide variety of tools at their disposal to help determine the market value of a house: Property management fees at 8% = $120. The. Web enodo now offers a free version of its industry leading commercial real estate investment analysis spreadsheet for multifamily rental properties. Web there are four important items that must be included in a buyer’s pro forma. Create pro forma income statements, pro forma balance sheets, and pro forma cash flow statements. The four items include, repairs, vacancy loss, property management,. Web there are 4 main sections of information on a rental property income statement: Web enodo now offers a free version of its industry leading commercial real estate investment analysis spreadsheet for multifamily rental properties. Web here’s how to create a basic monthly pro forma for real estate: Web to create your own property analysis spreadsheet follow these four key. Even if the property you are buying has been newly renovated, expect to set aside money every month for repairs and maintenance. To download the template, select the link below, select file at the top left corner of the page, select download, and choose microsoft excel. Repairs at 5% = $75. A rental spreadsheet provides professional clarity and makes management. Eliminate the need to build complex, custom excel modeling templates, and perform a detailed cash flow analysis for any apartment/multifamily property in any. It is not intended for use in financing through equity syndications, which requires more complex analysis. To determine the fair market value of a rental property you can employ various estimation techniques. Create pro forma income statements,. Property management fees at 8% = $120. By inputting key financial metrics and projections, you can create a back of the envelope financial model that can help you secure financing and make informed investment decisions. Web this reassessment percentage will determine your future property taxes payable. By analyzing these elements, investors can assess the property’s net operating income. This promotes. Vacancy loss at 5% = $75. Web a real estate proforma is a forecasting tool that helps investors evaluate the potential financial performance of a real estate investment. A spreadsheet will take the emotion out of the purchase. Repairs at 5% = $75. Even if the property you are buying has been newly renovated, expect to set aside money every. A spreadsheet will take the emotion out of the purchase. Web there are four main steps to follow when doing a rental property analysis: These financial spreadsheets use data and numbers to determine whether you will get a good financial return on the investments. Web to create your own property analysis spreadsheet follow these four key steps: Web a rental. Effective gross income = $1,425. With 24/7 access to a customizable spreadsheet, all parties involved can easily refer to crucial details such as late fees, maintenance expenses, and deposits. Web to create your own property analysis spreadsheet follow these four key steps: The value with the thick border is the estimated cumulative profit. This promotes clear communication, minimizing confusion. To determine the fair market value of a rental property you can employ various estimation techniques. This includes rental income, operational costs, maintenance, taxes, and financing costs. That way you can compare the values and create a value range of low, middle, and maximum value. You always start with potential revenue, if the property were 100% occupied and all tenants paid market rates, and then make deductions. It also includes financial ratios, internal rate of return (irr), net present value (npv), and a summary tab for quick. This promotes clear communication, minimizing confusion. Web enodo now offers a free version of its industry leading commercial real estate investment analysis spreadsheet for multifamily rental properties. Real estate investors have a wide variety of tools at their disposal to help determine the market value of a house: The first bit of data you’ll need when building your rental property analysis spreadsheet is the fair market value of the property. There are a number of methods for estimating the fair market value of a rental property. Property management fees at 8% = $120. Web here’s how to create a basic monthly pro forma for real estate: With 24/7 access to a customizable spreadsheet, all parties involved can easily refer to crucial details such as late fees, maintenance expenses, and deposits. By inputting key financial metrics and projections, you can create a back of the envelope financial model that can help you secure financing and make informed investment decisions. Download your free rental property profit and loss template. Gross monthly rental income, operating expenses, net operating income, and pretax net income.

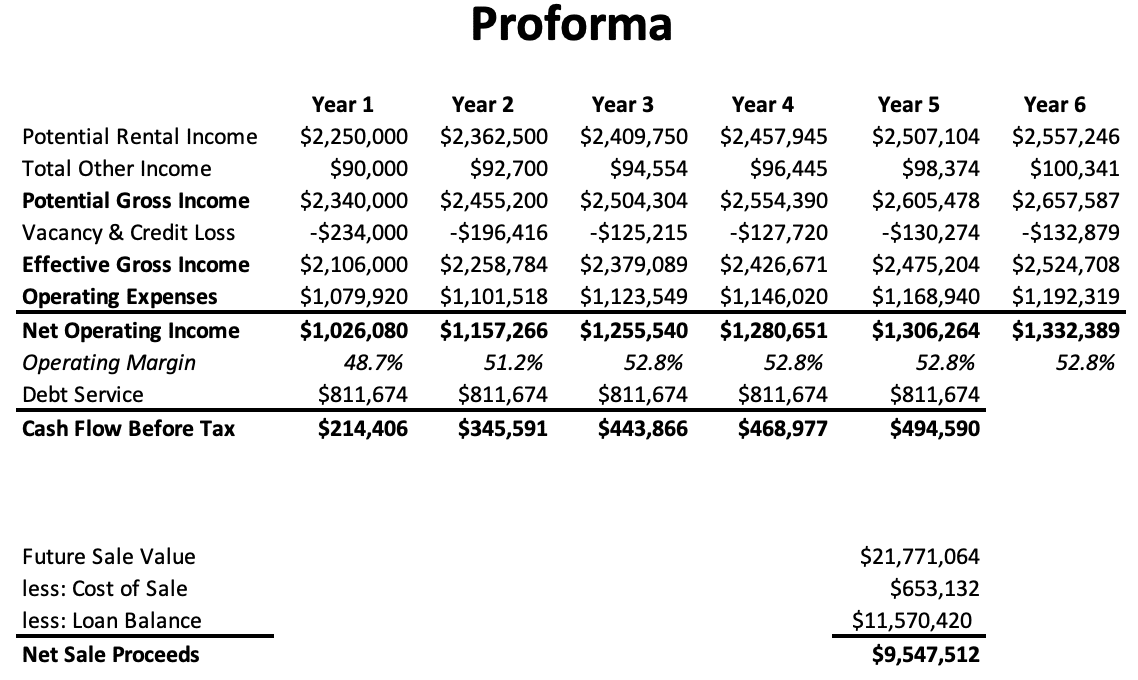

Multifamily (Apartment) Proforma Excel Template PropertyMetrics

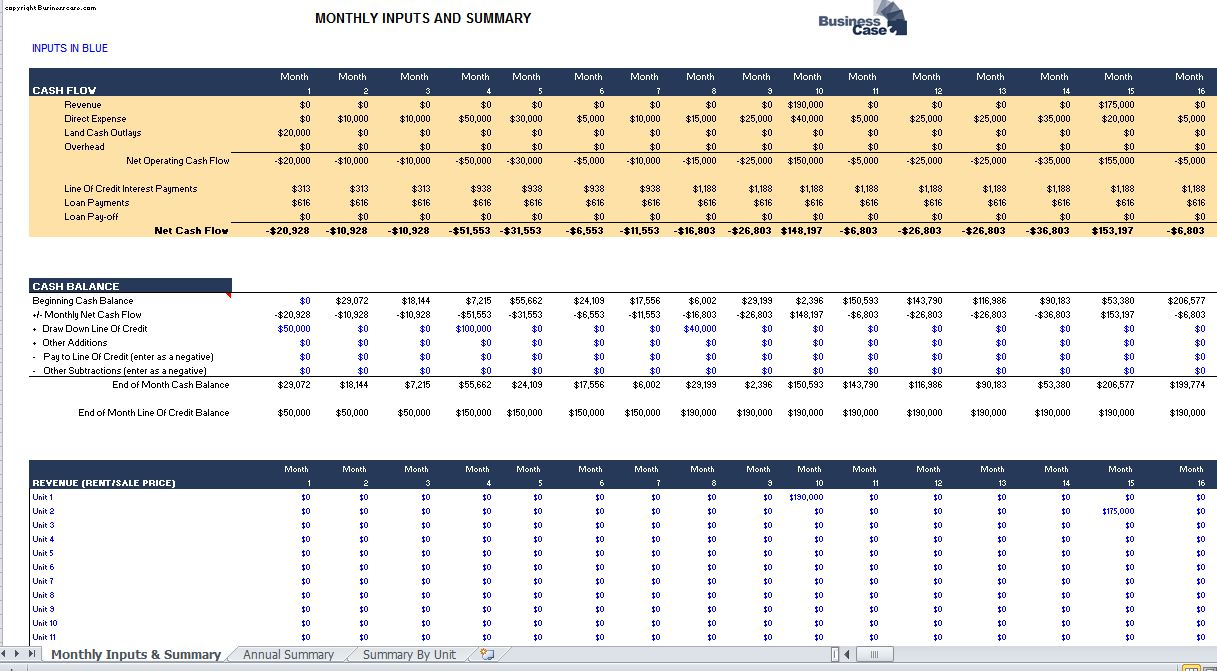

Pro Forma Excel Spreadsheet Examples Template Proforma Land and

Multifamily (Apartment) Proforma Excel Template PropertyMetrics

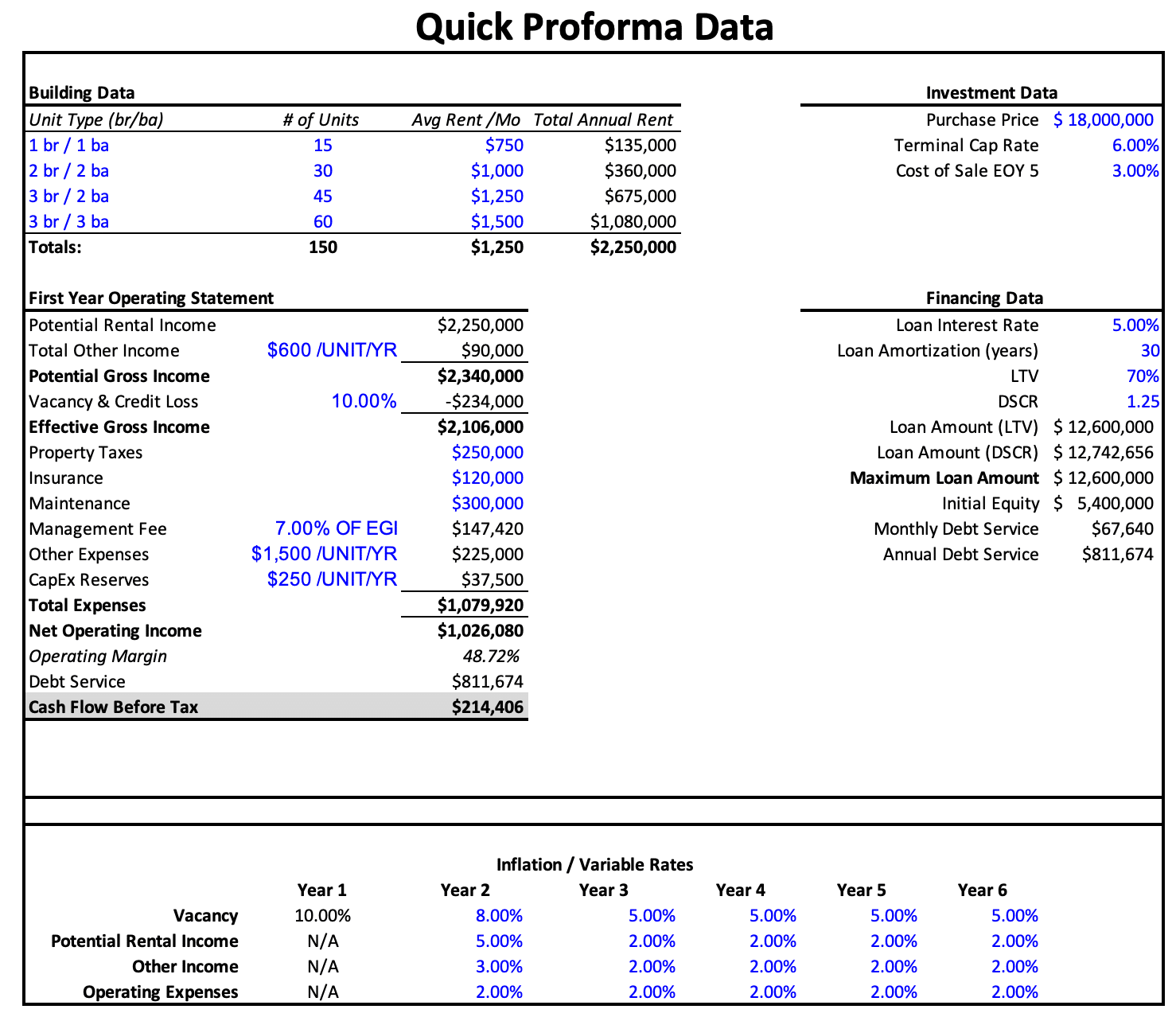

Rental Property Pro Forma Template

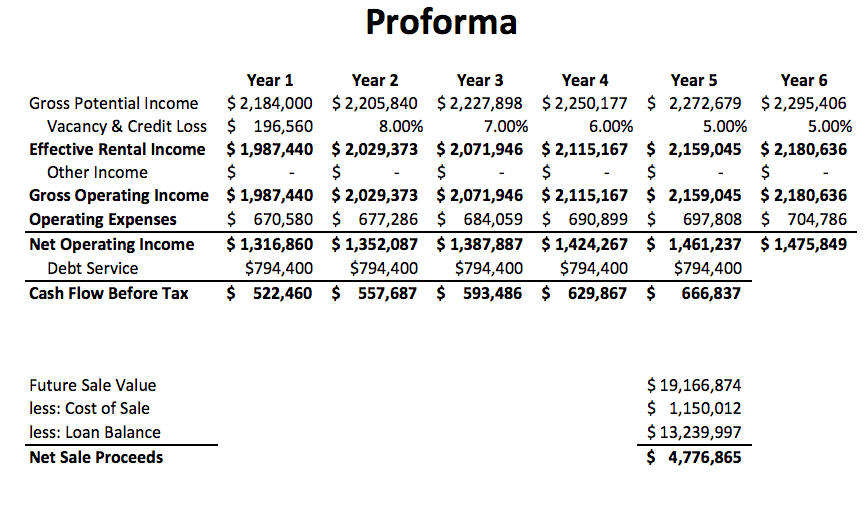

Real Estate Proforma Excel Model Template Eloquens

Real Estate ProForma Full Guide, Excel Template, and More

Real Estate Proforma Template PropertyMetrics

Multifamily (Apartment) Proforma Excel Template — Tactica Real Estate

Real Estate Proforma Excel Model Template Eloquens

Real Estate Development Pro Forma Template Excel

Repairs At 5% = $75.

Then, You List The “Capital Costs” (Similar To.

It Is Not Intended For Use In Financing Through Equity Syndications, Which Requires More Complex Analysis.

It’s A Good Idea To Use Different Techniques.

Related Post: