Projected Cash Flow Template

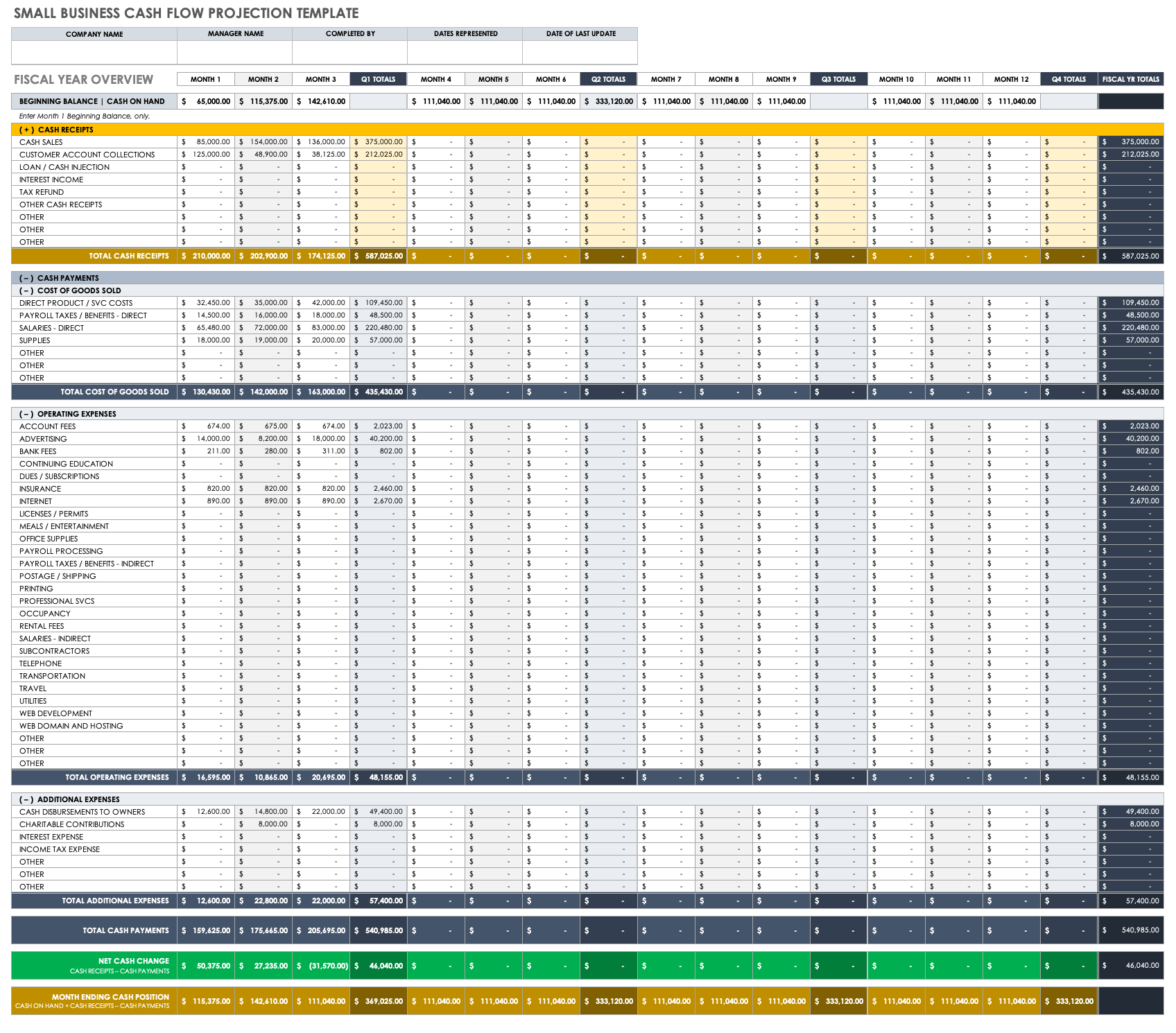

Projected Cash Flow Template - Estimate your monthly sources of cash. Web identify period for projection determine the time frame for which you want to project the free cash flow. Web here’s how to do a cash flow projection in excel: The cash flow statement—along with the balance sheet and income statement—is one of the 3 key financial statements used to assess your company’s financial position. This will be your “net cash flow”. This template is designed for easy planning, with a simple spreadsheet layout and alternating colors to highlight rows. Identify regular and consistent business expenses. Web use this template to create a cash flow forecast that allows you to compare projections with actual outcomes. If the number is positive, you receive more cash than you spend. What is the start and end date of the projection period? Web in the direct cash flow forecasting method, calculating cash flow is simple. Web access xero features for 30 days, then decide which plan best suits your business. Calculate the projected cash flow for the period. This will help in analyzing the financial performance of the company over a specific period. Even look back in time and predict your future. Consider factors such as sales, rental income, interest, and any other sources of income that may contribute to the cash flow. Web enter the collected data into the cash flow projection template. Totals in the template will be automatically calculated. Just subtract the amount of cash you plan on spending in a month from the amount of cash you plan. Web set yourself up for success. This will help in analyzing the financial performance of the company over a specific period. Web enter the collected data into the cash flow projection template. Estimate the amount for each cash inflow source. Web access xero features for 30 days, then decide which plan best suits your business. Web use this template to create a cash flow forecast that allows you to compare projections with actual outcomes. Profit and loss projections have different purpose than cash flow. Calculate the projected cash flow for the period. Web identify the projected income this task involves identifying the projected income for a specified period. Record the amount of income from each. Web cash flow projection template. List all sources of cash inflows. Web project cash flow template. Estimate the amount for each cash inflow source. This will be your “net cash flow”. Web project cash flow template. Just fill it out to learn when money might be tight, and when it’ll be alright. Download a free cash flow forecast template (instructions included). Web access xero features for 30 days, then decide which plan best suits your business. Web identify the projected income this task involves identifying the projected income for a specified. Web a forecasting template (also known as a cash forecasting model) is a blueprint that finance teams use for cash flow projection. Web this simple cash flow forecast template provides a scannable view of your company’s projected cash flow. Web here’s how to do a cash flow projection in excel: Quickbooks can generate all the reports you need to keep. Web enter the collected data into the cash flow projection template. Web use this cash flow forecast template to provide basic details about your company’s projected cash flow. Web cash forecasting can help you predict the months in which you’re likely to experience a cash deficit and make necessary changes, like changing your pricing or adjusting your business plan. Download. Web project cash flow refers to how cash flows in and out of an organization in regard to a specific existing or potential project. Below are some basic principles of project cash flow: Fill in the projected revenue for each source and the anticipated cost for each outflow. Input your estimates for income and expenses, and let the template do. Web here’s how to do a cash flow projection in excel: The monthly cash flow forecast model is a tool for companies to track operating performance in real time and for internal comparisons between projected cash flows and actual results. Download a free cash flow forecast template (instructions included). It is essential to accurately determine the expected revenue to create. Profit and loss projections have different purpose than cash flow. Sections include beginning and ending cash balances, cash sources, cash uses, and cash changes during the month. Web download a statement of cash flows template for microsoft excel® | updated 9/30/2021. Estimate your monthly sources of cash. Web optimize your finances with our free cash flow projection template. This will be your “net cash flow”. Record the amount of income from each source. Web identify the projected income this task involves identifying the projected income for a specified period. Web identify period for projection determine the time frame for which you want to project the free cash flow. Quickbooks can generate all the reports you need to keep your business running smoothly. Download a free cash flow forecast template (instructions included). Consider factors such as upcoming projects, seasonal trends, and market conditions. If the number is positive, you receive more cash than you spend. Web this simple cash flow forecast template provides a scannable view of your company’s projected cash flow. This template is designed for easy planning, with a simple spreadsheet layout and alternating colors to highlight rows. Calculate the projected cash flow for the period.

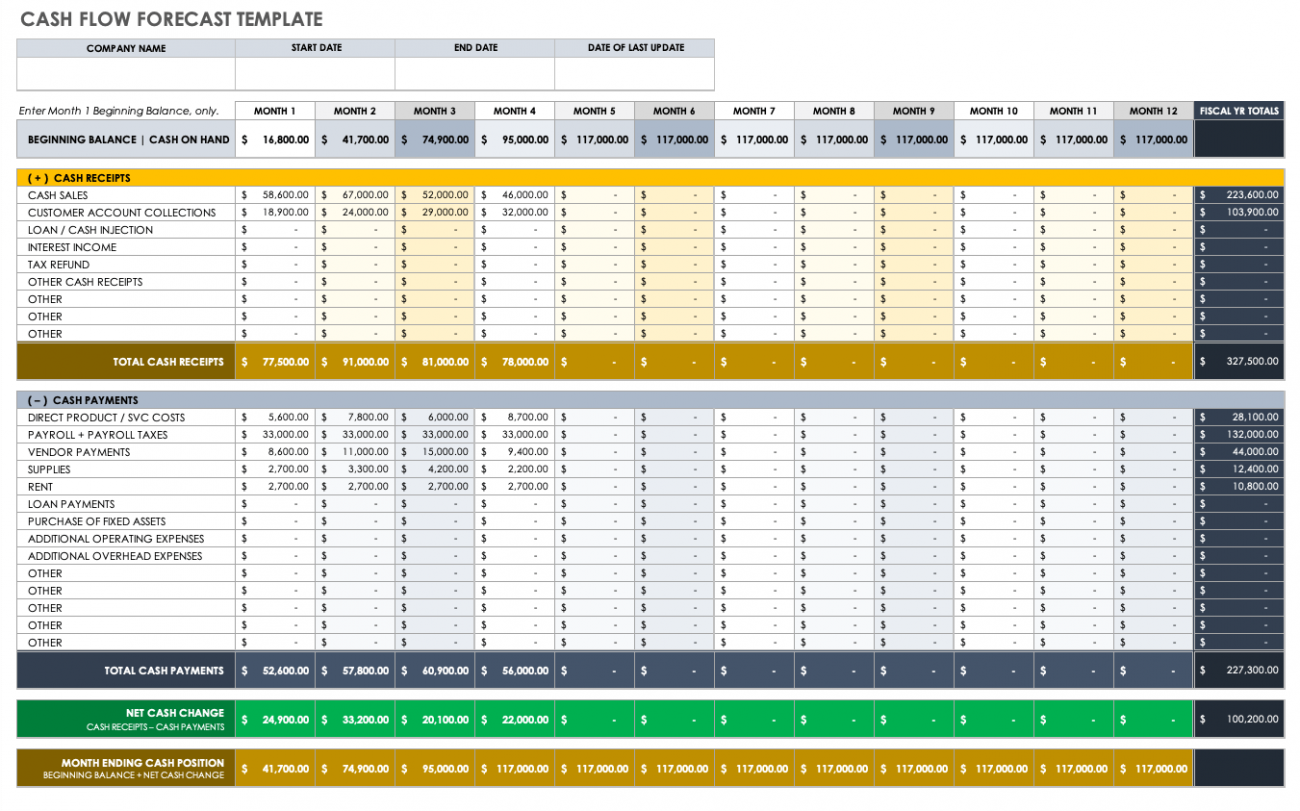

Free Cash Flow Forecast Templates Smartsheet

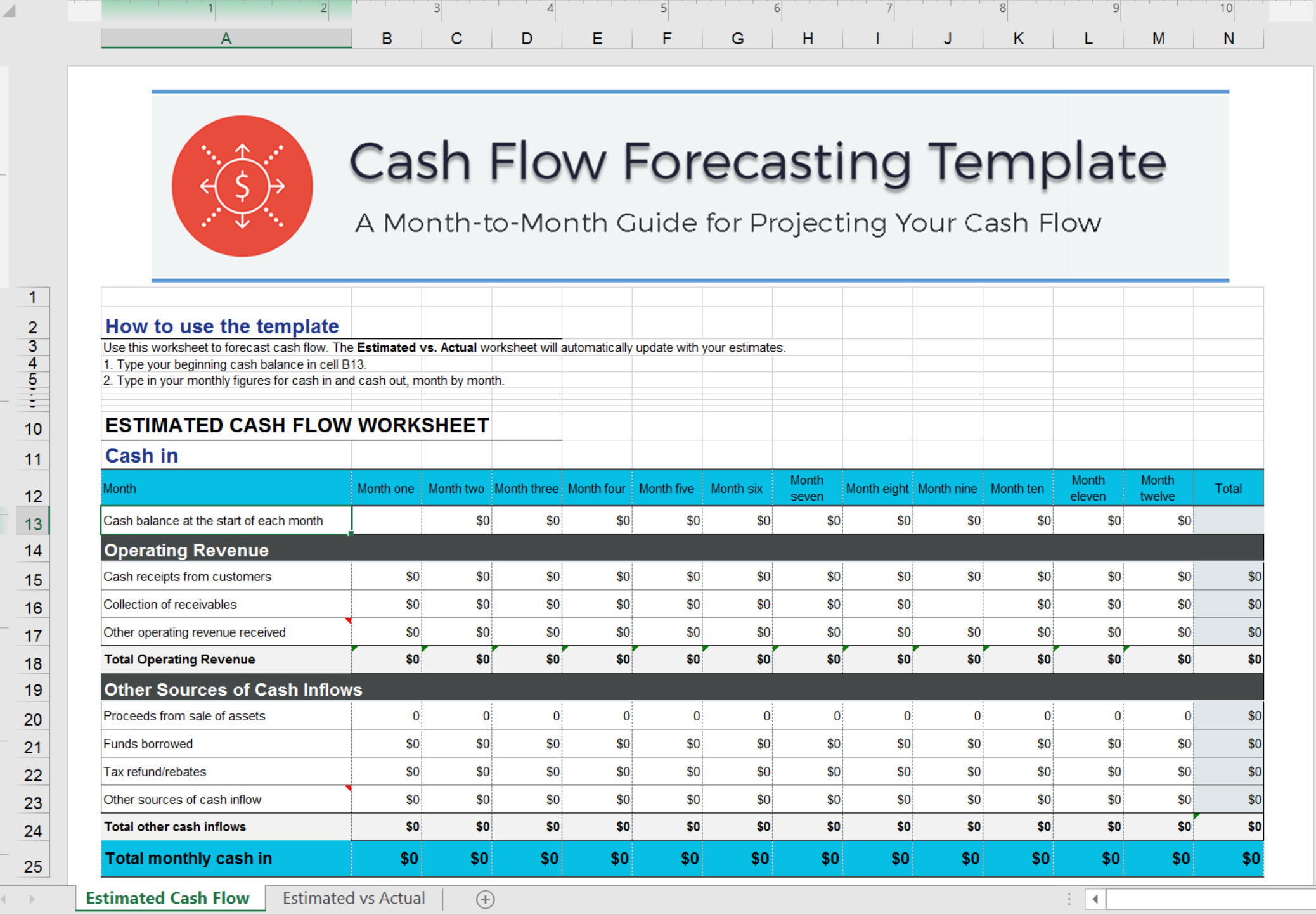

Cash Flow Excel Template Forecast Your Cash Flow

Cash Flow Statement Template for Excel Statement of Cash Flows

How to create a cash flow projection (and why you should)

How to create a cash flow projection (and why you should) Wave Blog

Free Cash Flow Forecast Templates Smartsheet

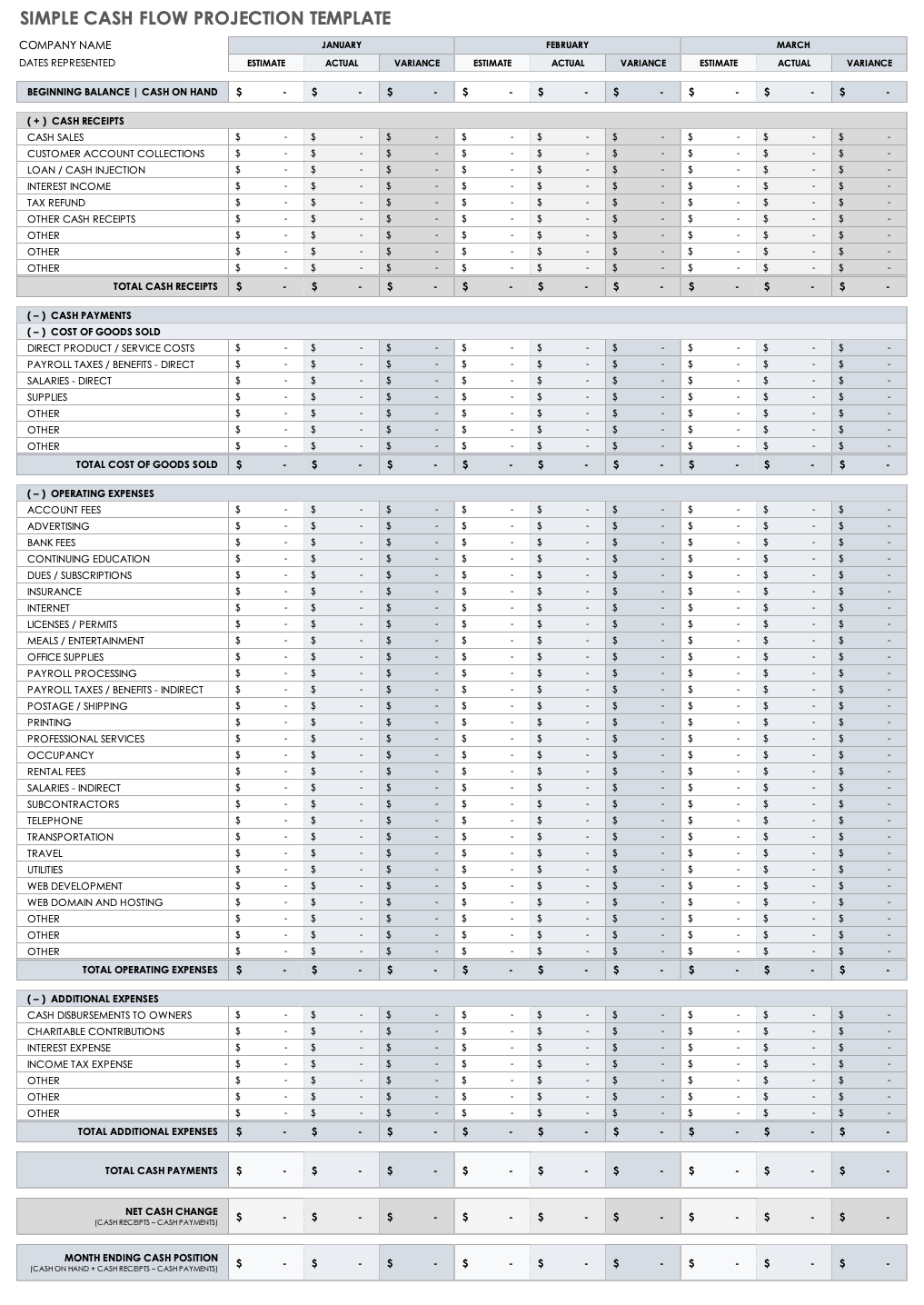

Cash Flow Projection Template Excel Templates Excel Spreadsheets

Free Cash Flow Statement Templates Smartsheet

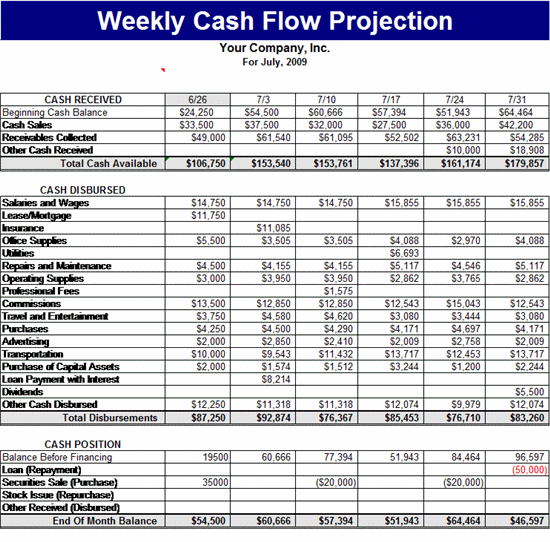

Weekly Cash Flow Projection Template Forecasts Template MS Excel

Free Cash Flow Forecast Templates Smartsheet

It Decreases The Impact Of Cash Shortages.

Even Look Back In Time And Predict Your Future Cash Flow.

Identify Regular And Consistent Business Expenses.

When You Can Predict Months In Which You Might Experience A Cash Shortage, You Can Take Steps To Plan For Them.

Related Post: