Printable 941 Tax Form

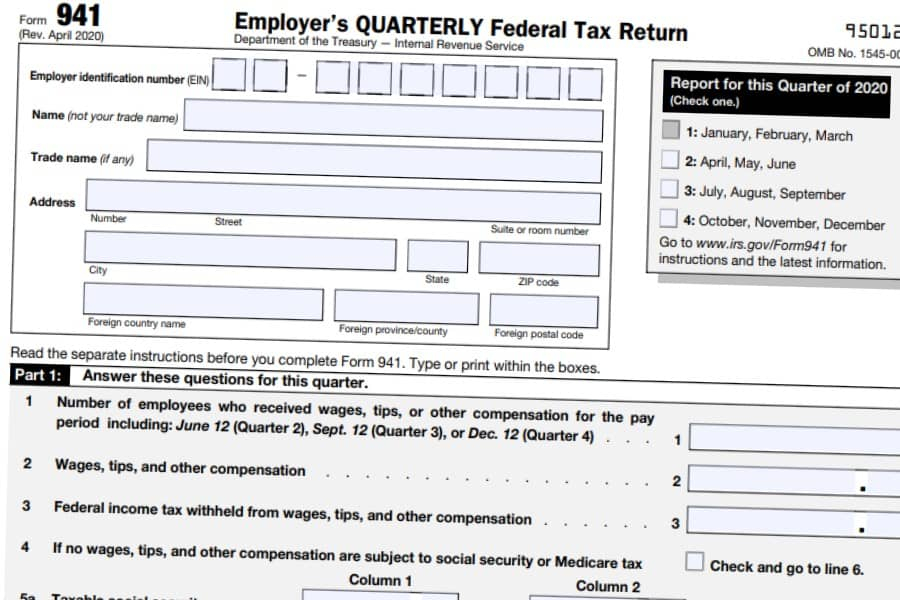

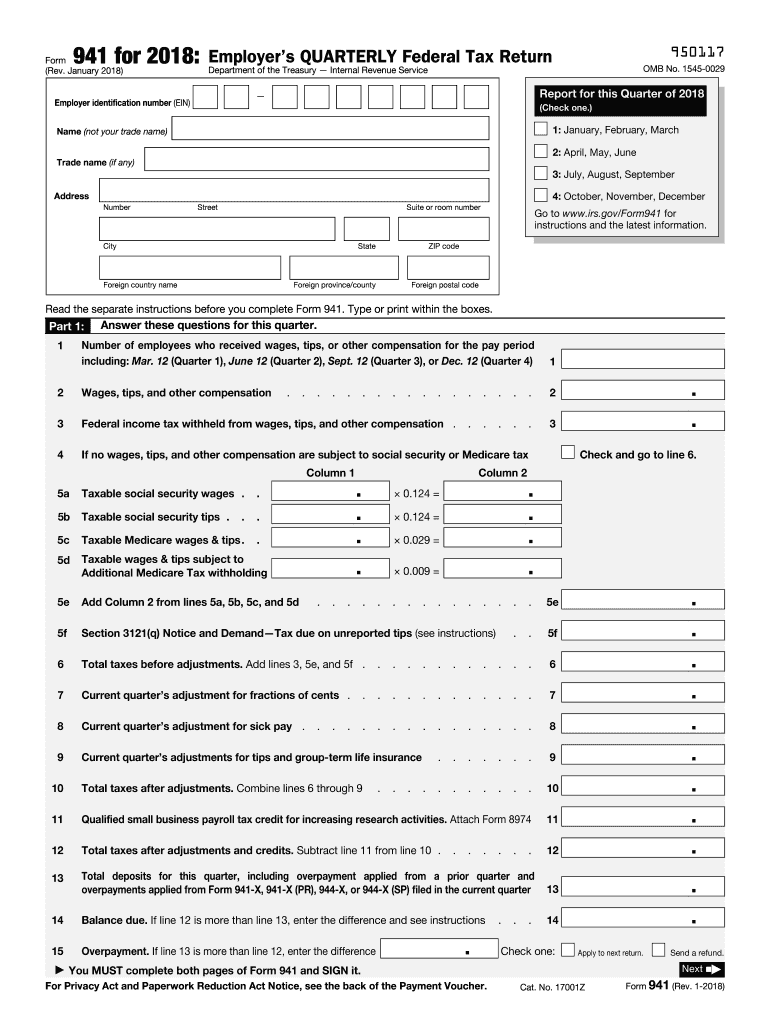

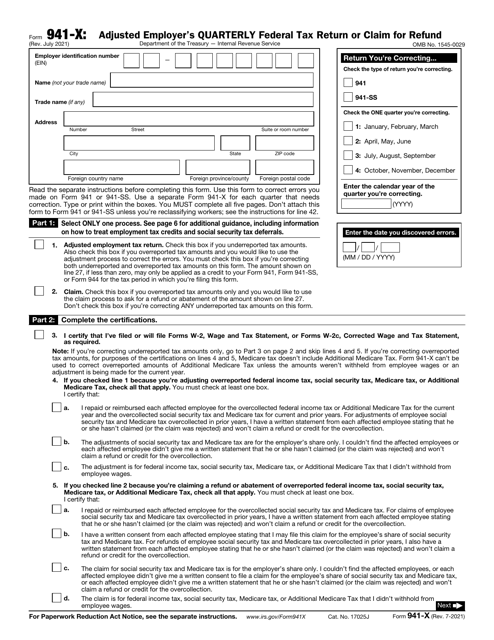

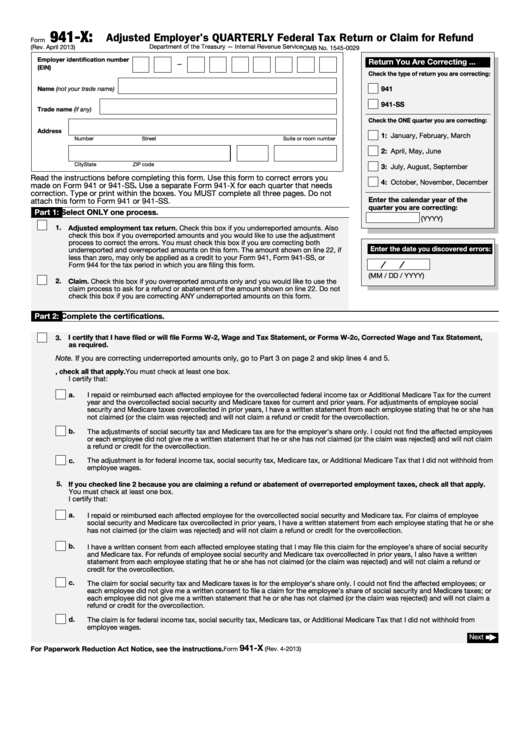

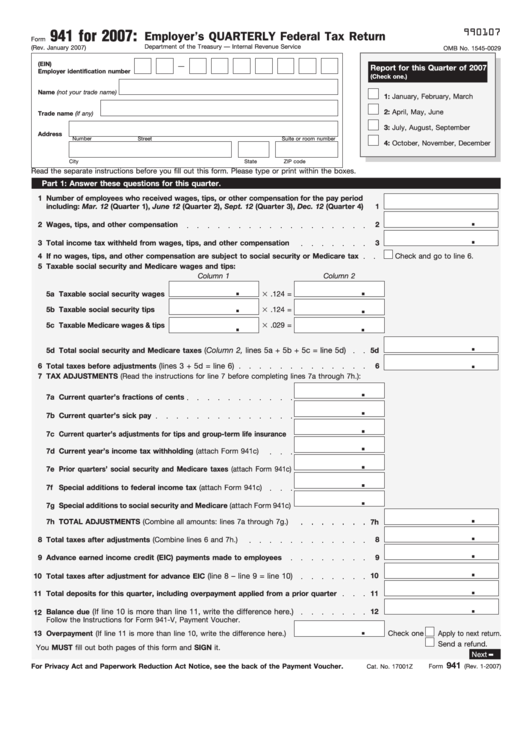

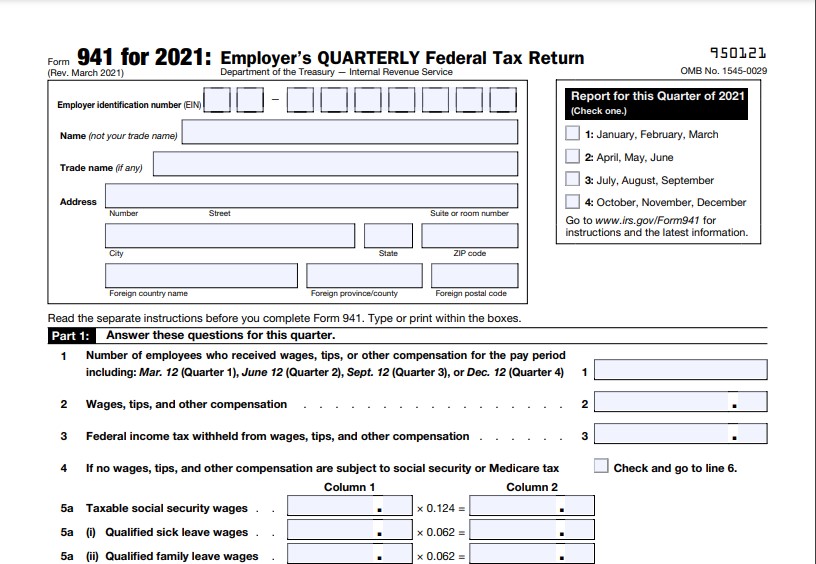

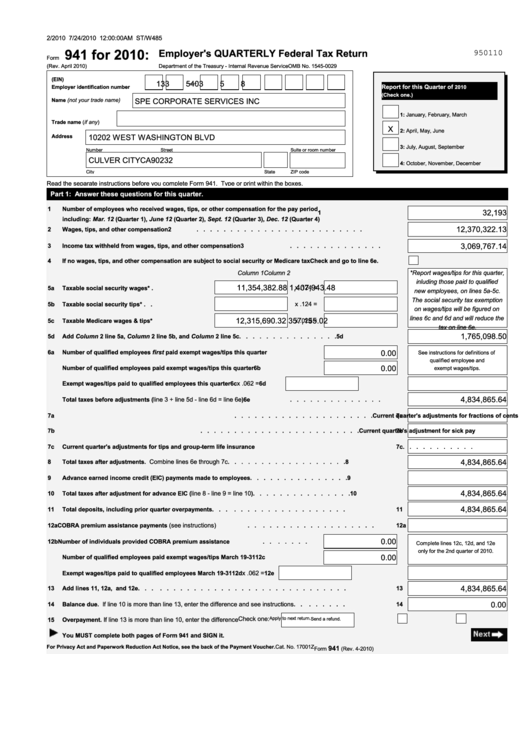

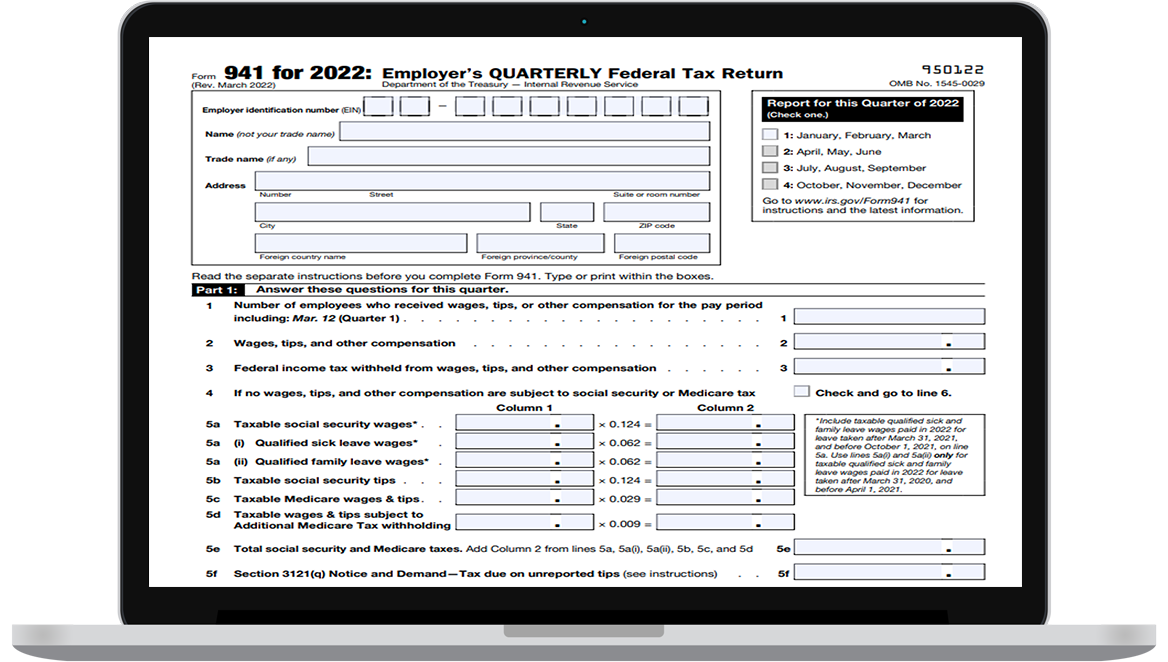

Printable 941 Tax Form - March 2021) employer's quarterly federal tax return. Type or print within the boxes. Irs form 941 is the employer's quarterly payroll tax report, including due dates and reminders. January 2020) employer's quarterly federal tax return. Employers engaged in a trade or business who pay compensation. Type or print within the boxes. The balance / daniel fishel. Learn filing essentials, get instructions, deadlines, mailing info, and more. You may claim head of household filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home for yourself and your. Web what is form 941? October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web read the separate instructions before you complete form 941. Before you fill out form 941. Web instructions for form 941. More about the federal form 941. In february 2022, the irs issued a new version of form 941 that employers needed to use beginning with q1’s tax filings. The balance / daniel fishel. Read the separate instructions before you complete form 941. Section references are to the internal revenue code unless otherwise noted. Web tax year 2023 guide to the employer's quarterly federal tax form 941. Before you fill out form 941. October, november, december go to www.irs.gov/form941 for instructions and the latest information. Section references are to the internal revenue code unless otherwise noted. Web we ask for the information on form 941 to carry out the internal revenue laws of the united states. Employer identification number (ein) — name (not your trade name) trade. More about the federal form 941. Read the separate instructions before you complete form 941. Section references are to the internal revenue code unless otherwise noted. October, november, december go to www.irs.gov/form941 for instructions and the latest information. It also includes the amount of social security and medicare taxes owed to the irs by both the employer and the employees. Employer's quarterly federal tax return. You may claim head of household filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home for yourself and your. Where to get form 941. Web tax year 2023 guide to the employer's quarterly federal tax form 941. It also includes. Web form 941 reports information about your employes’ income tax withholdings, social security taxes, medicate taxes, and more to the irs each quarter. We need it to figure and collect the right amount of tax. 12 (quarter 3), or dec. More about the federal form 941. You may claim head of household filing status on your tax return only if. It appears you don't have a pdf plugin for this browser. It also includes the amount of social security and medicare taxes owed to the irs by both the employer and the employees. Section references are to the internal revenue code unless otherwise noted. The form has undergone some changes in recent years. Web read the separate instructions before you. Answer these questions for this quarter. Employer identification number (ein) — name (not your trade name) trade name (if any) address. 12 (quarter 3), or dec. Form 941 is used to determine It also includes the amount of social security and medicare taxes owed to the irs by both the employer and the employees. We need it to figure and collect the right amount of tax. Where to get form 941. It also includes the amount of social security and medicare taxes owed to the irs by both the employer and the employees. Learn when and how to file it. Employer identification number (ein) — name (not your trade name) trade name (if any). October, november, december go to www.irs.gov/form941 for instructions and the latest information. Web form 941 is a required irs document that businesses must file every three months to report and calculate the federal income tax withheld from employees’ paychecks. Web form 941 reports information about your employes’ income tax withholdings, social security taxes, medicate taxes, and more to the irs. The balance / daniel fishel. We need it to figure and collect the right amount of tax. It also includes the amount of social security and medicare taxes owed to the irs by both the employer and the employees. More about the federal form 941. Form 941 is used to determine Web read the separate instructions before you complete form 941. Web what is form 941? Before you fill out form 941. Subtitle c, employment taxes, of the internal revenue code imposes employment taxes on wages and provides for income tax withholding. Read the separate instructions before you complete form 941. Federal — employer's quarterly federal tax return. Irs form 941 is the employer's quarterly payroll tax report, including due dates and reminders. Answer these questions for this quarter. You may claim head of household filing status on your tax return only if you are unmarried and pay more than 50% of the costs of keeping up a home for yourself and your. Web instructions for form 941. It appears you don't have a pdf plugin for this browser.

Printable 941 Tax Form 2021 Printable Form 2024

IRS 941 2018 Fill out Tax Template Online US Legal Forms

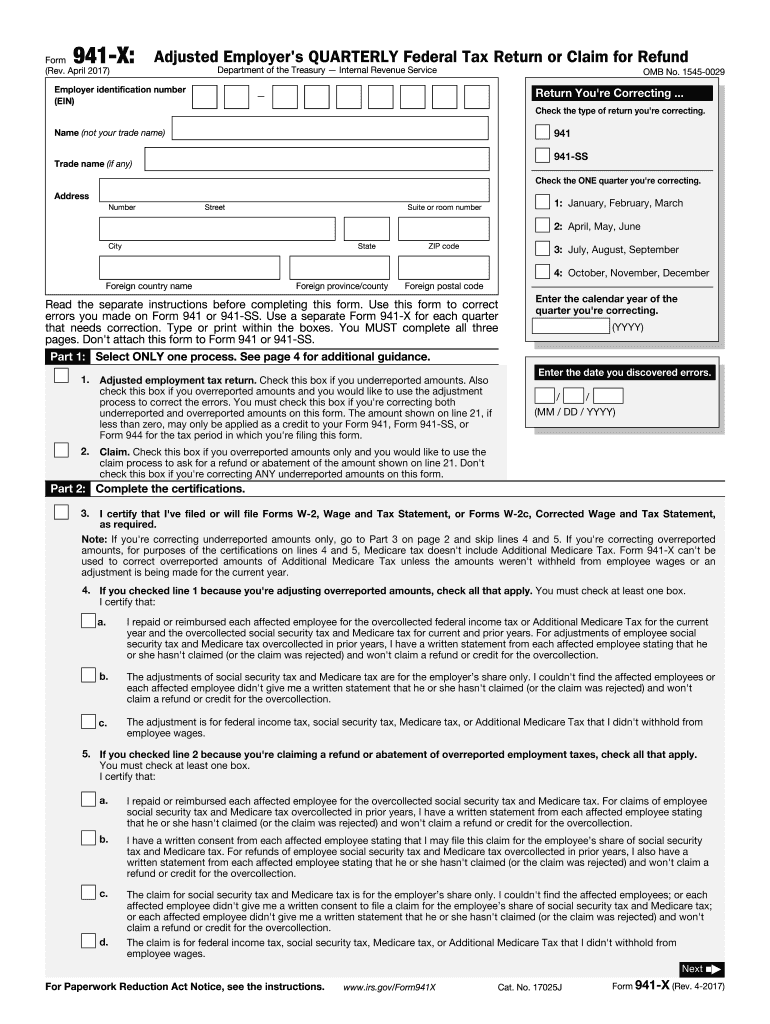

IRS Form 941X Download Fillable PDF or Fill Online Adjusted Employer's

Fillable Form 941X Adjusted Employer'S Quarterly Federal Tax Return

IRS Fillable Form 941 2024

941 Fillable Form Printable Forms Free Online

Form 941 Printable & Fillable Per Diem Rates 2021

Form 941 Employer'S Quarterly Federal Tax Return 2010 printable pdf

EFile Form 941 for 2022 File form 941 electronically

Irs S 941 20172024 Form Fill Out and Sign Printable PDF Template

The Form Has Undergone Some Changes In Recent Years.

Learn When And How To File It.

Section References Are To The Internal Revenue Code Unless Otherwise Noted.

October, November, December Go To Www.irs.gov/Form941 For Instructions And The Latest Information.

Related Post: