Pennat Pattern

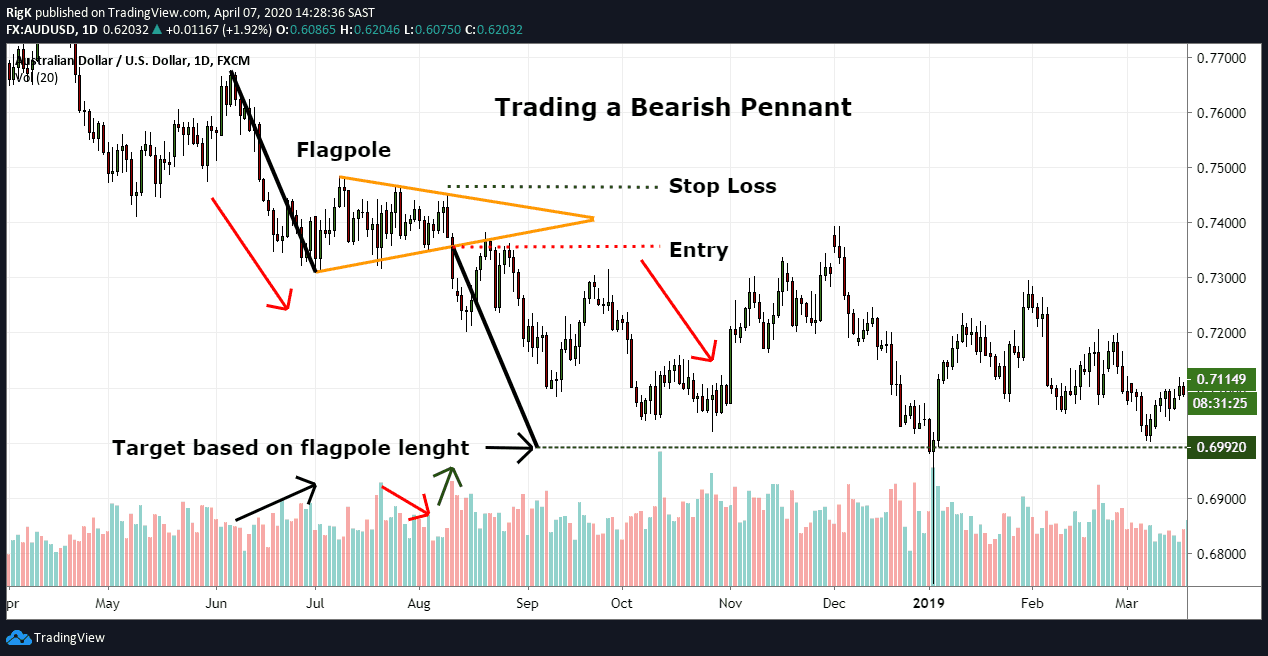

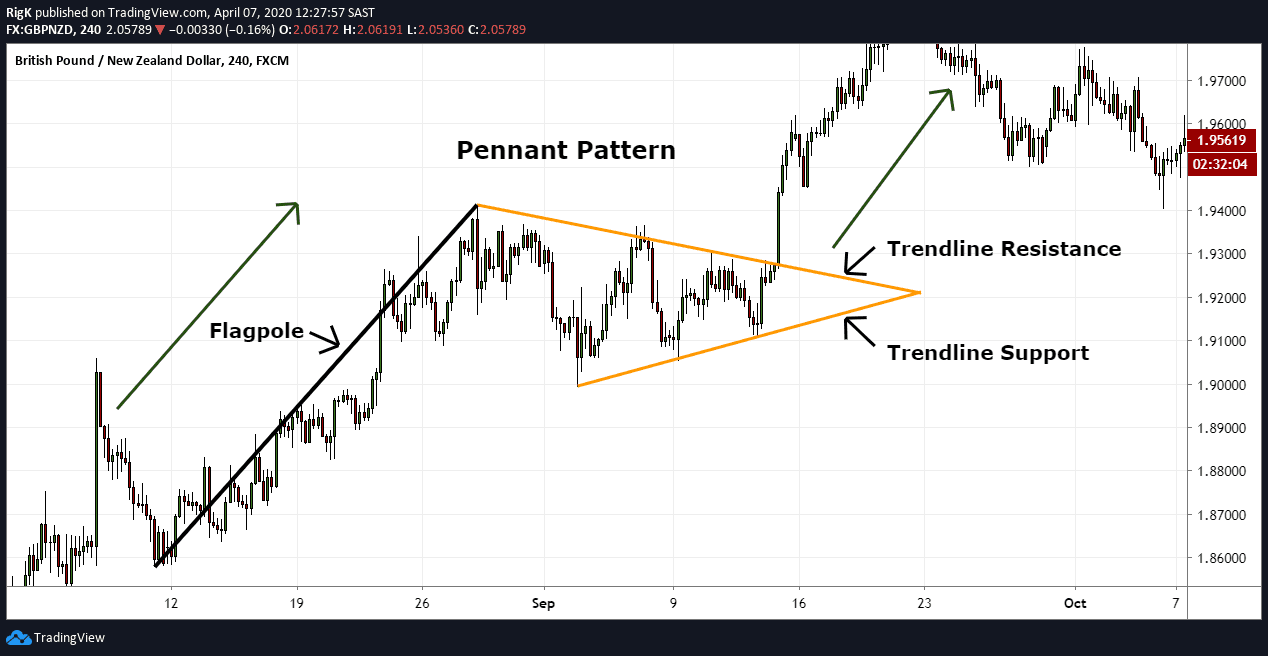

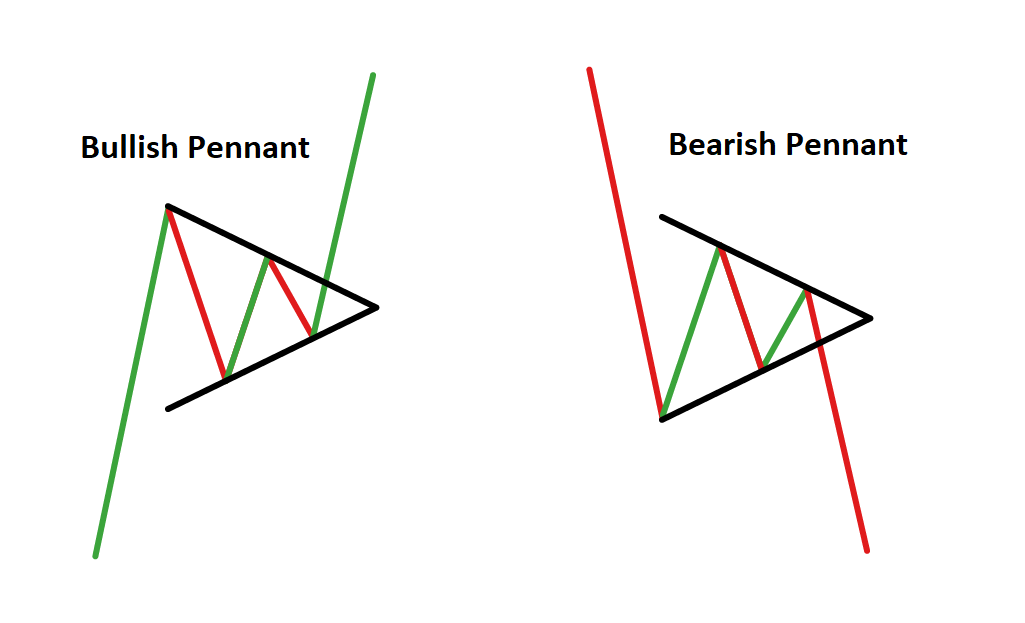

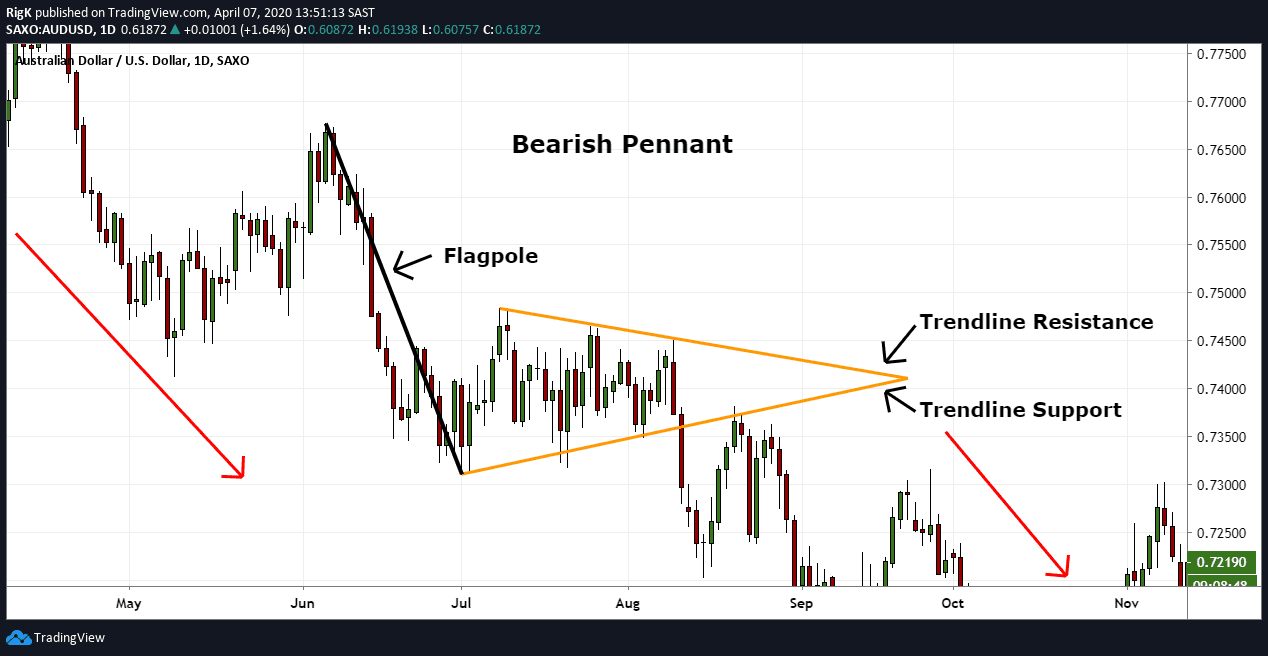

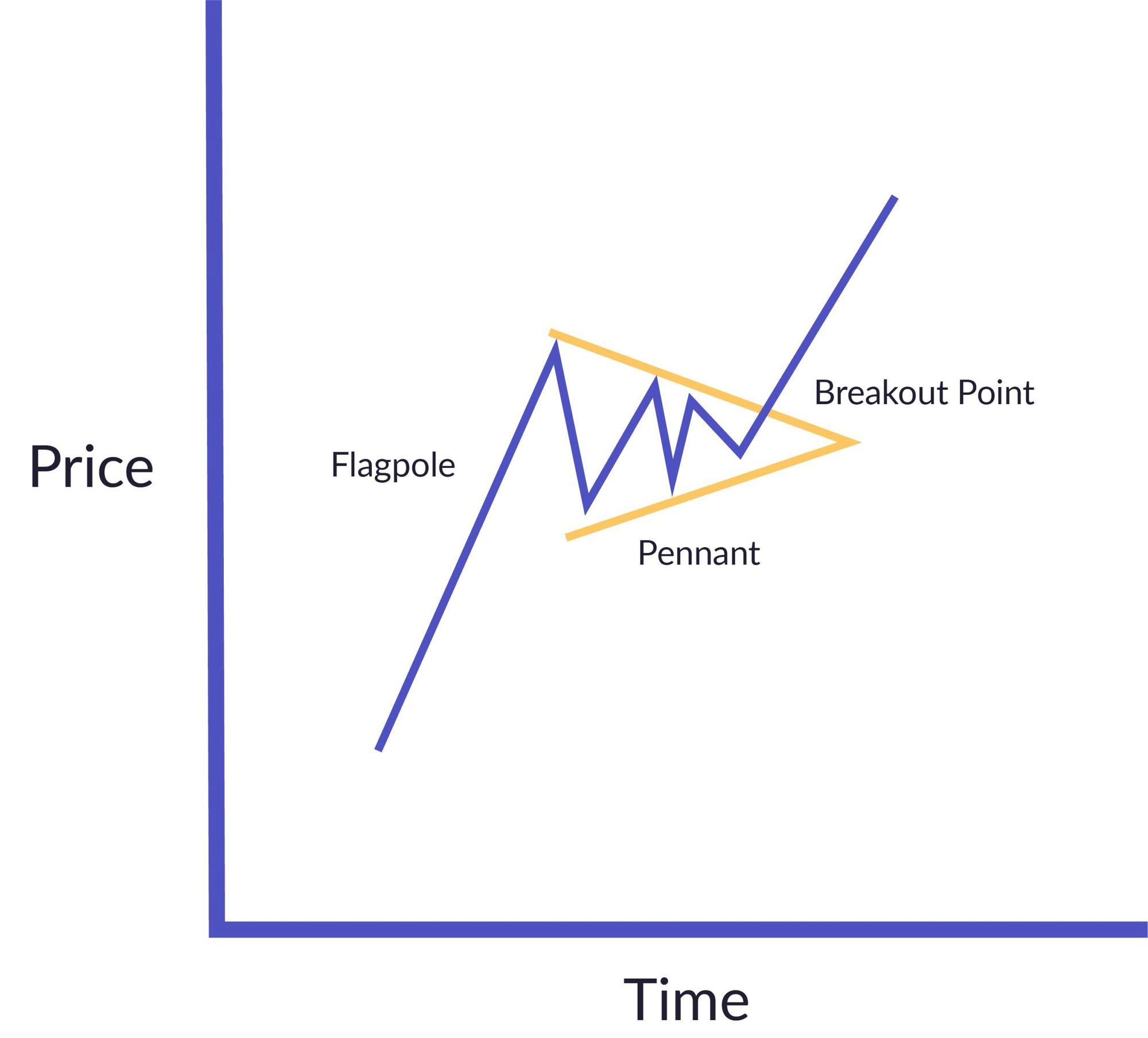

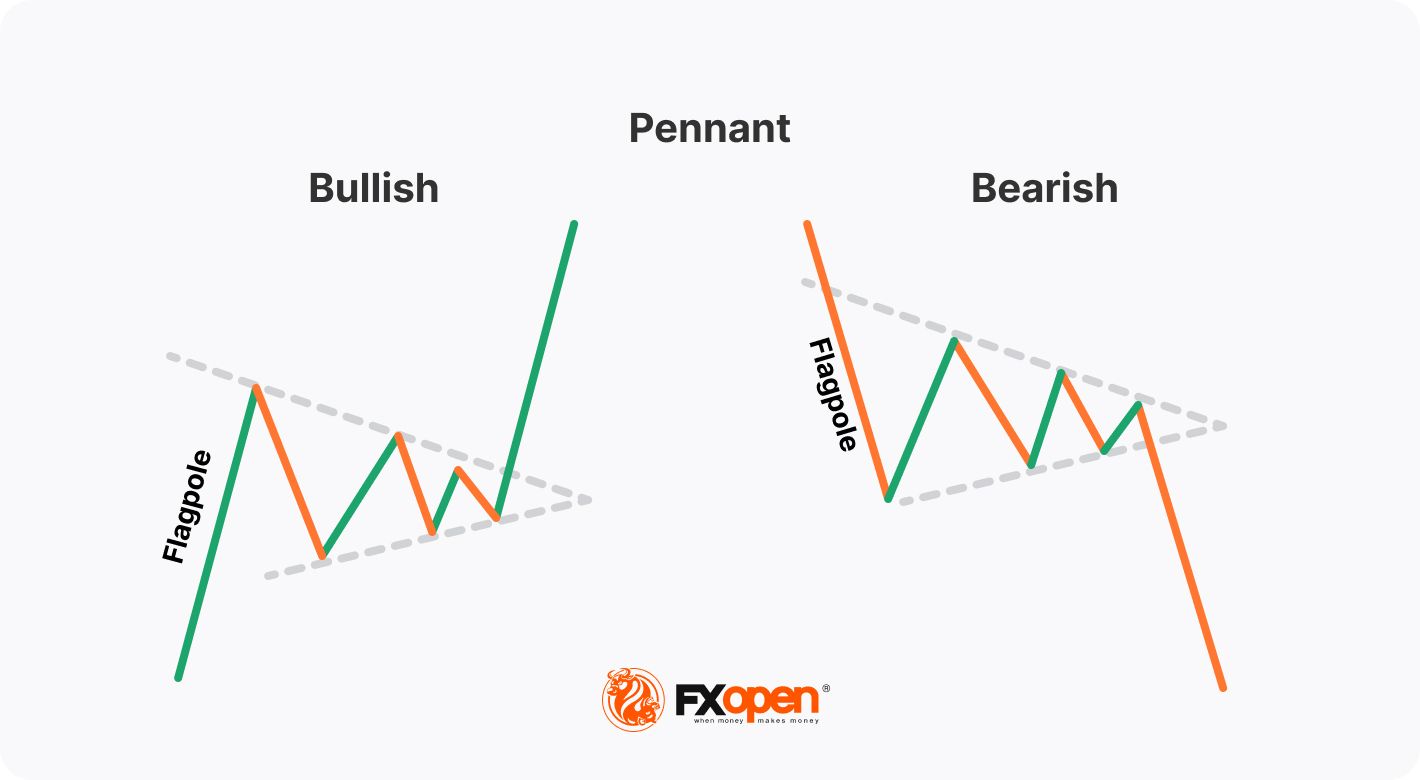

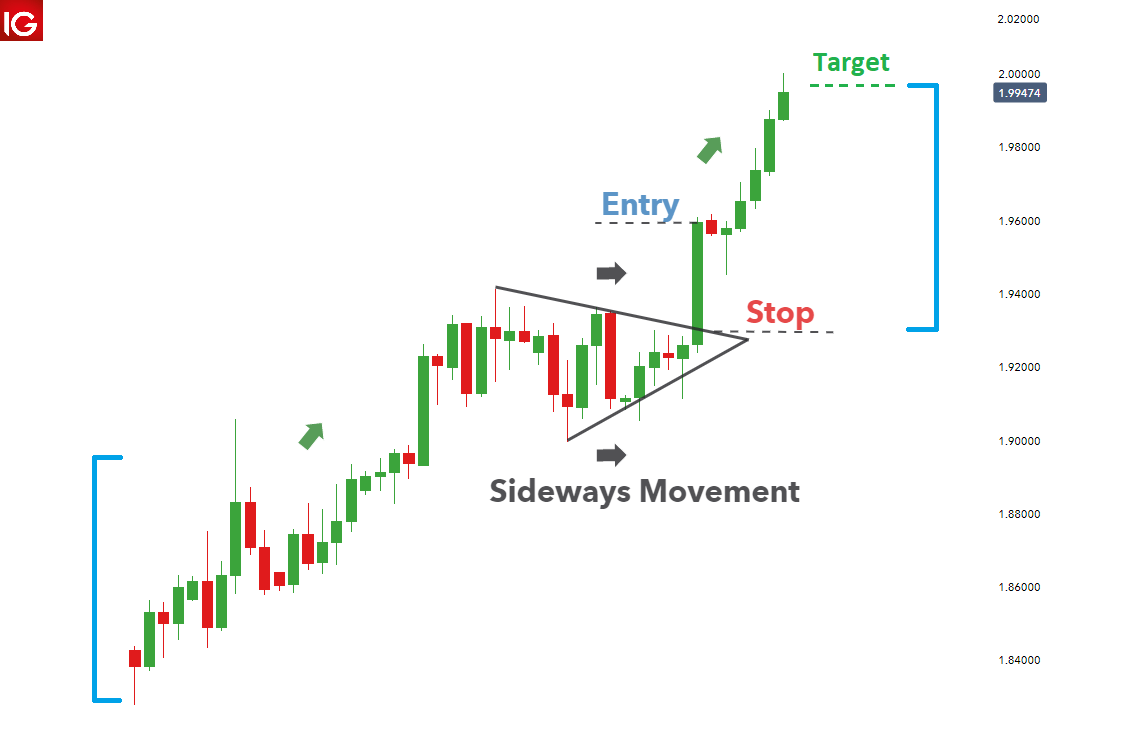

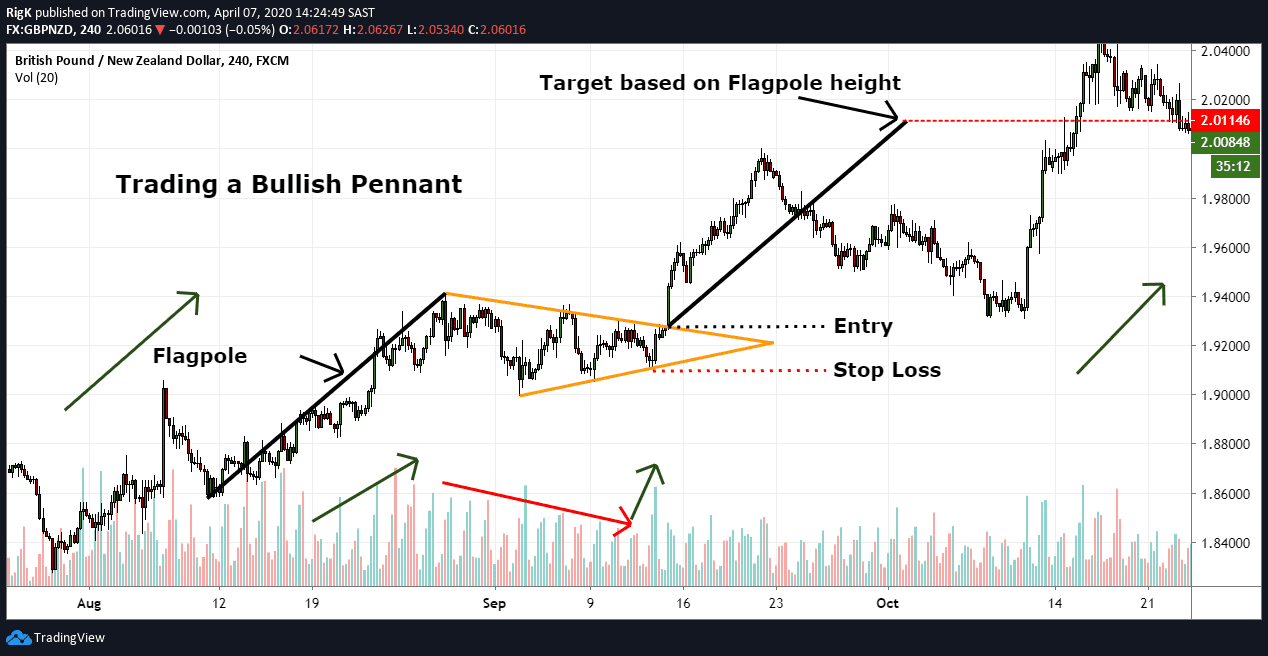

Pennat Pattern - The pattern resembles a flagpole. The two differ by duration and the appearance of a flagpole. symmetrical triangle. Web in price chart analysis, a pennant is a continuation chart pattern that forms when the market consolidates after a rapid price move. This sideways movement typically takes the form or a rectangle (flag) or. When looking at a pennant pattern, one will identify three distinct phases: The purpose of identifying a bull pennant pattern is to signal potential buying opportunities for traders and investors. The pennant is a continuation chart pattern that appears in both bullish and bearish markets. In this article, we will discuss the formation of a pennant pattern, how it works in the stock market, and how traders can use it to make informed trading decisions. Web the pennant patterns help traders identify strong market continuation trends and provide them with the ideal entry and exit points. Pennants pattern are a type of continuation chart pattern. When looking at a pennant pattern, one will identify three distinct phases: Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. Read for performance statistics, trading tactics, id guidelines and more. The purpose of identifying a bull pennant pattern is to signal potential buying opportunities for traders and investors. Web. In this article, we will discuss the formation of a pennant pattern, how it works in the stock market, and how traders can use it to make informed trading decisions. How to identify a pennant chart pattern? Web pennants are small consolidation patterns that sometimes appear midway into a move. Web in price chart analysis, a pennant is a continuation. A pennant is a consolidated price action in which the price takes a short breather before continuing its movement in the ongoing direction. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. Web a bullish pennant is a technical trading pattern that indicates the impending continuation of a strong. How to identify a pennant chart pattern? This formation occurs when there is a downtrend followed by a period of consolidation. The pattern can be seen in any time frame, and it consists of a small triangular price formation that follows a fast price movement in either an uptrend or a downtrend. Pennants are similar to flag chart patterns in. Web a pennant pattern is a kind of continuation pattern that appears when there’s a significant upward or downward movement in a financial instrument’s price and a subsequent period of consolidation before finally moving in the direction of the initial movement. Written by internationally known author and trader thomas bulkowski. Web updated december 10, 2023. Web pennants are small consolidation. The purpose of identifying a bull pennant pattern is to signal potential buying opportunities for traders and investors. How to identify a pennant chart pattern? The pattern can be seen in any time frame, and it consists of a small triangular price formation that follows a fast price movement in either an uptrend or a downtrend. Web a bullish pennant. Web a pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief consolidation, before continuing to move in the. Read for performance statistics, trading tactics, id guidelines and more. Traders follow this pattern to predict whether a market is getting ready to resume a previous trend after a.. The pennant is created when the highs and lows of this consolidation form a symmetrical triangle. Written by internationally known author and trader thomas bulkowski. The pennant is a continuation chart pattern that appears in both bullish and bearish markets. Web what is pennant pattern in trading. They're formed when a market makes an extensive move higher, then pauses and. The two differ by duration and the appearance of a flagpole. symmetrical triangle. This formation occurs when there is a downtrend followed by a period of consolidation. Web the pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. Web pennants are small consolidation patterns that. In this article, we will discuss the formation of a pennant pattern, how it works in the stock market, and how traders can use it to make informed trading decisions. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. Web a bearish pennant pattern is a technical analysis tool. In technical analysis, a pennant is a type of continuation pattern. How to identify a pennant chart pattern? Read for performance statistics, trading tactics, id guidelines and more. Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. This chart pattern takes one to three weeks to form. Web in technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in a security, known as the flagpole, followed by a consolidation period with converging trend lines—the pennant—followed by a breakout movement in the same direction as the initial large movement, which represents the second half of the. Traders follow this pattern to predict whether a market is getting ready to resume a previous trend after a. This formation occurs when there is a downtrend followed by a period of consolidation. Traders use it to predict upcoming price movements. Web in price chart analysis, a pennant is a continuation chart pattern that forms when the market consolidates after a rapid price move. Web a bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. Web a pennant pattern is a kind of continuation pattern that appears when there’s a significant upward or downward movement in a financial instrument’s price and a subsequent period of consolidation before finally moving in the direction of the initial movement. Web what is a pennant chart pattern? These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a midpoint of the move. A pennant is a consolidated price action in which the price takes a short breather before continuing its movement in the ongoing direction. A pennant is a trend continuation pattern, that generally appears in a strong uptrend or downtrend.

Pennant Chart Patterns Definition & Examples

Pennant Chart Patterns Definition & Examples

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Chart Patterns Definition & Examples

How To Identify and Trade Pennant Patterns? Phemex Academy

Pennant Pattern Types, Characteristics, and How to Trade

Blog Your guide to stock trading chart patterns United Fintech

How to Trade a Pennant Pattern Market Pulse

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Chart Patterns Definition & Examples

The Purpose Of Identifying A Bull Pennant Pattern Is To Signal Potential Buying Opportunities For Traders And Investors.

Web Updated December 10, 2023.

It’s What Traders Call A Continuation Pattern, Meaning It Suggests The Current Trend Is Going To Resume After The Period Of Sideways Price Consolidation.

Web A Bearish Pennant Pattern Is A Technical Analysis Tool That Is Used To Predict Price Movements In The Stock Market.

Related Post: