Pennant Pattern

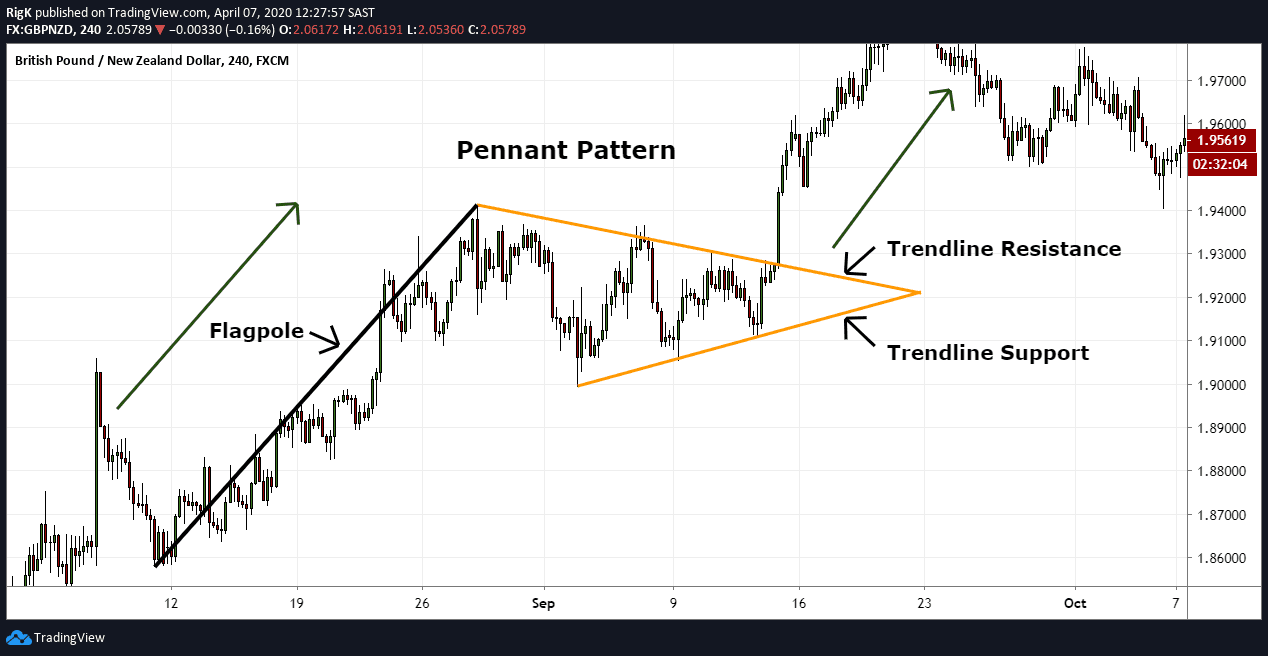

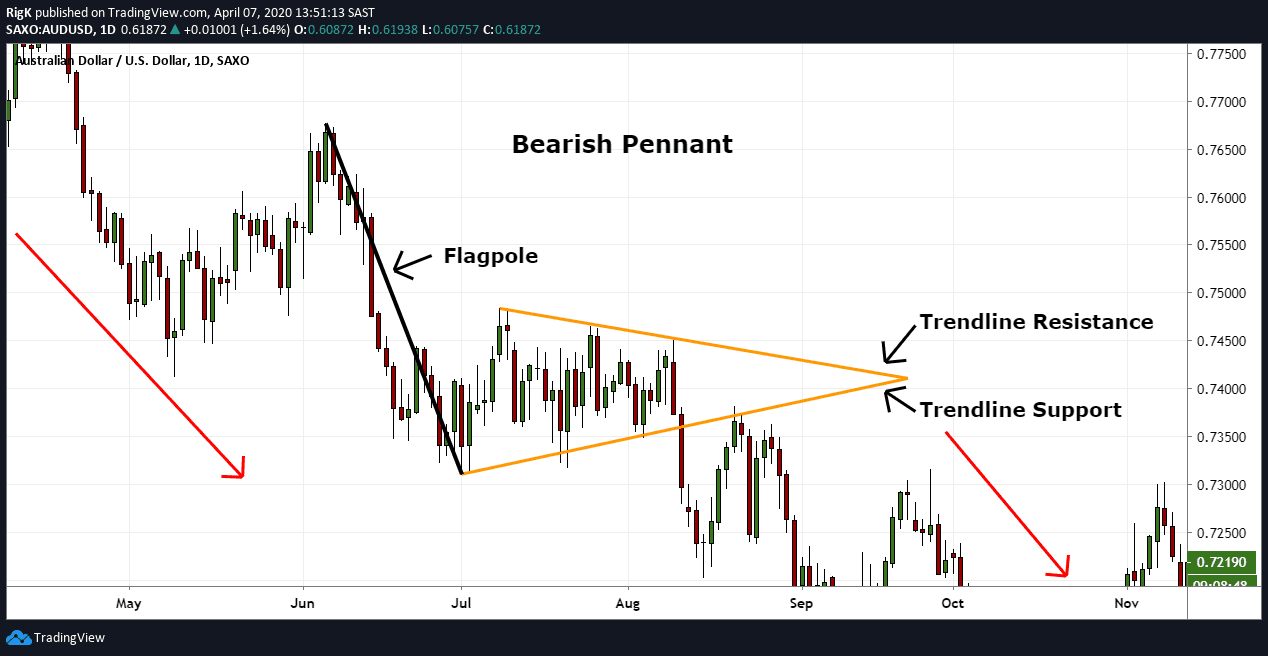

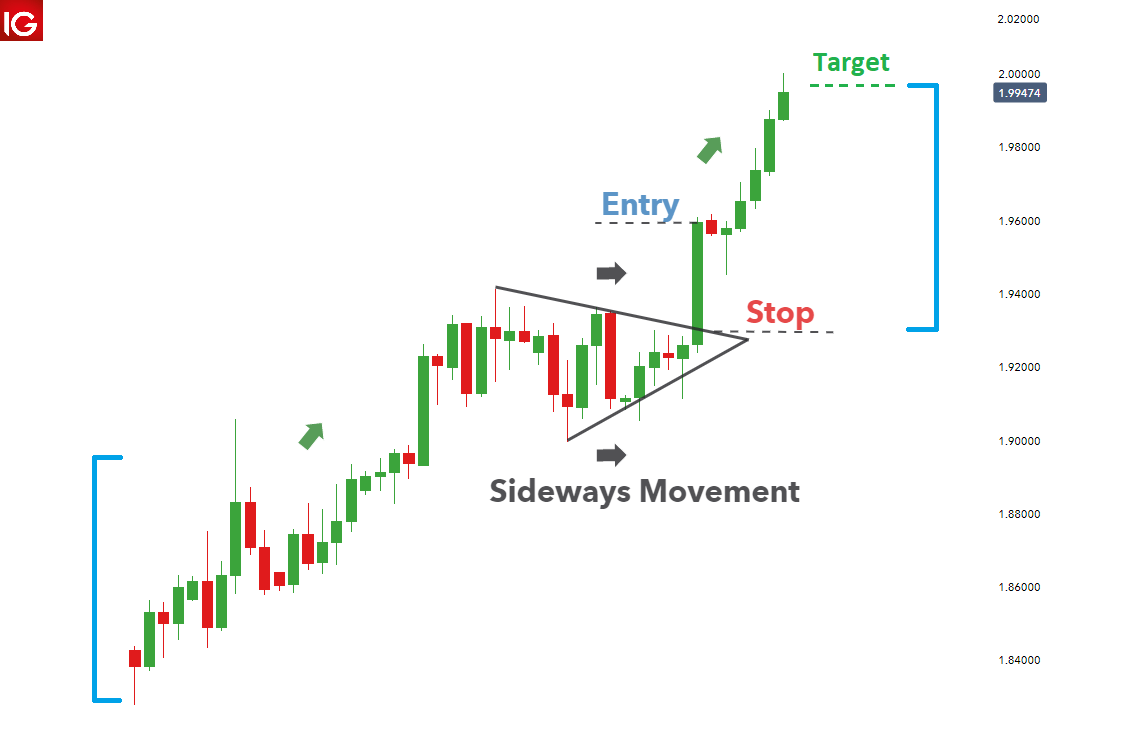

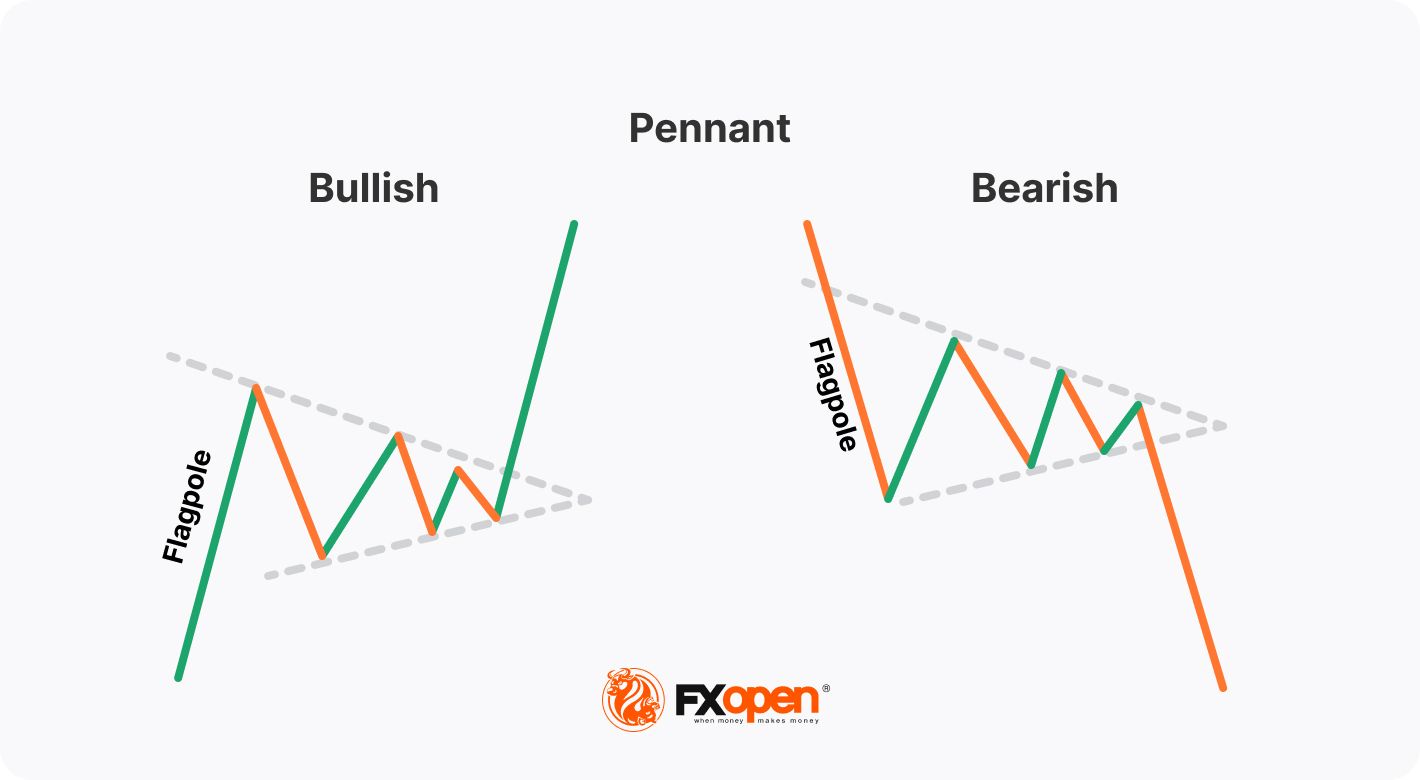

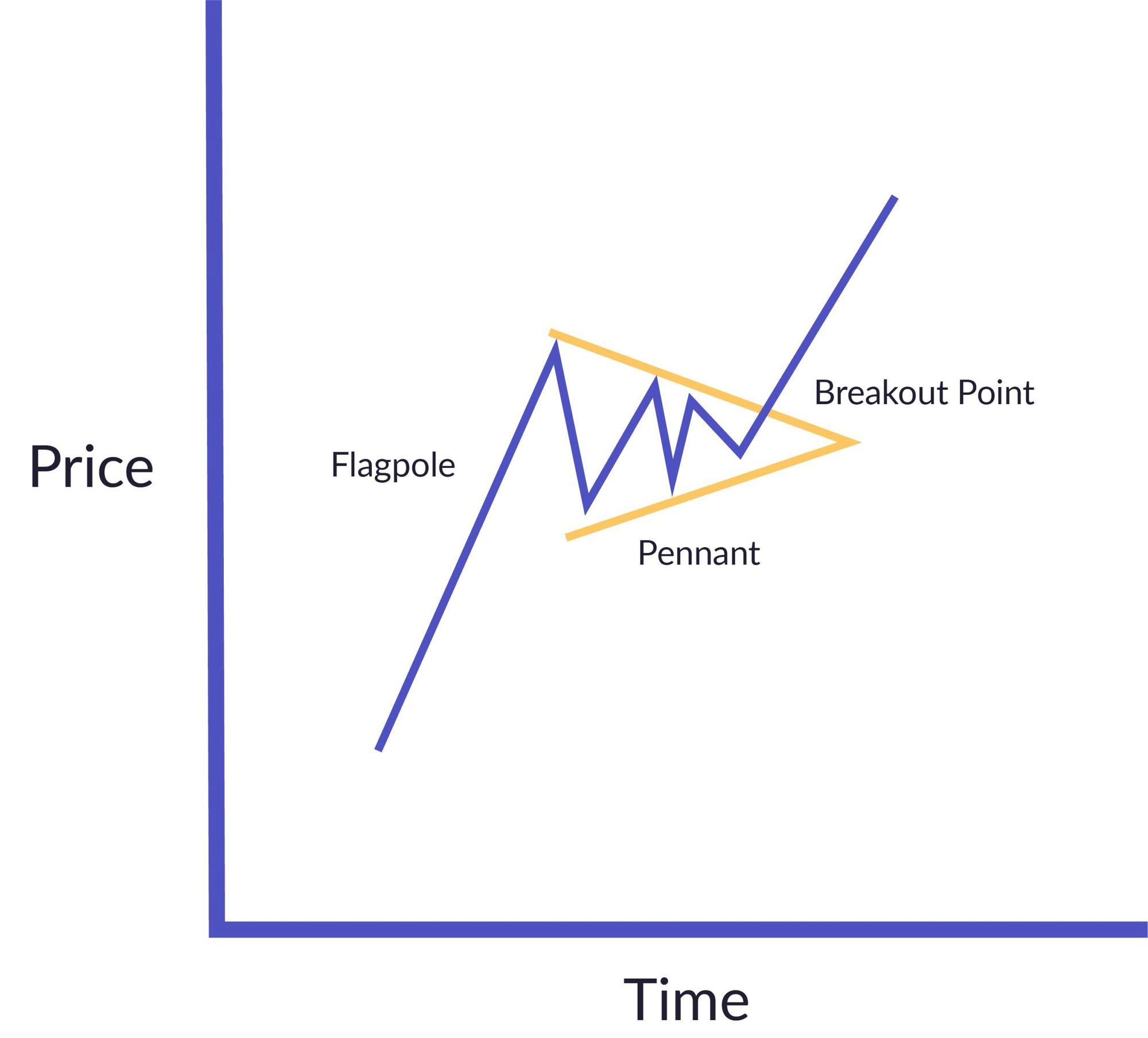

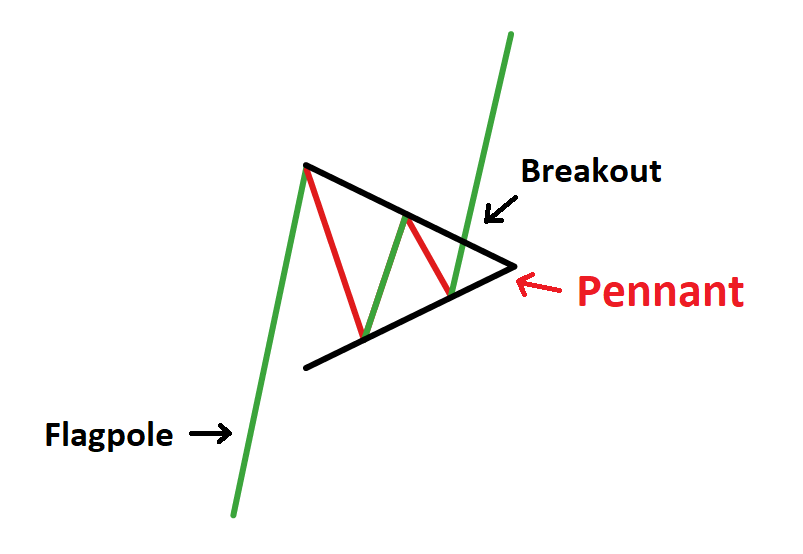

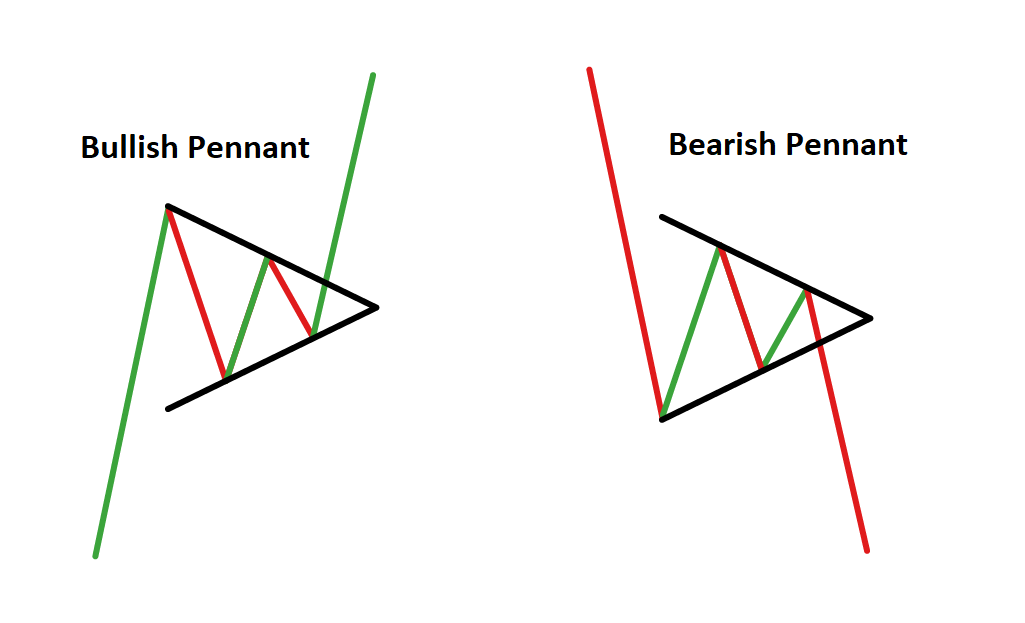

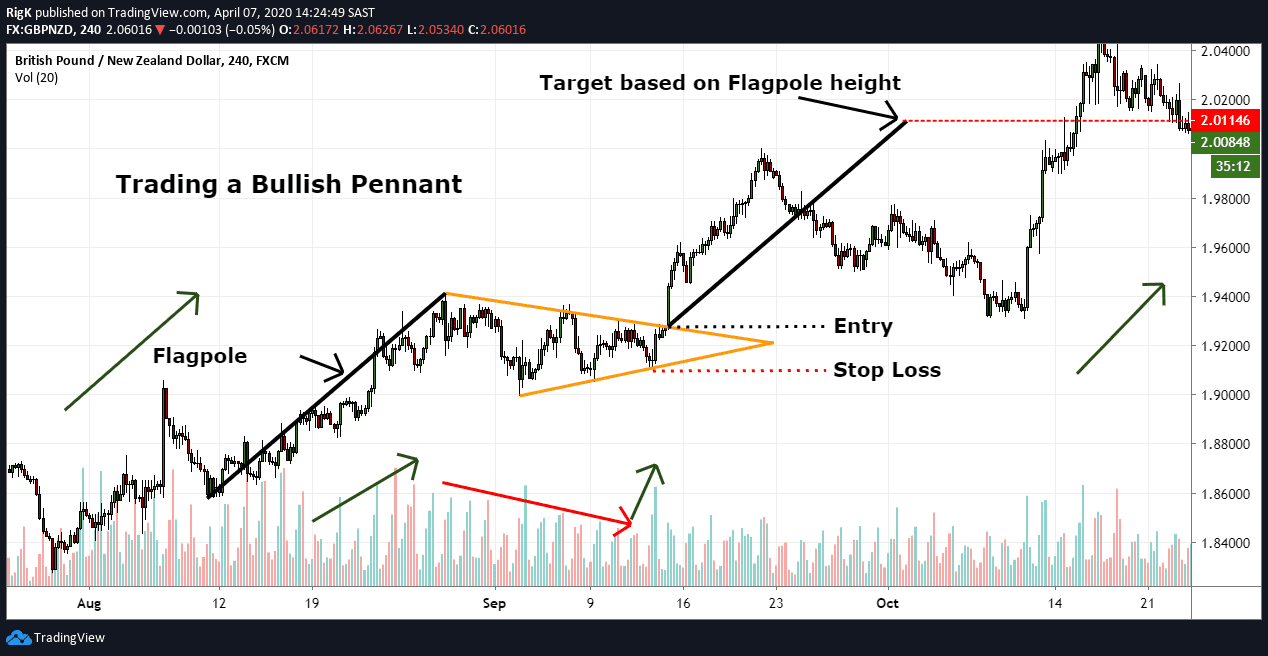

Pennant Pattern - A pennant is a consolidated price action in which the price takes a short breather before continuing its movement in the ongoing direction. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. How to identify a pennant chart pattern? Web pennant patterns are technical chart patterns that are used by traders to identify potential entry and exit points in the stock market. We’ll also discuss chart pattern entries, stop losses, and profit targets so you can start trading pennants effectively within your own trading strategy. Web pennants are continuation patterns where a period of consolidation is followed by a breakout. Web a pennant is a small symmetrical triangle that begins wide and converges as the pattern matures (like a cone). Web in technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in a security, known as the flagpole, followed by a consolidation period with converging trend lines—the pennant—followed by a breakout movement in the same direction as the initial large movement, which represents the second half of the. The pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. The pennant is a continuation chart pattern that appears in both bullish and bearish markets. Read for performance statistics, trading tactics, id guidelines and more. A pennant is a consolidated price action in which the price takes a short breather before continuing its movement in the ongoing direction. Web the pennant pattern is a reliable signal for traders as it indicates that the market is likely to continue its prior trend. Web a pennant is. A pennant is a consolidated price action in which the price takes a short breather before continuing its movement in the ongoing direction. How to identify a pennant chart pattern? Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. Web pennants are continuation patterns. A pennant is a type of continuation pattern formed when there is a large movement in. This chart pattern generally appears following a sudden upward or downward movement. Web pennant pattern is a continuation pattern formed by large currency pair price movements that help identify the direction in which currency pairs are headed. Web the pennant pattern is a reliable. Web pennants are continuation patterns where a period of consolidation is followed by a breakout. Web a pennant pattern is a pattern in technical analysis that forms when there is a large bullish or bearish trend and a price consolidation. The pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot. Pennants pattern are a type of continuation chart pattern. Web the pennant pattern is a reliable signal for traders as it indicates that the market is likely to continue its prior trend. If you appreciate our charts, give us a quick 💜💜 understanding the bullish pennant pattern: Sometimes there will not be specific reaction highs and lows from which to. Sometimes there will not be specific reaction highs and lows from which to draw the trend lines, and the price action should be contained within the converging trend lines. We’ll also discuss chart pattern entries, stop losses, and profit targets so you can start trading pennants effectively within your own trading strategy. The pennant pattern is a great chart pattern. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. The pennant is a continuation chart pattern that appears in both bullish and bearish markets. Traders follow this pattern to predict whether a market is getting ready to resume a previous trend after a. Web pennants are continuation patterns where. How to identify a pennant chart pattern? The pennant is a continuation chart pattern that appears in both bullish and bearish markets. You’ll learn how to identify both bullish pennant and bearish pennant formations. The bullish pennant emerges post an uptrend, forming a small symmetrical triangle (the pennant) during consolidation. The two differ by duration and the appearance of a. Web a bull pennant pattern is a technical chart pattern that forms after a significant upward price movement in a financial asset, such as a stock or cryptocurrency. The pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. Web the pennant pattern explained. This chart. Web what is a pennant pattern? Read for performance statistics, trading tactics, id guidelines and more. Web a pennant pattern, referred to technical analysis, is a continuation pattern that is seen when a security experiences a large movement to the upside or downside, followed by a consolidation period, before subsequently moving in the same direction. When looking at a pennant. A pennant is a consolidated price action in which the price takes a short breather before continuing its movement in the ongoing direction. In this article, we will discuss the formation of a pennant pattern, how it works in the stock market, and how traders can use it to make informed trading decisions. If you appreciate our charts, give us a quick 💜💜 understanding the bullish pennant pattern: Web what is a pennant pattern? Web in technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in a security, known as the flagpole, followed by a consolidation period with converging trend lines—the pennant—followed by a breakout movement in the same direction as the initial large movement, which represents the second half of the. Web in this guide, we unveil the secrets of bullish pennant pattern, exploring its psychology, identification, and trading strategies. Comparison between flags and pennants. You’ll learn how to identify both bullish pennant and bearish pennant formations. Sometimes there will not be specific reaction highs and lows from which to draw the trend lines, and the price action should be contained within the converging trend lines. Web updated december 10, 2023. The pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. Pennants pattern are a type of continuation chart pattern. Web a pennant is a small symmetrical triangle that begins wide and converges as the pattern matures (like a cone). Web a pennant pattern, referred to technical analysis, is a continuation pattern that is seen when a security experiences a large movement to the upside or downside, followed by a consolidation period, before subsequently moving in the same direction. Web the pennant pattern explained. Web pennant patterns are technical chart patterns that are used by traders to identify potential entry and exit points in the stock market.

Pennant Chart Patterns Definition & Examples

Pennant Chart Patterns Definition & Examples

Pennant Patterns Trading Bearish & Bullish Pennants

How to Trade a Pennant Pattern Market Pulse

Blog Your guide to stock trading chart patterns United Fintech

Pennant Pattern Types, Characteristics, and How to Trade

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Patterns Trading Bearish & Bullish Pennants

How To Identify and Trade Pennant Patterns? Phemex Academy

Pennant Chart Patterns Definition & Examples

The Two Differ By Duration And The Appearance Of A Flagpole. Symmetrical Triangle.

Web What Is A Pennant Chart Pattern?

Web A Pennant Pattern Is A Pattern In Technical Analysis That Forms When There Is A Large Bullish Or Bearish Trend And A Price Consolidation.

How To Identify A Pennant Chart Pattern?

Related Post: