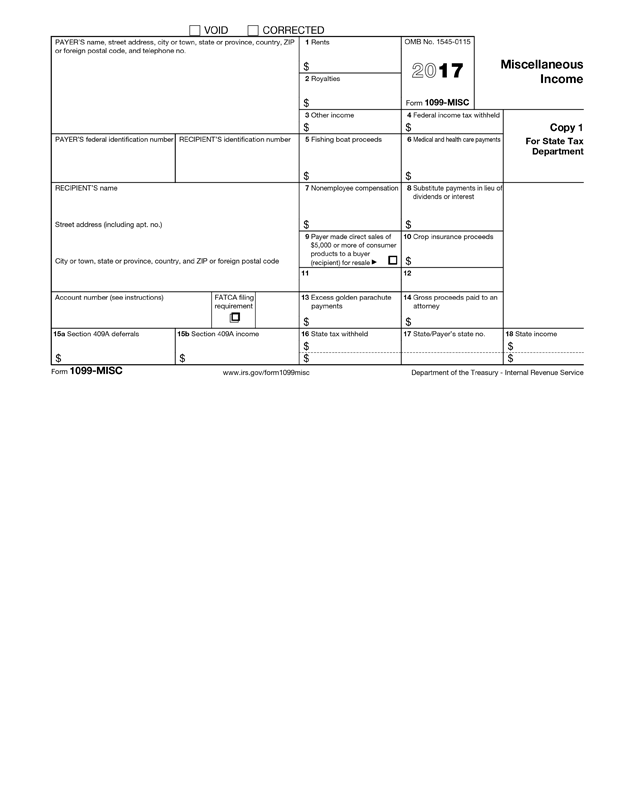

Printable 1099 Misc Form

Printable 1099 Misc Form - Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. However, the payer has reported your complete tin. Examples of amounts included in this box are deceased employee’s wages paid to an estate or beneficiary, prizes and awards, damages and juror’s compensation. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Any other payments exceeding $600,. To the irs by february 28, 2024 if filing by mail. Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. Make sure you’ve got the right paper in your printer. If you work as an independent contractor or freelancer, you'll likely have income. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. However, the payer has reported your complete tin. For your protection, this form may show only the last four digits of your social security number (ssn), individual taxpayer identification number (itin), adoption taxpayer identification number (atin), or employer identification number (ein). Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Web “it’s. Make sure you’ve got the right paper in your printer. Any other payments exceeding $600,. Web rental income can be a lucrative venture for many individuals, but it's crucial to understand the tax implications associated with it. Income from box 3 is generally reported on line 21 of page 1 of your form 1040. Select each contractor you want to. These can include payments to independent contractors, gambling winnings, rents, royalties, and more. Any other payments exceeding $600,. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Income from box 3 is generally reported on line 21 of page 1 of your form 1040. Web 10 or more returns: Web rental income can be a lucrative venture for many individuals, but it's crucial to understand the tax implications associated with it. Income from box 3 is generally reported on line 21 of page 1 of your form 1040. Web “it’s not 10 of a specific form,” he said. “it’s an aggregate of all the information returns filed under an. Persons with a hearing or speech disability with access to tty/tdd equipment can. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. Web prepare form 1099 (all variations) printable 1099 forms. [7] how to file (5 steps). Prepare form 1099 (all variations). Web form 1099 is a collection of forms used to report payments that typically aren't from an employer. Make sure you’ve got the right paper in your printer. To recipients by january 31, 2024. Also remember that if the payee is a registered c or s corporation, you don’t have to file a. However, the payer has reported your complete. To the irs by february 28, 2024 if filing by mail. Any other payments exceeding $600,. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. However, the payer has reported your complete tin. Examples of amounts included in this box are deceased employee’s wages paid to an estate or beneficiary, prizes and awards,. However, the payer has reported your complete tin. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. Income from box 3 is generally reported on line 21 of page 1 of your form 1040. Beholden to their own tax reporting requirements and file their own tax returns without the need for a 1099.. Web rental income can be a lucrative venture for many individuals, but it's crucial to understand the tax implications associated with it. If you work as an independent contractor or freelancer, you'll likely have income. Web recipient’s taxpayer identification number (tin). Also remember that if the payee is a registered c or s corporation, you don’t have to file a.. Select each contractor you want to print 1099s for. Make sure you’ve got the right paper in your printer. If you work as an independent contractor or freelancer, you'll likely have income. Starting tax year 2023, if you have 10 or more information returns, you must file them electronically. “it’s an aggregate of all the information returns filed under an. However, the payer has reported your complete tin. Web a 1099 form is a tax record that an entity or person — not your employer — gave or paid you money. Income from box 3 is generally reported on line 21 of page 1 of your form 1040. Attorney fees for professional services of any amount. 1099 copy b forms using the pressure seal filing method will print 1 form per sheet. Make sure you’ve got the right paper in your printer. Fill, generate & download or print copies for free. You should issue all other payments to the recipient by. Also remember that if the payee is a registered c or s corporation, you don’t have to file a. [7] how to file (5 steps). Prepare form 1099 (all variations). “it’s an aggregate of all the information returns filed under an employer identification number. Beholden to their own tax reporting requirements and file their own tax returns without the need for a 1099. If they don’t meet the $600 threshold, you don’t have to file. Persons with a hearing or speech disability with access to tty/tdd equipment can. Web recipient’s taxpayer identification number (tin).

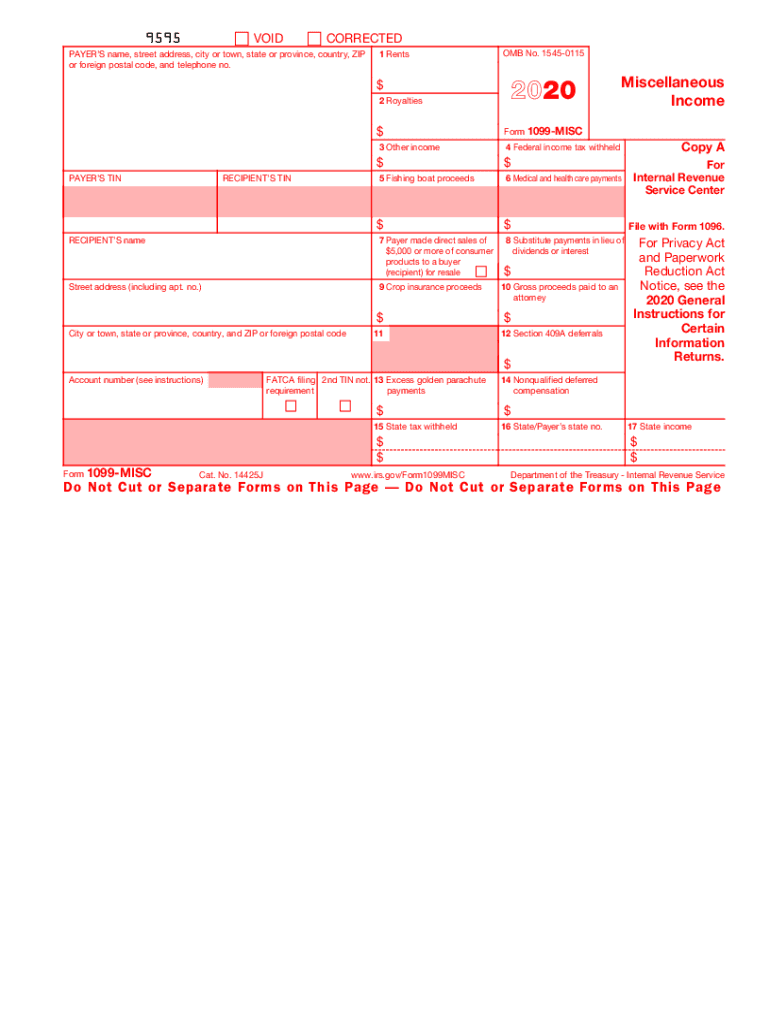

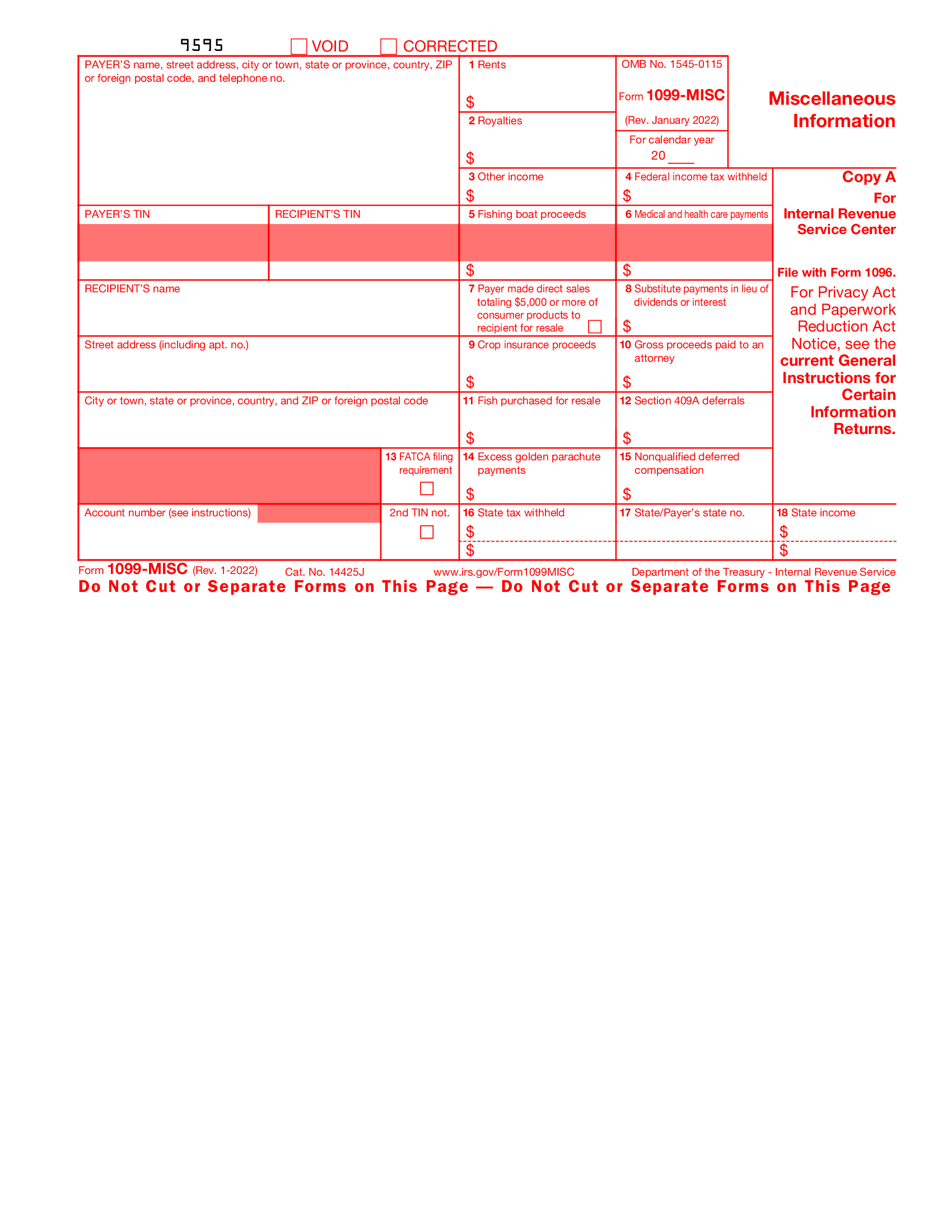

1099MISC Form Fillable, Printable, Download Free. 2021 Instructions

Form 1099MISC for independent consultants (6 step guide)

IRS 1099MISC 20202021 Fill and Sign Printable Template Online US

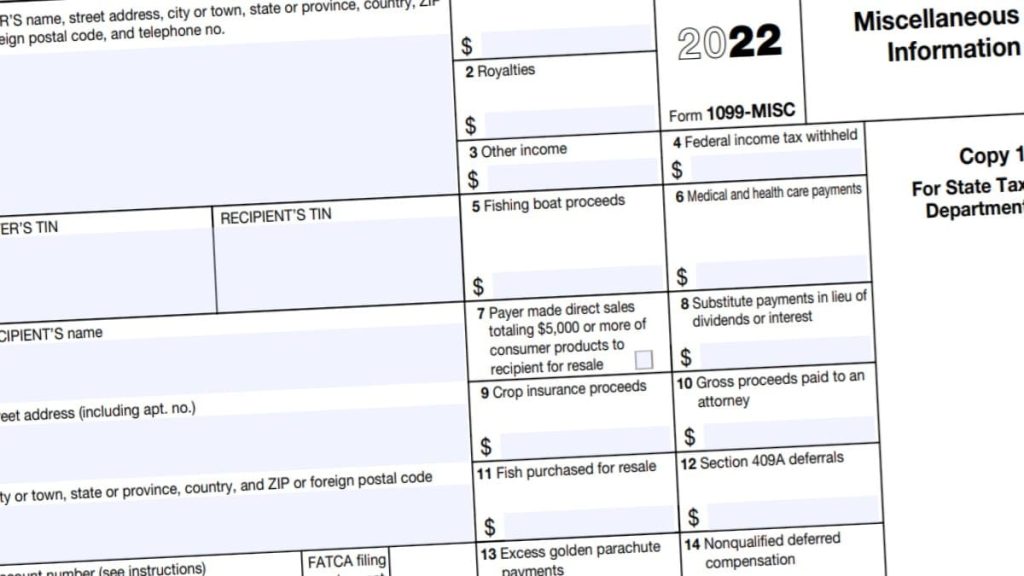

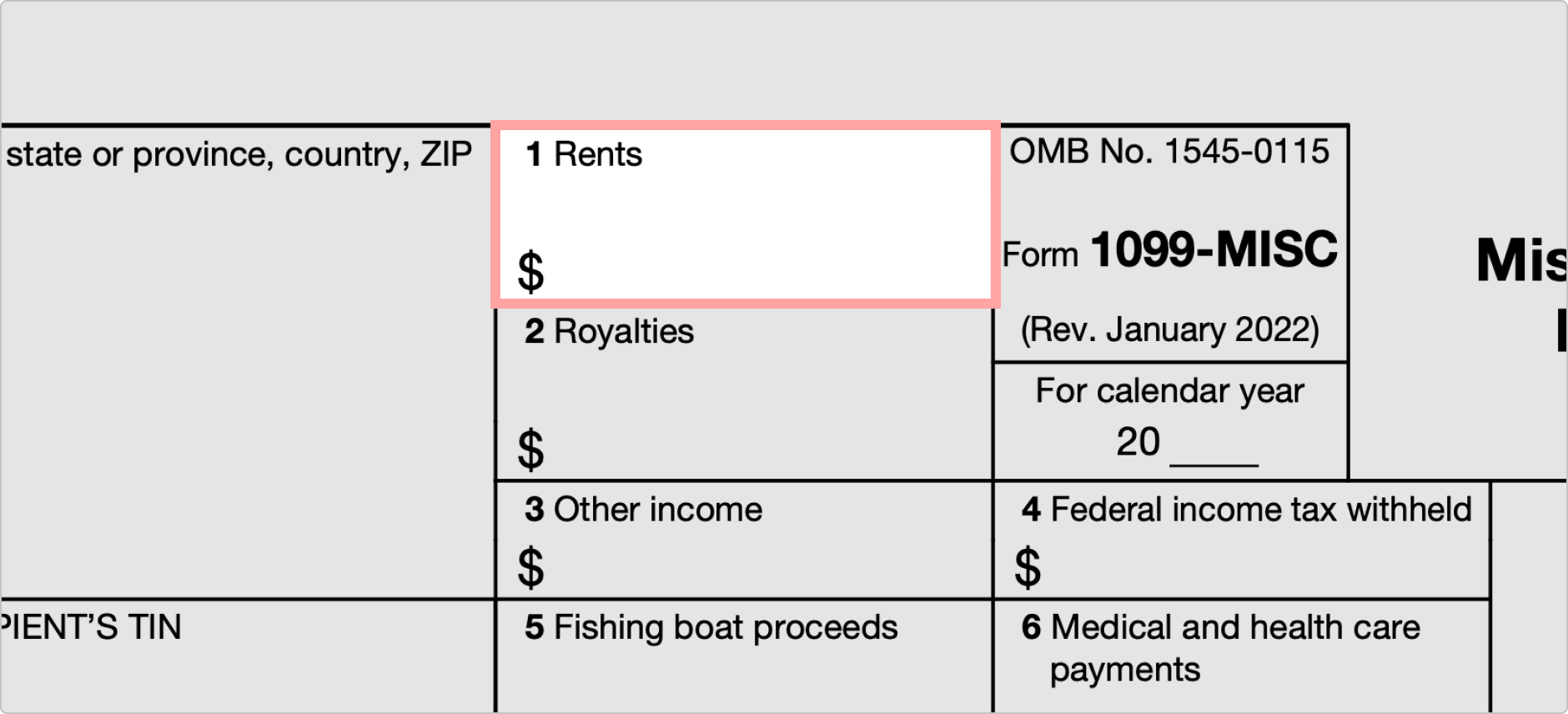

Tax Form 1099MISC Instructions How to Fill It Out Tipalti

Fillable 1099 Misc Irs 2022 Fillable Form 2024

Fillable 1099 Misc Irs 2023 Fillable Form 2023

1099MISC Form Fillable, Printable, Download. 2023 Instructions

How to Fill Out and Print 1099 MISC Forms

What is a 1099Misc Form? Financial Strategy Center

1099MISC Form Template Create and Fill Online

Web “It’s Not 10 Of A Specific Form,” He Said.

Any Other Payments Exceeding $600,.

1099 Forms Can Report Different Types Of Incomes.

Payments Above A Specified Dollar Threshold For Rents, Royalties, Prizes, Awards, Medical And Legal Exchanges, And Several Other Specific Transactions Must Be Reported To The Irs Using This Form.

Related Post: