Penant Pattern

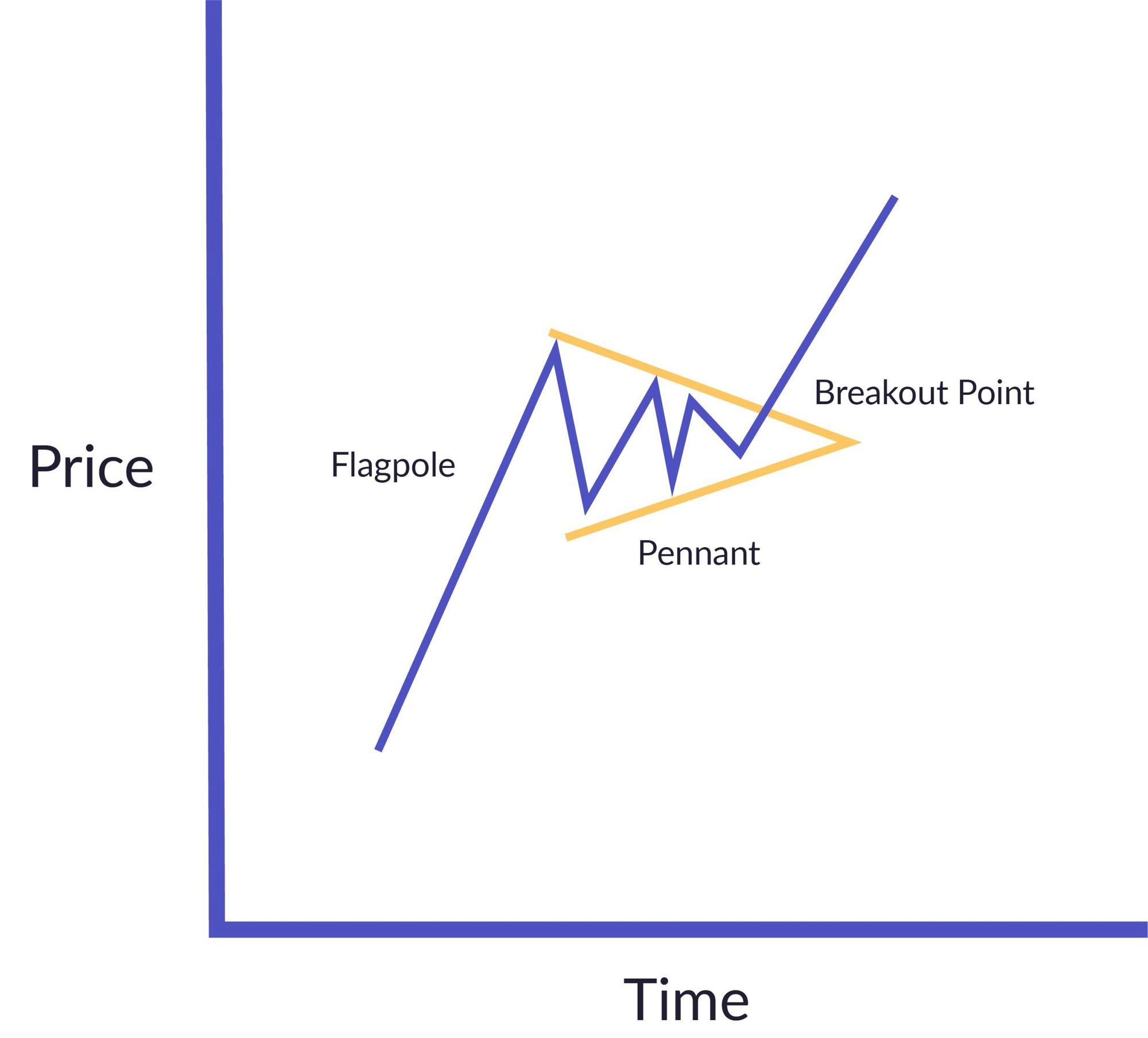

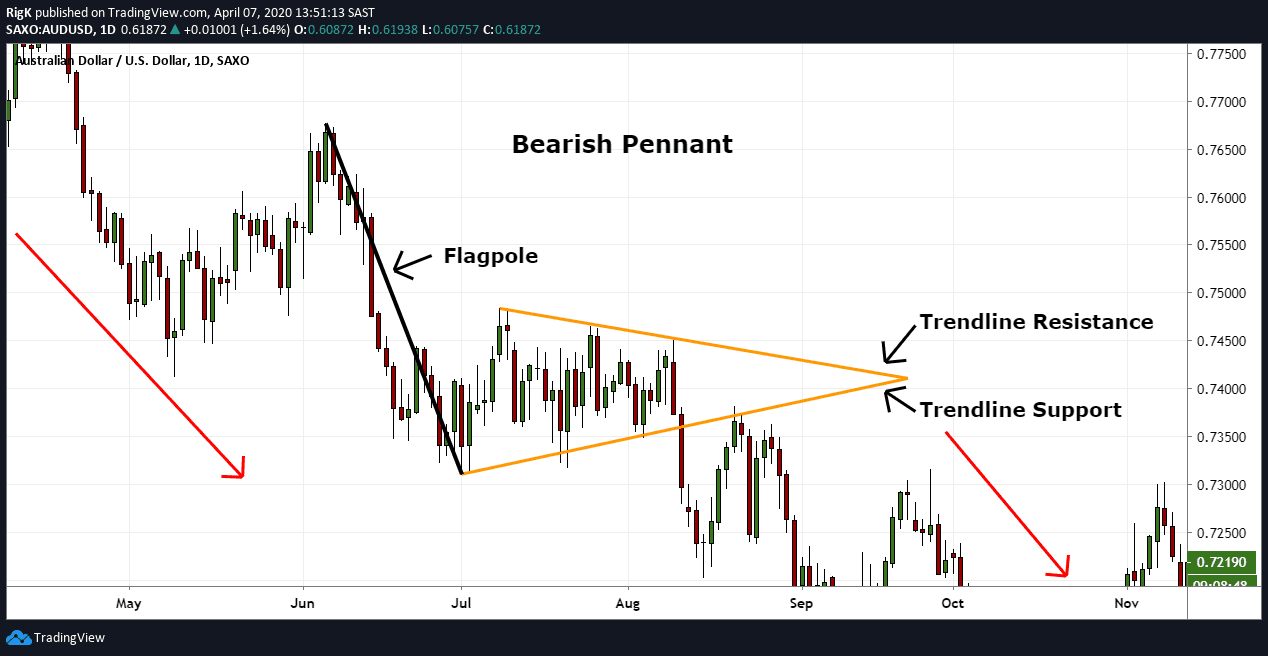

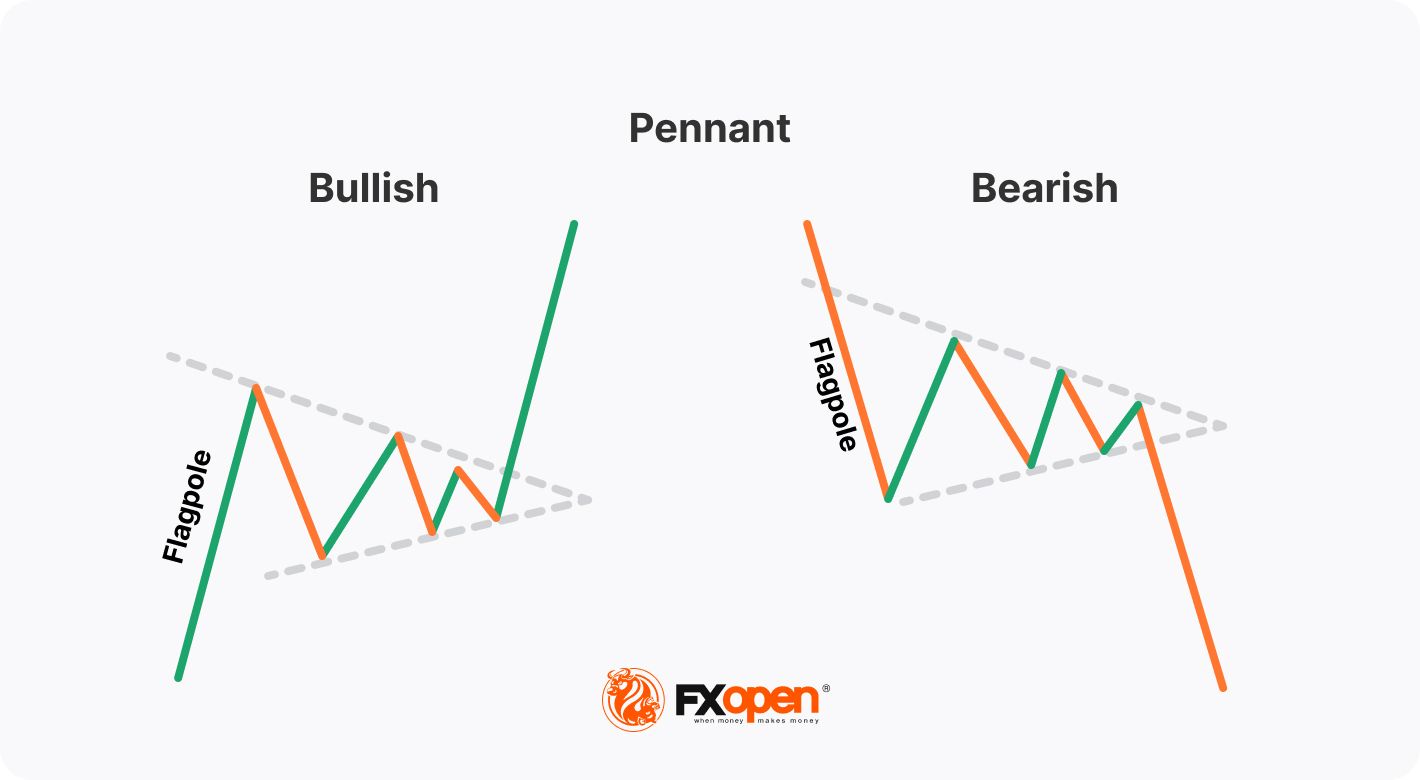

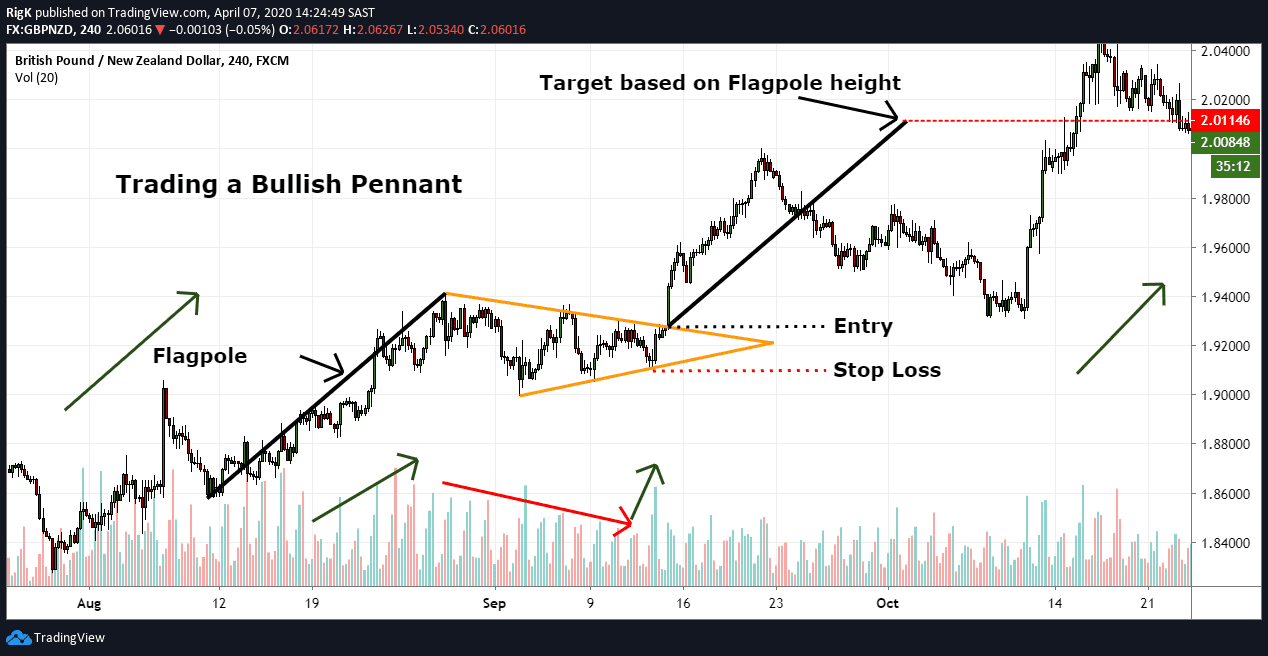

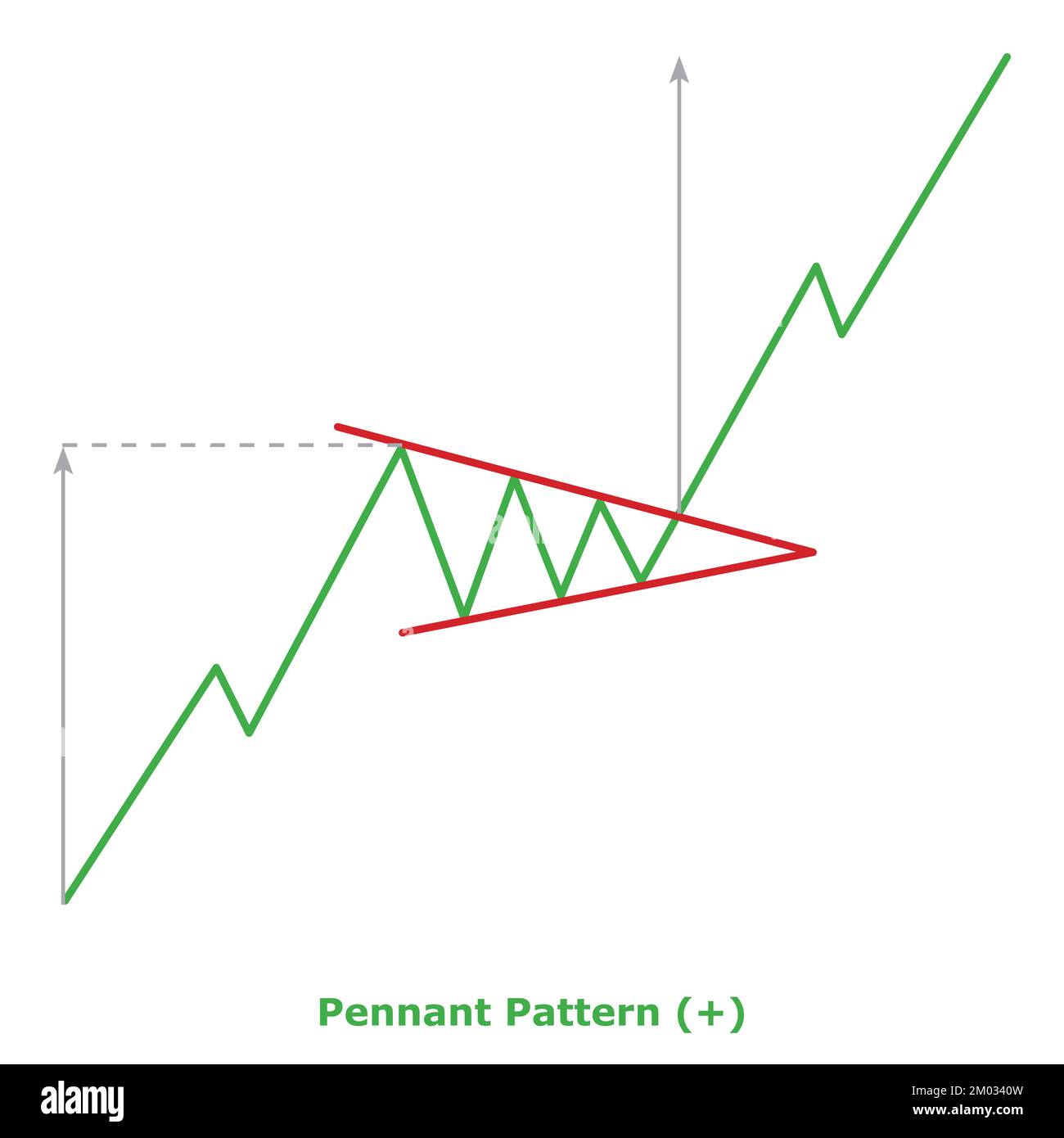

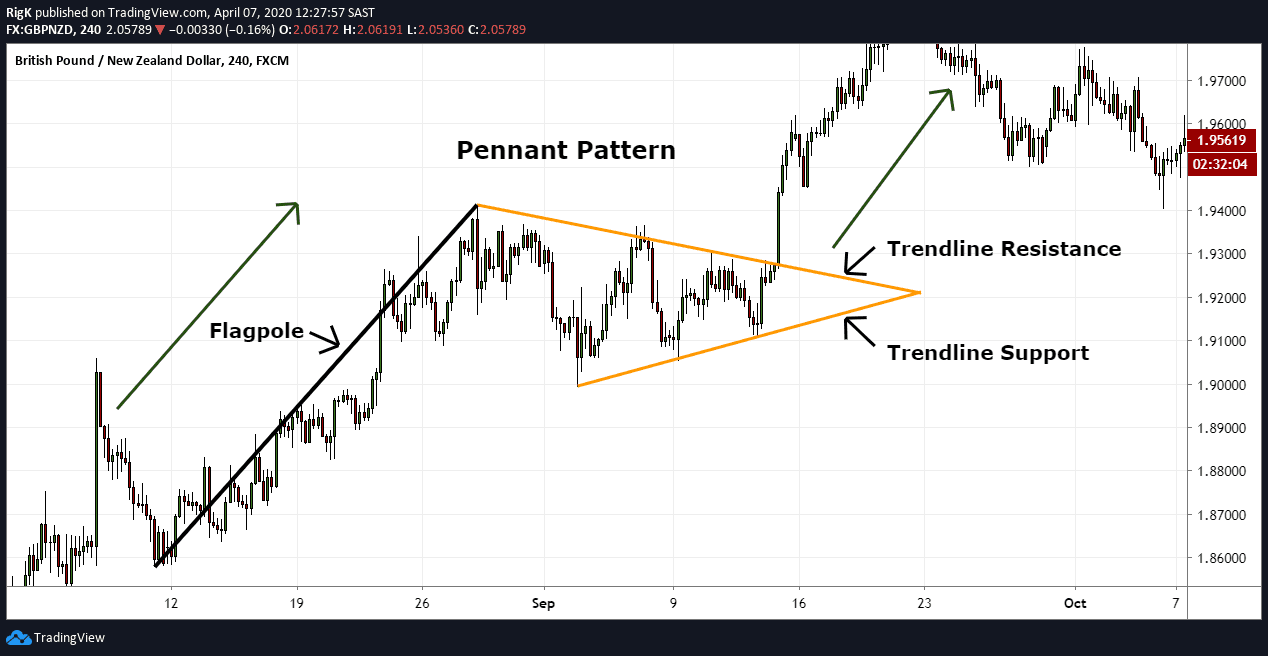

Penant Pattern - Web a pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief consolidation, before continuing to move in the. Web in technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in a security, known as the flagpole, followed by a consolidation period with converging trend lines—the pennant—followed by a breakout movement in the same direction as the initial large movement, which represents the second half of the. Similar to rectangles, pennants are continuation chart patterns formed after strong moves. Web pennants are a technical pattern used to identify continuations of sharp price moves; Trading them requires planning when to open your position, take a profit and cut a loss; Unlike the flag where the price action consolidates within the two parallel lines, the pennant uses two converging lines for consolidation until the breakout occurs. Learn more about pattern trading at ig academy A pennant is a type of continuation pattern formed when there is a large movement in security known as. After a big upward or downward move, buyers or sellers usually pause to catch their breath before taking the pair further in the same direction. Web a bull pennant pattern consists of a larger bullish candlestick, which forms the flag pole. Learn more about pattern trading at ig academy Bullish pennant pattern is an uptrend confirmation pattern that is formed after a sharp increase in the currency pair prices. Web updated december 10, 2023. A pennant is a consolidated price action in which the price takes a short breather before continuing its movement in the ongoing direction. The two differ by. It’s then followed by several smaller consolidation candles that form a pennant. Web the pennant pattern explained. In technical analysis, a pennant is a type of continuation pattern. Web a pennant pattern is a continuation chart pattern, seen when a security experiences a large upward or downward movement, followed by a brief consolidation, before continuing to move in the. This. Bearish pennants occur when a bear move pauses, while bullish pennants occur when bull moves pause; The shorter and milder the correction, the stronger the downtrend and the ultimate breakout usually is. The pennant is created when the highs and lows of this consolidation form a symmetrical triangle. The bullish pennant emerges post an uptrend, forming a small symmetrical triangle. The bullish pennant emerges post an uptrend, forming a small symmetrical triangle (the pennant) during consolidation. Learn more about pattern trading at ig academy When looking at a pennant pattern, one will identify three distinct phases: Bullish pennant pattern is an uptrend confirmation pattern that is formed after a sharp increase in the currency pair prices. After a big upward. Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. Bearish and bullish are two kinds of pennant chart patterns. Any bull pennant patterns that consolidate near support levels, then when support holds, price action breaks out of the apex of the pennant. Pennant pattern refers to a chart pattern that. Once the price increases, the currency pair starts trading within a range between its support and resistance levels,. A pennant is a type of continuation pattern formed when there is a large movement in security known as. A pennant is a consolidated price action in which the price takes a short breather before continuing its movement in the ongoing direction.. The pattern resembles a flagpole. Web pennants are continuation patterns where a period of consolidation is followed by a breakout. Similar to rectangles, pennants are continuation chart patterns formed after strong moves. Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. Web a pennant is a trend continuation pattern, that. This chart pattern takes one to three weeks to form. Bearish and bullish are two kinds of pennant chart patterns. Web the pennant pattern is a great chart pattern for beginners to learn because of how easy it is to spot and trade in real time. The pattern can be seen in any time frame, and it consists of a. Web the pennant pattern is a classic pattern for technical analysts and is identifiable by a large price move followed by a unification period and a breakout. Web pennants are a technical pattern used to identify continuations of sharp price moves; A pennant is a consolidated price action in which the price takes a short breather before continuing its movement. These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a midpoint of the move. Web in technical analysis, a pennant is a type of continuation pattern formed when there is a large movement in a security, known as the flagpole, followed by a consolidation period with converging trend lines—the pennant—followed by a breakout. Web pennants are a technical pattern used to identify continuations of sharp price moves; Web the bull pennant is a bullish continuation pattern that signals the extension of the uptrend after the period of consolidation is over. These patterns are usually preceded by a sharp advance or decline with heavy volume, and mark a midpoint of the move. Web pennants are continuation patterns where a period of consolidation is followed by a breakout. Web the pennant pattern explained. Once the price increases, the currency pair starts trading within a range between its support and resistance levels,. Bearish and bullish are two kinds of pennant chart patterns. Pennants are similar to flag chart patterns in the terms that they have converging lines during their consolidation period. You’ll learn how to identify both bullish pennant and bearish pennant formations. This chart pattern takes one to three weeks to form. Web a bull pennant pattern consists of a larger bullish candlestick, which forms the flag pole. The pattern can be seen in any time frame, and it consists of a small triangular price formation that follows a fast price movement in either an uptrend or a downtrend. Web the pennant pattern is a classic pattern for technical analysts and is identifiable by a large price move followed by a unification period and a breakout. Trading them requires planning when to open your position, take a profit and cut a loss; Web a formation that checks all three boxes (flagpole, a pennant, and a breakout) with a correction ending at around 38.2% is a textbook bear pennant pattern. Web a pennant is a trend continuation pattern, that generally appears in a strong uptrend or downtrend.

Blog Your guide to stock trading chart patterns United Fintech

Pennant Chart Patterns Definition & Examples

How to Trade a Pennant Pattern Market Pulse

How To Identify and Trade Pennant Patterns? Phemex Academy

Pennant Chart Patterns Definition & Examples

Pennant Patterns Trading Bearish & Bullish Pennants

Bullish Pennant Patterns A Complete Guide

Pennant Pattern Bullish (+) Small Illustration Green & Red

Pennant Patterns Trading Bearish & Bullish Pennants

Pennant Chart Patterns Definition & Examples

A Pennant Is A Type Of Continuation Pattern Formed When There Is A Large Movement In Security Known As.

Web A Pennant Pattern Is A Continuation Chart Pattern, Seen When A Security Experiences A Large Upward Or Downward Movement, Followed By A Brief Consolidation, Before Continuing To Move In The.

The Pennant Is A Continuation Chart Pattern That Appears In Both Bullish And Bearish Markets.

The Pennant Is Created When The Highs And Lows Of This Consolidation Form A Symmetrical Triangle.

Related Post: