Pennant Pattern Trading

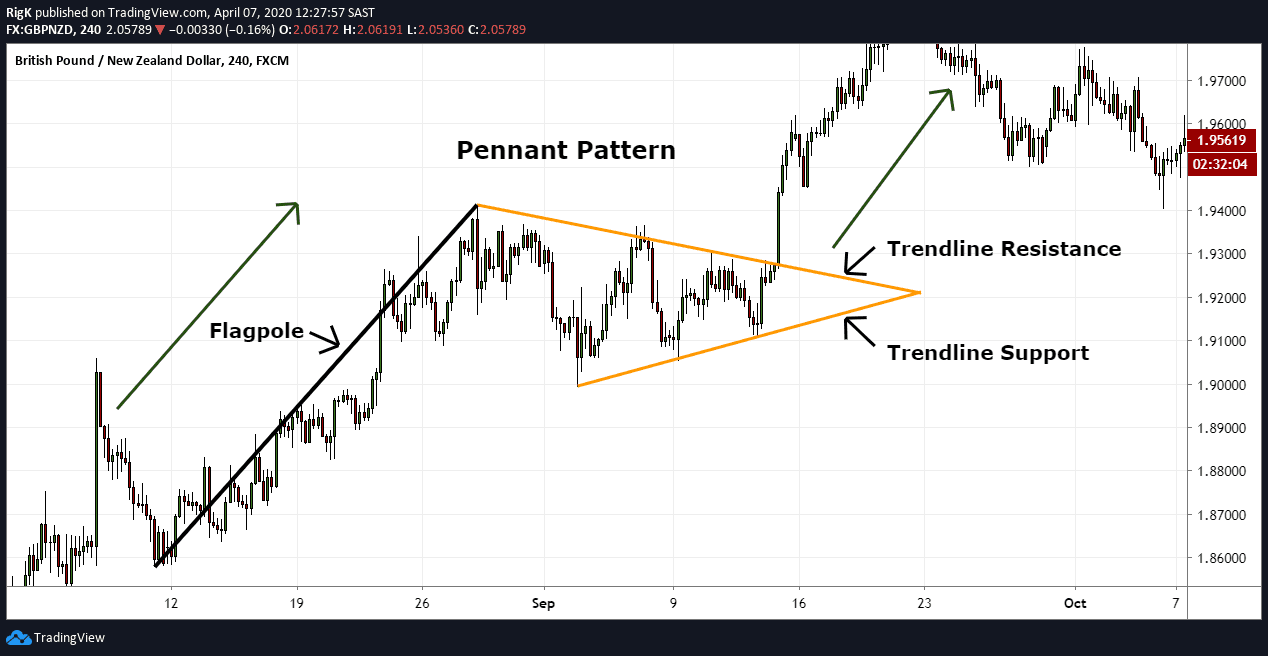

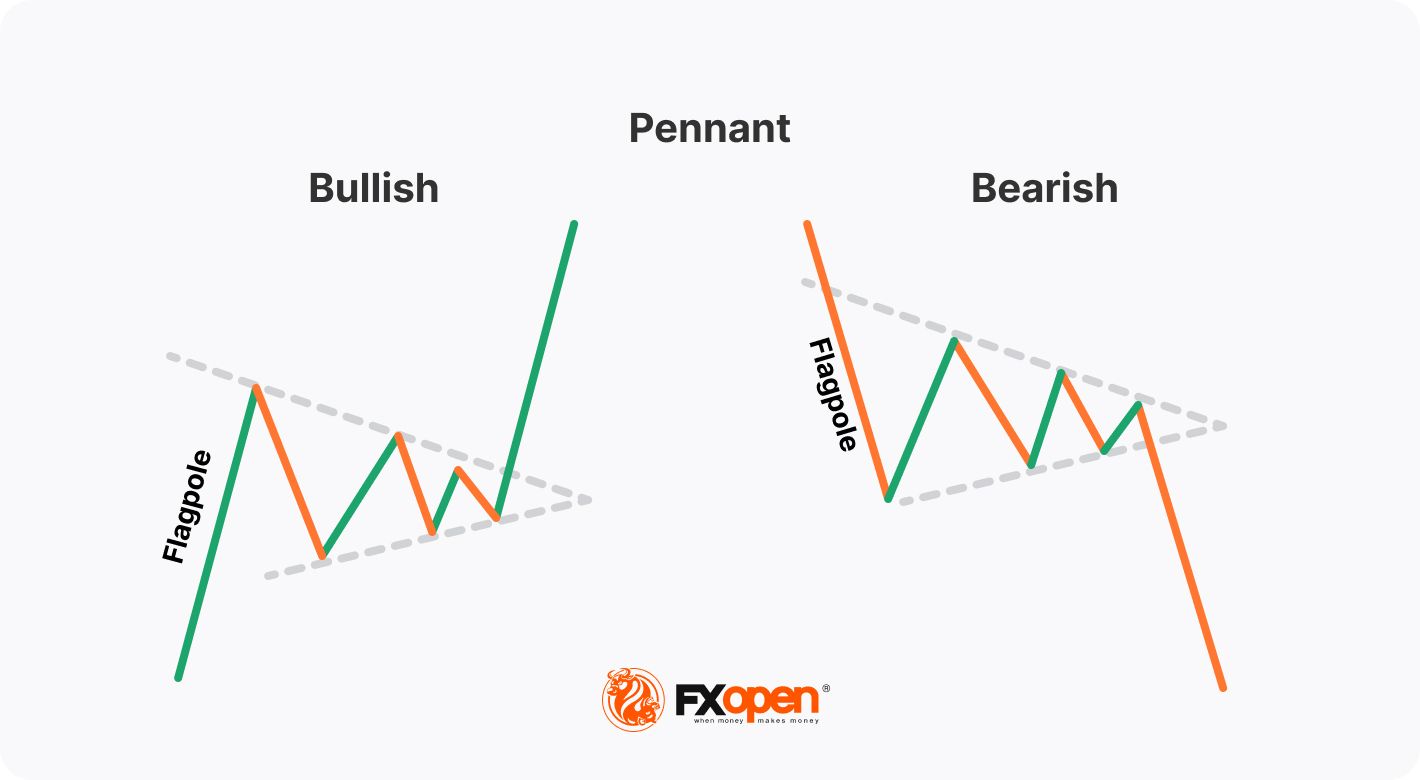

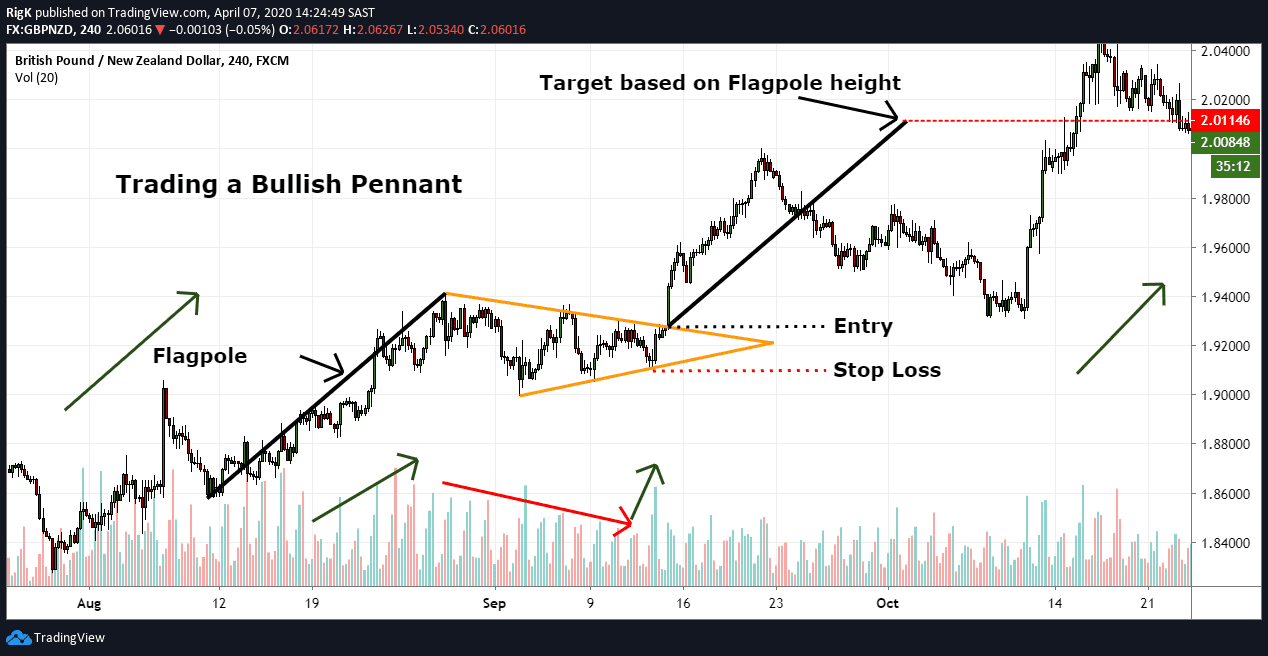

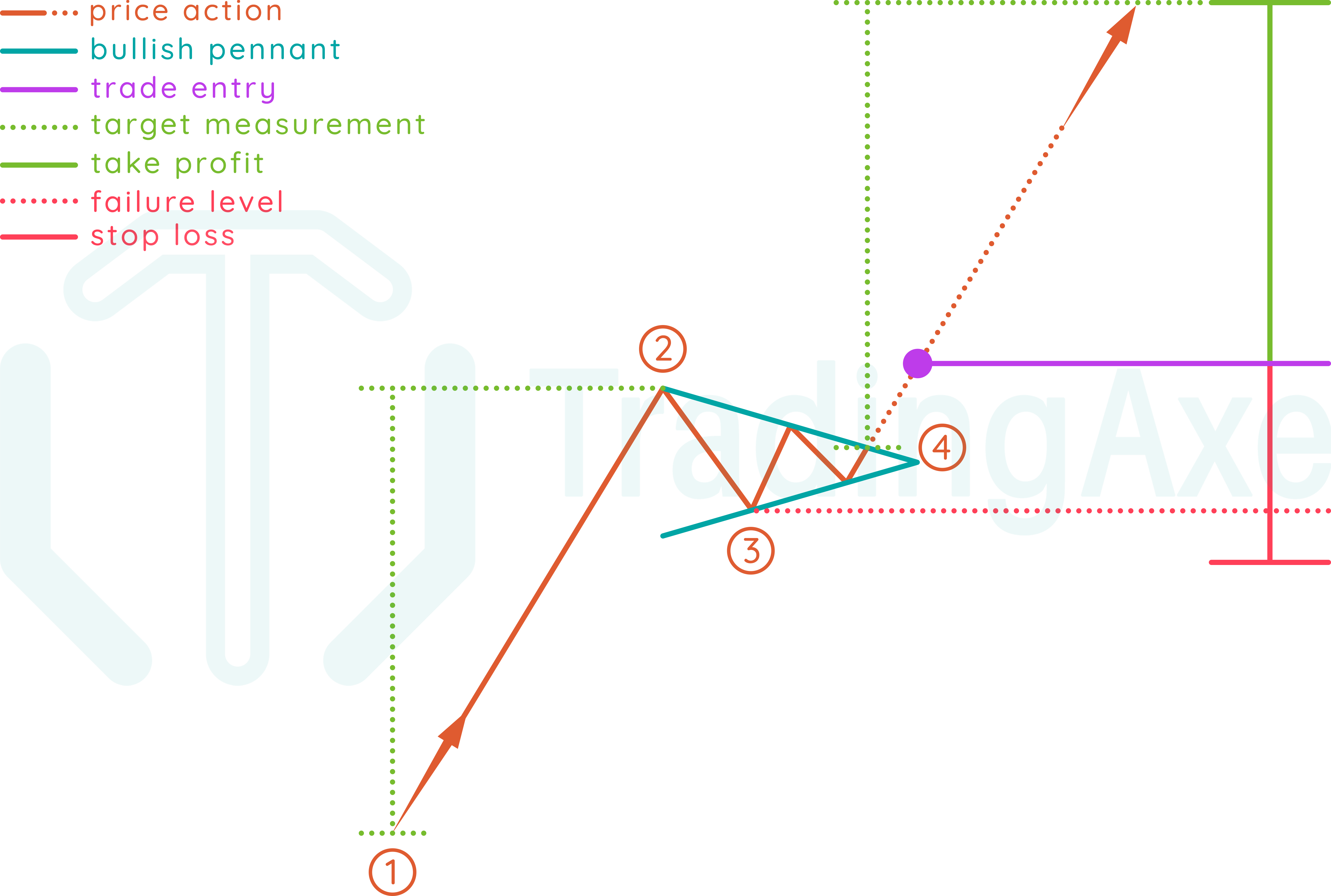

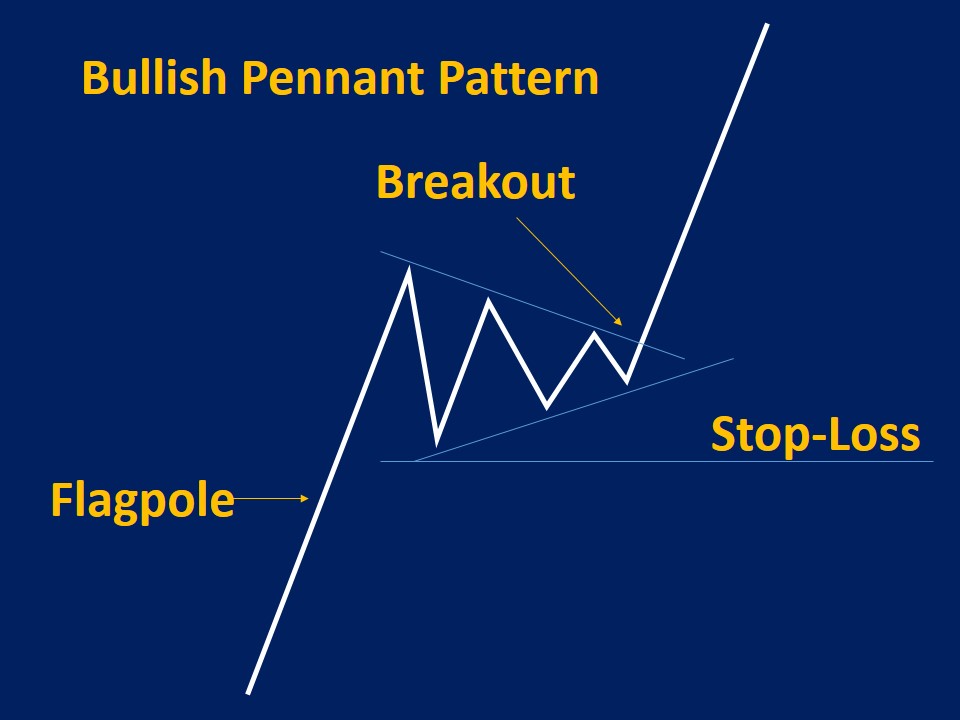

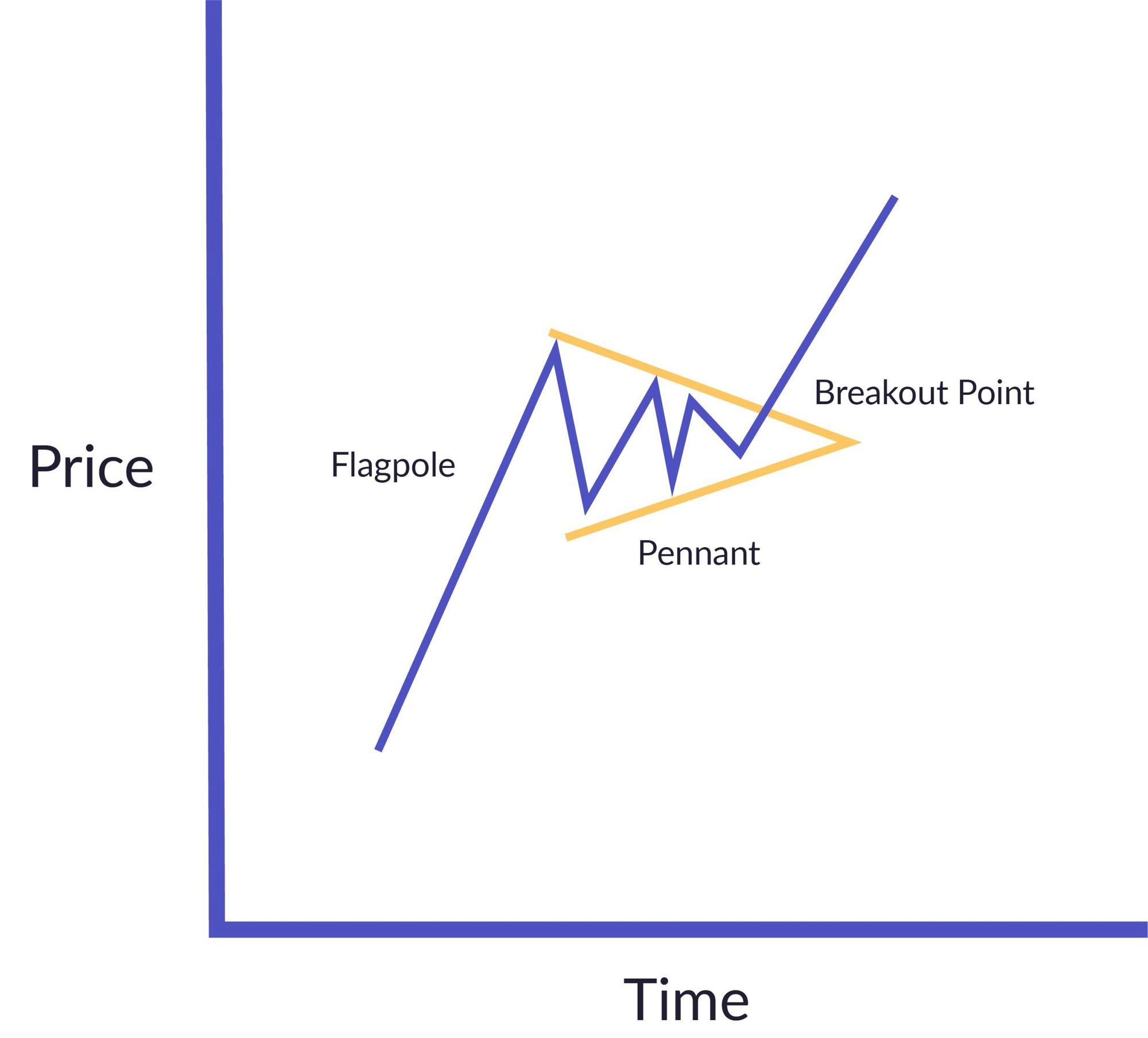

Pennant Pattern Trading - While similar to the triangle pattern, the pennant pattern has. Let us dive deep into what pennants patterns are and how you can trade the bullish and bearish versions of the same. How to trade bearish and bullish pennants. Pennants pattern are a type of continuation chart pattern. Web trading pennant patterns. Trading them requires planning when to open your position, take a profit and cut a loss; The bullish pennant emerges post an uptrend, forming a small symmetrical triangle (the pennant) during consolidation. Web the pennant pattern is a classic pattern for technical analysts and is identifiable by a large price move followed by a unification period and a breakout. Web in price chart analysis, a pennant is a continuation chart pattern that forms when the market consolidates after a rapid price move. Web the bull pennant is a bullish continuation pattern that signals the extension of the uptrend after the period of consolidation is over. How to trade bullish and bearish pennants. A pennant can be used as an entry pattern for the continuation of an established trend. After a big upward or downward move, buyers or sellers usually pause to catch their breath before taking the pair further in the same direction. Web the pennant pattern is a powerful trend continuation pattern that appears. You’ll learn how to identify both bullish pennant and bearish pennant formations. Pennants pattern are a type of continuation chart pattern. A pennant can be used as an entry pattern for the continuation of an established trend. It's important to look at the volume in a pennant—the period of. The pattern can be seen in any time frame, and it. Pennant pattern retest trading strategy. Web pennants are a technical pattern used to identify continuations of sharp price moves; Web the pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. Web pennant patterns work as a continuation signal in the forex market and help identify. Pennant pattern breakout trading strategy. Let us dive deep into what pennants patterns are and how you can trade the bullish and bearish versions of the same. Web the pennant pattern is a reliable signal for traders as it indicates that the market is likely to continue its prior trend. They can also predict future bullish and bearish market movements.. Web pennants are a technical pattern used to identify continuations of sharp price moves; The formation usually occurs after a sharp price movement that can contain gaps (known as the mast or pole of the pennant) where the pennant represents a period of indecision at the midpoint of the full move, consolidating the prior leg. Web the bearish pennant pattern. Similar to rectangles, pennants are continuation chart patterns formed after strong moves. Changes in volume and breakout confirmation for continuity. This chart pattern takes one to three weeks to form. Let us dive deep into what pennants patterns are and how you can trade the bullish and bearish versions of the same. Unlike the flag where the price action consolidates. Web trading with pennant patterns provides traders with a systematic strategy for identifying and capitalising on prospective market moves after periods of consolidation. Comparison between flags and pennants. They can also predict future bullish and bearish market movements. We’ll also discuss chart pattern entries, stop losses, and profit targets so you can start trading pennants effectively within your own trading. Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. Similar to rectangles, pennants are continuation chart patterns formed after strong moves. This pattern breaks out in the expected direction about 80% of the time. You’ll learn how to identify both bullish pennant and bearish. This chart pattern takes one to three weeks to form. Learn more about pattern trading at ig academy This pattern breaks out in the expected direction about 80% of the time. We’ll also discuss chart pattern entries, stop losses, and profit targets so you can start trading pennants effectively within your own trading strategy. Web the pennant pattern is a. Web in price chart analysis, a pennant is a continuation chart pattern that forms when the market consolidates after a rapid price move. This pattern breaks out in the expected direction about 80% of the time. The bullish pennant emerges post an uptrend, forming a small symmetrical triangle (the pennant) during consolidation. The formation usually occurs after a sharp price. Comparison between flags and pennants. Web the pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. A pennant can be used as an entry pattern for the continuation of an established trend. Web trading pennant patterns. Web the pennant pattern is a powerful trend continuation pattern that appears in all markets and timeframes. Bearish pennants occur when a bear move pauses, while bullish pennants occur when bull moves pause; You’ll learn how to identify both bullish pennant and bearish pennant formations. Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. To interpret this pattern accurately, one must keenly observe two critical signals: Pennant pattern breakout trading strategy. How to trade bullish and bearish pennants. Web trading with pennant patterns provides traders with a systematic strategy for identifying and capitalising on prospective market moves after periods of consolidation. In this article, we will discuss the formation of a pennant pattern, how it works in the stock market, and how traders can use it to make informed trading decisions. While similar to the triangle pattern, the pennant pattern has. Pennant pattern retest trading strategy. Web in this guide, we unveil the secrets of bullish pennant pattern, exploring its psychology, identification, and trading strategies.

Pennant Chart Patterns Definition & Examples

How to Trade a Pennant Pattern Market Pulse

How to Trade the Pennant, Triangle, Wedge, and Flag Chart Patterns

Pennant Chart Patterns Definition & Examples

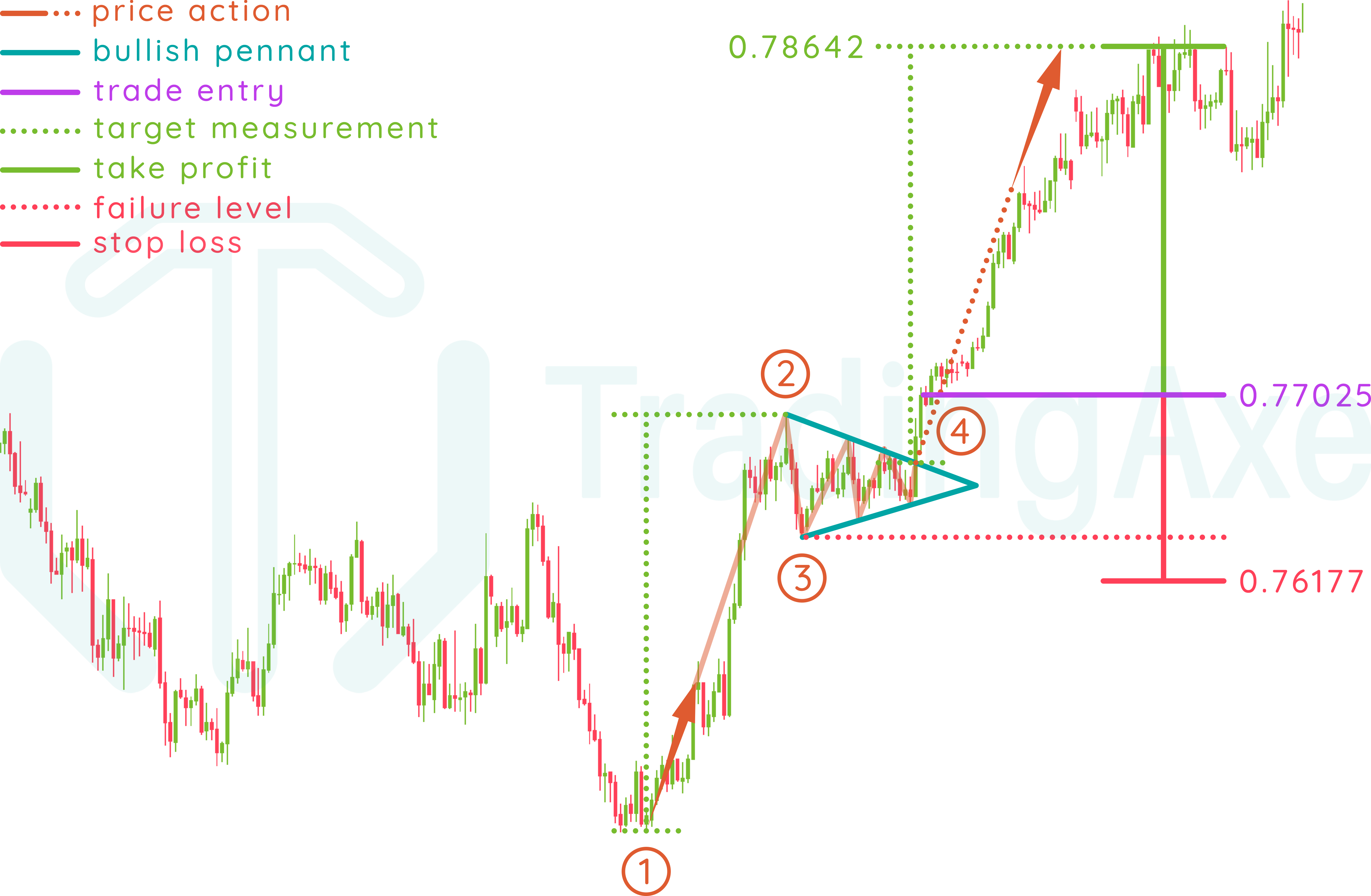

How To Trade Bullish Pennant Chart Pattern TradingAxe

How To Trade Bullish Pennant Chart Pattern TradingAxe

Pennant Pattern Types, How to Trade & Examples

Blog Your guide to stock trading chart patterns United Fintech

Pennant Patterns Trading Bearish & Bullish Pennants

How To Identify and Trade Pennant Patterns? Phemex Academy

Web Pennant Patterns Work As A Continuation Signal In The Forex Market And Help Identify The Ideal Entry And Exit Price Points.

Unlike The Flag Where The Price Action Consolidates Within The Two Parallel Lines, The Pennant Uses Two Converging Lines For Consolidation Until The Breakout Occurs.

Web Therefore, The Pennant Makes Life Easier For Traders, As It Provides Them With Precisely Defined Trading Levels, Thanks To The Flagpole And Pennant.

This Chart Pattern Takes One To Three Weeks To Form.

Related Post: