Pennant Trading Pattern

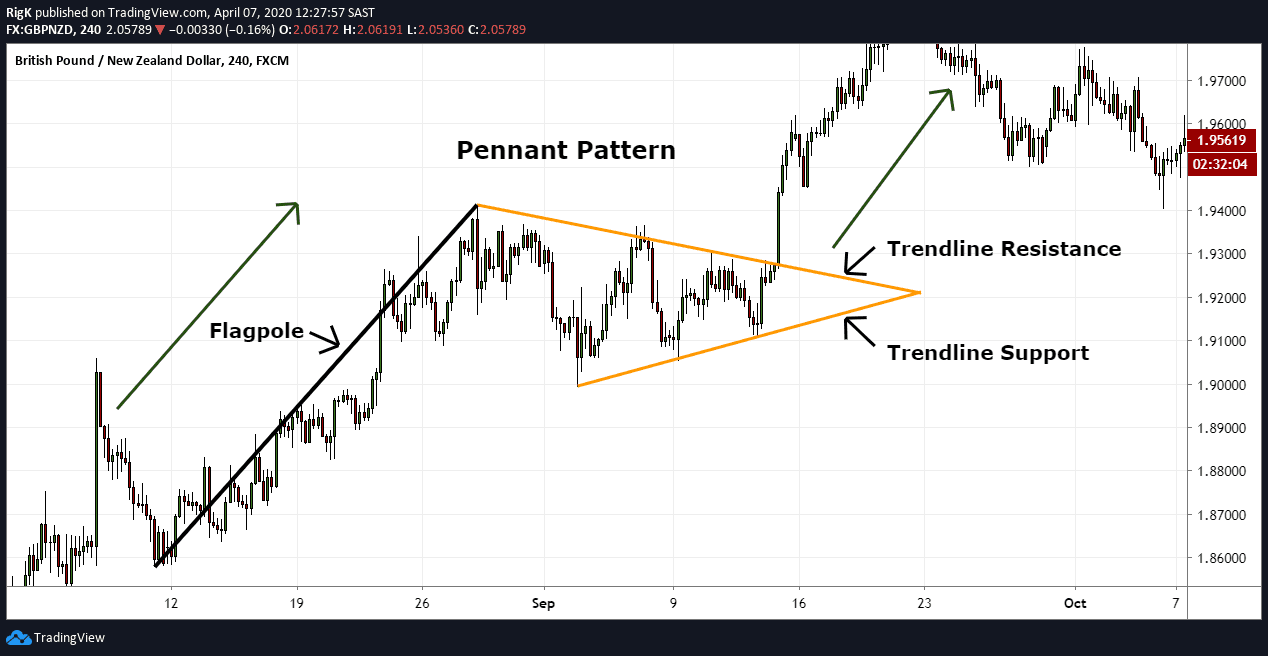

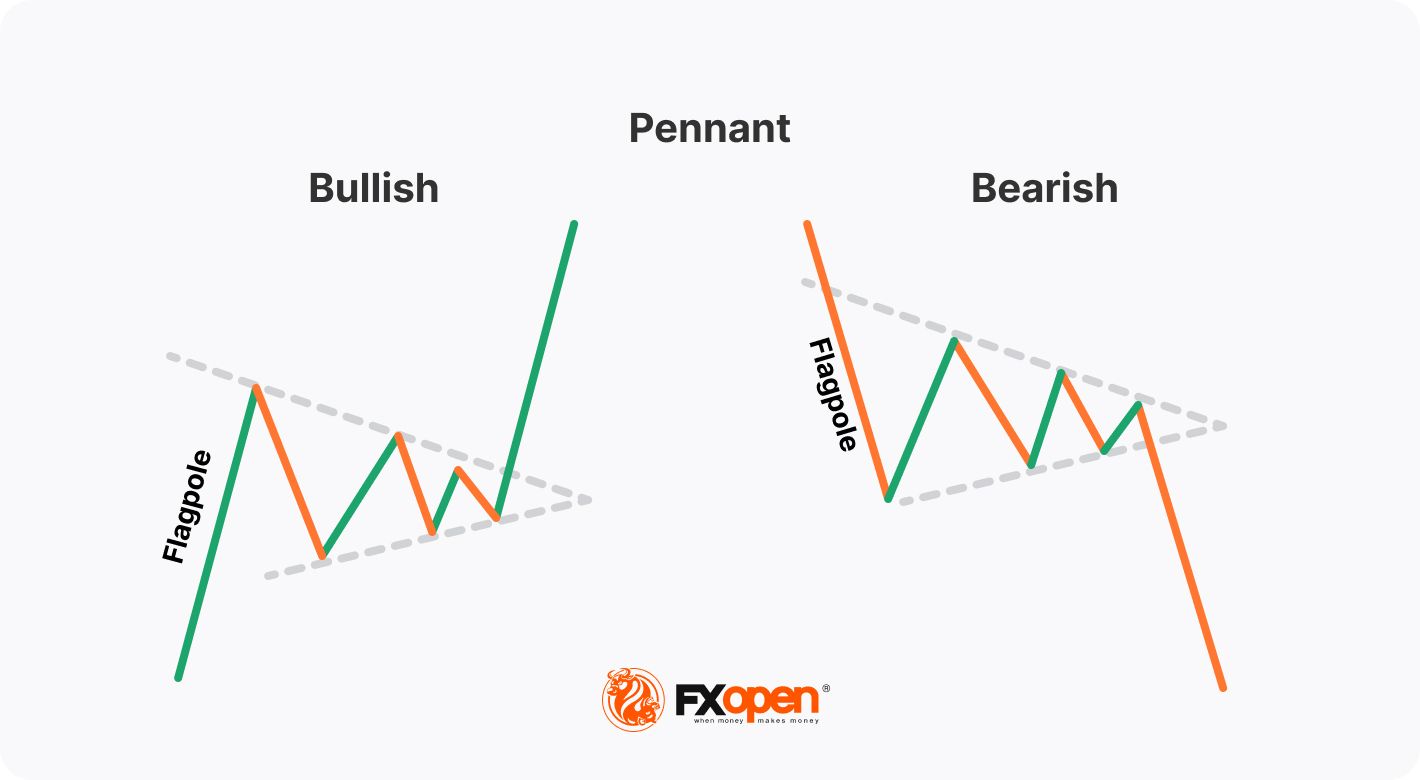

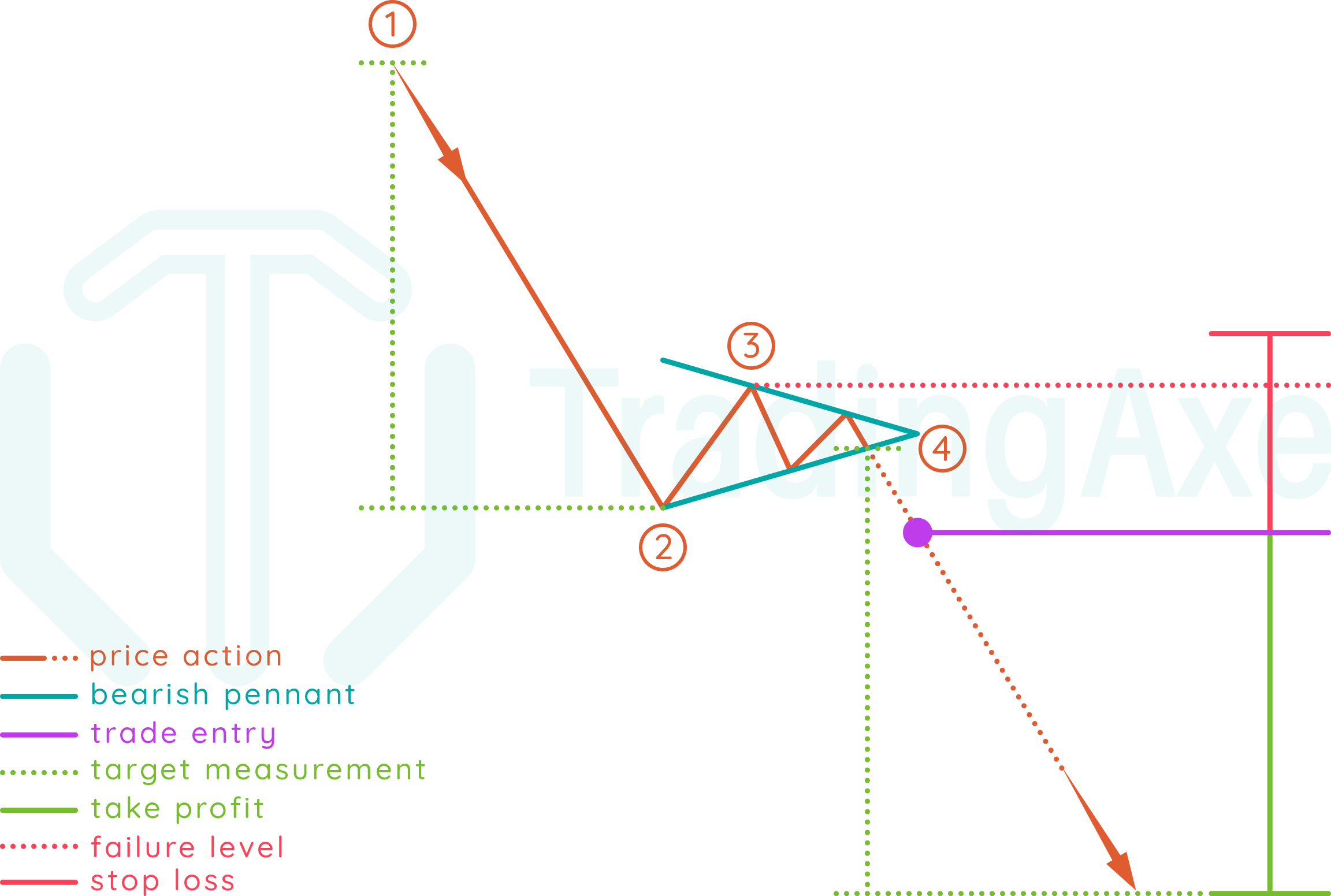

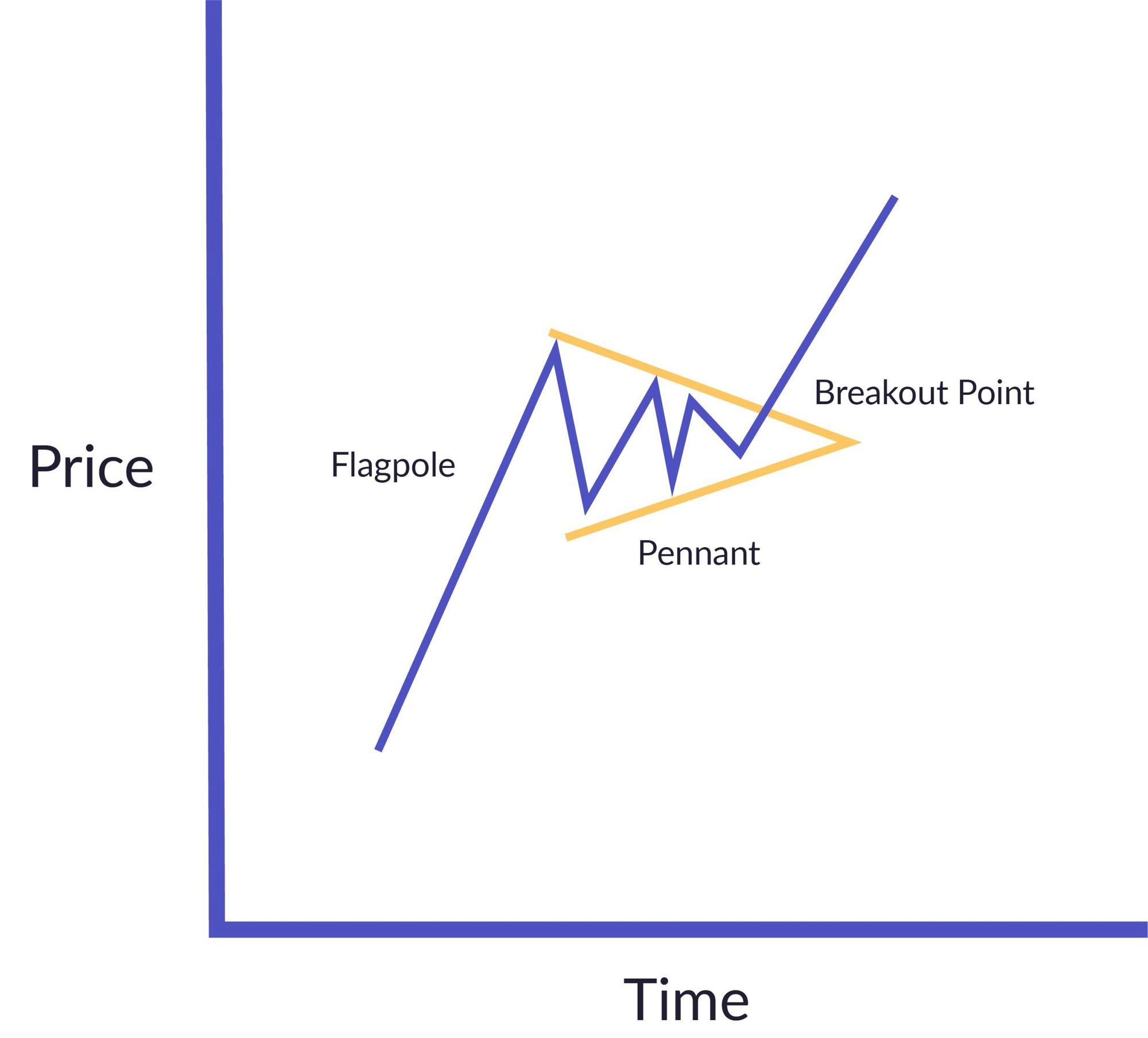

Pennant Trading Pattern - In this article, we will discuss the formation of a pennant pattern, how it works in the stock market, and how traders can use it to make informed trading decisions. Learn more about pattern trading at ig academy The symmetrical triangle pattern is a classic sideways pattern where the. During the consolidation phase price structure tends to move sideways within a narrowing range before a breakout occurs. Web unlike the flag chart pattern, where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. It's important to look at the volume in a pennant—the period of. You’ll learn how to identify both bullish pennant and bearish pennant formations. Comparison between flags and pennants. Web the pennant pattern is a reliable signal for traders as it indicates that the market is likely to continue its prior trend. Web trading the pennant pattern involves a combination of technical analysis and risk management. After a sharp decline, the formation of the bearish pennant occurs: Web the pennant is a continuation chart pattern that appears in both bullish and bearish markets. Ideally, a pennant pattern lasts between one and four weeks. The formation usually occurs after a sharp price movement that can contain gaps (known as the mast or pole of the pennant) where. Web pennants are continuation patterns where a period of consolidation is followed by a breakout used in technical analysis. It acts as a harbinger, signaling impending alterations to prevailing market conditions. If you appreciate our charts, give us a quick 💜💜 understanding the bullish pennant pattern: Web there are three different triangle patterns that are each discussed below; Traders follow. Web in price chart analysis, a pennant is a continuation chart pattern that forms when the market consolidates after a rapid price move. The bullish pennant emerges post an uptrend, forming a small symmetrical triangle (the pennant) during consolidation. In this blog post we look at how the bearish pennant works,. Web pennants are continuation patterns where a period of. The formation usually occurs after a sharp price movement that can contain gaps (known as the mast or pole of the pennant) where the pennant represents a period of indecision at the midpoint of the full move, consolidating the prior leg. Web pennants are continuation patterns drawn with two trendlines that eventually converge. Web the pennant pattern is a reliable. Similar to rectangles, pennants are continuation chart patterns formed after strong moves. Ideally, a pennant pattern lasts between one and four weeks. They can also predict future bullish and bearish market movements. We’ll also discuss chart pattern entries, stop losses, and profit targets so you can start trading pennants effectively within your own trading strategy. Web unlike the flag chart. The pattern can be seen in any time frame, and it consists of a small triangular price formation that follows a fast price movement in either an uptrend or a downtrend. Pennants pattern are a type of continuation chart pattern. Traders follow this pattern to predict whether a market is getting ready to resume a previous trend after a period. There are mainly seven important steps to trade a pennant pattern. A pennant can be used as an entry pattern for the continuation of an established trend. How to trade bearish and bullish pennants. The pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. Web. Ideally, a pennant pattern lasts between one and four weeks. Web in this guide, we unveil the secrets of bullish pennant pattern, exploring its psychology, identification, and trading strategies. Web there are three different triangle patterns that are each discussed below; Web a pennant pattern, referred to technical analysis, is a continuation pattern that is seen when a security experiences. Web trading the pennant pattern involves a combination of technical analysis and risk management. Ideally, a pennant pattern lasts between one and four weeks. It acts as a harbinger, signaling impending alterations to prevailing market conditions. Web pennants are a technical pattern used to identify continuations of sharp price moves; A symmetrical triangle is bigger and could give a few. A symmetrical triangle is bigger and could give a few trading opportunities between the two converging trendlines. A pennant pattern is characterised by a small symmetrical triangle formed after a. In this article, we will discuss the formation of a pennant pattern, how it works in the stock market, and how traders can use it to make informed trading decisions.. Traders follow this pattern to predict whether a market is getting ready to resume a previous trend after a period of consolidation. Web the pennant pattern is a reliable signal for traders as it indicates that the market is likely to continue its prior trend. Web the pennant is a continuation chart pattern that appears in both bullish and bearish markets. The pattern can be seen in any time frame, and it consists of a small triangular price formation that follows a fast price movement in either an uptrend or a downtrend. During the consolidation phase price structure tends to move sideways within a narrowing range before a breakout occurs. Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. When looking at a pennant pattern, one will identify three distinct phases: It acts as a harbinger, signaling impending alterations to prevailing market conditions. In this blog post we look at how the bearish pennant works,. A pennant pattern is characterised by a small symmetrical triangle formed after a. How to trade bearish and bullish pennants. The formation usually occurs after a sharp price movement that can contain gaps (known as the mast or pole of the pennant) where the pennant represents a period of indecision at the midpoint of the full move, consolidating the prior leg. Trading them requires planning when to open your position, take a profit and cut a loss; The bullish pennant emerges post an uptrend, forming a small symmetrical triangle (the pennant) during consolidation. The pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. If you appreciate our charts, give us a quick 💜💜 understanding the bullish pennant pattern:

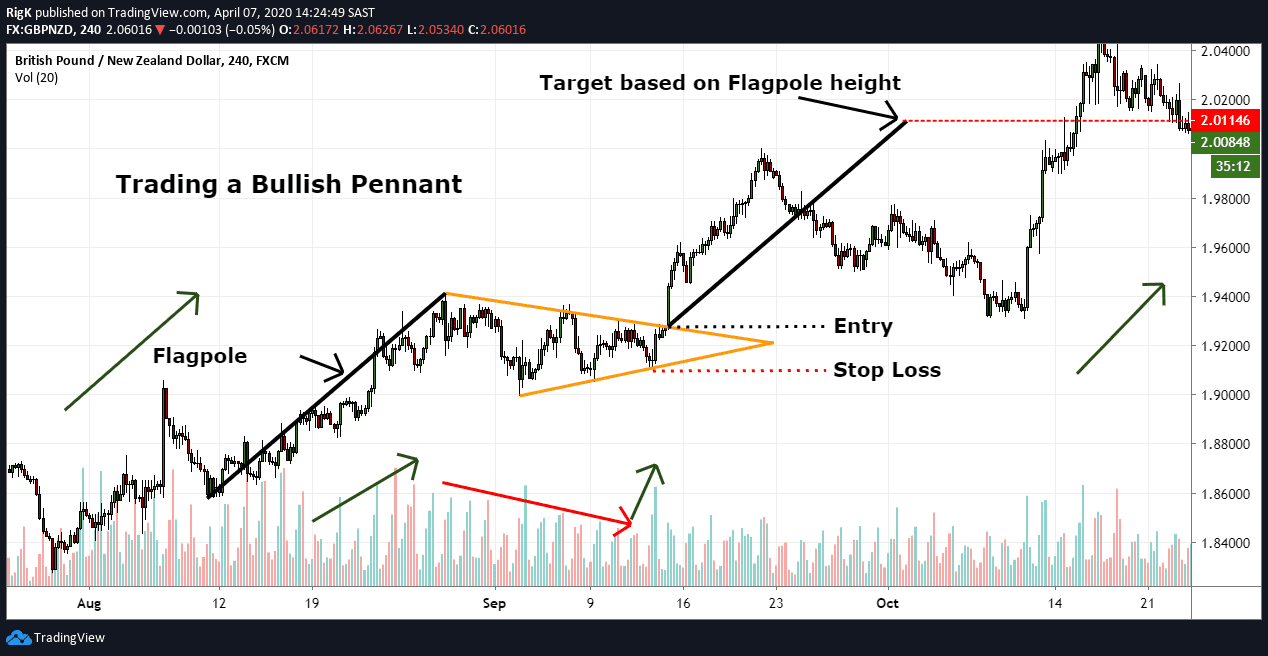

Bullish Pennant Patterns A Complete Guide

How to Trade the Pennant, Triangle, Wedge, and Flag Chart Patterns

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Chart Patterns Definition & Examples

Pennant Chart Patterns Definition & Examples

Bullish Pennant Patterns A Complete Guide

How to Trade a Pennant Pattern Market Pulse

How To Trade Bearish Pennant Chart Pattern TradingAxe

Blog Your guide to stock trading chart patterns United Fintech

How To Identify and Trade Pennant Patterns? Phemex Academy

Web In Technical Analysis, A Pennant Is A Type Of Continuation Pattern Formed When There Is A Large Movement In A Security, Known As The Flagpole, Followed By A Consolidation Period With Converging Trend Lines—The Pennant—Followed By A Breakout Movement In The Same Direction As The Initial Large Movement, Which Represents The Second Half Of The.

After A Sharp Decline, The Formation Of The Bearish Pennant Occurs:

It's Important To Look At The Volume In A Pennant—The Period Of.

Web There Are Three Different Triangle Patterns That Are Each Discussed Below;

Related Post: