Pay Off Debt Template

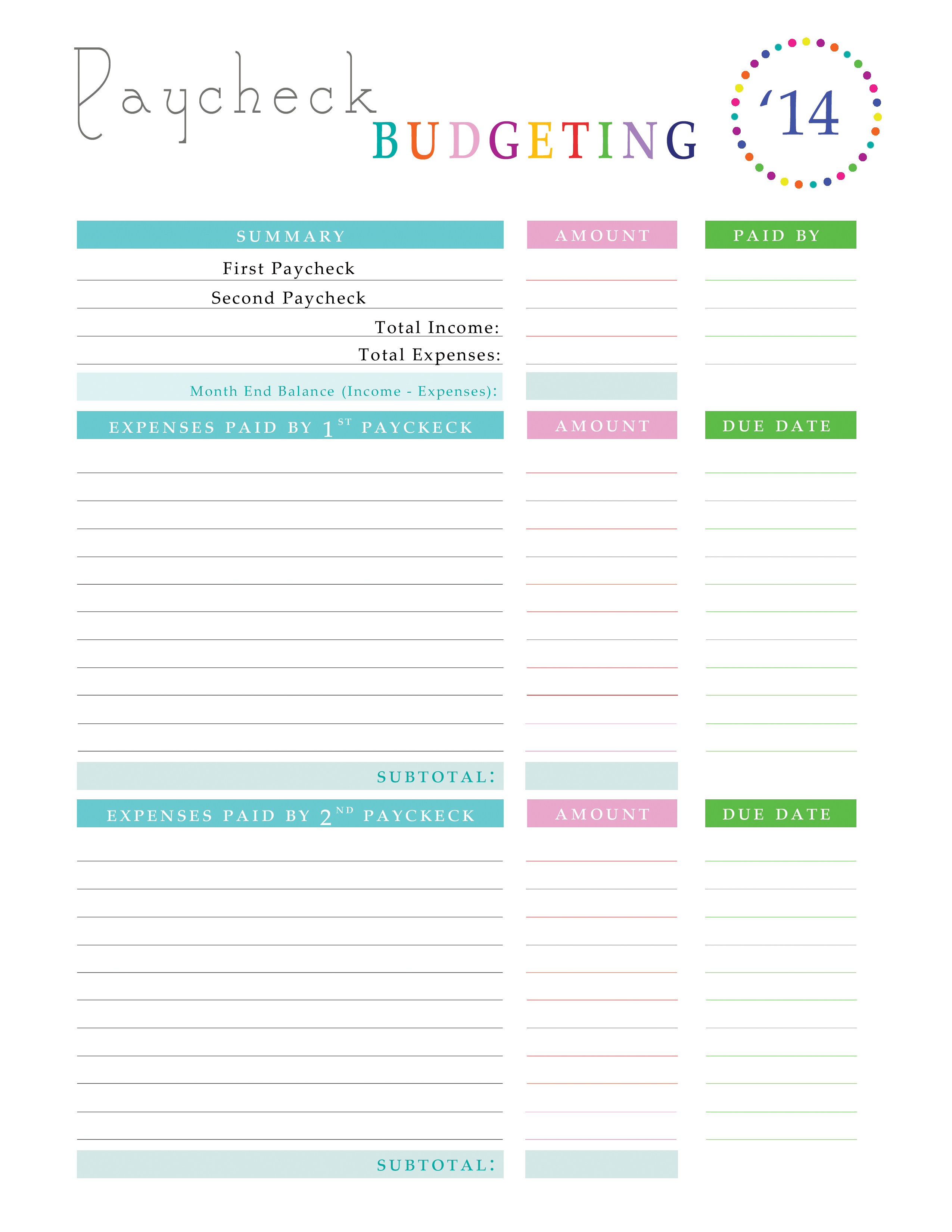

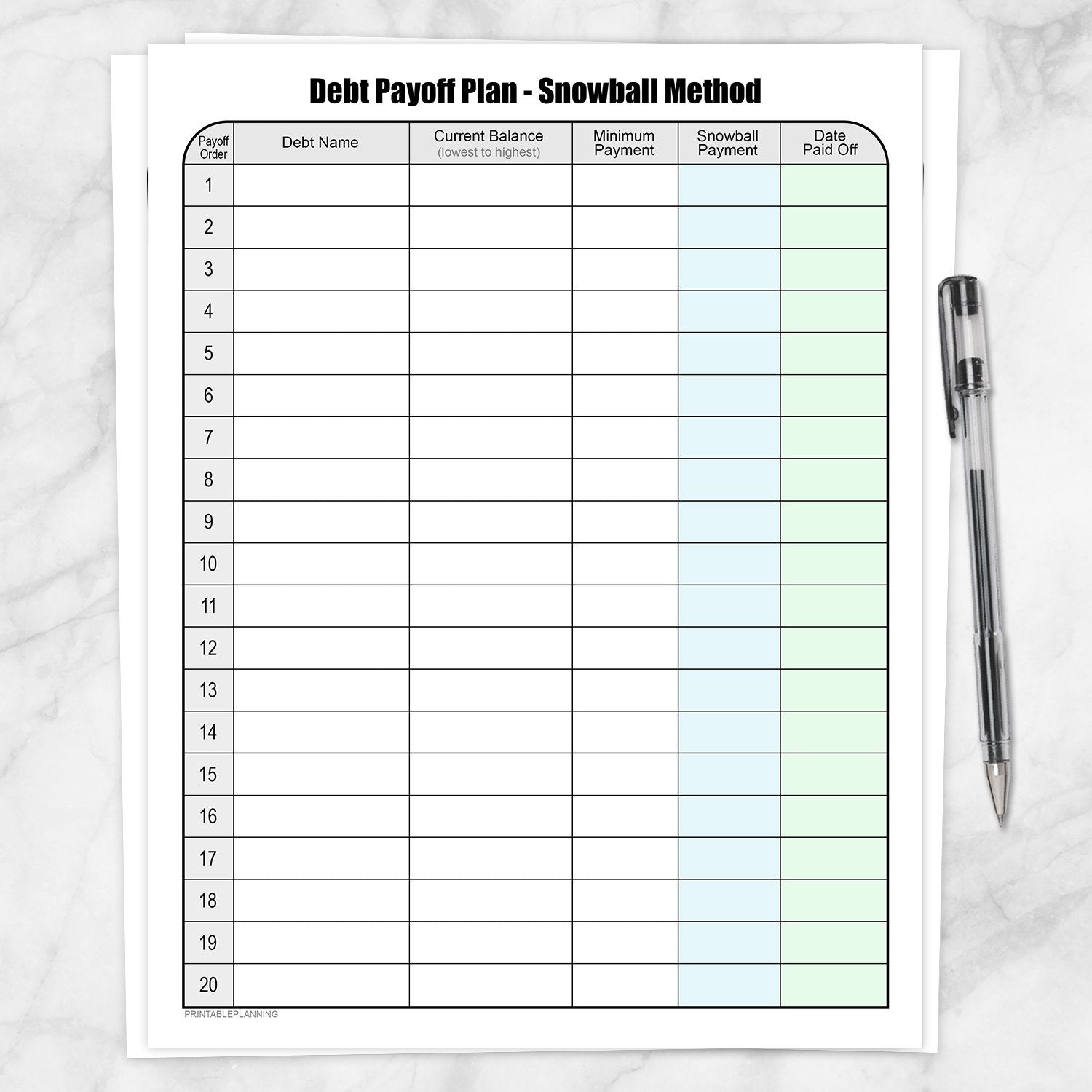

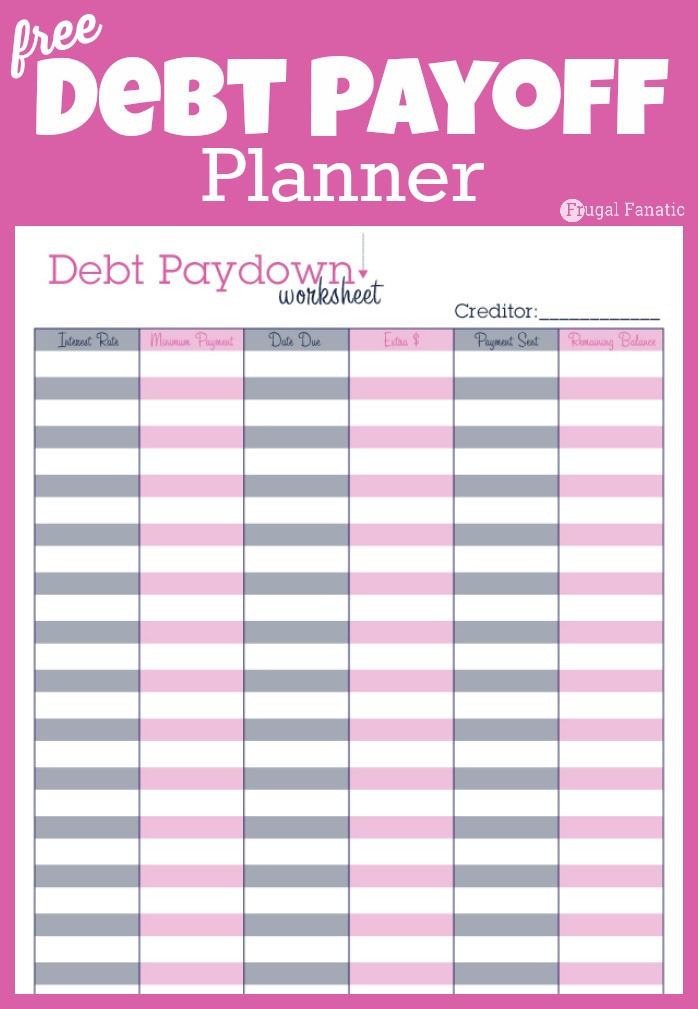

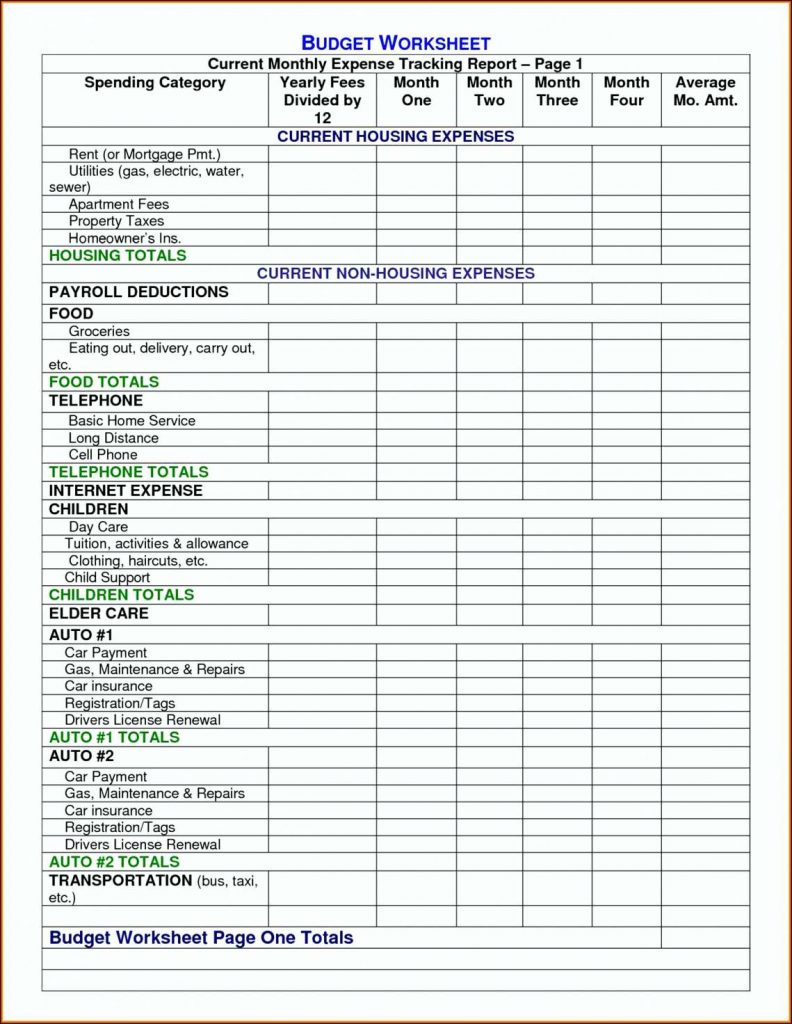

Pay Off Debt Template - Pay as much as possible on your smallest debt. 2.1 this method will build momentum as time goes by; Managing debt is a normal part of the modern financial journey. Web sticking with a budget that works will give you the highest chances of success. Web table of contents. Web you can borrow up to half or $50,000 — whichever is less — from your 401(k) to pay off debt. Below, we’ve got lots of free printable debt trackers (and debt payoff planners, debt snowball worksheets, debt thermometers, etc.) to help you work. Debts 3 and 4 would still only receive the minimum payment. However, you’d now be paying the freed up money from debt 1 to debt 2, in addition to the minimum payment. 4 how does the snowball method for paying off. Extra payment (any additional amount you can afford to pay) The minimum payment represents the amount of cash flow you will free up by completely paying off the debt. Free monthly zero based budgeting template Web you can borrow up to half or $50,000 — whichever is less — from your 401(k) to pay off debt. Web setting goals, knowing. Web advice, explainers and exercises on taking advantage of job benefits, creating a budget, paying off debt and thinking about your future. Include all your debts in the “debt name” column. In the first row, label the following columns to track your debt: paying off debt decreases your liquidity (the availability of cash or liquid. There are a couple of. The author of the spreadsheet and the squawkfox blog, kerry taylor, paid off $17,000 in student loans over six months using this downloadable debt reduction spreadsheet. Use this free debt payoff calculator to see how much you can pay down your debt each month, and to forecast your debt freedom date according to different payoff methods. If you don’t find. You can do this on the debt dashboard, which is the first page of your new debt payoff planner. Web credit card debt payoff spreadsheet. Record the creditor and the minimum payment at the top of the worksheet. The difference is in what you pay off first. Tagged debt payoff debt snowball f6f5f0 google sheets templates microsoft excel template. The two most common methods to pay off debt are “debt snowball” and “debt stacking,” which we like to call “debt wrecking ball.”. Shonnita leslie, 40, used a credit counseling agency to help her pay off around $20,000 in credit card debt. Web this can make the debt more manageable to pay off in full. Web now to see it. Interest rate (as a percentage) c1: Let’s say, for example, you have four debts to pay off with the smallest amount being $50, the next $100, the next $150 and the last being $200. Here’s how the debt snowball works: The second credit card is $9,000 at 9% interest. Exceltemplates.com is your ultimate source of debt payoff spreadsheet, that are. Interest rate (as a percentage) c1: You need to repay the loan you take out against your 401(k) within five years. This printable worksheet can be used to track individual debts you are trying to pay off. You can use it to print reports or create pdf reports, but the commercial license doesn't permit sharing the actual spreadsheet file. Make. If you’re already using tiller to budget and manage your money, you can select your debt accounts from the account dropdown menu. Web by month two, you would have paid off debt 1. In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open parenthesis. Let’s say, for example, you have four debts to pay. 2 the benefits of using the debt snowball method. Include all your debts in the “debt name” column. Make minimum payments on all your debts except the smallest. If you find an error, dispute it. In the cell corresponding to debt1’s january 2023 balance, type in the equal sign and open parenthesis. Free monthly zero based budgeting template 2.2 you can negotiate the interest rates; Web advice, explainers and exercises on taking advantage of job benefits, creating a budget, paying off debt and thinking about your future. Web the templates includes a section at the top to list your client's name and the preparer's name and address (see the screenshot). Make a. Credit card debt payoff spreadsheet for calculating your credit card payoff schedule according to experion, one of the three major credit reporting agencies, the average american has slightly over $6. 4 how does the snowball method for paying off. Include all your debts in the “debt name” column. The two most common methods to pay off debt are “debt snowball” and “debt stacking,” which we like to call “debt wrecking ball.”. Web 10 free debt snowball worksheet printables money minded mom’s debt payoff worksheets. If you don’t find any errors, ask the debt collector to verify it. There are a couple of ways you can do this. Stop taking on more debt. Let’s say, for example, you have four debts to pay off with the smallest amount being $50, the next $100, the next $150 and the last being $200. Download free credit card payoff and debt reduction calculators for excel. Web the templates includes a section at the top to list your client's name and the preparer's name and address (see the screenshot). The minimum payment represents the amount of cash flow you will free up by completely paying off the debt. Free monthly zero based budgeting template Your first credit card is $1000 at 12% interest. In the first row, label the following columns to track your debt: Web track your debt free journey using a column chart that gradually reveals a debt free image as you pay off your debt.

Free Printable Debt Thermometer Debt payoff, Debt free, Debt payoff

![]()

Free Printable Debt Payoff Worksheet —

Debt Payoff Planner Free Printables

How To Create A Spreadsheet To Pay Off Debt Spreadsheet Downloa how to

Debt Payoff Planner Free budget printables, Debt payoff, Budget

Debt Payoff Plan Chart Debt Snowball Method Printable at Printable

Pdf Debt Tracker Printable Printable Blank World

Debt Payoff Planner Free Printable

Debt Payoff Printable Free Templates Printable Download

Budget To Pay Off Debt Spreadsheet within Debt Consolidation

Web Setting Goals, Knowing How Much You Can Afford To Pay, Making Payments On Time, And Being Sure You Are Making The Progress You Need To Are Essential To Paying Off Debts As Quickly As Possible.

This Printable Worksheet Can Be Used To Track Individual Debts You Are Trying To Pay Off.

Web Now To See It In Action, Assume The Following Is Your Debt Snowball Strategy.

Once You’ve Chosen The Debt Payoff Strategy That Works Best For You, It’s Time To List Your Debts.

Related Post: