Promissory Note Template Ohio

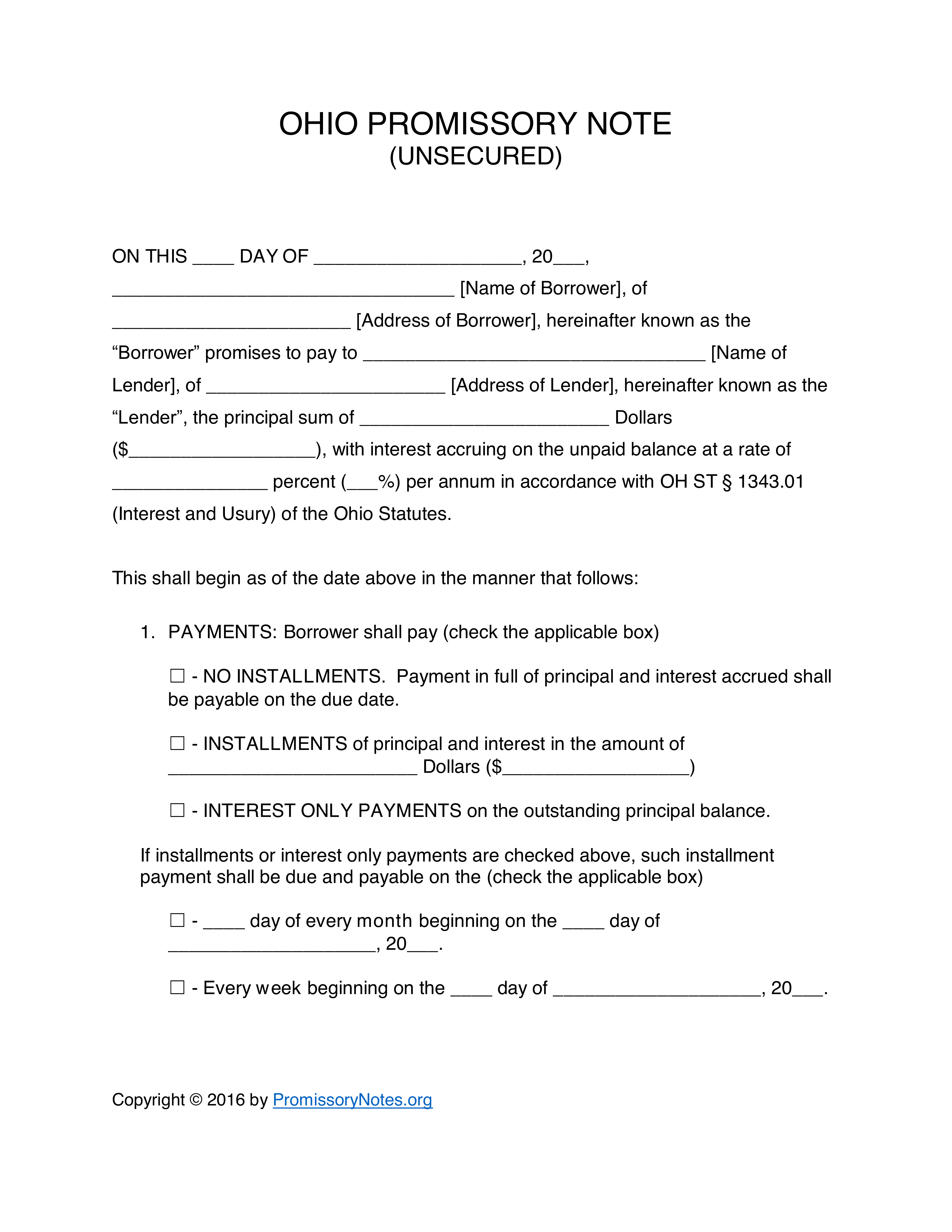

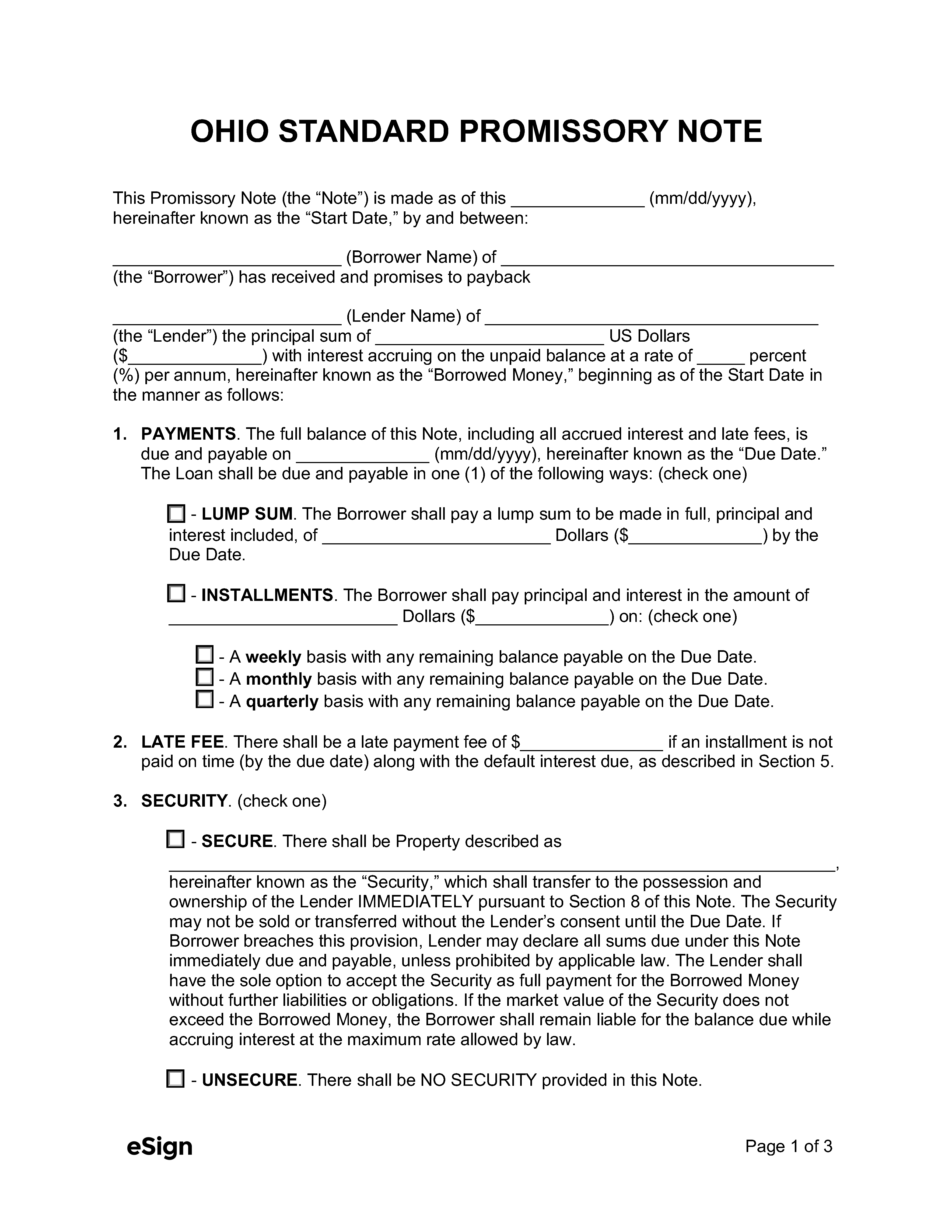

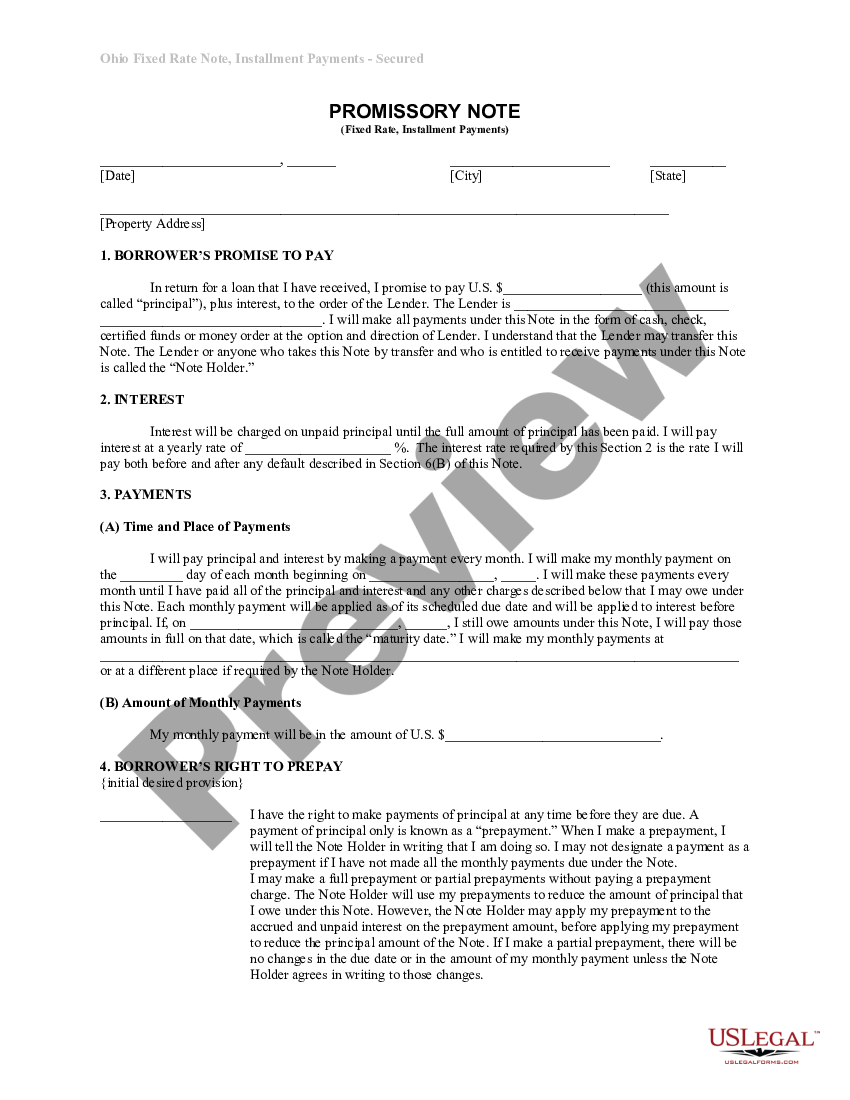

Promissory Note Template Ohio - This note is unsecured, meaning the lender does not receive security if the borrower fails to recover after entering into default. Web an ohio unsecured promissory note is a legal document that formalizes a loan agreement without demanding collateral from the borrower. The most common form of a secured promissory note is a car loan. This note shall be governed under the laws in the state of ohio. An unsecured promissory note is a signature loan. Download a free ohio promissory note form on our site, customized to your liking based on the type of loan. Ohio standard promissory note template Web a secured ohio promissory note provides the lender with the ability to collect collateral if the borrower does not pay as promised. This document is essentially a promise to repay a specific principal sum of money within a determined due date. Web an ohio secured promissory note is a legal agreement in which a borrower pledges valuable assets like real estate, vehicles, or investment accounts as collateral to guarantee loan repayment. No limit if loan > $100,000: Use this free simple promissory note template in ohio when processing and. The most common form of a secured promissory note is a car loan. What is an ohio promissory note used for? ☐this is an unsecured note. Once signed by all parties, it becomes. This note shall be governed under the laws in the state of ohio. Within the template, the borrower promises to return the money to the lender either at an agreed time or when requested by the lender. Web the borrower executes this note as a principal and not as a surety. Create and. This note shall be governed under the laws in the state of ohio. This promissory note (the “note”) is made as of [mm/dd/yyyy], hereinafter known as the “start date,” by and between: The good news is that you don't have to create a promissory note from scratch. Web an ohio secured promissory note is a legal agreement in which a. Download a free ohio promissory note form on our site, customized to your liking based on the type of loan. This arrangement places a higher risk on the lender, as there is no security. Web in ohio, a promissory note is a document that functions as an enforceable agreement between two parties: Web terms of this note. ☐this is an. An ohio promissory note template is a legal promise stating a borrower of a monetary balance will repay a loaned amount back to the lender with the addition of interest in a timely and orderly manner. Web a promissory note template in ohio is a document used to outline the terms and conditions of a loan or debt between two. Web in ohio, a promissory note is a document that functions as an enforceable agreement between two parties: What is an ohio promissory note used for? No limit if loan > $100,000: Waiver by lender of a breach or violation of any provision of this note shall not constitute a waiver of any other subsequent breach or violation. No limit. Web ohio promissory note templates. ☐this is an unsecured note. Web ☐this is a secured note. The good news is that you don't have to create a promissory note from scratch. Once signed by all parties, it becomes. What is an ohio promissory note used for? No limit if agreed upon: Web this note or the exercise of any rights held under this note unless such waiver is made expressly and in writing. Should you want to lend or borrow money, think about using a promissory note. An unsecured promissory note is a signature loan. This document is essentially a promise to repay a specific principal sum of money within a determined due date. Learn how to draft your own promise to pay letter using our simple promissory note examples. When the signatures of all parties have been recorded in the document it will be legally binding. The good news is that you don't have. A borrower and a lender. Web a promissory note outlines the terms of a loan agreement. Learn how to draft your own promise to pay letter using our simple promissory note examples. Web in ohio, a promissory note is a document that functions as an enforceable agreement between two parties: An ohio promissory note acts. If the borrower does not comply with the terms, the lender repossesses the vehicle. In the event that any of the provisions of this note are held to An ohio promissory note is similar to an iou, just fancier. Web a promissory note template in ohio is a document used to outline the terms and conditions of a loan or debt between two parties. This collateral is usually of equal value to the money borrowed. No limit if loan > $100,000: An unsecured promissory note is a signature loan. It's a pact between two entities in which one borrows funds from the other while vowing. Ohio standard promissory note template Web the borrower executes this note as a principal and not as a surety. It specifies the interest rate, total repayment amount, and payment frequency to ensure clear communication of the terms. The borrower executes this note as a principal and not as a surety. The good news is that you don't have to create a promissory note from scratch. Create and print online now. The most common form of a secured promissory note is a car loan. If the borrower defaults, the.

Fillable Form Ohio Promissory Note Installment PDFRun

Free Ohio Promissory Note Form Template

Free Ohio Promissory Note Template PDF Word

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-32.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-18.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![Ohio Promissory Note Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/03/Ohio-Unsecured-Promissory-Note-Templates.Legal_-1448x2048.jpg)

Ohio Promissory Note Templates (Free) [Word, PDF, ODT]

Cincinnati Ohio Installments Fixed Rate Promissory Note Secured by

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-25.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![Ohio Promissory Note Templates (Free) [Word, PDF, ODT]](https://templates.legal/wp-content/uploads/2021/03/Ohio-Secured-Promissory-Note-Templates.Legal_.jpg)

Ohio Promissory Note Templates (Free) [Word, PDF, ODT]

Free Ohio Secured Promissory Note Template Word PDF eForms

This Document Outlines The Loan’s Terms, Including The Amount, Interest, And Repayment Method (Installments Or Lump Sum).

Create A Free High Quality Ohio Promissory Note Online Now!

Prior To Disbursing Funds, Both The Lender And Borrower Collaboratively Document Crucial Details On The Promissory Note, Including The Repayment Schedule, Interest Rates, And Any Collateral Involved.

After Filling All The Blank Areas, The Lender, Borrower, And A Witness Should All Sign The Paper.

Related Post: