Pin Bar Candlestick Pattern

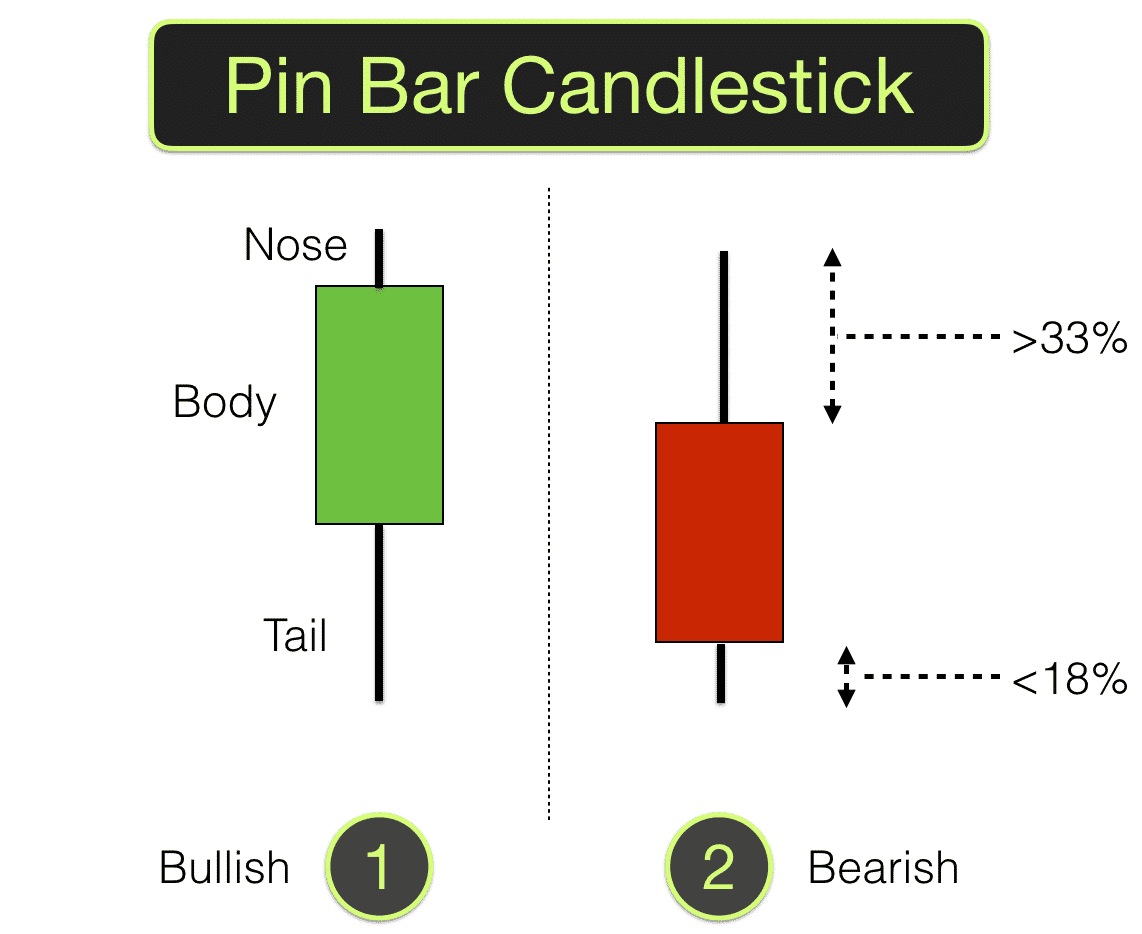

Pin Bar Candlestick Pattern - Web a pin bar is a candlestick pattern consisting of a single bar with a small body and a long wick. This pattern forms when a smaller bullish pin bar is followed by a larger bearish pin bar that completely engulfs the previous candlestick, including its body and wicks. After the price slid below the psychological level of 1.2000 and tested the area near the 1.1900 support zone, the pin bar pattern was formed. A good quantified pin bar candle will have a long wick on one side and no wick or a very small. This pattern often indicates a shift in market sentiment and possible trend reversal. In an uptrend you would normally expect candlesticks to. Web the pin bar candlestick is a simple yet powerful formation you can use in various market contexts. The significance of the pin bar is rooted in the. Understanding the story behind the. Web a pin bar is a single candlestick with a long tail (wick) who’s price action demonstrates a rejection of a price level and reversal in price closing near its high (bullish pin bar) or low (bearish pin bar) for a user defined session. It gets its name from the tail looking like a sharp pin or needle sticking out of the candle body. Web a pin bar is a single candlestick with a long tail (wick) who’s price action demonstrates a rejection of a price level and reversal in price closing near its high (bullish pin bar) or low (bearish pin bar) for. Web the pin bar candlestick pattern is one of the best candle patterns available and one of the most reliable candlestick reversal formations you can see on the. Web the pin candlestick pattern, often referred to as a “pin bar,” is a popular tool used by traders to gauge market sentiment and potential price reversals. Web the pin bar pattern. Web the pin bar is effectively comprised of two segments, the “wick” portion and the “body” of the candlestick. The wick appears top and bottom of the candlestick, with one of the wicks looking longer than the other. In the image you can see a sharp decline caused the price breakthrough several retracement levels before reversing at the 61.80% level,. A pin bar is a japanese candlestick that has a long wick on one side and a small body. In an uptrend you would normally expect candlesticks to. The pin bar reversal as it is sometimes called, is defined by a long tail, the tail is also referred to as a “shadow” or “wick”. After the price slid below the. The pin bar reversal as it is sometimes called, is defined by a long tail, the tail is also referred to as a “shadow” or “wick”. This pattern often indicates a shift in market sentiment and possible trend reversal. Ideally, we want the body to be small relative to the size of the wick. The stop loss would be placed. Web the pin bar candlestick pattern comprises a small body, a long wick or shadow, an opening price, and a closing price. Web a pin bar is a candlestick pattern with a long tail or wick relative to its body size. Learn how you can use it in trading with fbs tips for traders. Web the pin bar pattern (reversal. After the price slid below the psychological level of 1.2000 and tested the area near the 1.1900 support zone, the pin bar pattern was formed. This candlestick pattern is easily identifiable on a price chart by its unique structure, which features a long tail or shadow with a small body. Web the pin bar candlestick pattern is one of the. A bearish engulfing pin bar suggests a shift from bullish to bearish sentiment, indicating potential downward momentum. The wick appears top and bottom of the candlestick, with one of the wicks looking longer than the other. As we discuss more below, the best pin bars are found at important market levels or within obvious trends. The actual pin bar itself. The long upper shadow of a bearish pin bar indicates that the price rose. Characterized by its distinctive shape, the pin bar has a small body and a long wick or shadow that protrudes from one end. In most cases, the bar is formed between a bullish and bearish candlestick. Bullish pin bar candle pattern and fibonacci levels. The bullish. The significance of the pin bar is rooted in the. The pin bar reversal as it is sometimes called, is defined by a long tail, the tail is also referred to as a “shadow” or “wick”. Most traders describe the pin bar candlestick pattern as needlelike because of its long wick. Web the pin bar is a price action reversal. The significance of the pin bar is rooted in the. Web a pin bar is a candlestick pattern that signals the reversal of a price trend. Web a pin bar candlestick pattern visually shows when price reverses in a time frame back near its starting point. Web the pin bar candlestick pattern comprises a small body, a long wick or shadow, an opening price, and a closing price. Web the pin candlestick pattern, often referred to as a “pin bar,” is a popular tool used by traders to gauge market sentiment and potential price reversals. A bearish engulfing pin bar suggests a shift from bullish to bearish sentiment, indicating potential downward momentum. A trader can buy near the 50% retracement of the wick, or simply wait for a breakout and place a buy stop above the pin bar’s high. In an uptrend you would normally expect candlesticks to. Web the pin bar is a price action reversal pattern that shows that a certain level or price point in the market was rejected. This pattern suggests a strong rejection of price at a certain. Learn how you can use it in trading with fbs tips for traders. It gets its name from the tail looking like a sharp pin or needle sticking out of the candle body. This candlestick pattern is easily identifiable on a price chart by its unique structure, which features a long tail or shadow with a small body. The actual pin bar itself is a bar with a long upper or lower “tail”, “wick” or “shadow” and a much smaller “body” or “real body”. In this guide, we’ll delve into the intricacies of the. Web trading the pins is simply a matter of waiting for the price to hit a retracement level and then seeing if a bullish or bearish pin bar forms.

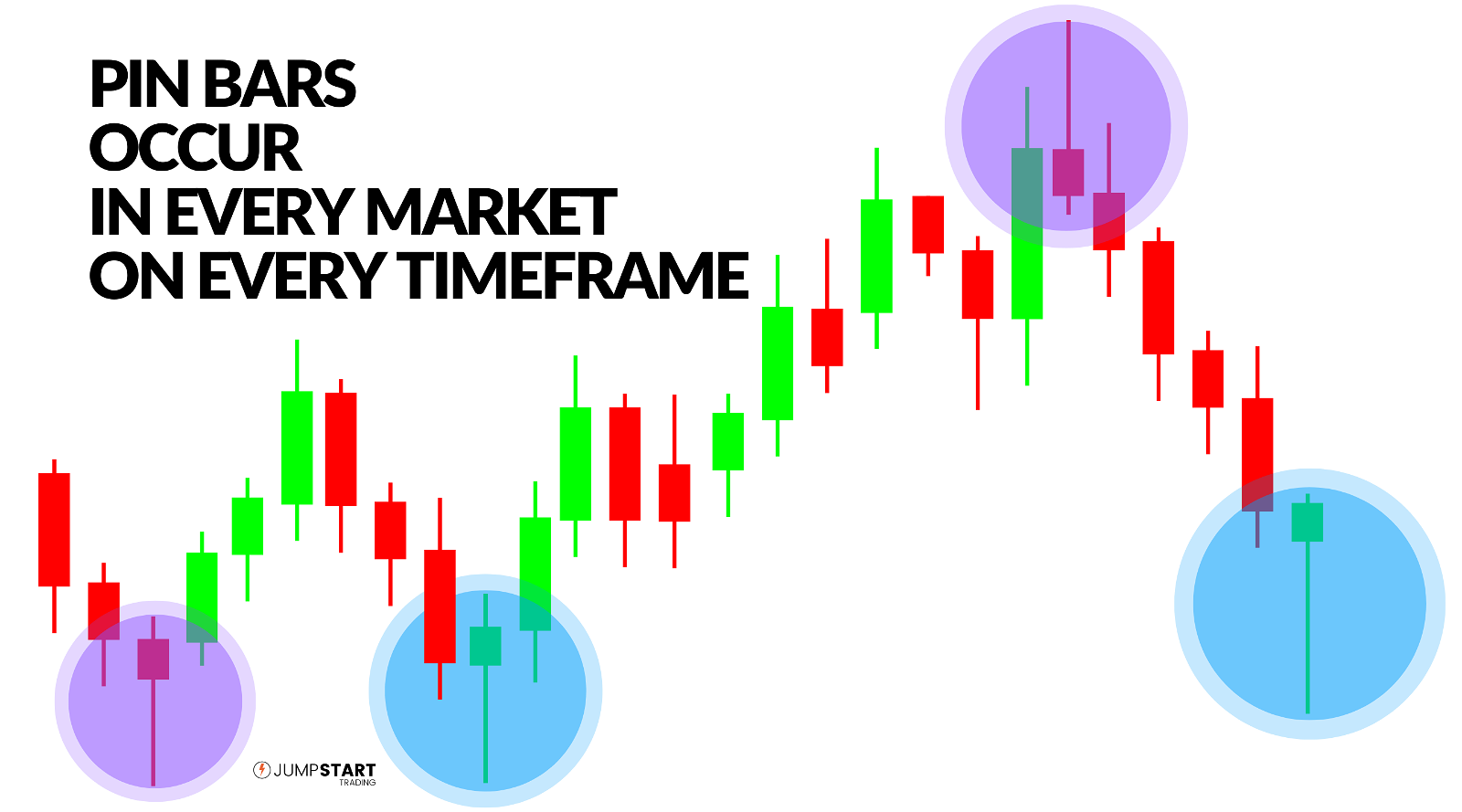

Pin Bars Ultimate Strategy Guide

Pin Bar candlestick pattern Regular pattern in Trading candlestick charts

What Is Pin Bar Candlestick? How To Use It To Trade Binary Option

What Is Pin Bar Candlestick? How To Use It To Trade Binary Option

Pin Bar Candlestick Pattern Explained (Inc. Useful Strategies)

Pin Bar candlesticks with Support And Resistance Trading Strategy

Pin Bar candlestick pattern Regular pattern in Trading candlestick charts

How To Trade Forex & Win with Pin Bar Candlestick Pattern

Pin Bar candlestick pattern Regular pattern in Trading candlestick charts

Bearish Pin Bar Candlestick Pattern

Web An Effective Pin Bar Trading Strategy Would Be To Wait For The Price To Retrace About Half The Distance Of The Wick.

As We Discuss More Below, The Best Pin Bars Are Found At Important Market Levels Or Within Obvious Trends.

Web The Pin Bar Is Effectively Comprised Of Two Segments, The “Wick” Portion And The “Body” Of The Candlestick.

If The Headline Index Manages To Hold Thursday's Low Of 21,932, A Pullback Looks Possible To Chartists.

Related Post: