Printable Blank 1099

Printable Blank 1099 - Must be submitted to recipients and irs by january 31st. Most people get a copy in the mail. Your 2023 tax form will be available online on february 1, 2024. Sign in to your account. Who gets a 1099 form? Forms can be filed online, by mail if less than 10, or through software. (you don’t want the information getting printed in the wrong box!) Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. Payments above a specified dollar threshold for rents, royalties, prizes, awards, medical and legal exchanges, and several other specific transactions must be reported to the irs using this form. If you paid an independent contractor more than $600 in a. Fill out a 1099 form. Select state you’re filing in. Get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Most people get a copy in the mail. Sign in to your account. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. You can print the following number of copies for these 1099 forms on 1 page: Select state you’re filing in.. Quick & secure online filing. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. How it works, who gets one. Your 2023 tax form will be available online on february 1, 2024. Forms can be filed online, by mail if less than 10, or through software. (you don’t want the information getting printed in the wrong box!) Businesses fill out this form for each individual to whom they pay. Forms can be filed online, by mail if less than 10, or through software. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary. (you don’t want the information getting printed in the wrong box!) Most people get a copy in the mail. Select state you’re filing in. You can print the following number of copies for these 1099 forms on 1 page: Get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security. Printable from laser and inkjet printers. What it is, how it works. If you paid an independent contractor more than $600 in a. Web updated november 06, 2023. Forms can be filed online, by mail if less than 10, or through software. If you paid an independent contractor more than $600 in a. Your 2023 tax form will be available online on february 1, 2024. (you don’t want the information getting printed in the wrong box!) Printable from laser and inkjet printers. How it works, who gets one. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. Fill out a 1099 form. Select state you’re filing in. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends,. Get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return. Most people get a copy in the mail. Quick & secure online filing. Web updated november 06, 2023. Web it's just $50. (you don’t want the information getting printed in the wrong box!) Onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Select state you’re filing in. Simple instructions and pdf download. Your 2023 tax form will be available online on february 1, 2024. Web it's just $50. Web select which type of form you’re printing: You can print the following number of copies for these 1099 forms on 1 page: Onpay’s goal is to make it easier for small business owners to take care of payroll, hr, and employee benefits. Who gets a 1099 form? Quick & secure online filing. How it works, who gets one. Your 2023 tax form will be available online on february 1, 2024. Individuals or independent contractors who earn $600 or more in nonemployment income within a calendar year must receive a form 1099. Select state you’re filing in. Must be submitted to recipients and irs by january 31st. What it is, how it works. Irs 1099 forms are a series of tax reporting documents used by businesses and individuals to report income received outside of normal salary or wages, such as freelance earnings, interest, dividends, and more. A 1099 form is a record that an entity or person (not your employer) gave or paid you money. Fill out a 1099 form. Get tax form (1099/1042s) download a copy of your 1099 or 1042s tax form so you can report your social security income on your tax return.

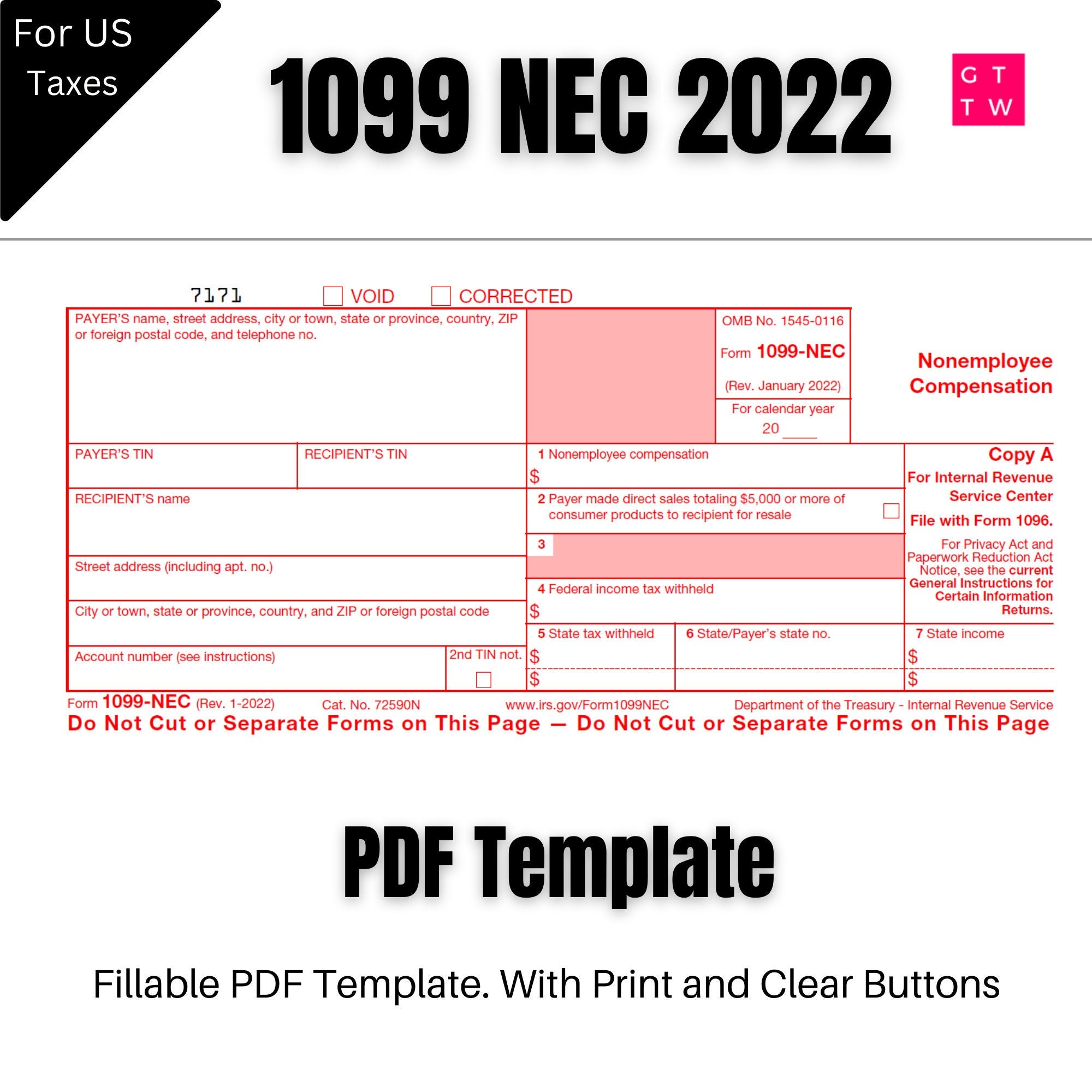

1099 Form 2022

Microsoft Word 1099 Tax Form Printable Template Printable Templates

Forma 1099 How to Print and File 1099B, Proceeds From Broker and

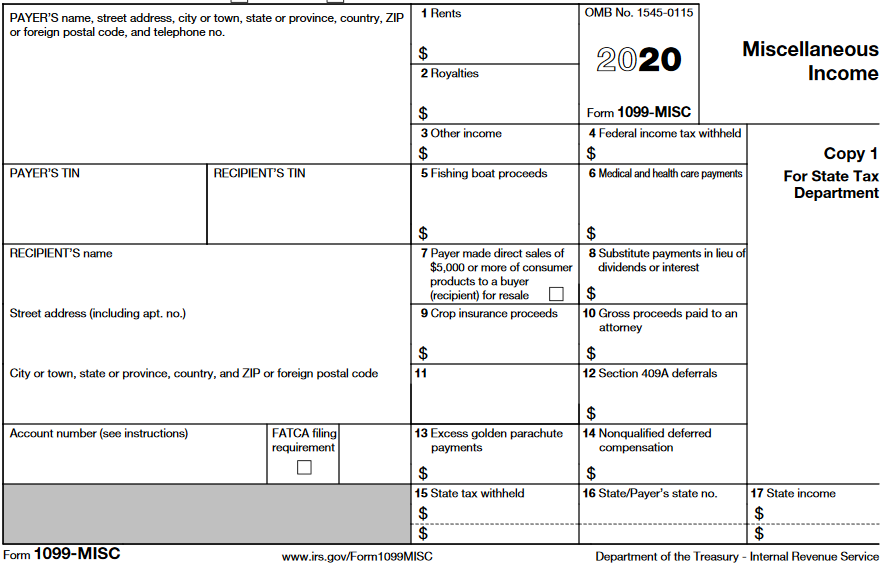

Free Printable Irs 1099 Misc Form Printable Forms Free Online

Printable 1099Nec Form

![]()

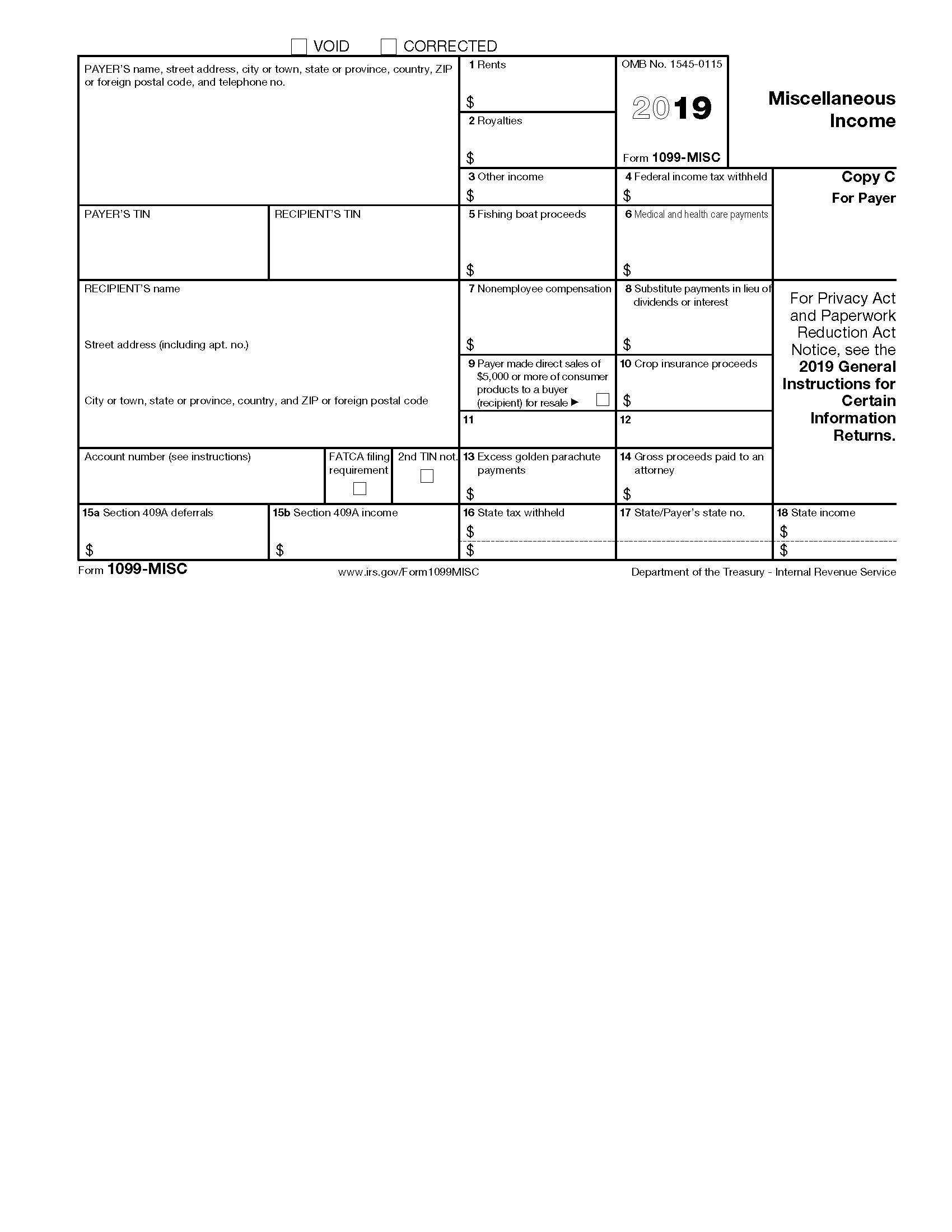

Printable 1099 Form Pdf Free Printable Download

Blank 1099 Form Blank 1099 Form 2021 eSign Genie

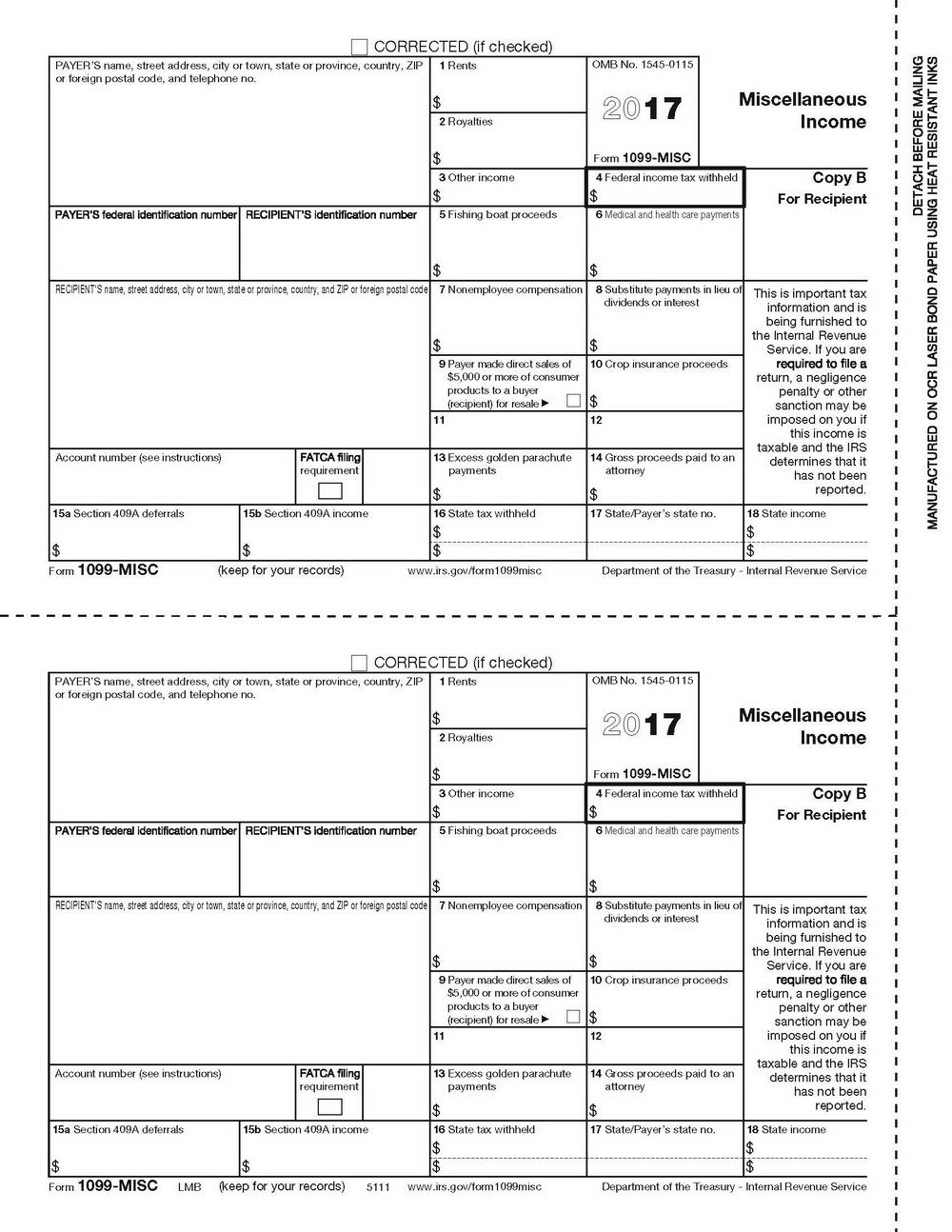

Printable 1099 Form 2017 Free Mbm Legal Free Printable 1099 Misc

Free Blank Printable 1099misc Form Printable Blank Templates

1099 Form Printable 2018 MBM Legal

8 1/2 X 11 Item Numbers:

Most People Get A Copy In The Mail.

Simple Instructions And Pdf Download.

How To File A 1099 Form Online.

Related Post: