Plan Year Vs Calendar Year

Plan Year Vs Calendar Year - The choice between a plan year and a calendar year for health insurance has various advantages and disadvantages. From an administrative perspective, i think matching the section 125 plan year with the medical renewal works best. The deductible limit is the maximum. A plan year provides flexibility in coverage start dates,. It takes approximately 365.25 days for earth to orbit the sun — a solar year. Detailed comparison pros and cons. Web plan year vs calendar year: Web this year’s canada carbon rebate amounts reflect the temporary pause of the fuel charge on deliveries of home heating oil that came into effect on november 9,. Our benefit year is 10/1 to 9/30. Web updated on january 25, 2024. The choice between a plan year and a calendar year for health insurance has various advantages and disadvantages. To find out when your plan year begins, you can check your plan documents or ask your employer. The deductible limit is the maximum amount covered in a given year a participant may have to pay before the plan coverage is required. We usually round the days in a calendar year. Detailed comparison pros and cons. When it comes to deductibles, it’s calendar year vs. Web learn the difference between plan year and calendar year deductibles for health insurance in nevada and how they affect your out of pocket maximums. Web since plan eligibility switches to plan year after that, the person. Web the common confusion here is generally caused by the reporting requirement—the required reporting is for the calendar year regardless of when your. Web a calendar year deductible, which most health plans operate on, begins on january 1 and ends on december 31. Our benefit year is 10/1 to 9/30. Web updated on january 25, 2024. Web plan year vs. A flexible spending account plan year does not have to be based on the calendar year. Web since plan eligibility switches to plan year after that, the person is eligible if worked 500 hours in calendar year 2022 and also 500 in 2023, then is eligible 1/1/2024. Benefits coverage provided through the adp totalsource health and. Our benefit year is. We usually round the days in a calendar year. Web the common confusion here is generally caused by the reporting requirement—the required reporting is for the calendar year regardless of when your. Can we setup our plans so the limits follow the benefit. A flexible spending account plan year does not have to be based on the calendar year. 24,. Can we setup our plans so the limits follow the benefit. Web annual plan limits are confusing for off calendar year plans. Starting the new year feels like a continuation from 2023 due to a lot factors of holding to the. elle | beauty + wellness. The irs sets fsa and hsa limits based on calendar year. Web the difference. Web the 415 (c) limit to be used for determining annual additions for the plan year running from july 1, 2010 through june 30, 2021 is $58,000, which is the 415 limit set by the irs for. The deductible limit is the maximum. Our benefit year is 10/1 to 9/30. Web the common confusion here is generally caused by the. A flexible spending account plan year does not have to be based on the calendar year. Detailed comparison pros and cons. However, if the medical plan has. Web a leap year means there's an extra day in the calendar. Our benefit year is 10/1 to 9/30. Everything you read talks about 500 hours worked in 2021, 2022 and 2023 implying the hours are. Off calendar plan years could be more expensive to administer since they would not be streamlined with. A plan year provides flexibility in coverage start dates,. Web the difference between calendar year and plan year. Web annual plan limits are confusing for off. The choice between a plan year and a calendar year for health insurance has various advantages and disadvantages. Web since plan eligibility switches to plan year after that, the person is eligible if worked 500 hours in calendar year 2022 and also 500 in 2023, then is eligible 1/1/2024. Web the difference between calendar year and plan year. 24, 2022,. Web posted july 9, 2002. Web a calendar year deductible, which most health plans operate on, begins on january 1 and ends on december 31. Web a leap year means there's an extra day in the calendar. Web the common confusion here is generally caused by the reporting requirement—the required reporting is for the calendar year regardless of when your. Can we setup our plans so the limits follow the benefit. Off calendar plan years could be more expensive to administer since they would not be streamlined with. 31, known as calendar year. Does an fsa have to be on a calendar year? Web this year’s canada carbon rebate amounts reflect the temporary pause of the fuel charge on deliveries of home heating oil that came into effect on november 9,. When it comes to deductibles, it’s calendar year vs. 587 views 3 years ago #medicalbilling. Starting the new year feels like a continuation from 2023 due to a lot factors of holding to the. elle | beauty + wellness. What's the difference between calendar year and plan year? From an administrative perspective, i think matching the section 125 plan year with the medical renewal works best. A plan year provides flexibility in coverage start dates,. Web annual plan limits are confusing for off calendar year plans.

Accident Year vs Calendar Year Insurance Terminology Actuarial 101

Plan Year Vs Calendar Year

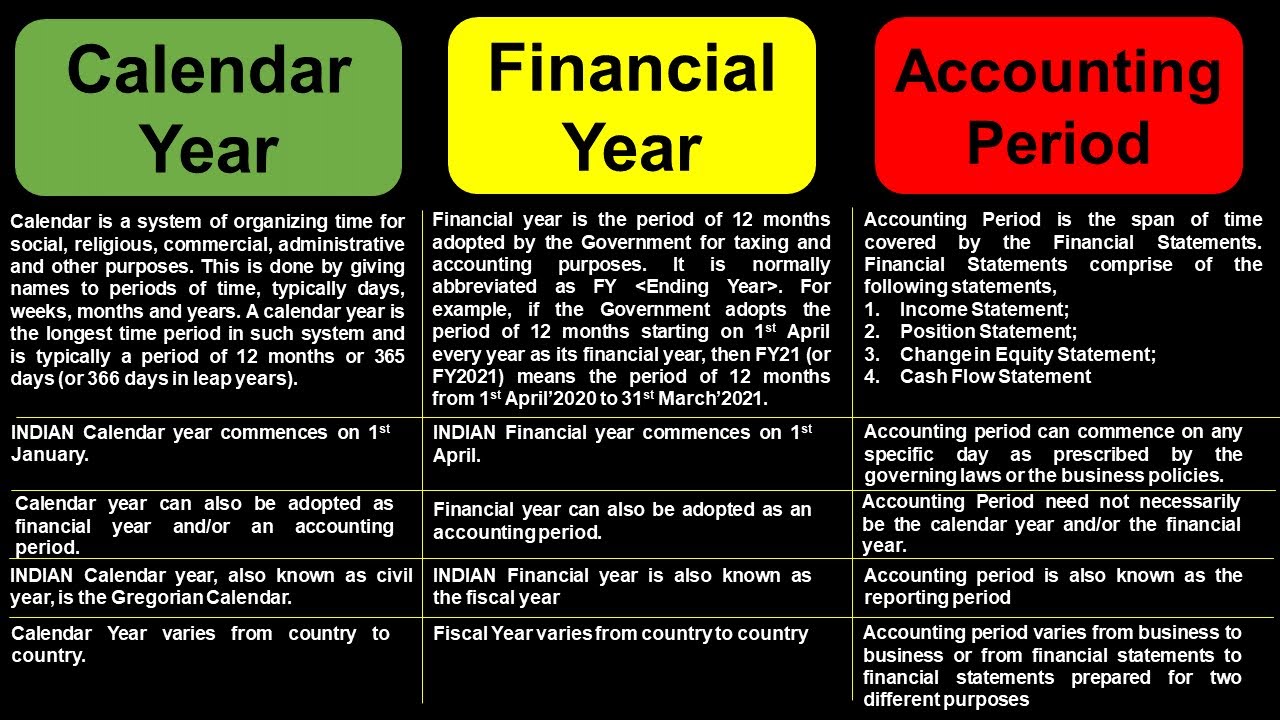

What is Calendar Year What is Financial Year What is Accounting

Calendar Year Vs Plan Year For Insurance 2024 Calendar 2024 Ireland

Fiscal Year vs. Calendar Year Which to choose? Moose Creek

Plan Year Deductible vs. Calendar Year Deductible YouTube

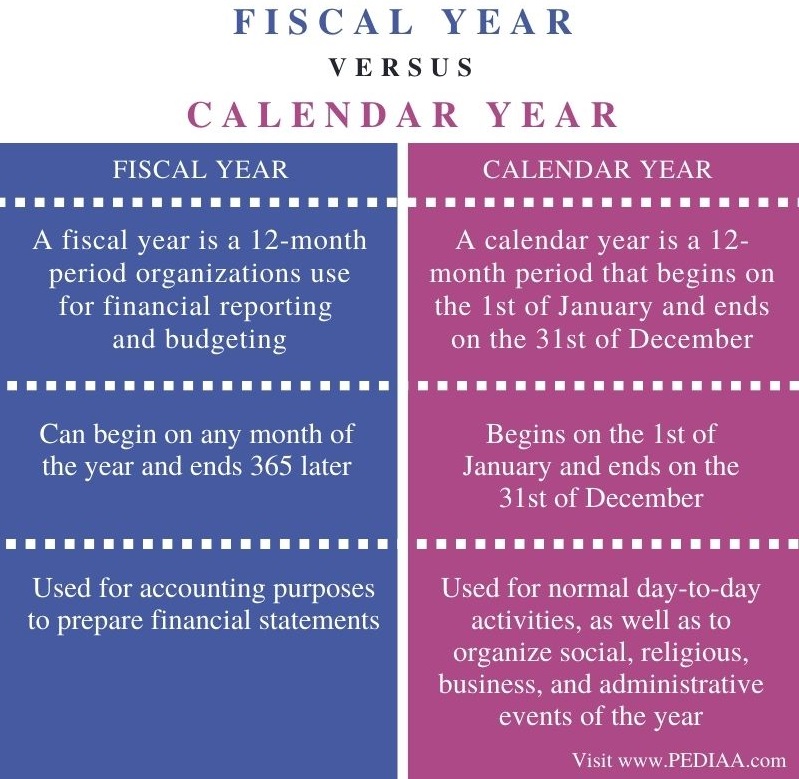

What is the Difference Between Fiscal Year and Calendar Year

Fiscal Year vs Calendar Year What's The Difference?

Fiscal Year VS Calendar Year for Business Taxes

Calendar vs Plan Year What is the difference? Medical Billing YouTube

Benefits Coverage Provided Through The Adp Totalsource Health And.

Our Benefit Year Is 10/1 To 9/30.

It Takes Approximately 365.25 Days For Earth To Orbit The Sun — A Solar Year.

Web The 415 (C) Limit To Be Used For Determining Annual Additions For The Plan Year Running From July 1, 2010 Through June 30, 2021 Is $58,000, Which Is The 415 Limit Set By The Irs For.

Related Post: