Payroll Journal Entry Template

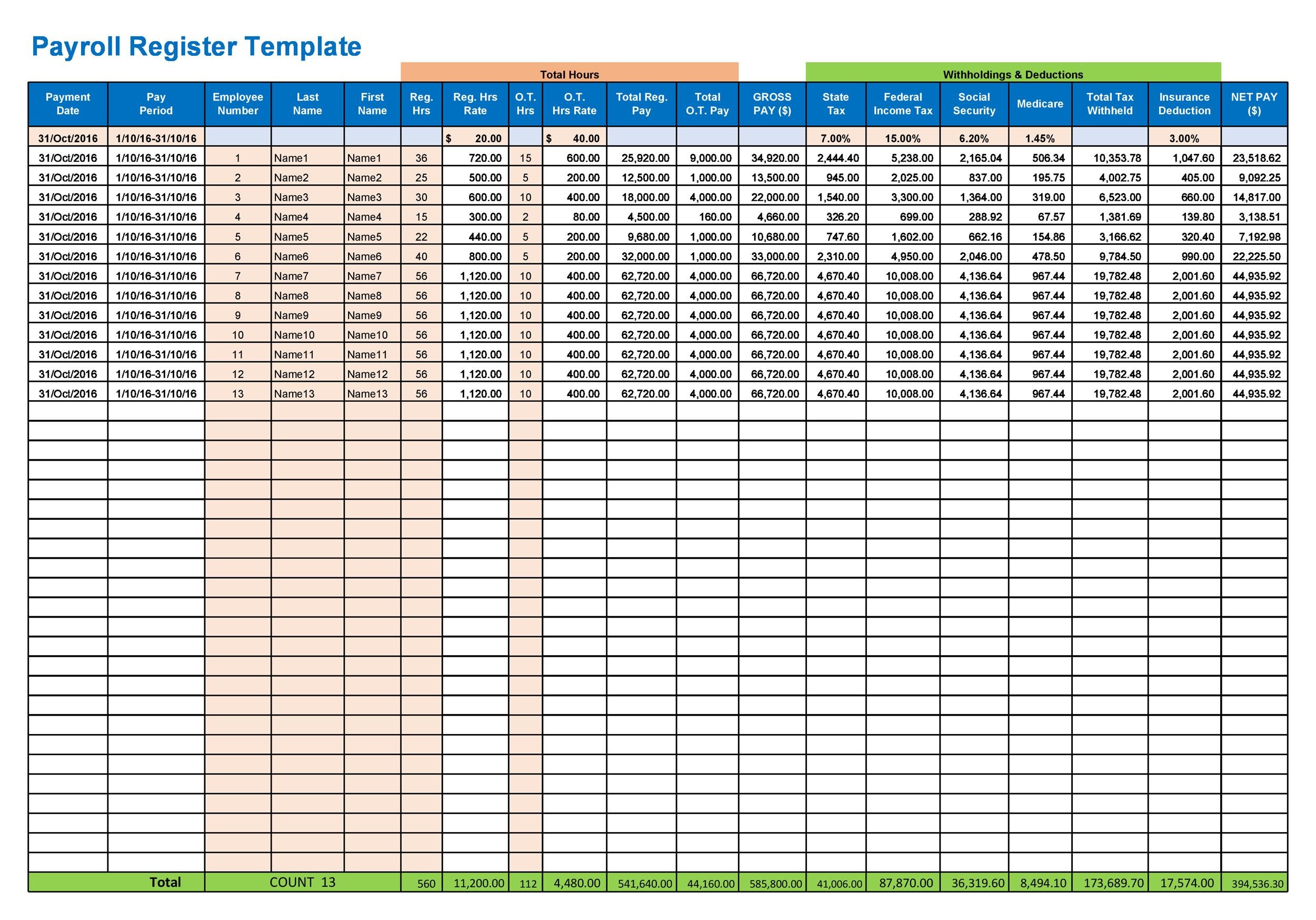

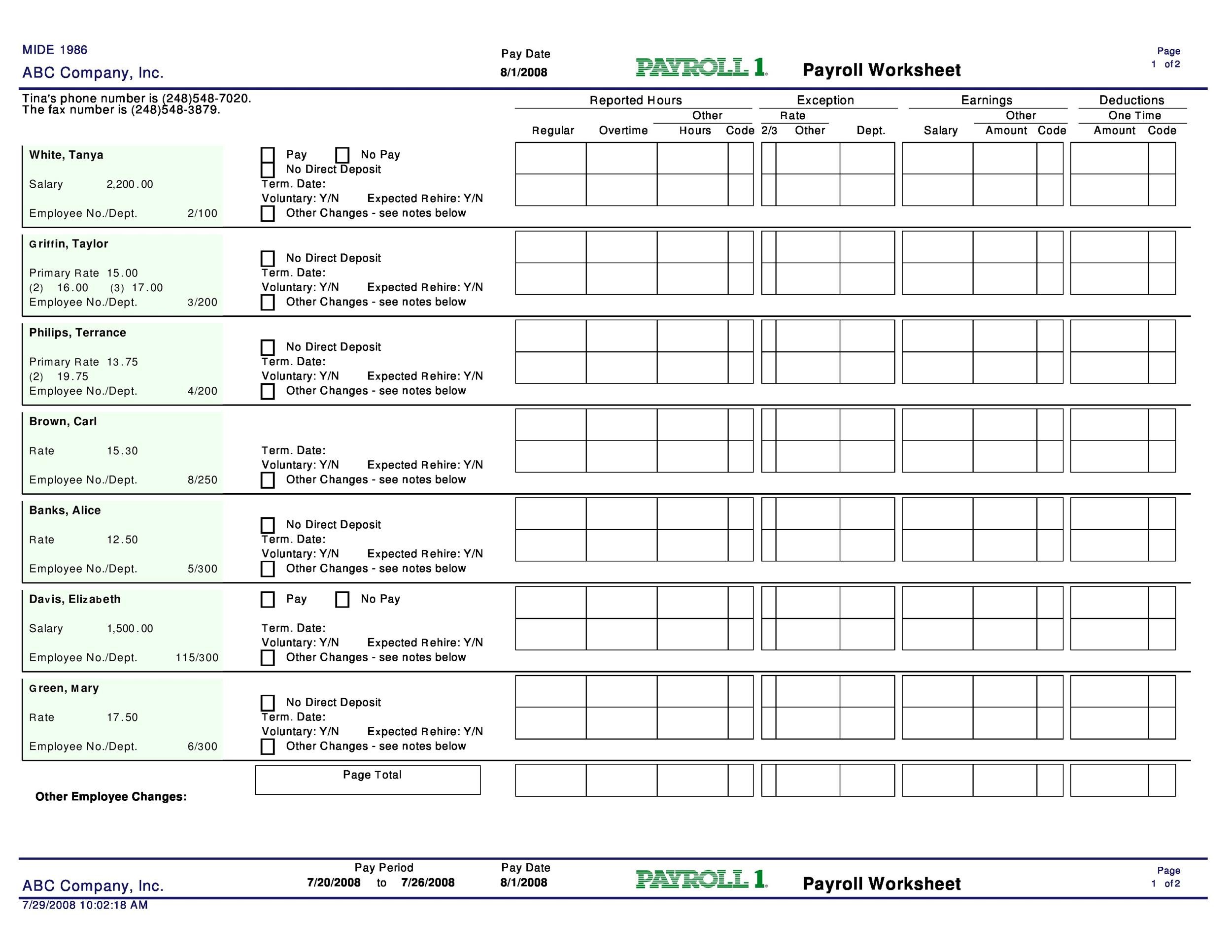

Payroll Journal Entry Template - Web the key types of payroll journal entries are noted below. Proceed to the account column and record them using them using these entries: Web a payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. It’s one of the harder aspects of small business accounting. Journal entries are used in accrual accounting to record payroll expenses that have been. A payroll is a list of company employees and the amount they can expect to receive for their work. Enter the juris chart of accounts account number in column a. This explains how to record information about your payroll in your accounts. For someone new to payroll accounting, the idea of recording gross wages, tax withholdings, and net pay may seem overwhelming. One such method is a payroll journal entry, which involves accurately recording pay for each. Discover best practices to manage and record your payroll! That way, you can look back and see details about employee compensation, such as when you paid it, how much it was, and where the money went. Examples of payroll journal entries for wages. In the following examples we assume that the employee’s tax rate for social security is 6.2% and. Enter the amount as a debit. Create a manual payroll journal. That way, you can look back and see details about employee compensation, such as when you paid it, how much it was, and where the money went. This entry records the gross wages earned by employees, as well as all withholdings from their pay, and any additional taxes owed. Web creating a journal entry import file and template for adp payroll. Accruing payroll liabilities, transferring cash, and making payments. Enter the juris chart of accounts account number in column a. Effective payroll accounting is complicated. Fill out the fields to create your journal entry. That way, you can look back and see details about employee compensation, such as when you paid it, how much it was, and where the money went. At companies of all sizes, accountants may use a variety of systems to track team member hours and pay. Set aside copies of this information in order to include it in the next. By laura chapman updated march 11, 2019. Payroll taxes, costs, and benefits paid by employers. Web thu apr 25 06:10:16 edt 2024. Web go to the company menu and select make general journal entries. Payroll accounting can be pretty complicated. Web a payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. Web updated december 22, 2023. In the following examples we assume that the employee’s tax rate for social security is 6.2% and that the employer’s tax rate is 6.2%. However, there’s no need to. You’ll need to collect a few. Web recording the payroll process with journal entries involves three steps: Web updated december 22, 2023. Fill out the fields to create your journal entry. A payroll journal entry is a method of accrual accounting, in which a business records its debit and credit payroll transactions pertaining to employee compensation. Payroll accounting can be pretty complicated. Web recording the payroll process with journal entries involves three steps: Web updated december 22, 2023. Web payroll journal entries | financial accounting. Accruing payroll liabilities, transferring cash, and making payments. Web this page offers a wide variety of free payroll templates that are fully customizable and easy to use. Web using a payroll journal entry template can help you make sure you don’t miss anything. This step is completed by the human resources. Below is an example of how to record a payroll journal entry transaction. Journal entries are used in accrual accounting to record payroll expenses that have been. You’ll need to collect a few forms from your. However, there’s no need to. One such method is a payroll journal entry, which involves accurately recording pay for each. Below is an example of how to record a payroll journal entry transaction. Web a payroll journal entry is an accounting method to control gross wages and compensation expenses. It’s one of the harder aspects of small business accounting. Web creating a journal entry import file and template for adp payroll. Web payroll journal entries | financial accounting. For someone new to payroll accounting, the idea of recording gross wages, tax withholdings, and net pay may seem overwhelming. Web one method for recording payroll is to create journal entries to account for each piece of payroll, including employee paychecks and employer taxes. A payroll journal entry includes employee wages, direct labor expenses, fica expenses, payroll taxes, and holiday, vacation and sick days in the debit section. Below is an example of how to record a payroll journal entry transaction. Taxes & benefits paid by employees; A payroll is a list of company employees and the amount they can expect to receive for their work. Web a payroll journal entry is a record of how much you pay your employees and your overall payroll expenses. See how you can take your recurring payroll summary and transform it into a template you can use to record payroll at the department level. Web recording the payroll process with journal entries involves three steps: Enter the amount as a debit. Take the following steps to format your adp journal entry batch in excel: Journal entries are used in accrual accounting to record payroll expenses that have been. However, there’s no need to. This entry records the gross wages earned by employees, as well as all withholdings from their pay, and any additional taxes owed to the government by the company.

10 Payroll Journal Entry Template Template Guru

Payroll Journal Entry Template Excel Resume Examples

Payroll Journal Entry Template Excel Template 2 Resume Examples

NonProfit And Payroll Accounting Examples of Payroll Journal Entries

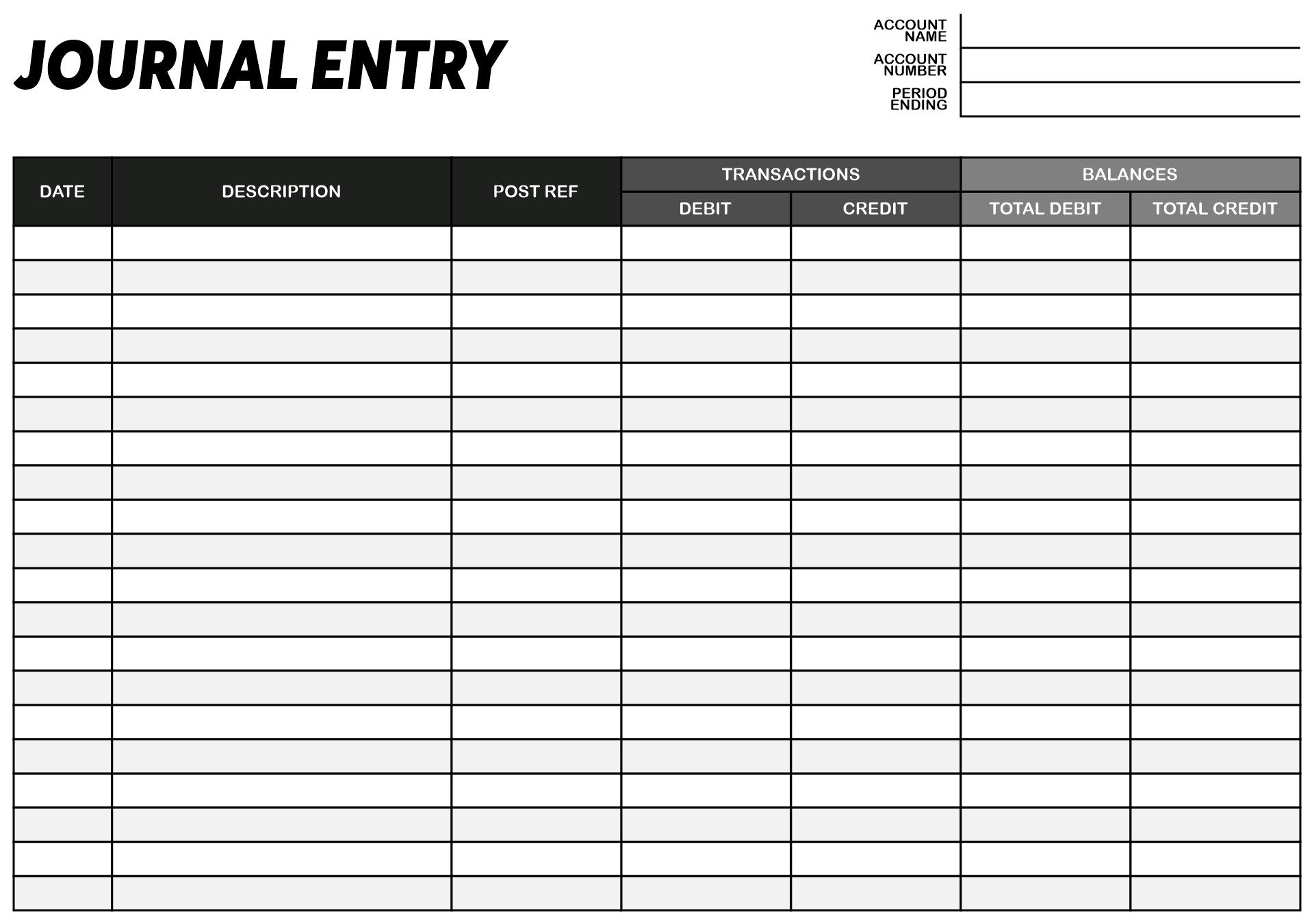

Free Journal Entry Template Printable Templates

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

Payroll Journal Entry Template Excel Template 2 Resume Examples

40+ Free Payroll Templates & Calculators ᐅ TemplateLab

FREE 26+ Payroll Templates in Excel

Payroll Journal Entry Example Explanation My Accounting Course

All Good Templates Have A Mapping Between Their Payroll And Gl System.

Web The Key Types Of Payroll Journal Entries Are Noted Below.

Create A Manual Payroll Journal.

By Laura Chapman Updated March 11, 2019.

Related Post: