Printable 1040 Sr Form

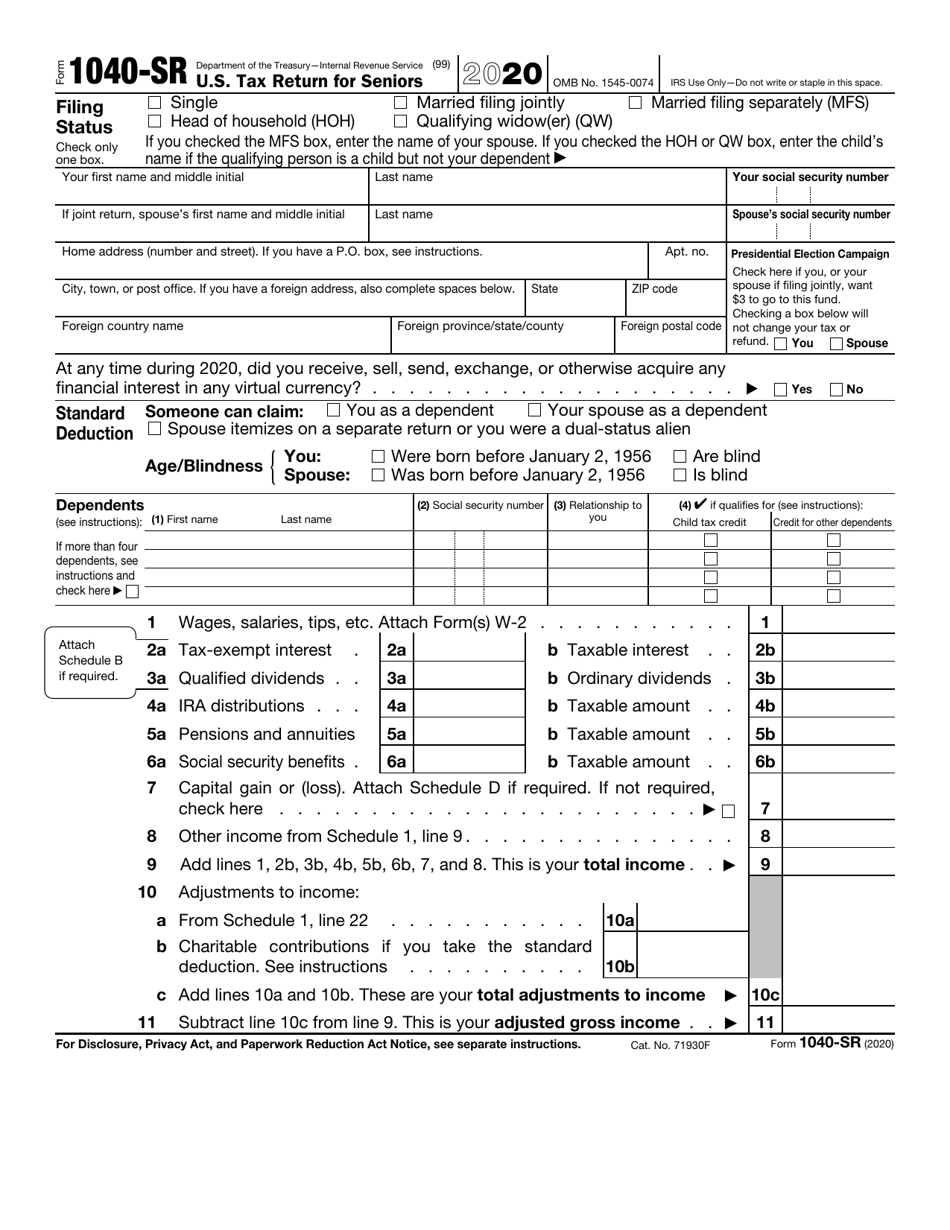

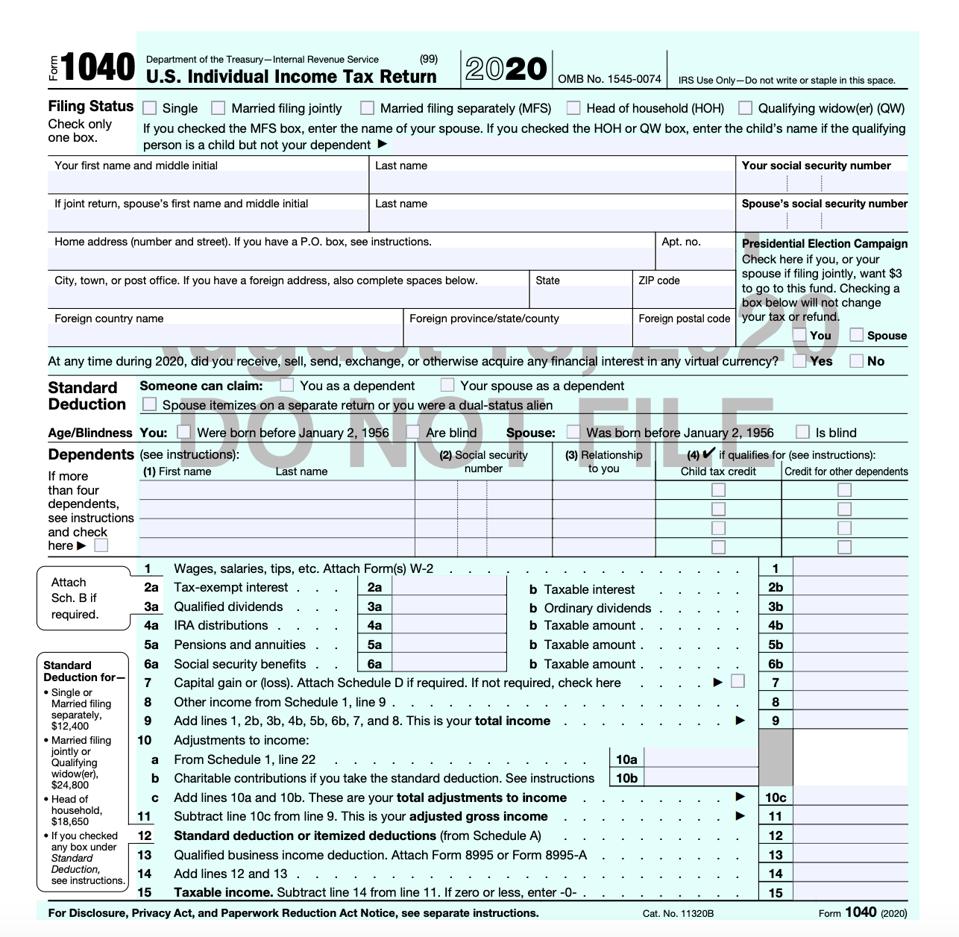

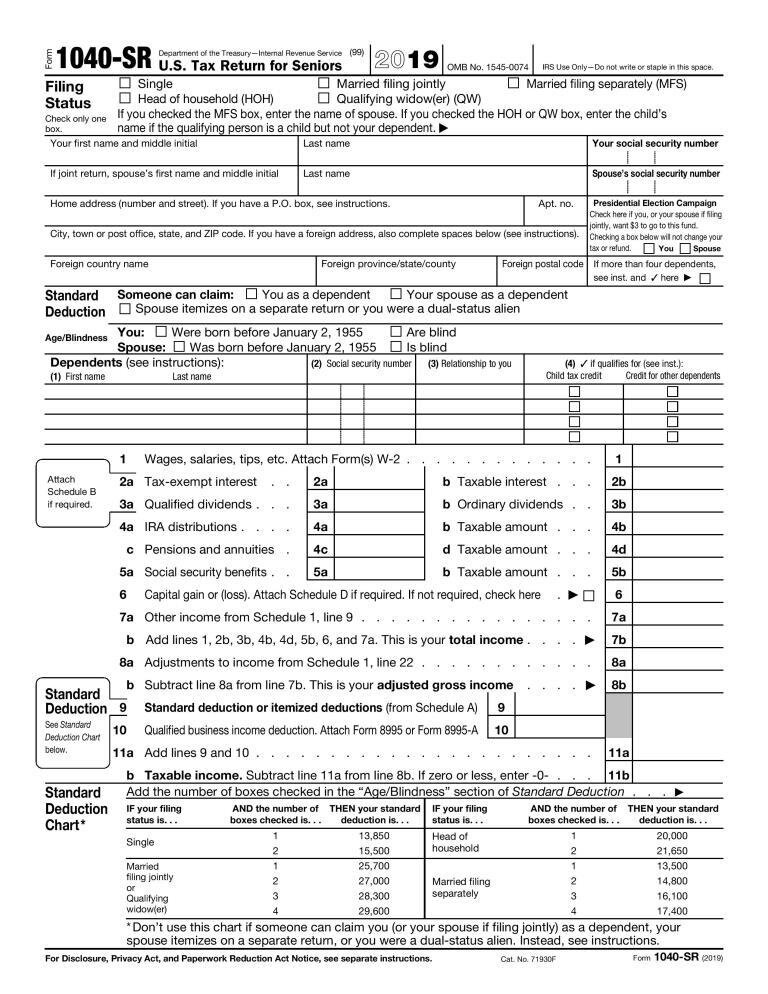

Printable 1040 Sr Form - Seniors may continue to use the standard 1040 for tax filing if they prefer. If you are at least 65 years old or blind, you can claim an added 2023 standard deduction of $1,500 if your filing status is married filing jointly, married filing separately or qualifying surviving spouse filing status. If you checked the hoh or qw box, enter the child’s name if the qualifying person is a child but. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow (er) (qw) if you checked the mfs box, enter the name of your spouse. Spouse name is marcia garcia. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of your spouse. Keep in mind, these are draft samples only and not to be filed. If you checked the mfs box, enter the name of your spouse. Taxpayer's date of birth is january 17, 1954. Web name(s) shown on return. Wages, salaries, tips, taxable scholarships, and taxable fellowship grants. Federal income tax forms and instructions are generally published in december of each year by the irs. 31, 2023, or other tax year beginning , 2023, ending , 20. If you checked the mfs box, enter the name of your spouse. Taxpayer's date of birth is january 17, 1954. This includes items such as: You may be able to take this credit and reduce your tax if by the end of 2022: If you checked the hoh or qw box, enter the child’s name if the qualifying person is a child but. Web kingdom of the planet of the apes: Individual income tax return form 1040 for fiscal year. Test scenario 1 includes the following forms: Assume the dependent is not eligible for the child dependent care credit or the other dependent credit. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of your spouse. Single married filing jointly married filing separately (mfs) head. Irs use only—do not write or staple in this space. This year, that means you must have been born before january 2, 1957. Department of the treasury—internal revenue service. A document published by the internal revenue service (irs) that provides seniors with information on how to treat retirement income, as well as special deductions and credits. Web irs publication 554: If you checked the mfs box, enter the name of your spouse. Web calculating your tax liability. Irs use only—do not write or staple in this space. Keep in mind, these are draft samples only and not to be filed. The prior tax year pdf file or a draft version will download if the irs has not yet. E taxable dependent care benefits from form 2441, line 26. Irs use only—do not write or staple in this space. Web name(s) shown on return. Filing single married filing jointly. This includes items such as: You get an added $1,850 if using the single or head of household filing status. This year, that means you must have been born before january 2, 1957. Assume the dependent is not eligible for the child dependent care credit or the other dependent credit. C tip income not reported on line 1a (see instructions). Single married filing jointly married. C tip income not reported on line 1a (see instructions). Its creation was mandated by. • you were age 65 or older or • you were under age 65, you retired on permanent and total disability,. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name. Filing single married filing jointly. If you checked the hoh or qw box, enter the child’s name if the qualifying person is a child but. E taxable dependent care benefits from form 2441, line 26. Department of the treasury—internal revenue service. This includes items such as: Individual income tax return form 1040 for fiscal year 2021. To file form 1040sr, senior taxpayers must be 65 or older as of the first of the year. Web name(s) shown on return. Web calculating your tax liability. • you were age 65 or older or • you were under age 65, you retired on permanent and total disability,. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow(er) (qw) if you checked the mfs box, enter the name of spouse. If you checked the hoh or qw box, enter the child’s name if the qualifying person is a child but. If you are at least 65 years old or blind, you can claim an added 2023 standard deduction of $1,500 if your filing status is married filing jointly, married filing separately or qualifying surviving spouse filing status. Many years after the reign of caesar, a young ape goes on a journey that will lead him to question everything he's been taught about the past and make choices that will define a future for apes and humans alike. Tax return for seniors, including recent updates, related forms and instructions on how to file. Single married filing jointly married filing separately (mfs) head of household (hoh) qualifying widow (er) (qw) if you checked the mfs box, enter the name of your spouse. You don't have to be retired to. Irs use only—do not write or staple in this space. Married filing separately (mfs) status head of household (hoh) qualifying widow(er) (qw) check only. Assume the dependent is not eligible for the child dependent care credit or the other dependent credit. Web the internal revenue service's new “u.s. Spouse name is marcia garcia. Irs use only—do not write or staple in this space. The prior tax year pdf file or a draft version will download if the irs has not yet. Use schedule d to report sales, exchanges or some involuntary conversions of capital assets, certain capital gain distributions, and nonbusiness bad debts. Department of the treasury—internal revenue service.

IRS Form 1040SR Download Fillable PDF or Fill Online U.S. Tax Return

Download Instructions for IRS Form 1040, 1040SR Schedule A Itemized

Irs 1040 Form / Best Use for 1040SR Tax Form for Seniors Irs form

How to Fill Out Form 1040SR Expert Guide

Irs 1040 Form / Best Use for 1040SR Tax Form for Seniors Irs form

How to Fill Out Form 1040SR Expert Guide

The New 2019 Form 1040 SR U S Tax Return For Seniors 1040 Form Printable

Irs Fillable Form 1040 Irs Schedule 1 Form 1040 Or 1040 Sr Fill Out

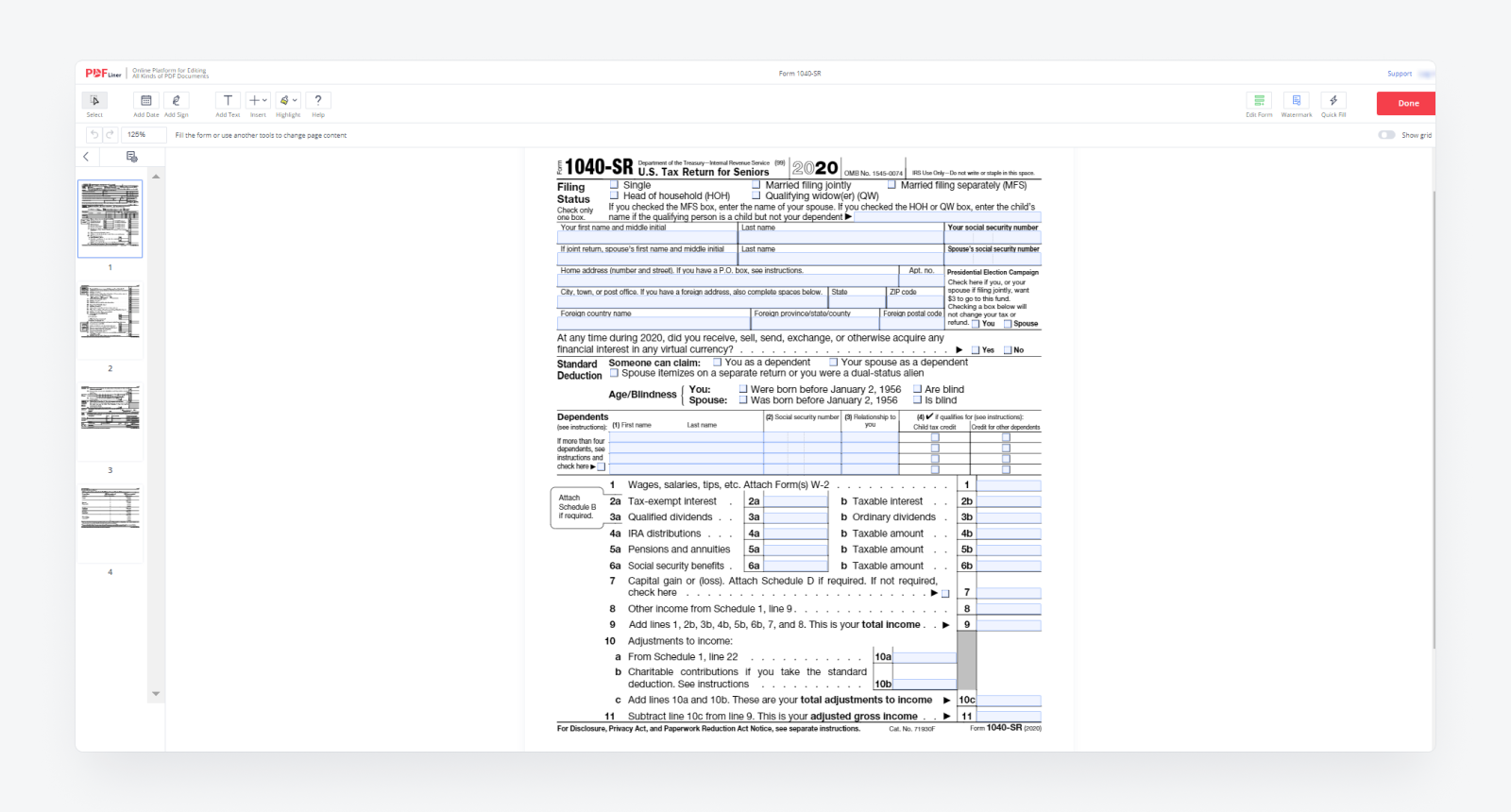

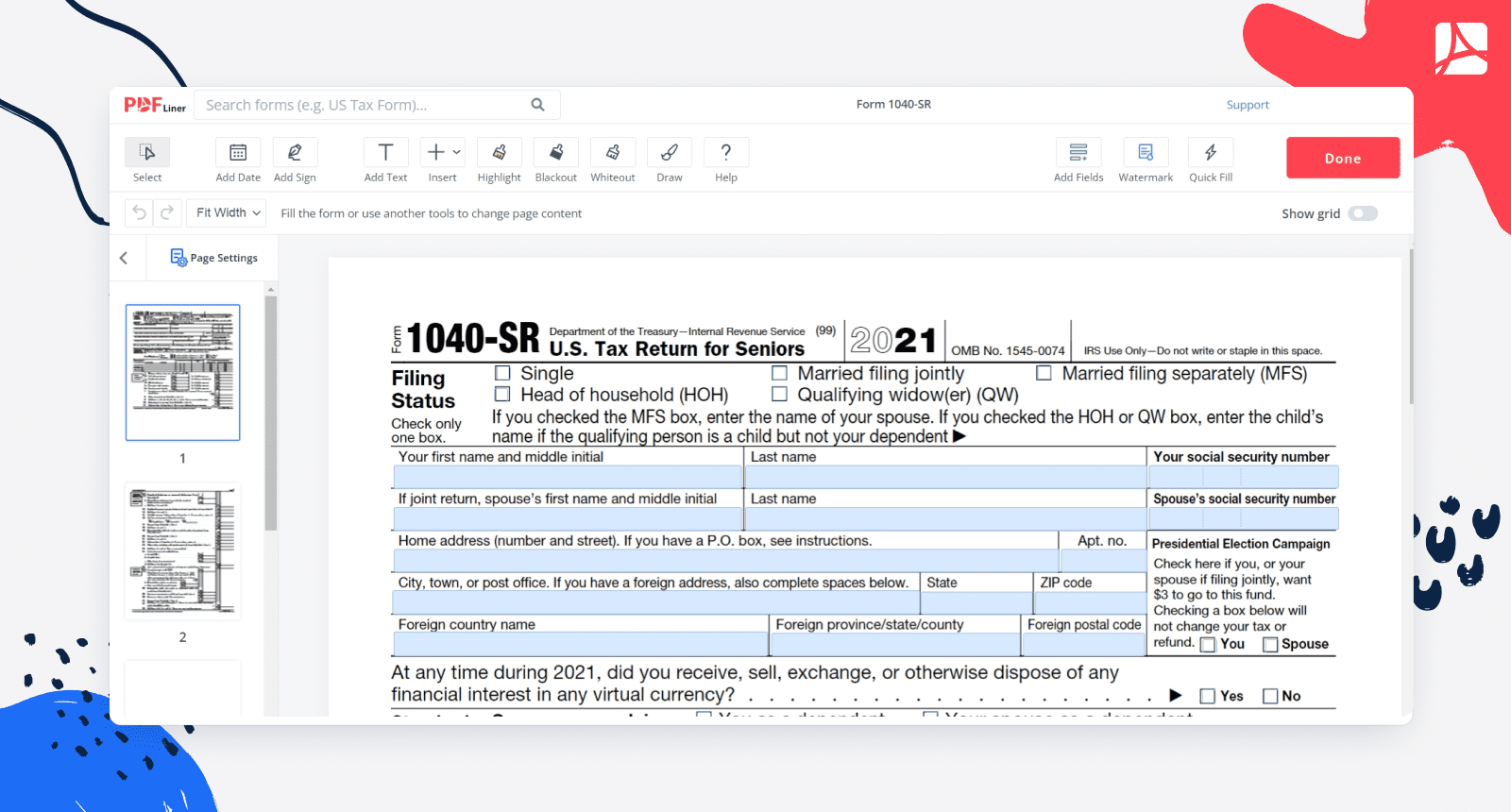

Form 1040SR (2022) Sign Online, Print Form PDFliner

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png)

2023 Form 1040sr Printable Forms Free Online

Web Name(S) Shown On Return.

If You’re Married And Filing Jointly , Only One Spouse Is Required To Meet The Age Limit.

Single Married Filing Jointly Married Filing Separately (Mfs) Head Of Household (Hoh) Qualifying Widow(Er) (Qw) If You Checked The Mfs Box, Enter The Name Of Your Spouse.

Web Calculating Your Tax Liability.

Related Post: