Pennant Flag Pattern

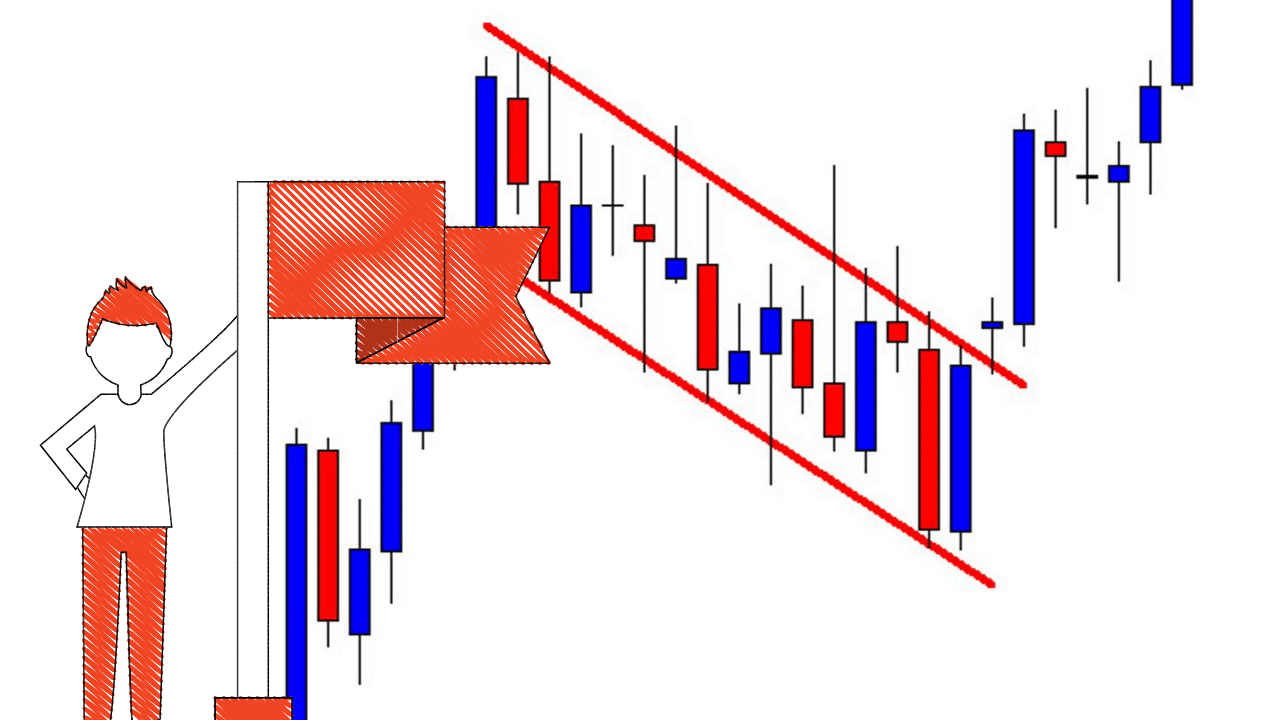

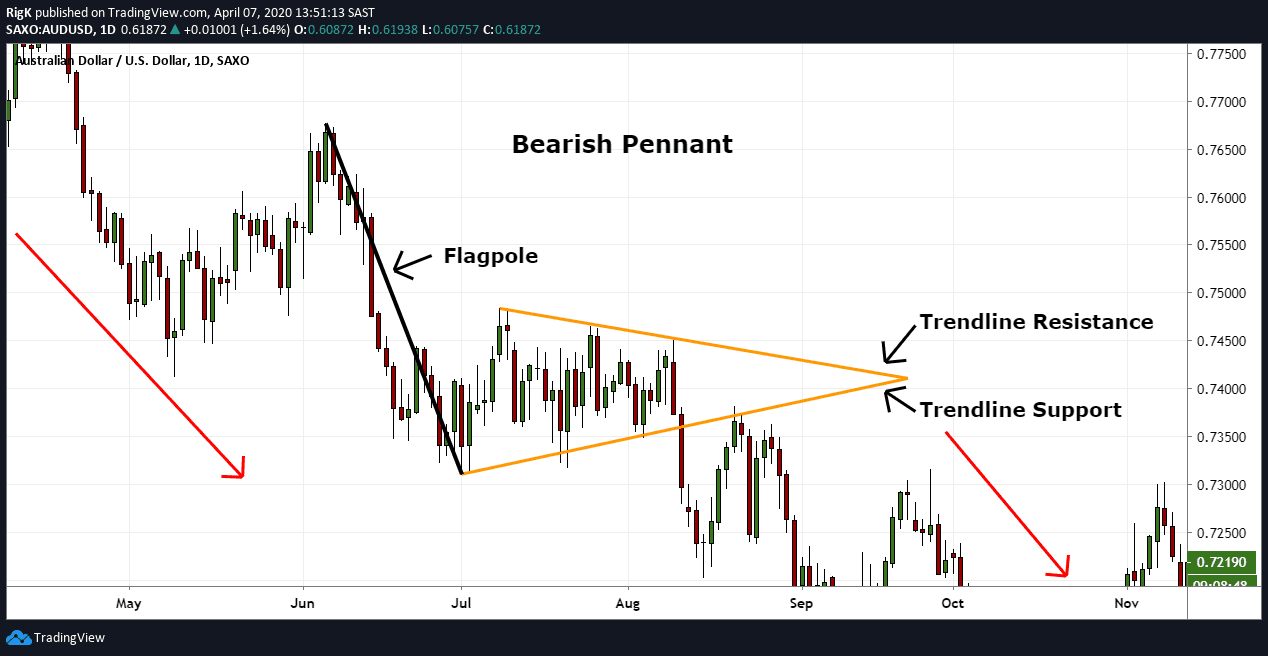

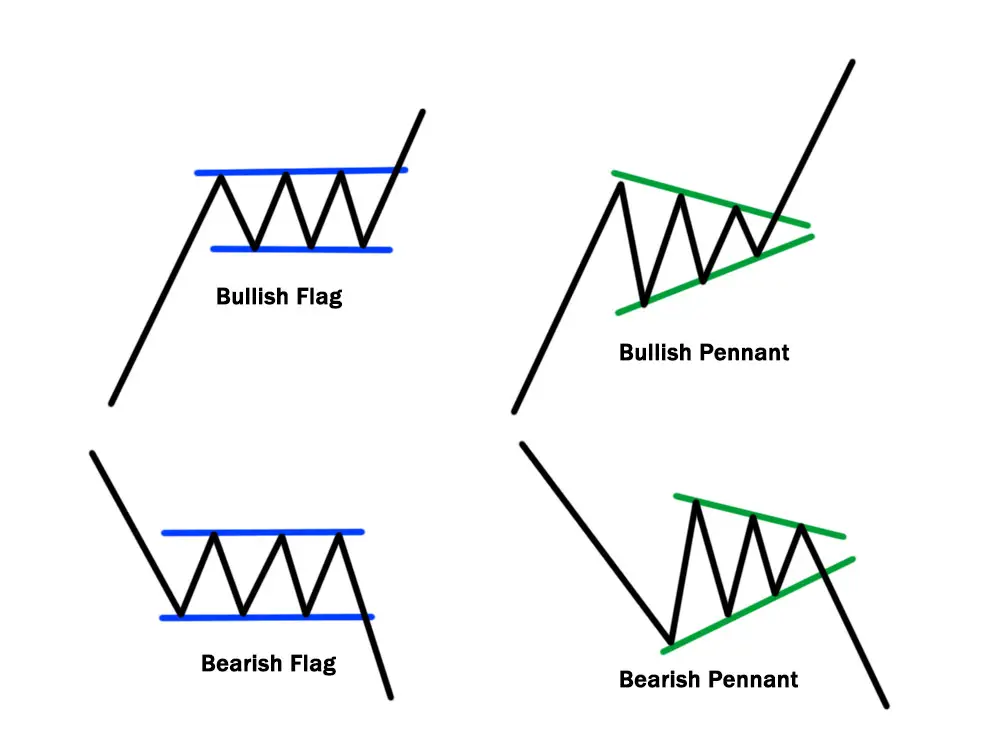

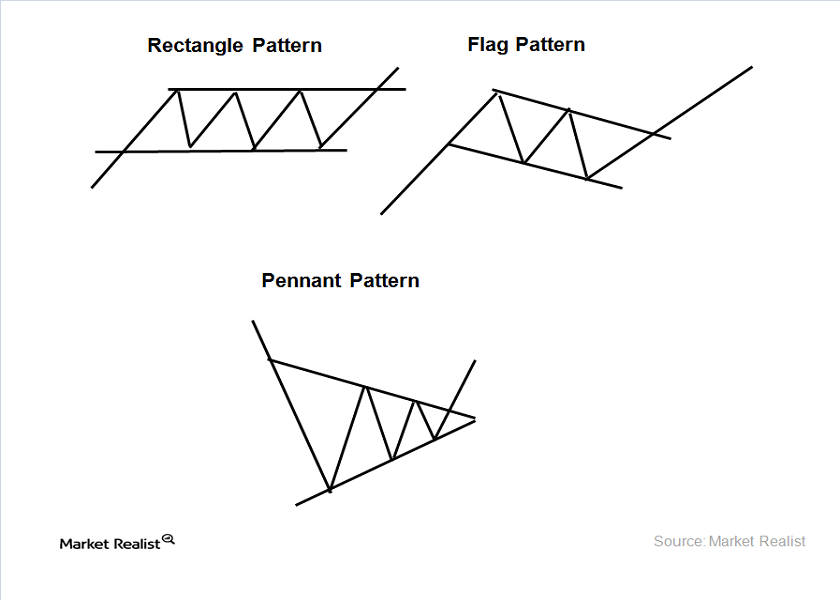

Pennant Flag Pattern - Web what is a flag pattern? The chart pattern is characterized by a countertrend price consolidation (the pennant) that follows a rapid price ascent or descent (the pole). Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking out in the direction of the prevailing trend. This sideways movement typically takes the form or a rectangle (flag) or. These patterns are usually preceded by a sharp advance or decline with heavy volume and mark a midpoint of the move. The only difference is that the flagpole is not as straight and the pattern forms a small rectangle. Draw trendlines along the highs and lows of the sideways price action. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a midpoint of the move. Explore our expanded education library. Web a flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. Web in technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in a security, known as the flagpole, followed by a consolidation period with converging trend lines—the. Web a pennant pattern is a type of continuation pattern formed when there is a large movement in a security in technical analysis known as the flagpole, followed by a consolidation period with converging trendlines. The only difference is that the flagpole is not as straight and the pattern forms a small rectangle. A bullish flag appears like an. Web. The pattern resembles a flagpole. Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking out in the direction of the prevailing trend. It is named the pennant pattern because it resembles a pennant on a flagpole. Web a bullish pennant is indicated by a positive thrust preceding a. Web the pennant is a relatively short chart formation and appears as a small triangle pattern that forms after a steep trend. Web pennant and flag pattern are chart formations that indicate a continuation in the trend for that time period especially if there is volume on the breakout. Web there are many variants to flags, pennants, and ascending triangle. 🎲 pattern classifications and characteristics🎯 bullish flag pattern characteristics of bullish flag pattern are as follows. Web trading pennant patterns. Web what are flag and pennant chart patterns? Web a flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. You’ll learn how to identify both bullish pennant and bearish pennant formations. Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking out in the direction of the prevailing trend. The chart pattern is characterized by a countertrend price consolidation (the pennant) that follows a rapid price ascent or descent (the pole). Pennants are similar to flag chart patterns in the. Web a flag or pennant pattern forms when the price rallies sharply, then moves sideways or slightly to the downside. Explore our expanded education library. It is named the pennant pattern because it resembles a pennant on a flagpole. Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking. Web a bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. Web a bullish pennant is indicated by a positive thrust preceding a converging triangle or ascending triangle. A pennant pattern is preceded by a strong up or down move that resembles a flagpole. Web pennant and flag pattern are chart. We’ll also discuss chart pattern entries, stop losses, and profit targets so you can start trading pennants effectively within your own trading strategy. The pattern resembles a flagpole. Draw trendlines along the highs and lows of the sideways price action. 🎲 pattern classifications and characteristics🎯 bullish flag pattern characteristics of bullish flag pattern are as follows. Web the pennant is. This chart pattern takes one to three weeks to form. Web what is a flag pattern? Web pennant and flag pattern are chart formations that indicate a continuation in the trend for that time period especially if there is volume on the breakout. Ideally, a pennant pattern lasts between one and four weeks. A classic pattern for technical analysts, the. It is considered a continuation pattern, indicating that the prevailing trend is likely to continue after a brief consolidation or pause. The bullish flag pattern leans against the trend. They represent pauses while a trend consolidates and are reliable continuation signals in a strong trend. The pattern resembles a flagpole. We’ll also discuss chart pattern entries, stop losses, and profit targets so you can start trading pennants effectively within your own trading strategy. They're formed when a market makes an extensive move higher, then pauses and consolidates between converging support and resistance lines. Web a flag pattern is a technical analysis chart pattern that can be observed in the price charts of financial assets, such as stocks, currencies, or commodities. Web in technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in a security, known as the flagpole, followed by a consolidation period with converging trend lines—the pennant—followed by a breakout movement in the same direction as the initial large movement, which represents the second half of the. It is named the pennant pattern because it resembles a pennant on a flagpole. Web trading pennant patterns. Web a bullish pennant is a technical trading pattern that indicates the impending continuation of a strong upward price move. Web what are flag and pennant chart patterns? This chart pattern takes one to three weeks to form. Whenever you see this pattern form on a chart, it means that there are high chances of the price action breaking out in the direction of the prevailing trend. Web what is a flag pattern? A bullish flag appears like an.

Pennant & Flag Pattern Comparison Warrior Trading

Pennant Patterns Trading Bearish & Bullish Pennants

26 Bunting Pennant Banner Flag Shapes Straight & Scallop Edge Etsy

Pennant guide How to Trade Bearish and Bullish Pennants?

How to Trade the Pennant, Triangle, Wedge, and Flag Chart Patterns

Pennant Chart Patterns Definition & Examples

Flag and Pennant Pattern Indicator (MT4) Free Download Best Forex

Technical analysis—the rectangle, flag, and pennant patterns

.png)

Mastering Trading Our Ultimate Chart Patterns Cheat Sheet

Flag Forex Indicator How To Trade Es Futures Options

Comparison Between Flags And Pennants.

The Only Difference Is That The Flagpole Is Not As Straight And The Pattern Forms A Small Rectangle.

🎲 Pattern Classifications And Characteristics🎯 Bullish Flag Pattern Characteristics Of Bullish Flag Pattern Are As Follows.

This Sideways Movement Typically Takes The Form Or A Rectangle (Flag) Or.

Related Post: