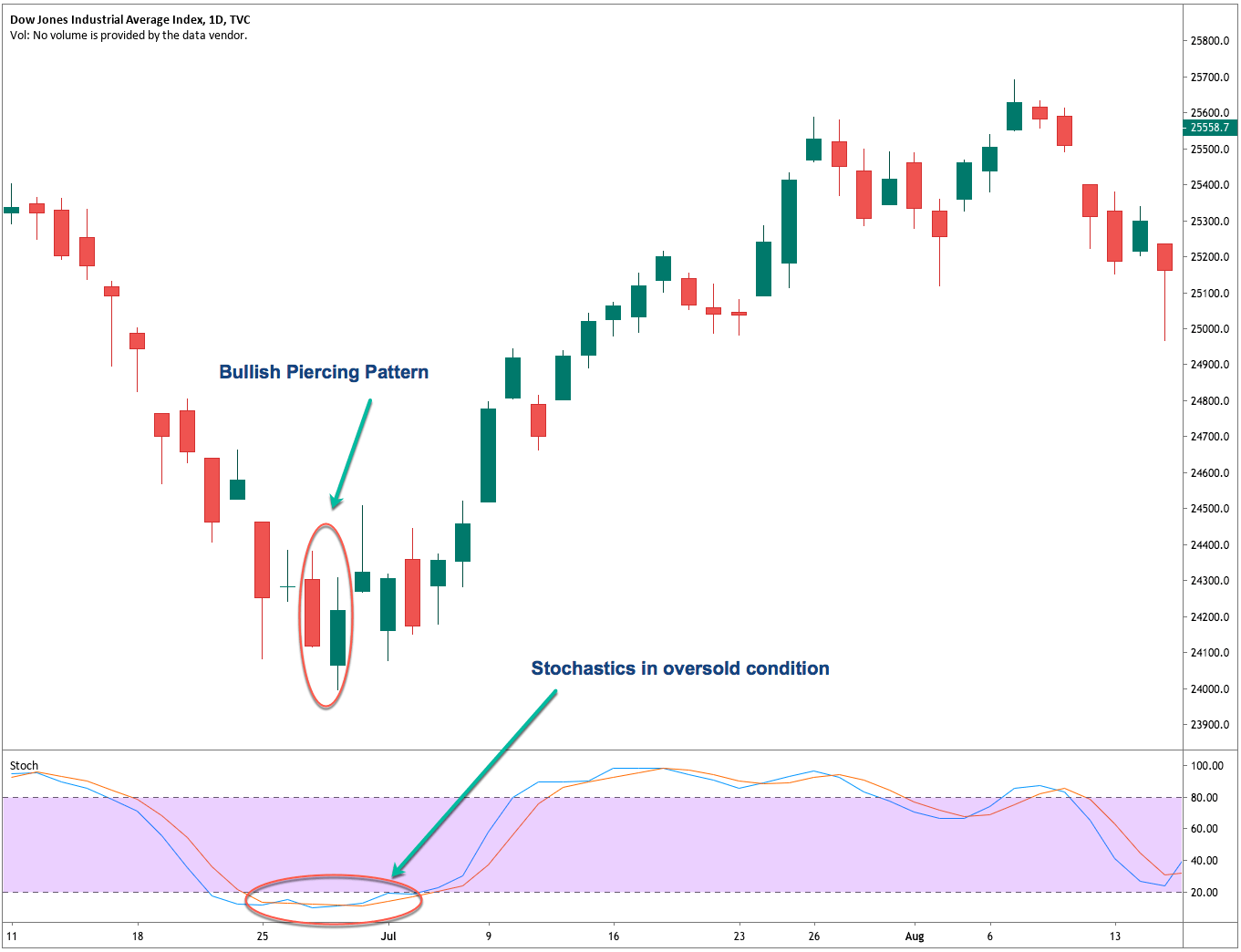

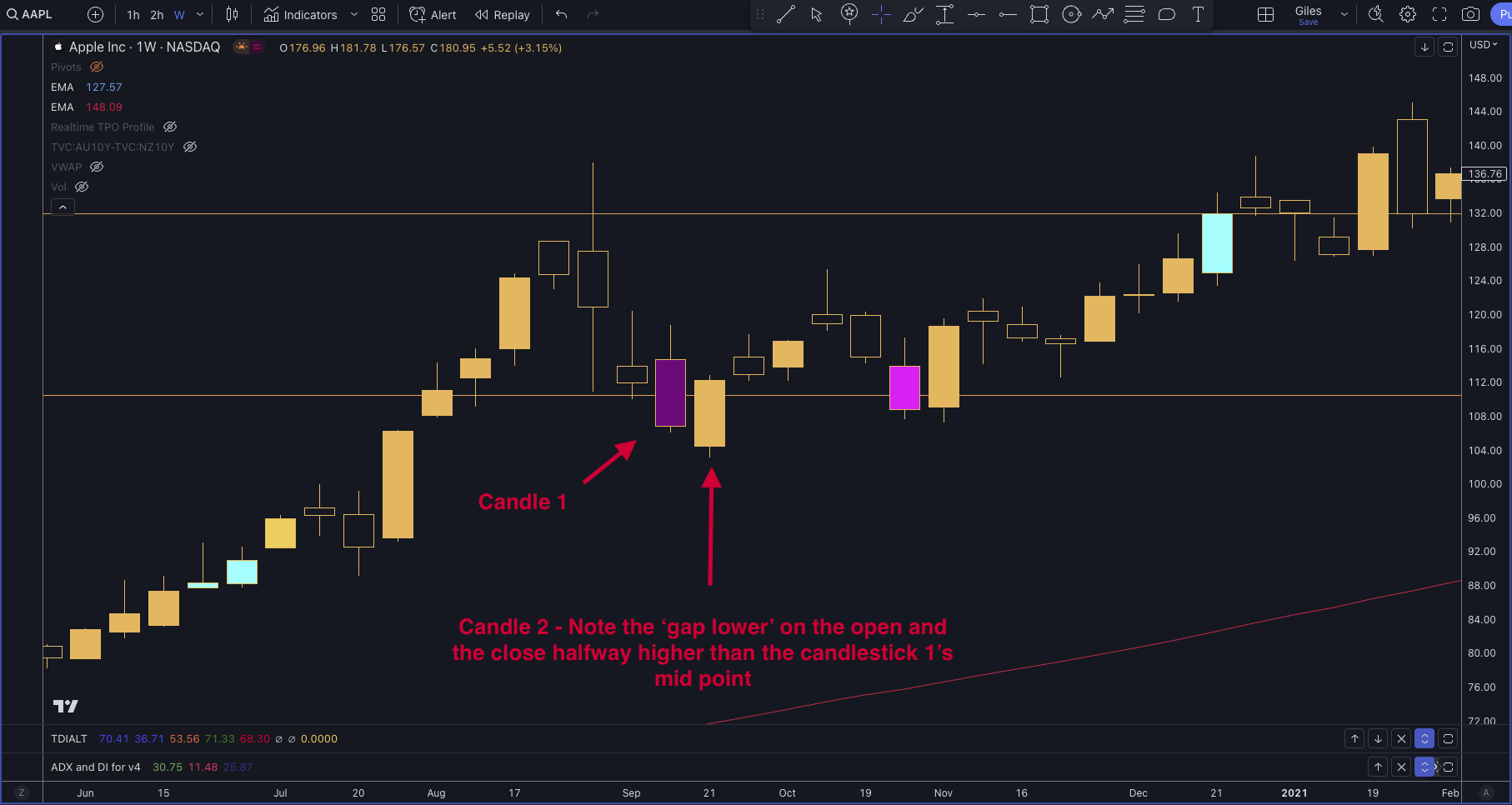

Piercing Pattern

Piercing Pattern - Web the piercing pattern on dis’s chart, transitioning from near despair to renewed optimism, powerfully illustrates the illuminating potential of technical analysis in identifying market turning points. And then closes back above 50% of the previous candle’s body! It closely resembles a bullish engulfing pattern. Being one of the few two candlestick patterns, the piercing line pattern consists of two consecutive candles with a first bearish candlestick and a. However, recognizing these patterns equips you with valuable tools for. Web the piercing pattern gets its name because bulls come in to “pierce” price through the falling trend. The formation consists of a long black candlestick followed by a long white candlestick. The piercing pattern depends upon the near high opening prices of. In a bullish engulfing pattern, the p2’s blue candle engulfs p1’s red candle. Chimpanzees ( pan troglodytes) and bonobos ( pan paniscus) both exhibit remarkable intelligence and strikingly similar features, yet several distinctive traits set. The rejection of the gap down by the bulls typically can be viewed as a bullish sign. Web the piercing pattern does well for day trading as well as in the case of larger time frames. Web the piercing pattern stands out as a renowned and potent reversal pattern that offers valuable insights into market trends and potential trading opportunities.. “wait a minute, that looks like a bullish engulfing candle!”. Web what is the piercing line candlestick pattern? As the name suggests, a piercing line pattern refers to a candlestick formation that shows the effect of piercing through an ongoing trend to reverse it. This type of pattern is formed when the bulls and bears both fight to gain control. Web the piercing pattern gets its name because bulls come in to “pierce” price through the falling trend. The fact that bulls were able to press further up into the. Web the piercing pattern is a bullish reversal pattern that consists of two candlesticks. It typically occurs during a downtrend, indicating that the bears may be losing control and a. It appears at the bottom of a downtrend and indicates that buyers are starting to overwhelm sellers, pushing prices higher. Web the piercing pattern is very similar to the bullish engulfing pattern with a minor variation. Web a piercing pattern happens when a candle gaps down at the open: As stated earlier, traders need more than just that pattern to. Web the piercing pattern acts in theory as it does in reality, as a bullish reversal, ranking 21 out of 103 candlestick patterns where 1 is best. “wait a minute, that looks like a bullish engulfing candle!”. This is followed by buyers driving prices up to close above 50%. Web additionally, the price gaps down on day 2 only for. Patterns fail all the time, and two candle patterns are no different. The rejection of the gap down by the bulls typically can be viewed as a bullish sign. This candlestick pattern is used as an indicator to enter a long position or exit the sell position. You may also spot piercing candles when small price peaks happen. The only. It appears at the bottom of a downtrend and indicates that buyers are starting to overwhelm sellers, pushing prices higher. Understanding the basic concepts behind this pattern is crucial to effectively interpret its signals and make informed trading decisions. Overall performance is good, too, suggesting the price trend after the breakout is a lasting and profitable one. The only difference. Web the piercing pattern is very similar to the bullish engulfing pattern with a minor variation. Web the piercing pattern on dis’s chart, transitioning from near despair to renewed optimism, powerfully illustrates the illuminating potential of technical analysis in identifying market turning points. Candlestick patterns serve as vital tools for traders and investors in analyzing price movements in financial markets.. The fact that bulls were able to press further up into the. The piercing pattern is made up of two candlesticks. A crucial element is a gap down after the first day, where the. Web the piercing pattern stands out as a renowned and potent reversal pattern that offers valuable insights into market trends and potential trading opportunities. You may. Overall performance is good, too, suggesting the price trend after the breakout is a lasting and profitable one. Interpreting the piercing line pattern. Web additionally, the price gaps down on day 2 only for the gap to be filled and closes significantly into the losses made previously in day 1’s bearish candlestick. The piercing pattern depends upon the near high. As stated earlier, traders need more than just that pattern to confirm the reversal. The bearish piercing pattern is composed of two candles with the second candle closing below the first candle’s close but opening above its closing price, giving. It is found towards the end of a downtrend and is quite similar to the dark cloud cover. Web the bullish piercing candlestick pattern is likely named piercing because of the way the white candle’s close cuts through the midpoint of the previous day’s black candle. Web what is a piercing pattern? Web additionally, the price gaps down on day 2 only for the gap to be filled and closes significantly into the losses made previously in day 1’s bearish candlestick. Web the piercing pattern acts in theory as it does in reality, as a bullish reversal, ranking 21 out of 103 candlestick patterns where 1 is best. And then closes back above 50% of the previous candle’s body! Web piercing patterns manifest over two consecutive trading days, offering insights into a potential reversal from a prevailing downtrend to an upward trajectory. Web the piercing pattern is very similar to the bullish engulfing pattern with a minor variation. The piercing line is a bullish reversal candlestick pattern found at the end of a bearish trend that helps traders find potential reversal zones. Scroll down to learn how to identify, interpret, and react to the bullish piercing. The piercing pattern does best in a bear market, especially after a downward breakout. However, recognizing these patterns equips you with valuable tools for. Being one of the few two candlestick patterns, the piercing line pattern consists of two consecutive candles with a first bearish candlestick and a. Web the piercing pattern stands out as a renowned and potent reversal pattern that offers valuable insights into market trends and potential trading opportunities.

Piercing Line Pattern The Complete Guide 2022

Candlestick Reversal Patterns I Overview and The Piercing Pattern

:max_bytes(150000):strip_icc()/PiercingPattern1-4a52690ddbb642838f5ca6a5b6d360c6.png)

Piercing Pattern Definition

How to Trade with the Piercing Line Pattern

The piercing pattern explained

Piercing Pattern Meaning, Formation & Trading Setup Finschool

:max_bytes(150000):strip_icc()/PiercingPattern2-db540caea4cb45c6953f68db1d57eb55.png)

Piercing Pattern Definition

16 Ear Piercing Combinations

How To Trade Blog How To Use The Piercing Pattern Effectively In Forex

Piercing Candlestick Pattern How to Identify Piercing Line

Web A Piercing Pattern Happens When A Candle Gaps Down At The Open:

It Signals A Potential Short Term Reversal From Downwards To Upwards.

Web The Piercing Pattern Gets Its Name Because Bulls Come In To “Pierce” Price Through The Falling Trend.

Web A Piercing Pattern Is A Candlestick Pattern Formed Near The Support Levels, And It Gives Us Potential Bullish Reversal Signs.

Related Post: