Promise To Pay Contract Template

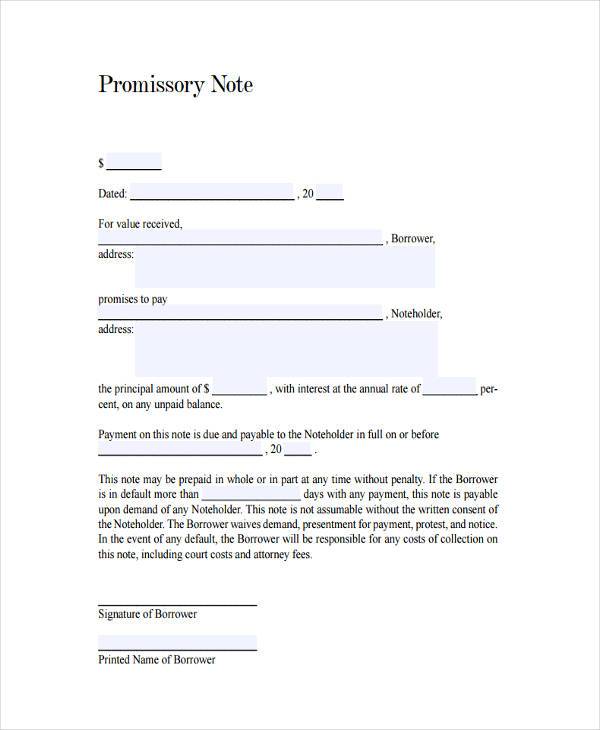

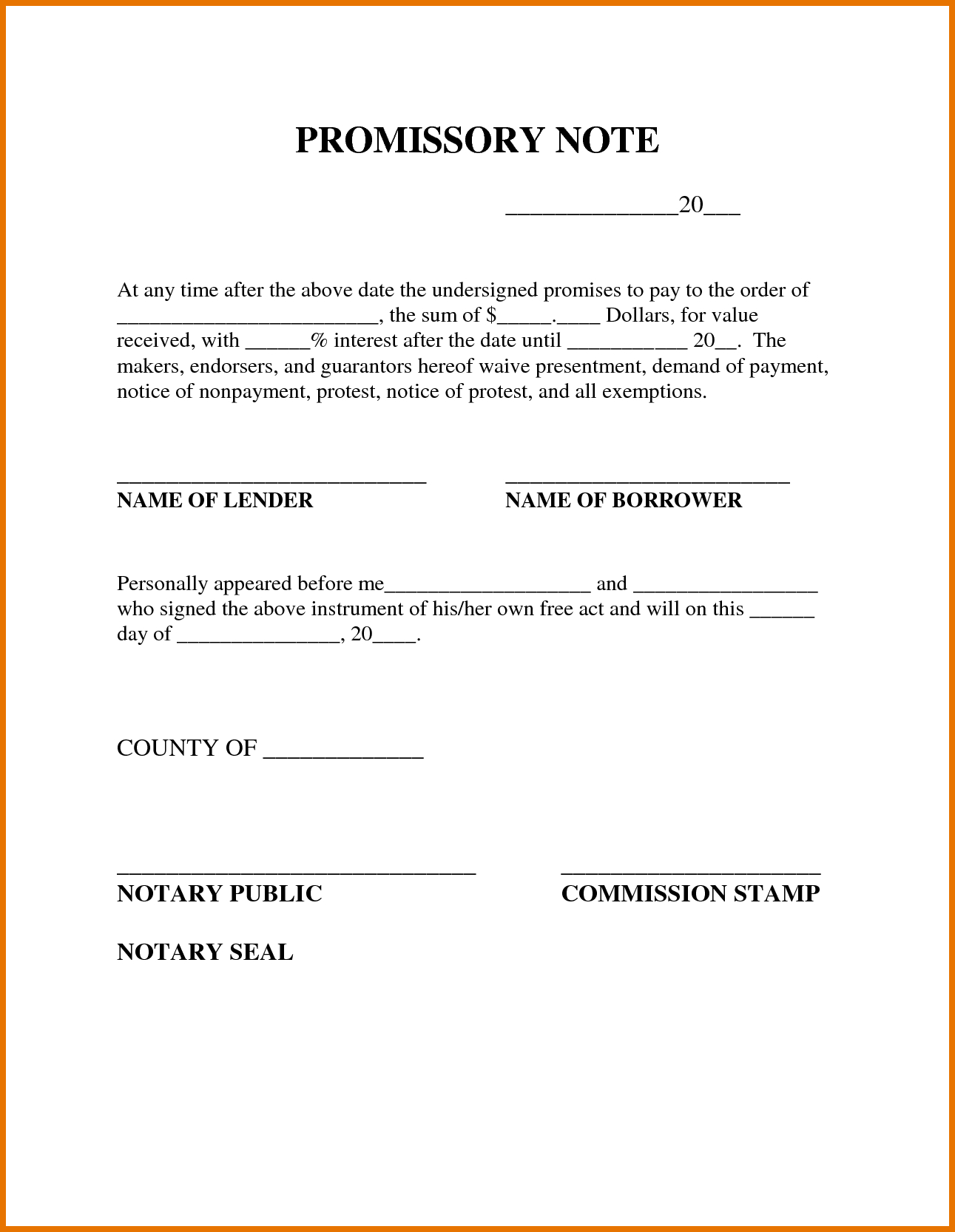

Promise To Pay Contract Template - A promise to pay agreement is a promissory note. Web a promissory note is a document that sets out all the details of a loan that has been made between two parties. If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower. Web a promise to pay letter is also called a promissory note and is a diy contract that promises payment to a given individual or entity by a set timeline. The two parties need to abide by the details of the loan itself while the loan exists, and the promissory note guides this process. Similar to a promissory document, a mortgage outlines the repayment terms, the size of the loan, the interest rate, and the penalty for late fees. The parties.this promissory note (the “note”) is made this [mm/dd/yyyy], (the “start date”), by and between [borrower name] of [borrower address] (the “borrower”), who has received and promises to payback [lender name] of [lender address] (the “lender”) the principal sum of $. Generally, it is used by a private bank or investor to hold a borrower accountable for repaying a loan they have received. Both parties must sign this document to guarantee the borrower will repay the lender on that date. Below are the following repayment types. Small loans might only need a simple promissory note to be protected, but you should still create this. Web pay the note in full on the due date, the unpaid principal shall accrue interest at the maximum rate allowed by law until the borrower is no longer in default. A copy will suffice if the original is lost. Web this. It lays out all the specifics of the loan, including the amount, the interest rate, and when payments are due. The two parties need to abide by the details of the loan itself while the loan exists, and the promissory note guides this process. Gives the lender a good feel as to how the borrower is making good on their. A promissory note must be signed by the borrower, it must outline the sum of the debt, and it can specify more detailed loan terms if both parties agree. They both include loan details, repayment schedules, and borrower/lender information. Both parties must sign this document to guarantee the borrower will repay the lender on that date. Web 8% is the. Any emails, letters, or other communications regarding the loan and repayment with the. Web a promissory note is also known as a loan agreement, iou, personal note, or note payable. Use a real estate purchase agreement to facilitate a private sale of residential property between a seller and a buyer. The most important aspect of an unsecured promissory note is. Small loans might only need a simple promissory note to be protected, but you should still create this. You can also take and discuss screenshots directly in the app. If the borrower does not pay back the amount within the mandated timeframe, the lender will have the right to obtain the property of the borrower. Use a real estate purchase. If the promissory note doesn’t. Cenat was required to pay $55,000 to the union square partnership to cover cleanup and. Generally, it is used by a private bank or investor to hold a borrower accountable for repaying a loan they have received. Establishes a repayment plan for the amount borrowed A promissory note includes much more detail than a simple. Any emails, letters, or other communications regarding the loan and repayment with the. A well crafted iou or loan contract form guarantees that the lender will eventually get the money back, in many. The maker must duly draw and sign it. With a simple keyboard shortcut (option + space), you can instantly ask chatgpt a question. Web a promissory note,. It must have an official stamp. They both include loan details, repayment schedules, and borrower/lender information. You can think of it as a more comprehensive and legally binding iou. Donald trump pledged to double down on tax cuts if he wins a second term as president, drawing a distinction with president joe biden who has called for tax hikes on. Web a mortgage is a financial agreement made between a homeowner and a lender, with the promise to pay back the loan used to purchase real estate. Justice lee is expected to deliver his ruling on. Web a promissory note is a document that sets out all the details of a loan that has been made between two parties. A. A promissory note documents the borrower’s legally binding promise to repay a loan under certain terms and conditions. You can think of it as a more comprehensive and legally binding iou. Web real estate purchase agreement: The maker must duly draw and sign it. A well crafted iou or loan contract form guarantees that the lender will eventually get the. Promissory note laws vary by state, but they typically include the loan amount, loan terms and signatures from both the lending and borrowing party. Below are the following repayment types. This serves as proof that you have formally demanded repayment. A copy will suffice if the original is lost. Web a promissory note is a written promise for one person (or company) to pay a specific amount of money to someone else. Web blank loan agreement, contract sample. Web this is the original agreement that indicates the borrower’s promise to pay and contains your signatures. Web a promissory note is also known as a loan agreement, iou, personal note, or note payable. Iowa § 535.2(3)(a) the general maximum interest rate is 5% if the interest: Web 8% is the maximum without an agreement 25% for consumer loans that are not supervised: Web ten's lawyers had also asked for any documents showing any agreement with a third party to pay the costs, but none were produced to the court. It must have an official stamp. Web for both free and paid users, we're also launching a new chatgpt desktop app for macos that is designed to integrate seamlessly into anything you’re doing on your computer. A promissory note documents the borrower’s legally binding promise to repay a loan under certain terms and conditions. A promissory note is useful for both borrowers and. A promissory note includes much more detail than a simple iou.

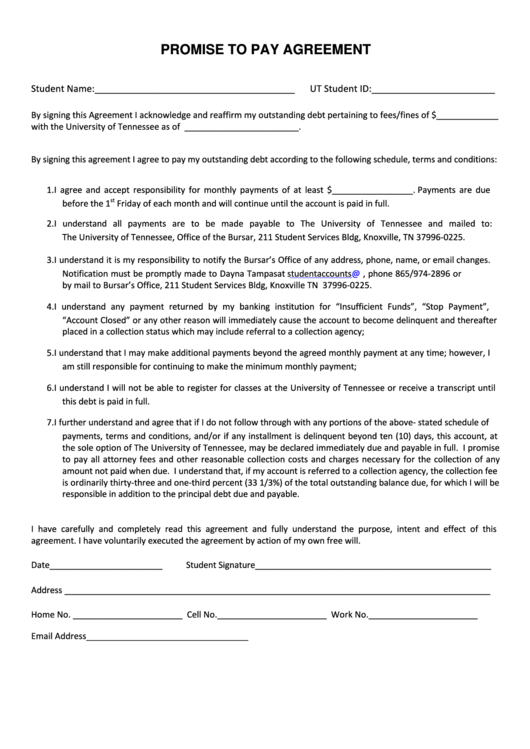

Fillable Promise To Pay Agreement Template printable pdf download

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-25.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-02.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-41.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] Template Lab

FREE 7+ Sample Promissory Note Agreement Forms in PDF MS Word

16 Free Promise to Pay Letter (Promissory Note) Templates & Samples

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-40.jpg?w=395)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

Printable Promissory Note Customize and Print

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](http://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-27.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

![45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab](https://templatelab.com/wp-content/uploads/2016/09/promissory-note-template-01.jpg)

45 FREE Promissory Note Templates & Forms [Word & PDF] ᐅ TemplateLab

They Both Include Loan Details, Repayment Schedules, And Borrower/Lender Information.

It Is A Document That:

Similar To A Promissory Document, A Mortgage Outlines The Repayment Terms, The Size Of The Loan, The Interest Rate, And The Penalty For Late Fees.

Cenat Was Required To Pay $55,000 To The Union Square Partnership To Cover Cleanup And.

Related Post: