Printable Form Dol4N

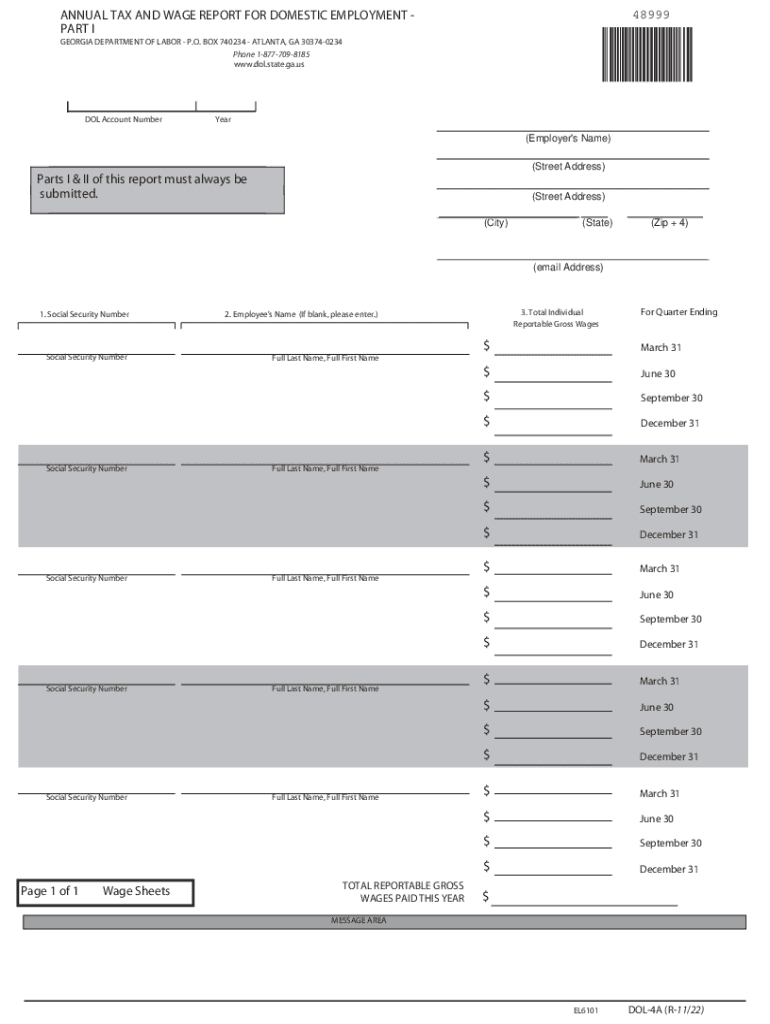

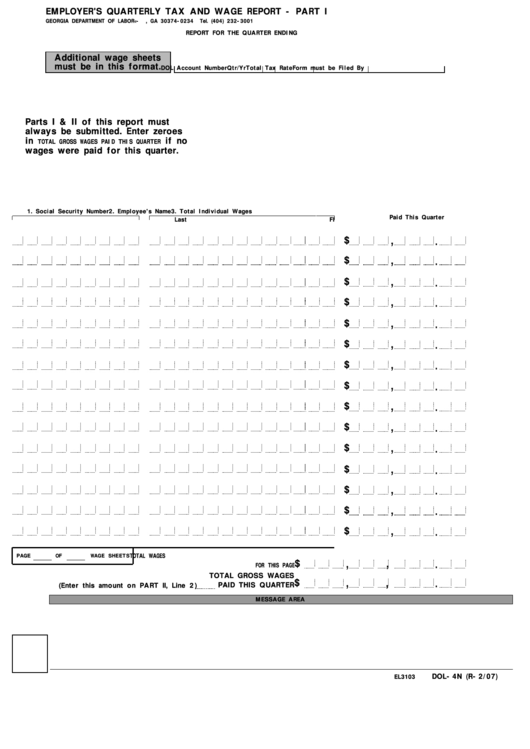

Printable Form Dol4N - All you have to do is download it or send it via email. You can complete some forms online, while you can download and print all others. Part i is designed for reporting wages and names of. An upload file formatted to meet dol standards as either a.csv or magnetic media file type. Type text, add images, blackout confidential details, add comments, highlights and more. Sign it in a few clicks. Web if you have questions or concerns, contact the electronic filing unit at uitax_electronicfileupload@gdol.ga.gov or call 404.232.3265. Web annual tax and wage report which domestic employers must file. Share your form with others. These are the most frequently requested u.s. Web if you have questions or concerns, contact the electronic filing unit at uitax_electronicfileupload@gdol.ga.gov or call 404.232.3265. Send printable form dol 4n via email, link, or fax. Share your form with others. Easily fill out pdf blank, edit, and sign them. Employers are required to file their quarterly wage and tax reports. Web annual tax and wage report which domestic employers must file. The annual report and any payment due must be filed on or before january 31st of the following year to be. Web after that, your printable form dol 4n is ready. Part i is designed for reporting wages and names of. Draw your signature, type it, upload its image,. These are the most frequently requested u.s. Save or instantly send your ready documents. Part i is designed for reporting wages and names of. Web generic state quarterly unemployment compensation and wage report. Web tax and wage reports may be filed using the preferred electronic filing methods available on the employer portal. Easily fill out pdf blank, edit, and sign them. Requirements for electronic filing of quarterly tax and wage reports. Web generic state quarterly unemployment compensation and wage report. You can complete some forms online, while you can download and print all others. Share your form with others. (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage. All you have to do is download it or send it via email. Beginning september 2023, the state accounting office (sao) will use a new automated process to submit the ui tax. Web georgia department of labor. Share. Airslate signnow makes signing easier and more convenient since it provides. Share your form with others. 824 georgia tax forms and templates are. Requirements for electronic filing of quarterly tax and wage reports. Type text, add images, blackout confidential details, add comments, highlights and more. (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage. Web tax and wage reports may be filed using the preferred electronic filing methods available on the employer portal. Sign it in a few clicks. Web after that, your printable form dol 4n is ready. 824 georgia tax. Web been printed on the form. Save or instantly send your ready documents. The annual report and any payment due must be filed on or before january 31st of the following year to be. Airslate signnow makes signing easier and more convenient since it provides. Web after that, your printable form dol 4n is ready. Easily fill out pdf blank, edit, and sign them. Web generic state quarterly unemployment compensation and wage report. Employers are required to file their quarterly wage and tax reports. Send printable form dol 4n via email, link, or fax. Web if you have questions or concerns, contact the electronic filing unit at uitax_electronicfileupload@gdol.ga.gov or call 404.232.3265. Domestic employers must file an annual tax and wage report for. Type text, add images, blackout confidential details, add comments, highlights and more. New employers should print the appropriate quarter and year at the top of the form and use a total ta x. All you have to do is download it or send it via email. Part i is. These are the most frequently requested u.s. Employers are required to file their quarterly wage and tax reports. You can complete some forms online, while you can download and print all others. (1) correct previously reported wages and/or (2) report wages of individuals who were omitted from the original employer’s quarterly tax and wage. Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 824 georgia tax forms and templates are. Web the form is designed to: New employers should print the appropriate quarter and year at the top of the form and use a total ta x. Web been printed on the form. Money back guaranteeform search enginepaperless solutions30 day free trial Web annual tax and wage report which domestic employers must file. The annual report and any payment due must be filed on or before january 31st of the following year to be. Requirements for electronic filing of quarterly tax and wage reports. Web after that, your printable form dol 4n is ready. Part i is designed for reporting wages and names of. Sign it in a few clicks.

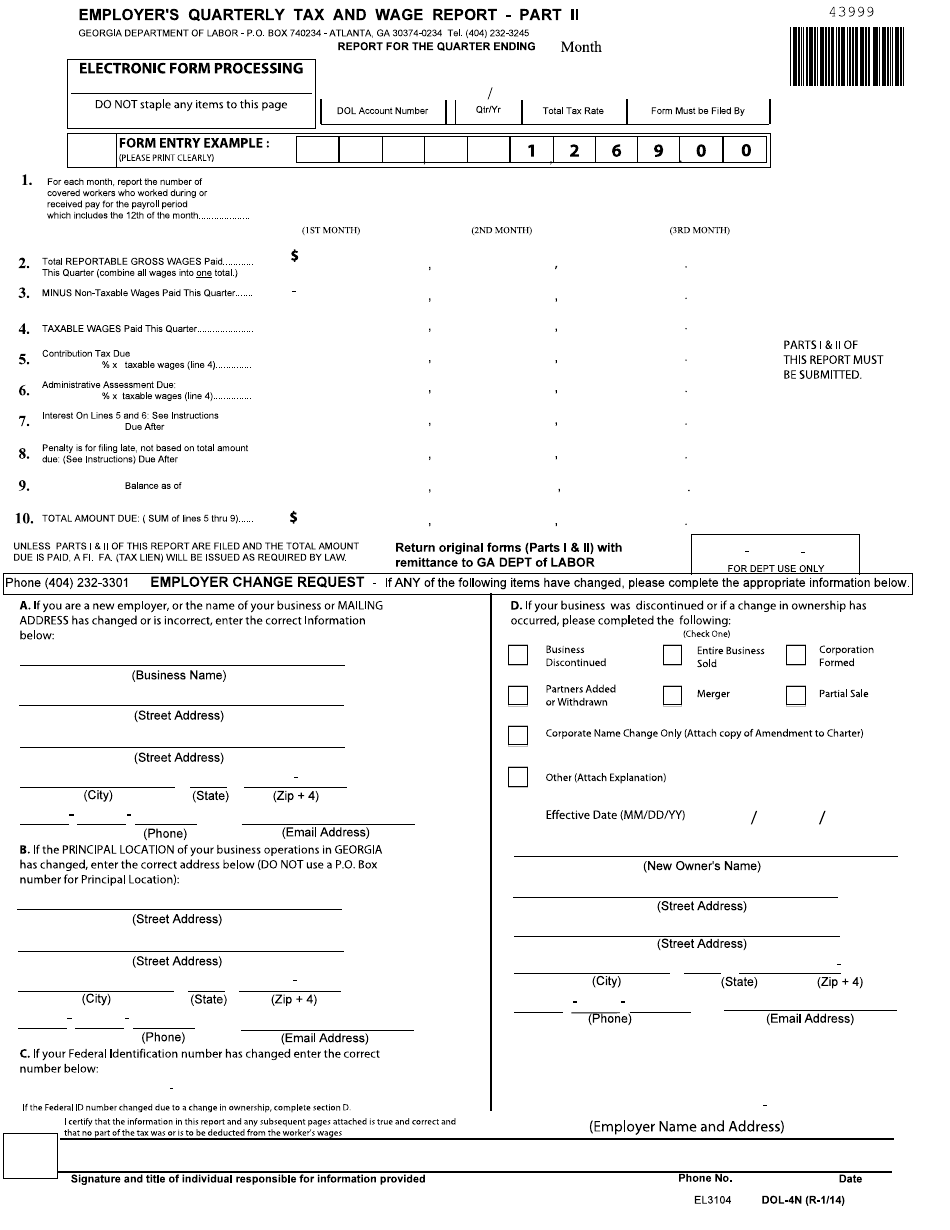

Form DOL4N Fill Out, Sign Online and Download Fillable PDF,

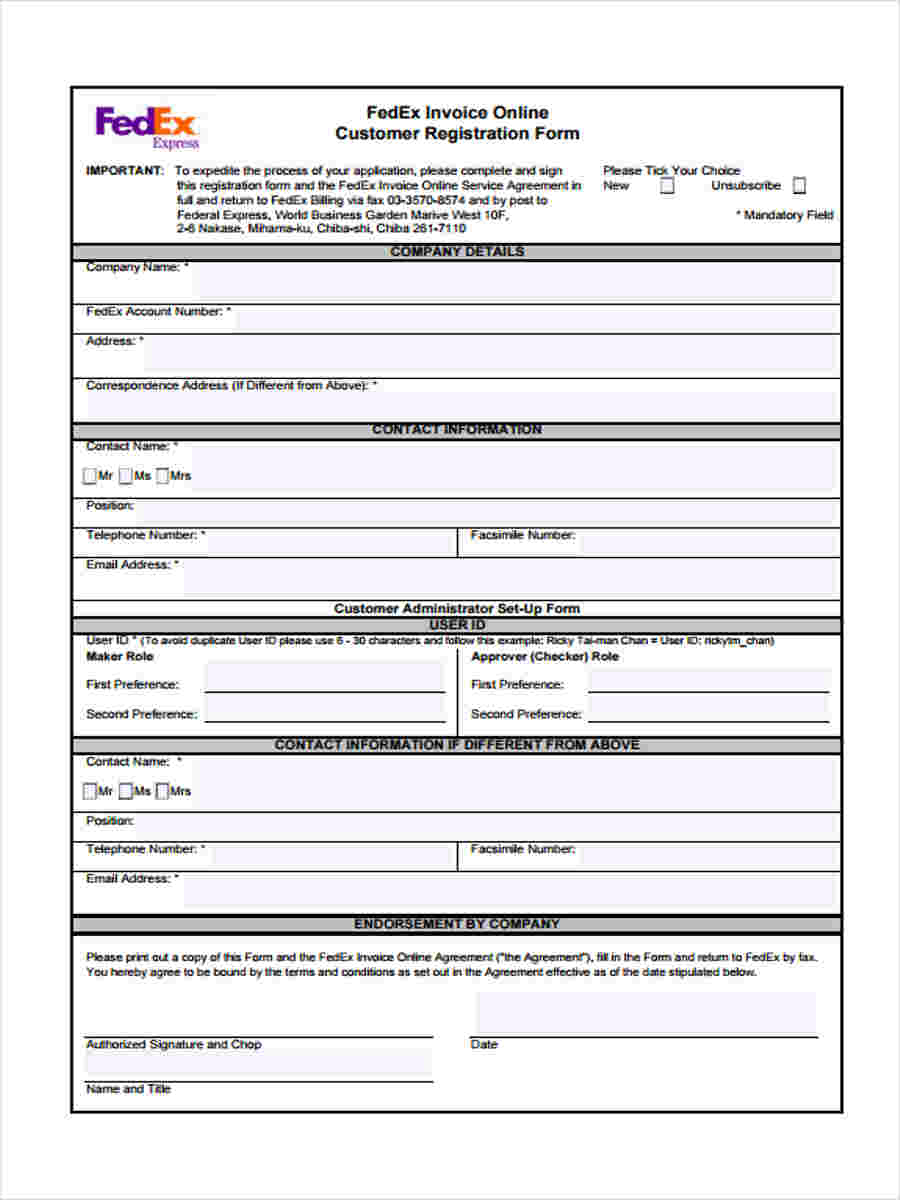

8 Best Images Of Free Printable Office Forms Templates Free Printable

Dol 4n 20222024 Form Fill Out and Sign Printable PDF Template

Department Of Labor Implementing digital tax workflows airSlate

2005 Form GA DOL800 Fill Online, Printable, Fillable, Blank pdfFiller

2005 Form DoL EE2 Fill Online, Printable, Fillable, Blank pdfFiller

Form Dol4n Employer'S Quarterly Tax And Wage Report State Of

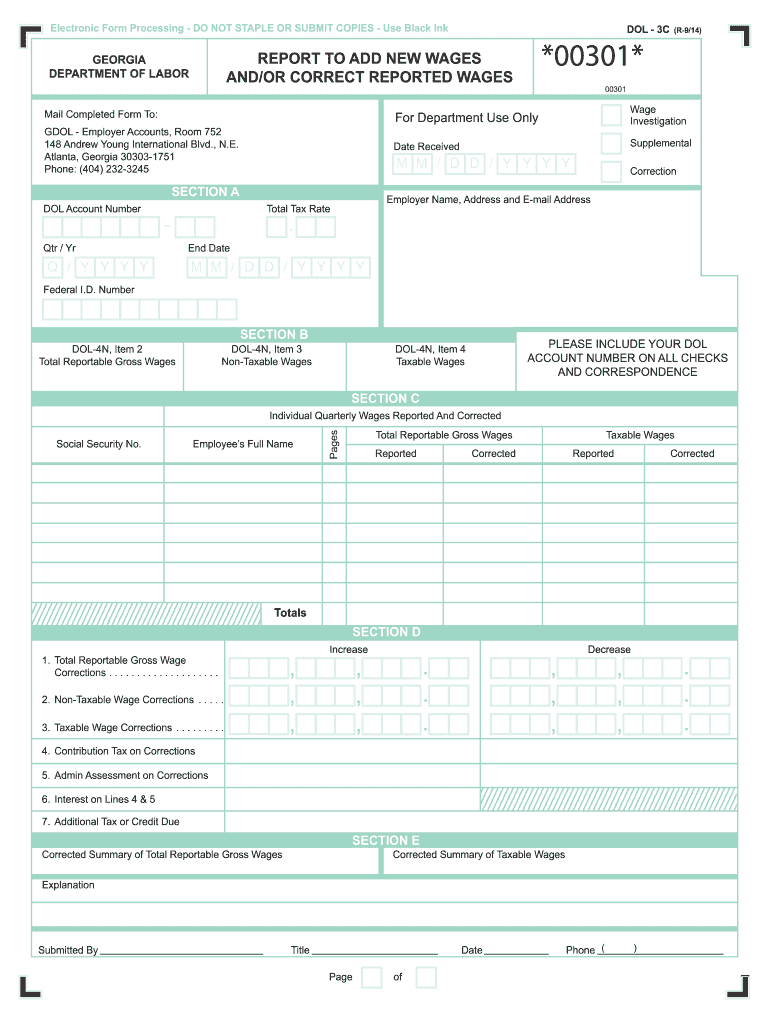

Ga Dol Correction 20142024 Form Fill Out and Sign Printable PDF

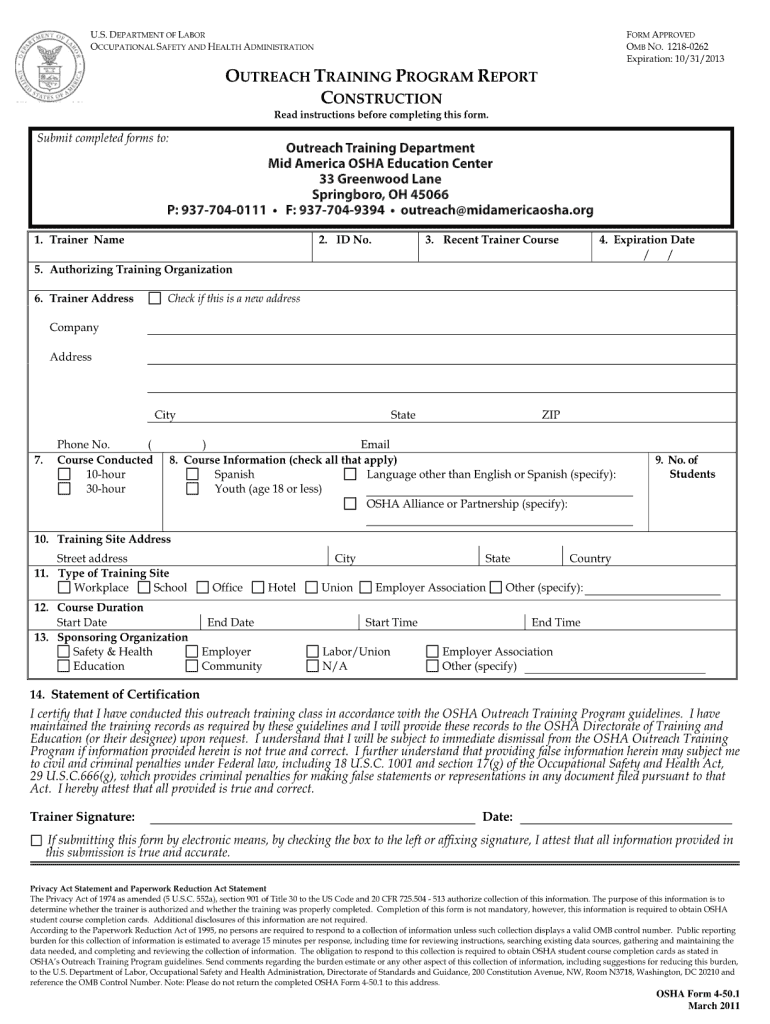

DoL OSHA 450.1 2011 Fill and Sign Printable Template Online US

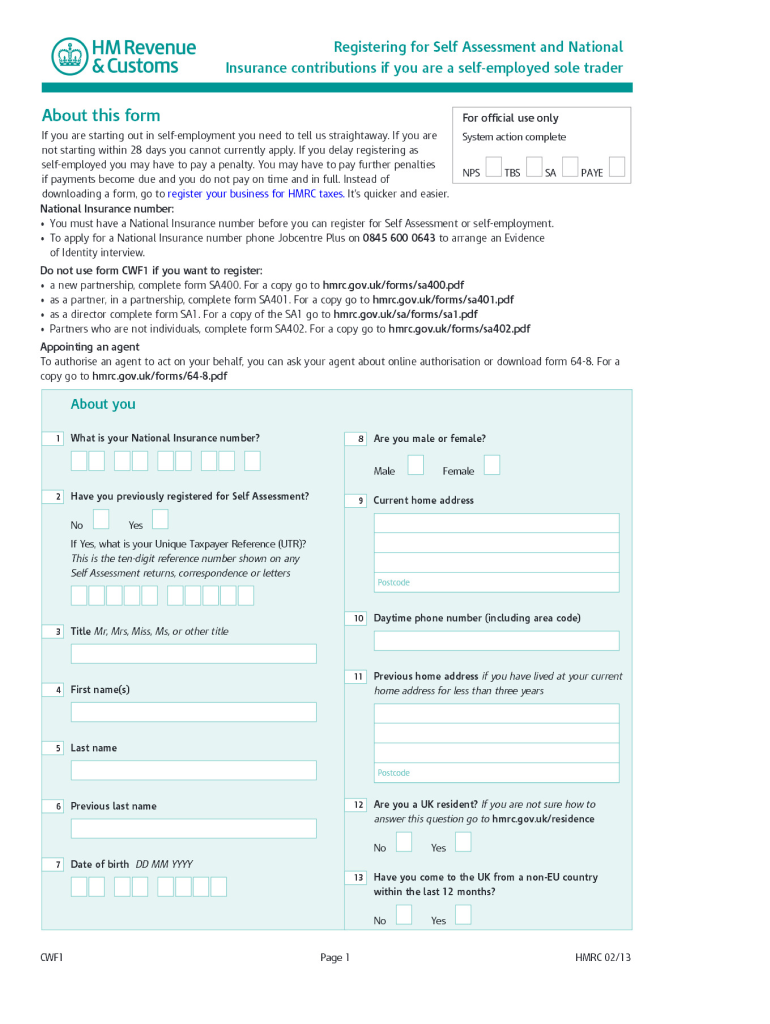

Cwf1 Printable Form Printable Form, Templates and Letter

Web If You Have Questions Or Concerns, Contact The Electronic Filing Unit At Uitax_Electronicfileupload@Gdol.ga.gov Or Call 404.232.3265.

Dol Ui Quarterly Wage Files And Error Reports.

An Upload File Formatted To Meet Dol Standards As Either A.csv Or Magnetic Media File Type.

Easily Fill Out Pdf Blank, Edit, And Sign Them.

Related Post: