Qualified Income Trust Template

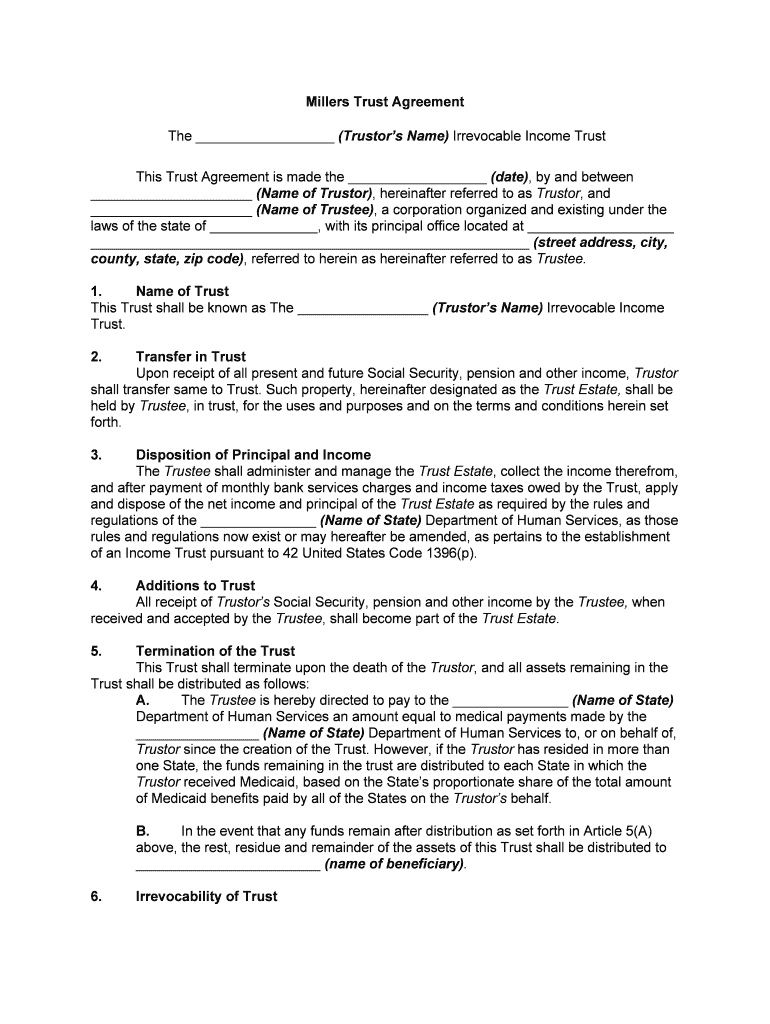

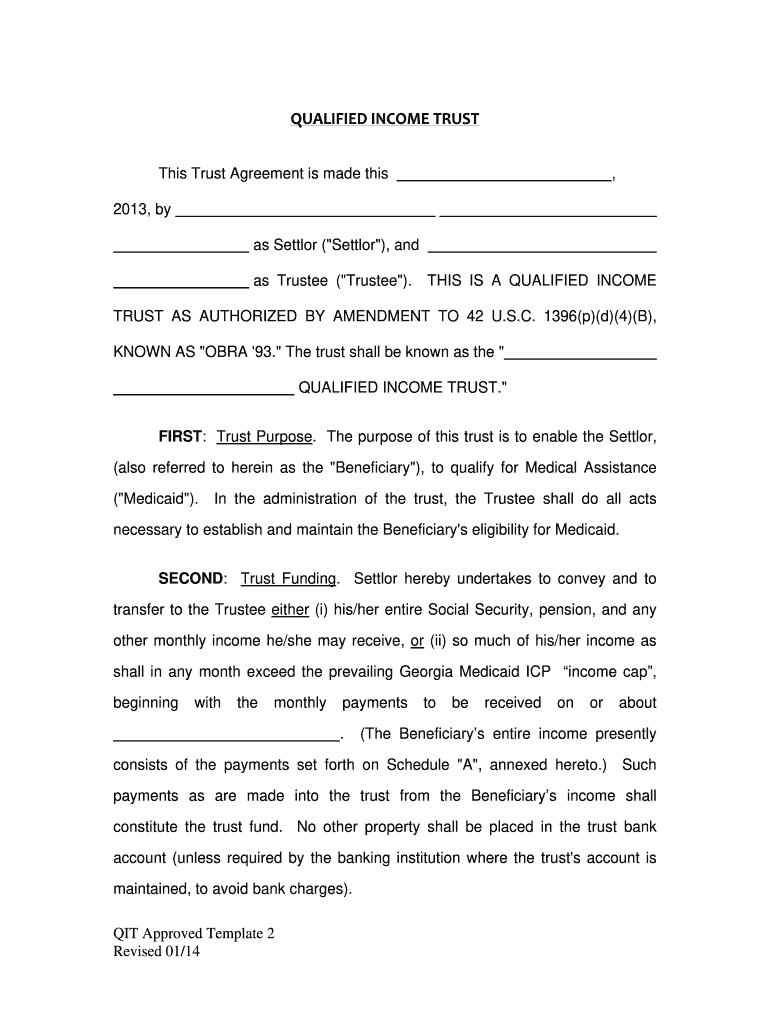

Qualified Income Trust Template - Web although the use of a qit can help when income that is above the special income limit for medicaid eligibility, a qit does not address other eligibility requirements for institutional. This trust agreement is made this , 2013, by as settlor (settlor), and. Search forms by statecustomizable formschat support availableview pricing details If you have income that exceeds. What is a qualified income trust? Information on establishing a miller trust for banks. Web qualified income trust template | medicaid. Grantor is establishing this qualified income trust in order for grantor to qualify for medicaid assistance under florida’s institutional care program. Web health insurance medicaid & medicare. Composed by legal hotline for texans • last updated. Web overview of qualified income trusts : Web you can find the qualified income trust template which includes the qit form and certification of trust document on the ohio department of medicaid’s website. You can find it on the ohio department of medicaid’s website at. What is a qualified income trust? To qualify for medicaid long term care, you or. Web basic information about the use of a qualified income trust (qit) (sometimes referred to as a miller trust) to establish income eligibility for managed long term services and. Web qualified income trust information sheet. Search forms by statecustomizable formschat support availableview pricing details It is to help people applying for medicaid and their attorneys and provides. Web qualified income. What is a qualified income trust (qit)? Web overview of qualified income trusts : Here are seven things to know before creating one. Web this irrevocable qualified income trust agreement is made this __ day of____, 20____ by _____, by _____, attorney in fact for _____, (hereinafter, the “grantor), whose. This article explains qualified income trusts (qits) in texas. Qualified income trust, certification of. Web health insurance medicaid & medicare. Web a qualified income trust (qit), also known as a “miller trust,” is a legal arrangement that can help you become or remain eligible for medicaid. In order to receive medicaid long. This article explains qualified income trusts (qits) in texas. Information on establishing a miller trust for banks. This is a qualified income. Web the texas health and human services commission (hhsc) offers this information. Web although the use of a qit can help when income that is above the special income limit for medicaid eligibility, a qit does not address other eligibility requirements for institutional. It is to help. To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. Web the texas health and human services commission (hhsc) offers this information. This trust agreement is made this , 2013, by as settlor (settlor), and. What medicaid applicants need to tell a bank when. Composed by legal hotline for. Web a qualified income trust, or miller trust, is a trust (a special bank account) that allows individuals to qualify for tenncare choices benefits when their monthly income is too. What is a qualified income trust? Web overview of qualified income trusts : This is a qualified income. Web you can find the qualified income trust template which includes the. Web although the use of a qit can help when income that is above the special income limit for medicaid eligibility, a qit does not address other eligibility requirements for institutional. Web health insurance medicaid & medicare. To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. Web the. Web qualified income trust miller trust template. It is to help people applying for medicaid and their attorneys and provides. If you have gross income of more than $2,829 a month, and you want medicaid benefits to pay for long term care, you will need a qualified income. Web health insurance medicaid & medicare. Search forms by statecustomizable formschat support. Web the texas health and human services commission (hhsc) offers this information. Web health insurance medicaid & medicare. What is a qualified income trust (qit)? To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. In order to receive medicaid long. Web _______________________qualified income trust (miller trust) [name of beneficiary] _________________________ [name of settlor] hereby creates a trust, to. Web you can find the qualified income trust template which includes the qit form and certification of trust document on the ohio department of medicaid’s website. In order to receive medicaid long. Web qualified income trust template | medicaid. Estimated miller trusts needed per county. Information on establishing a miller trust for banks. Web not everyone will benefit from a qualified income trust (which is also commonly referred to as a “miller trust”). Composed by legal hotline for texans • last updated. Web although the use of a qit can help when income that is above the special income limit for medicaid eligibility, a qit does not address other eligibility requirements for institutional. Web the texas health and human services commission (hhsc) offers this information. A qualified income trust (qit), also known as a miller trust, is a special legal arrangement for holding a. To qualify for medicaid long term care, you or your loved one must meet certain financial requirements, including an income limit. Web qualified income trust miller trust template. What is a qualified income trust? Here are seven things to know before creating one. Web a qualified income trust (qit), also known as a “miller trust,” is a legal arrangement that can help you become or remain eligible for medicaid.

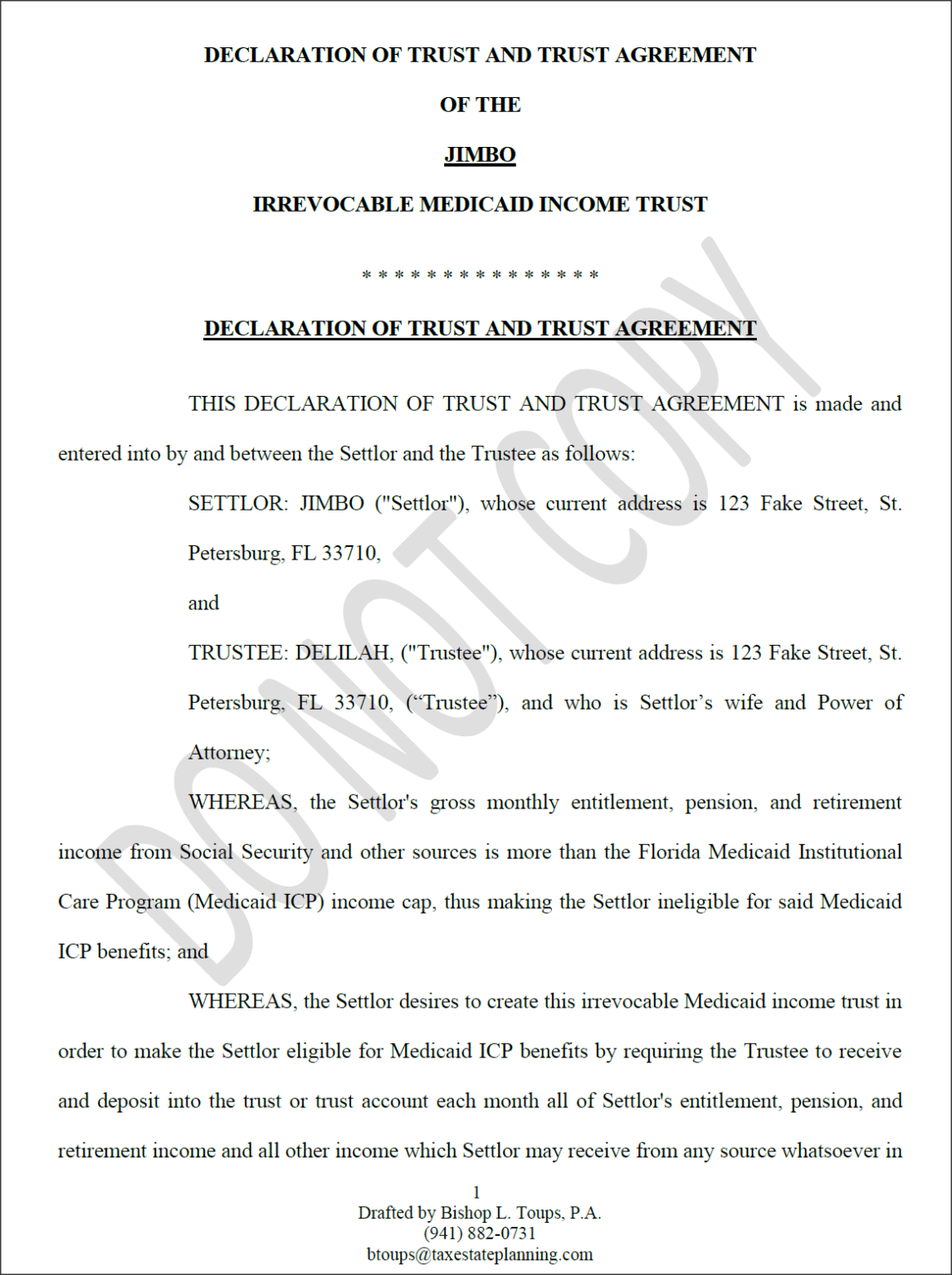

QIT What is a Florida Medicaid Qualified Trust?

Does a Qualified Trust File a Tax Return airSlate SignNow

Resolución 34 169 DE 17 DE Diciembre DE 1979 Acnudh Alto Comisionado de

Florida Qualified Trust Template Fill Online, Printable

Qualified Miller Trust Fill and Sign Printable Template Online

Tennessee Qualified Trust Form Fill Online, Printable

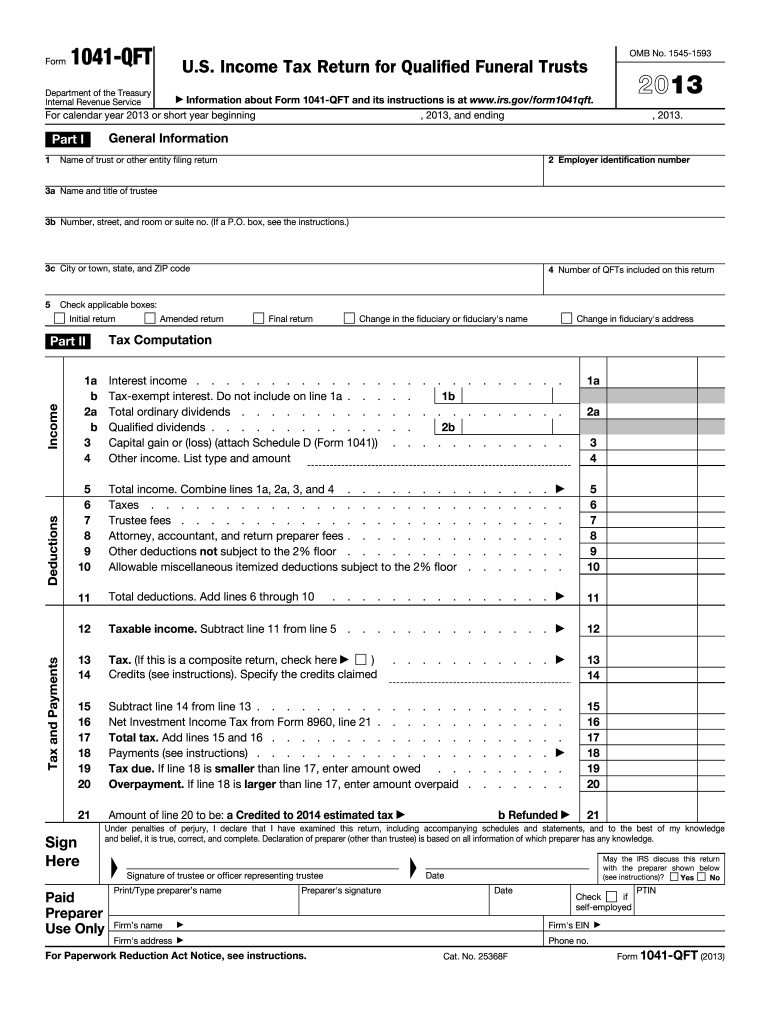

Form 1041 QFT U S Tax Return for Qualified Funeral Trusts Fill

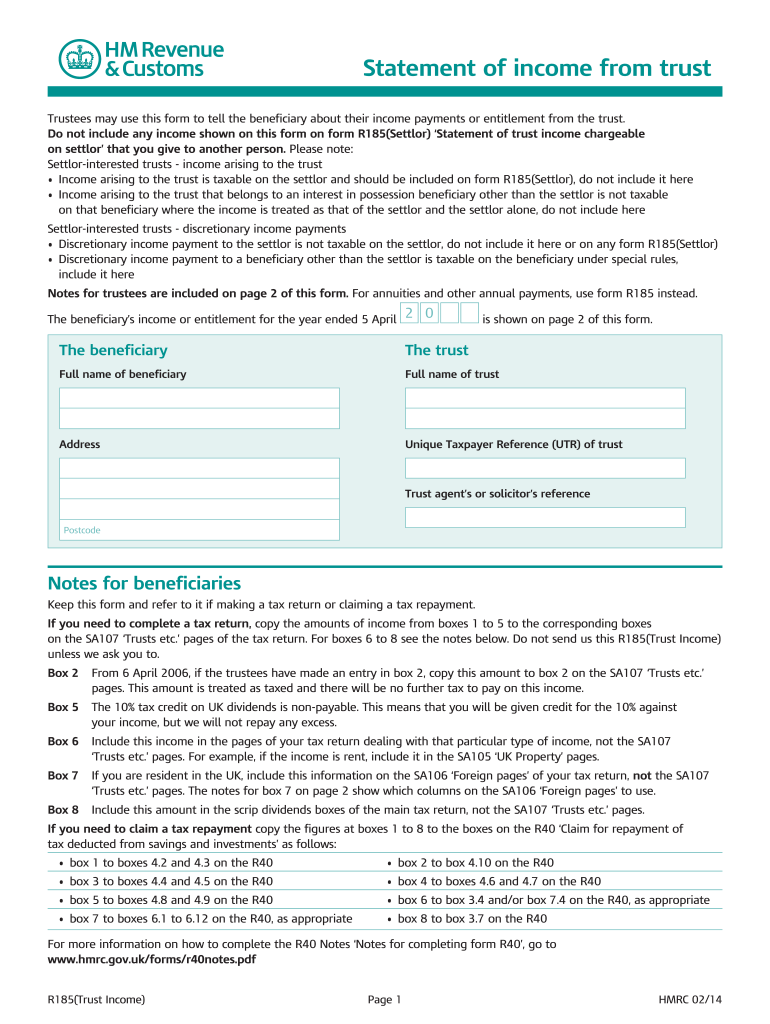

R185 Trust Form Fill Out and Sign Printable PDF Template

Fillable Online icew Qualified Trust Form. qualified

Qualified Trust Form Fill Online, Printable, Fillable

Web A Miller Trust (Also Known As A Qualified Income Trust) Is Designed To Own Income In Order For An Individual To Get Around Medicaid’s Income Caps.

Web Basic Information About The Use Of A Qualified Income Trust (Qit) (Sometimes Referred To As A Miller Trust) To Establish Income Eligibility For Managed Long Term Services And.

It Is To Help People Applying For Medicaid And Their Attorneys And Provides.

Web Qualified Income Trust Information Sheet.

Related Post: